Stabilizing Ethereum Funding Rates Suggests Recovery Might Be In The Works

September 22 2022 - 7:00PM

NEWSBTC

Ethereum funding rates had taken a beating after the Merge was

completed. This event was the single most anticipated upgrade in

the history of the network, and it had affected both price and

funding rates in adverse ways. However, as the market begins to

settle into the new normal of Ethereum being a proof of stake

network, things are beginning to stabilize. One of those is funding

rates returning to pre-Merge levels. Funding Rates Stabilizing The

days leading up to the Ethereum Merge had been extremely volatile

for the crypto market. Ethereum itself had borne the brunt of this,

and even though the days leading up to the upgrade were filled with

positive movement, it had quickly changed. Related Reading: Prepare

For Volatility: Data Suggests Bitcoin Gets Chaotic During FOMC

Meetings Ethereum funding rates nosedived on the back of the Merge.

It fell from trending just below neutral levels at around negative

0.02% to negative 0.35% by the time the upgrade was final. It also

follows the sell-offs that rocked the market at the same time. In

the days leading up to the Merge, FTX longs had seen a total of

9.92% paid by shorts to hedge their positions on the exchange. ETH

funding rates recover | Source: Arcane Research However, not long

after the Merge was finalized, the market began to see recovery.

This recovery was just as sharp as the decline, returning from

negative 0.35% to around negative 0.02% by September 16th. This

sharp uptrend was shown in the price of the digital asset, which

maintained most of its value through this time. This shows that

despite the sell-offs, there are still a significant number of

Ethereum holders who maintain long exposure to the digital asset.

Ethereum Might Recover With funding rates recovering back to

pre-Merge levels, it shows that there is still bullish sentiment

among investors. This sustained bullish sentiment continues to prop

up the price of the digital asset even through the bear

market. Since most of the sell-offs happened due to the hype

around the Merge, it is only normal that Ethereum has begun to

stabilize once most of that hype has now worn off. It leaves the

accumulators at a point where they are able to purchase the digital

asset without sacrificing too much of their previous value. ETH

price drops below $1,300 | Source: ETHUSD on TradingView.com Even

now, with the FOMC-inspired volatility in the market, support for

ETH continues to ramp up. Exchange outflows over the last 24 hours

show this growing accumulation trend. Outflows were about 40%

higher than inflows for ETH for the day, according to data from

Glassnode. Related Reading: Bitcoin Dumps After Revisiting June

Lows, Where Does The Bottom Lie? If ETH is able to maintain its

support level at $1,250, this point will serve as a bounce-off

point for the digital asset. If ETH successfully breaks through the

$1,300 resistance, a retest of the $1,500 level is possible in the

next week. Featured image from Currency.com, charts from

Arcane Research and TradingView.com Follow Best Owie on Twitter for

market insights, updates, and the occasional funny tweet…

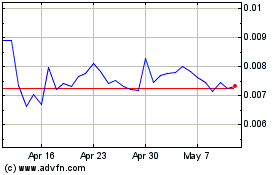

Amp (COIN:AMPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Amp (Cryptocurrency): 0 recent articles

More Amp News Articles