CoinShares: Altcoins Defy Trends As Bitcoin Faces $600M in Outflows – What’s Next?

June 17 2024 - 5:00PM

NEWSBTC

The Bitcoin market has witnessed significant shifts recently,

influenced by macroeconomic factors and changing investor

sentiments. Last week, digital asset investment products saw

substantial outflows, which CoinShares attributed to several key

economic updates. These included the release of US CPI data, the

Federal Open Market Committee (FOMC) meeting, and Producer Price

Index (PPI) figures. These events seemed to spark a rapid surge in

Bitcoin price, pushing it briefly towards the $70,000 mark before a

swift downturn adjusted the valuation back to around $65,000.

Related Reading: Metrics Signal Bitcoin Price Increase – But When

Is Anyone’s Guess Market Shifts: BTC Faces Major Outflows While

Some Altcoins Attract Investment So far, this fluctuation in

Bitcoin’s price is part of a broader pattern of volatility that has

characterized the digital currency market. Just last week alone,

institutional and retail investors pulled back approximately $600

million from crypto funds, marking a significant retreat.

CoinShares suggests that this could signal a growing trend of

caution, amplified by a “hawkish stance” at the recent FOMC

meeting, which may have encouraged investors to reduce their

exposure to volatile assets like cryptocurrencies. Bitcoin, notably

the most impacted, faced outflows totaling $621 million. Despite

this, there was a silver lining as altcoins like Ethereum,

Litecoin, and others saw minor inflows. Ethereum led with a $13

million increase, suggesting divergent investor confidence in

altcoins compared to Bitcoin. This scenario presents a mixed view

where Bitcoin struggles under selling pressure while select

altcoins gain marginal traction. Meanwhile, the overall impact on

the market has been palpable, with total assets under management

dropping from over $100 billion to $94 billion within a week.

Trading volumes also dipped significantly from their annual

average, indicating a cautious approach by traders across the

board. Regionally, while the US experienced the brunt of the

outflows, countries like Germany saw inflows, suggesting a varied

global response to the current economic climate. Bitcoin ETFs See

Mixed Fortunes Despite a steady increase in the overall net inflows

into US spot Bitcoin exchange-traded funds (ETFs), which reached

$15.11 billion in recent weeks, the sector experienced a downturn

last week with a net outflow of $190 million per day, based on data

from SoSoValue. In terms of market performance, Bitcoin’s value

sharply declined, hitting a low of $65,398 last Friday. However, as

of today, Bitcoin’s price has slightly recovered to $65,552, though

it still shows a decline of 1.1% in the past day and 5.5% over the

week. Speaking on Bitcoin spot ETFs, BlackRock’s Chief Investment

Officer, Samara Cohen, has observed a gradual but steady interest

in them despite their slower-than-expected uptake. According to

Cohen, currently, the majority of Bitcoin ETF transactions,

approximately 80%, are conducted by “self-directed investors” using

online brokerage platforms. Cohen added that the iShares Bitcoin

Trust (IBIT) is one of the ETFs launched this year, attracting

attention from individual investors and hedge funds and brokerages,

as indicated in the recent 13-F filings. Related Reading: This

Altcoin Gem Will Overtake Solana, Predicts Arthur Hayes However,

participation from registered investment advisors remains

comparatively low, Cohen discussed during the recent Crypto Summit.

Featured image created with DALL-E, Chart from TradingView

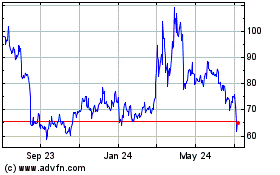

Litecoin (COIN:LTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

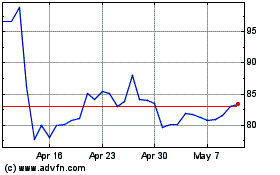

Litecoin (COIN:LTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024