U.S Federal Reserve Set To Hike Rates Above 400 BPs – How Will Crypto Market React?

September 24 2022 - 4:14AM

NEWSBTC

The United States Federal Reserve is tightening, and interest rates

hike has heavily impacted on the crypto market. Earlier this month,

Bloomberg Analyst McGlone said Bitcoin would outperform traditional

stocks as interest rates hike. However, to this point, Bitcoin does

not seem to follow Bloomberg’s predicted trend. As a matter of

fact, despite Bloomberg’s bullish standpoint, Bitcoin and other

cryptocurrencies are still in a crash. For example, BTC and ETH

dropped by 2% after the Fed’s announcement and bounced back. But

have now crashed again. BTC is currently trading below $19,000. The

Fed Reserve’s Federal Open Market Committee manages the economy

during inflation and recession by controlling the money supply in

the country. The Fed maintains the money supply via quantitative

tightening and easing of reserves. As a result, a rise in interest

rates triggers volatility in the market. Related Reading: Prepare

For Volatility: Data Suggests Bitcoin Gets Chaotic During FOMC

Meetings Inflation Would Drop To 2% By 2025, Says Federal Reserve

The Federal Reserve revealed its plans to tackle inflation at

Thursday’s Federal open market committee meeting. The Fed 75bps

interest rate hike is just the tip of the iceberg as it plans to

raise the rates as high as 400bps by the end of 2022. In August,

the CPI indicated 8.3% YoY inflation, but the Federal Reserve

forecasts inflation to come down to 2% by 2025. The Fed Reserve

plans to bring inflation down to 5.4% by 2022 and 2.8% by 2023.

Reports show that Fed raised this year’s interest benchmark by four

times. The current rates are between 2.25% to 2.50%. From the CNBN

Fed Survey for September, Fed’s interest hike would remain at the

peak rate for 11 months. John Ryding, the Chief economic advisor at

Brean Capital, commented in response to the survey. Ryding said the

Fed has finally realized the inflation problem is critical. He

thinks the Fed’s monetary tightening rate is a ‘positive real

policy rate.’ The economist advises Fed to increase the current

rate by 5%. The survey reported that among 35 survey respondents,

some economists, strategists, and fund managers think Fed might

overdo its tightening. Recession Would Hit Global Economy – World

Bank The World Bank says recession would hit the global economy

because of the war-like monetary policies of the world economy.

Svan Henrich, the founder of Northman Trader, thinks interest rates

would depend on recession than inflation in the next year. He

thinks Jerome Powell, Chairman of the Fed Reserve, emulates Paul

Volcker. Henrich further advised Powel to pivot before hitting the

40bps rates target. Paul Volcker is the former Chairman of the U.S

Fed Reserves. Related Reading: Bitcoin Dumps After Revisiting June

Lows, Where Does The Bottom Lie? Jerome refused to say much about

the recession, saying he didn’t know the depth or when the

recession would occur. Meanwhile, Fed dismissed all speculations of

recession. Everyone awaits the release of the following inflation

data in the Consumer Protection Index for September. In addition,

the next Federal Open Market Meeting will take place on November 2.

Featured image from Pixabay, charts TradingView.com

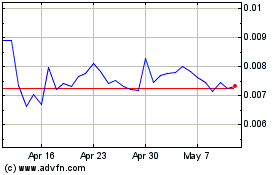

Amp (COIN:AMPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Amp (Cryptocurrency): 0 recent articles

More Amp News Articles