How Crypto is Evolving Luxury Real Estate in the USA

September 14 2022 - 4:26AM

NEWSBTC

What if buying a piece of real estate wasn’t a complex and

time-intensive process? Dealing in real estate typically involves

interacting with an intermediary, swimming through paperwork, and

paying steep fees and commissions. Even with the latest

advancements in technology, many jurisdictions still require real

estate buyers and sellers to show up in person to execute their

documents. Most often, this is due to notaries being required to

see people physically sign documents, and while some notaries can

do this task virtually, not all have the same capabilities. Now,

with the help of cryptocurrency (specifically NFTs and smart

contracts), the trajectory of real estate transactions is rapidly

changing. We’re talking about taking out the middleman and

obtaining and transferring ownership with ease. Sales can even be

made through sites similar to eBay, but with a new level of added

security. In this writing, we will be specifically focusing on

crypto’s effect on the luxury real estate market. But first, let’s

start with the basics—how NFTs and smart contracts work. What is an

NFT? NFTs, short for non-fungible tokens, are cryptographic tokens

that can come in the form of many things (e.g., music, drawings,

videos). Each NFT is 100% unique and cannot be replicated or

replaced. Many times, NFTs represent digital ownership of

something, such as a piece of digital art. In other instances, they

can be representative of a physical item, such as real estate

property and memberships. NFTs use blockchain technology to

maintain their verifiability and proof of ownership. Theoretically,

the actual digital file that an NFT lies on can, in fact, be

copied, but this does not mean that someone has taken over

ownership. The culprit would need access to the smart contract

that’s attached to the NFT as well. Moreover, they would have to be

able to alter the smart contract that has been recorded on the

blockchain, which is virtually impossible to do. What is a smart

contract? Smart contracts are self-executing pieces of code built

to facilitate a transaction. The transaction automatically resolves

after pre-defined conditions have been met. The contracts are coded

into the blockchain and maintained by regulators after recording

them. They are binding contracts that do not require the

interference of a central authority or legal system. Because of

this, they’re much more cost-efficient. After all, attorneys,

realtors, and appraisers are never cheap. How are the two

transforming luxury real estate? As previously mentioned, the two

above elements are changing the luxury real estate industry by

cutting out intermediaries, but another way is by innovating the

use of memberships. If you’ve ever owned a timeshare or had a

country club membership, you probably know that ownership is not

easily transferred. Moreover, your package typically includes an

annual renewal process and membership dues. Now, with promising

memberships such as the Aspen Lakes Membership by RHUE Resorts,

assets can be owned in perpetuity without the need for annual

renewal. Said assets can even be passed down through family members

and friends if desired. Conversely, memberships can be sold in

secondary markets such as OpenSea, an NFT marketplace that’s

similar to eBay. Through the NFT membership model, Aspen Lakes

Membership purchasers can enjoy: Little to no application process

or fees No annual recurring dues Transferability with ease (no

middleman required) Existing amenities, such as the world-class

18-hole golf course, pro-shop, restaurant, wedding and event

center. Most NFTs are restricted to being purchased with

cryptocurrency only which can ostracize certain investors. RHUE

Resorts is combating this by allowing the purchase of memberships

through cryptocurrency or debit/credit cards. This allows them to

appeal to the traditional market while also engaging

crypto-enthusiasts. City DAO Another example is the crypto project

City DAO. The idea here is that a person can purchase a piece of

land in Wyoming and sell rights of governance to interested

parties. Those who want to be a piece of the government structure

must obtain a certificate of citizenship via NFT. It’s important to

note that citizens are not the owners of the land. They only make

decisions regarding it, which includes policy changes and

regulations. Of course, in this kind of “government” structure,

there are only so many memberships that can be purchased. FlyFish

Club FlyFish Club (FFC) brings an interesting spin to the food

industry. The private dining club hosts the world’s very first NFT

restaurant that requires an NFT membership for dining access. Said

restaurant will feature over 10,000 square feet and be in an

“iconic location” in New York City. In addition, FFC NFT purchasers

can enjoy “various culinary, cultural, and social experiences,”

according to the FlyFish Club website. The project makes several

big promises, however, it’s still in its infancy. Great offerings

and optimistic ideas While NFTs and blockchain are opening doors in

several industries, it’s still hard to tell which ventures are

going to “stick.” Projects like City DAO have interesting ideas but

have yet to provide anything concrete. On the other hand, companies

such as RHUE Resorts are established and flourishing, providing

luxury in real life immediately. The blockchain looks to

revolutionize numerous industries with the many efficiencies and

advantages it has over traditional alternatives. Real estate has

shown that it’s ripe for improvement and looks to be the perfect

candidate to enter the world of cryptocurrency and NFTs.

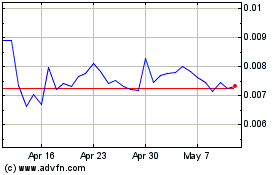

Amp (COIN:AMPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024