Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

June 17 2024 - 5:16PM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Registration No. 333-275345

June 17, 2024

PRICING TERM SHEET

| | | | | | | | | | | |

| Issuer: | American Electric Power Company, Inc. |

| | | |

| Transaction Date: | June 17, 2024 |

| | | |

| Settlement Date: | June 20, 2024 (T+2) |

| | | |

| Designation: | 7.050% Fixed-to-Fixed Reset Rate Junior Subordinated Debentures Series A due 2054 | | 6.950% Fixed-to-Fixed Reset Rate Junior Subordinated Debentures Series B due 2054 |

| | | |

| Principal Amount: | $400,000,000 | | $600,000,000 |

| | | |

| Maturity: | December 15, 2054 | | December 15, 2054 |

| | | |

| Interest Rate: | (i) from and including the date of original issuance to, but excluding, December 15, 2029 at an annual rate of 7.050% and (ii) from and including December 15, 2029 during each Interest Reset Period at an annual rate equal to the Five-Year Treasury Rate as of the most recent Reset Interest Determination Date, plus 2.750% | | (i) from and including the date of original issuance to, but excluding, December 15, 2034 at an annual rate of 6.950% and (ii) from and including December 15, 2034 during each Interest Reset Period at an annual rate equal to the Five-Year Treasury Rate as of the most recent Reset Interest Determination Date, plus 2.675% |

| | | |

| Optional Deferral: | Up to 10 consecutive years per deferral | | Up to 10 consecutive years per deferral |

| | | |

| Interest Payment Dates: | June 15 and December 15 | | June 15 and December 15 |

| | | |

| First Interest Payment Date: | December 15, 2024 | | December 15, 2024 |

| | | |

| Day Count Convention: | 30/360 | | 30/360 |

| | | |

| Price to Public: | 100% of the principal amount thereof | | 100% of the principal amount thereof |

| | | |

| Redemption Terms: | In whole or in part on one or more occasions at a price equal to 100% of the principal amount being redeemed, plus accrued and unpaid interest to, but excluding, the redemption date (i) on any day in the period commencing on the date falling 90 days prior to the first Series A Reset Date and ending on and including the first Series A Reset Date and (ii) after the first Series A Reset Date, on any interest payment date | | In whole or in part on one or more occasions at a price equal to 100% of the principal amount being redeemed, plus accrued and unpaid interest to, but excluding, the redemption date (i) on any day in the period commencing on the date falling 90 days prior to the first Series B Reset Date and ending on and including the first Series B Reset Date and (ii) after the first Series B Reset Date, on any interest payment date |

| | | |

| Call for Tax Event: | In whole, but not in part, at 100% of the principal amount, plus any accrued and unpaid interest | | In whole, but not in part, at 100% of the principal amount, plus any accrued and unpaid interest |

| | | |

| Call for Rating Agency Event: | In whole, but not in part, at 102% of the principal amount, plus any accrued and unpaid interest | | In whole, but not in part, at 102% of the principal amount, plus any accrued and unpaid interest |

| | | |

| CUSIP/ISIN: | 025537 AZ4 / US025537AZ40 | | 025537 BA8 / US025537BA89 |

| | | |

| Minimum Denomination: | $2,000 and integral multiples of $1,000 in excess thereof |

| | | |

| | | | | | | | | | | |

| Joint Book-Running Managers: | Barclays Capital Inc.

Citigroup Global Markets Inc.

J.P. Morgan Securities LLC

MUFG Securities Americas Inc.

Scotia Capital (USA) Inc.

Credit Agricole Securities (USA) Inc.

CIBC World Markets Corp.

Goldman Sachs & Co. LLC

Morgan Stanley & Co. LLC

U.S. Bancorp Investments, Inc. |

| | | |

| Ratings*: | Baa3 (Stable) by Moody’s Investors Service, Inc. BBB- (Negative) by S&P Global Ratings, a division of S&P Global Inc. BB+ (Stable) by Fitch Ratings, Inc. |

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting Barclays Capital Inc. toll-free at (888) 603-5847, Citigroup Global Markets Inc. toll-free at (800) 831-9146, J.P. Morgan Securities LLC collect at (212) 834-4533, MUFG Securities Americas Inc. toll-free at (877) 649-6848 or Scotia Capital (USA) Inc. toll-free at (800) 372-3930.

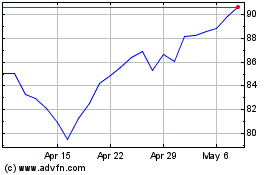

American Electric Power (NASDAQ:AEP)

Historical Stock Chart

From May 2024 to Jun 2024

American Electric Power (NASDAQ:AEP)

Historical Stock Chart

From Jun 2023 to Jun 2024