Amerisafe Not So Safe - Analyst Blog

September 15 2011 - 12:54PM

Zacks

We reiterated our Underperform recommendation on

Amerisafe Inc. (AMSF) based on its persistent weak

performance that questions its current sustainability factor. The

company’s second-quarter operating earnings per share of 23 cents

substantially lagged the Zacks Consensus Estimate of 38 cents and

53 cents reported in the prior-year quarter. Operating income

substantially plummeted 56.4% year over year to $4.4 million.

Results worsened primarily due to higher underwriting losses,

reduced investment income and higher-than-expected expenses, which

further deteriorated the combined ratio and weakened the return on

average equity (ROE).

These factors also negated the higher premiums earned that

shored up the top-line growth. However, a modest cash and capital

position coupled with lower share count supported the book value

per share growth.

While Amerisafe is at an inflection point, the company witnessed

drastic decline in earnings growth in the first half of 2011, given

the inadequate growth in investment income owing to low investment

yield, which was followed by increased loss and loss adjusted

expenses. Moreover, higher underwriting expenses also withheld the

company’s underwriting profitability. Consequently, net income and

operating income have been witnessing sharp declines.

Going ahead, increasing imbalance in underwriting profitability

and sluggish investment yield inflates ample financial and

operating risk, thereby entailing vigilance over the company’s

growth model in the upcoming quarters.

Additionally, higher-than-expected losses from weather-related

events, underwriting and loss adjusted expenses are further

nibbling into the bottom-line growth. As a result, combined ratio,

a significant operating risk measurement ratio in the insurance

industry, has been continuously declining over the past several

years.

These issues have even marred the ROE. Amerisafe’s financial

objective is to produce an ROE of at least 15% over the long term

while maintaining optimal operating leverage in its insurance

subsidiaries. However, the sluggish economic recovery and dampened

macro factors have produced an operating ROE of 9.9% for 2010

against 15.4% in 2009, and 6.6% in the first half of 2011 against

12.3% in the year-ago period. Being a significant growth measure,

deteriorating ROE further showcases declining earnings growth.

Moreover, the workers compensation industry is cyclical in

nature and influenced by many factors including price competition,

natural and man-made disasters, changes in interest rates and

general economic conditions. Currently, the workers compensation

insurance industry is in the midst of a soft market cycle,

characterized by increased competition that results in lower

premium rates, expanded policy coverage terms and higher

commissions paid to agencies. Going ahead, any change in the

workers compensation laws could also affect the revenue.

On the flip side, though Amerisafe’s top-line growth has been

improving through its strong market presence in its niche workers’

compensation market for high hazard risks, a proactive and

disciplined approach in underwriting and prudent capital

management. These aspects also contributed to a favorable growth of

book value per share.

Moreover, the company and its subsidiaries enjoy superior credit

and financial strength ratings, which further reflect Amerisafe’s

potential to overcome its operational risks and regain growth in

the long run, once the macro dynamics rebounds to their historical

highs.

Overall, though the pricing environment has witnessed some

improvement, the company is expected to face uncertainty for the

next few quarters as the market weakness continues to hurt

payrolls. Amerisafe competes with SeaBright Insurance

Holdings (SBX) and Employers Holdings

Inc. (EIG).

On account of all these issues, Amerisafe’s third quarter

earnings are expected to be 30 cents, about 15% higher than the

year-ago quarter. However, for 2011, earnings are projected to

plunge to $1.23 per share, down 24% over 2010.

Additionally, the quantitative Zacks Rank for Amerisafe is

currently #5, indicating strong downward pressure on the shares

over the near term.

AMERISAFE INC (AMSF): Free Stock Analysis Report

EMPLOYERS HLDGS (EIG): Free Stock Analysis Report

SEABRIGHT INSUR (SBX): Free Stock Analysis Report

Zacks Investment Research

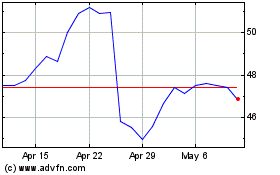

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From May 2024 to Jun 2024

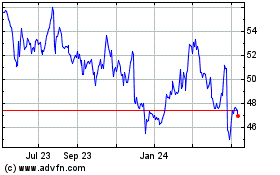

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From Jun 2023 to Jun 2024