Current Economic Conditions Favor American Capital Agency and Annaly

April 20 2011 - 8:16AM

Marketwired

High yielding REITs (Real Estate Investment Trusts) have been a

popular investment in the stock market since the low interest rate

environment set in two years ago. Several Diversified REITs earn

their money on the spread between low-interest short-term borrowing

and purchasing high-interest long-term securities. Given the

current economic conditions, analysts argue that REITs' profits

should remain stable. The Bedford Report examines the outlook for

diversified REITs and provides research reports on American Capital

Agency Corporation (NASDAQ: AGNC) and Annaly Capital Management,

Inc. (NYSE: NLY). Access to the full company reports can be found

at:

www.bedfordreport.com/2011-04-AGNC

www.bedfordreport.com/2011-04-NLY

REIT investments have some of the highest yields on Wall Street.

As REITs these companies are typically not taxed on their income

but are required to pay out 90 percent of their taxable income in

dividends -- making their dividend payouts more volatile. While

high yielding dividend paying stocks are appealing, be forewarned

that companies can cut, slash, or suspend dividends at any time,

often without notice.

The Bedford Report releases regular market updates on REITs so

investors can stay ahead of the crowd and make the best investment

decisions to maximize their returns. Take a few minutes to register

with us free at www.bedfordreport.com and get exclusive access to

our numerous analyst reports and industry newsletters.

Many companies in the industry are focused on raising capital

and expanding their portfolios. American Capital Agency recently

announced plans for a public offering with total estimated gross

proceeds of around $780 million which is intended for the

acquisition of agency securities and general corporate purposes.

Currently, American Capital Agency pays an annual dividend of $5.60

for a massive yield of around 19.60 percent.

Annaly Capital Management presently pays an annual dividend of

$2.48 for a yield of around 14.20 percent.

The Bedford Report provides Analyst Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

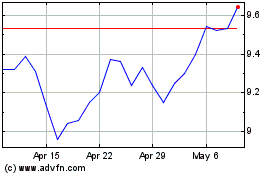

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

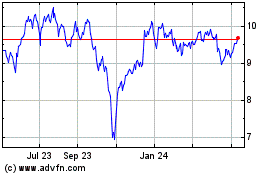

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Nov 2023 to Nov 2024