Ethereum Whales Go On Buying Spree As Market Crash Leaves Retail Panicking

April 14 2024 - 3:00PM

NEWSBTC

Ethereum, one of the leading cryptocurrencies, finds itself amidst

a price decline alongside the broader crypto industry. This

downturn has been exacerbated by escalating tensions in the Middle

East, casting a shadow of uncertainty over the market. As the

majority of cryptocurrencies experience a bleed in value, Ethereum

is not immune to the trend. However, while retail investors

panic-sell their holdings, on-chain data presents a different

picture. Big player whales in the market are seizing the

opportunity to accumulate assets, displaying a bullish sentiment

amid the turmoil. Related Reading: Bitcoin Below $70,000: Is $80K

Still Possible, Or Is The Rally Over? Particularly, on-chain data

from Lookonchain has shown an Ethereum whale accumulating during

the price decline. Interestingly, the timeline of accumulation

suggests that this whale has been in action even before the

escalating tensions in the Middle East. Ethereum Whales Accumulate

During Market Downturn On-chain transaction tracker Lookonchain has

noted both a selloff and accumulation trend from different Ethereum

whales in the past few days. One of the latest accumulations came

from a whale that has been on constant withdrawals from crypto

exchange Binance. As revealed by Lookonchain, whale “0x4359” has

withdrawn 62,141 ETH worth $202.6 million from Binance in the past

five days. This whale’s latest withdrawal from Binance was less

than 12 hours ago, where they withdrew 37,018 ETH worth $120.7

million. Ethereum on the other hand, has fallen from $3,722 to as

low as $2,866 in the last five days, representing a 23% price

decline. In a similar manner, 7,300 ETH worth $23.8 million were

transferred from Binance into “0xE347,” a newly created whale

wallet. It seems that whales bought $ETH at the bottom!

Whale”0x4359″ withdrew 37,018 $ETH($120.7M) from #Binance 4 hrs ago

and this whale has withdrawn 62,141 $ETH($202.6M) from #Binance in

the past 5 days.https://t.co/41366OnM5Y Fresh whale wallet”0xE347″

withdrew 7,300 $ETH($23.8M)… pic.twitter.com/qEtTSYU3Us —

Lookonchain (@lookonchain) April 13, 2024 That said, Lookonchain

also noted a trend of whales selling off their holdings. One

example of such selloffs came from whale address “0xaF35” who

deposited 6,700 ETH worth $23.65 million into Binance immediately

before the price drop. It’s important to note that this same whale

withdrew 26,698 ETH worth $94.3 million from Binance between Feb. 7

and April 1. In another social media post, Lookonchain revealed

four whales dumping 31,683 ETH worth $106 million during the price

drop. Total crypto market cap is currently at $2.261 trillion.

Chart: TradingView What’s Next For Ethereum? The ETH accumulation

and selloffs from different whale cohorts highlight the contrasting

trading strategies between large holders of the crypto asset. While

some are selling off, others are taking advantage of the low prices

and buying the dip. It would seem the whale accumulation is

still outweighing selloffs from their counterparts at the time of

writing. Despite this, a selloff from retail investors has tipped

the price action in favor of the bears. As a result, Ethereum now

finds itself trading around the $3,000 price level, which remains a

crucial price level. Related Reading: Uniswap Bloodbath: UNI Price

Crashes 16% On SEC Lawsuit Fears A continued accumulation from

whales could eventually tip the price of Ethereum to the side of

the bulls as tensions in the global market start to subside. We

could then see Ethereum hold up above $3,000 and surge upwards at

least till it reaches $3,200. A continued selloff could lead to a

further price decline, causing Ethereum to break below $3,000.

Featured image from Pexels, chart from TradingView

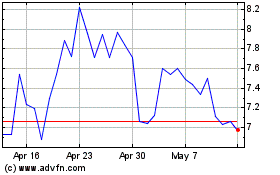

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025