Celsius CEO Mashinsky Proposes Resurrecting Platform As A Digital Asset Custody Firm

September 14 2022 - 12:57AM

NEWSBTC

The saga that has been Celsius’ downfall this year has been well

documented. CEO Alex Mashinsky has been a focal point of crypto

critics after his engagement in ‘taking over‘ Celsius’ crypto

strategy in the 11th hour before the platform’s pseudo-shutdown.

That isn’t slowing down a persistent Mashinsky, who, despite

enduring a slew of bankruptcy procedures, continues to trudge along

in forecasting some sort of future for Celsius. This week,

Mashinsky is looking to reposition Celsius as a digital asset

custody firm, according to a new report from The New York Times.

What Led To Today’s Celsius ‘Doom & Gloom’ About a year

ago, state regulators across a handful of U.S. states started

setting their sights on yield-generating platforms such as BlockFi

and Celsius. Celsius, for some time, was offering aggressive rates

for holding tokens on the platform. At it’s highest point last

year, Celsius held tens of billions of funds and at times, promised

double digit percentage yield that was compounding weekly. As 2022

came into the fold, the market was middling but certainly not into

‘bear mode’ when Mashinsky and company rolled out their initial

“custody solution.” Within a few months later, following the

crumbling of Terra Luna, the platform was revealed to have exposure

to DeFi protocols, including the likes of Terra’s Anchor Protocol,

and was experiencing strong headwinds from more aggressive market

conditions. It was around this time that Mashinsky starting

deepening his position in company strategy. By July, the company

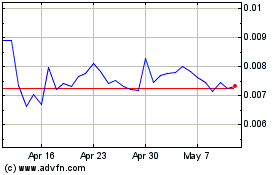

had frozen user funds and filed for bankruptcy. Celsius (CEL) token

has seen a volatile short-term performance. | Source: CEL-USD on

TradingView.com Related Reading: FTX (FTT) Token Flashes Buy Ahead

Of A Rally, Will $35 Be Reclaimed The Pivot: Can It Work? According

to the Times report, in the past week, Mashinsky has proposed a

project codenamed ‘Kelvin,’ where Celsius shifts to solely

providing custody services and collecting fees from depositors.

According to the report, Celsius employees were rightfully

skeptical. Mashinsky countered to internal skeptics, according to

the Times, by citing some of the biggest corporate turnarounds,

telling employees: “Delta filed for bankruptcy. Do you not fly

Delta because they filed for bankruptcy?” The short stroke is that

Celsius’ credibility is just as bankrupt as it’s balance sheet.

Take one look at Celsius’ Twitter replies for a prime example.

While Delta and Pepsi recovered from bankruptcy, they did so in

different eras, and more importantly: neither was beholden to mass

amounts of customer’s wealth. The brand image and identity behind

the firm is likely a ship too far sailed. Related Reading: Bitcoin

Takes A Blow After It Falls Below $22,000, Any Chances For A Bull

Run Featured image from Pixabay, Charts from TradingView.com The

writer of this content is not associated or affiliated with any of

the parties mentioned in this article. This is not financial

advice.

Amp (COIN:AMPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Amp (Cryptocurrency): 0 recent articles

More Amp News Articles