0001375205false--12-31FY202334892000Oct-20248574904100640240.660.68001.140.6927089890022469962100013752052023-01-012023-12-310001375205urg:USFederalDeposiInsuranceCorporationMember2023-12-310001375205urg:PostDecemberThirtyOneTwentySeventeenMember2023-01-012023-12-310001375205urg:PreJanuaryOneTwentyEighteenMember2023-01-012023-12-310001375205urg:CanadaMember2022-01-012022-12-310001375205urg:CanadaMember2021-01-012021-12-310001375205urg:CanadaMember2023-01-012023-12-310001375205urg:UnitedStatesMember2022-01-012022-12-310001375205urg:UnitedStatesMember2021-01-012021-12-310001375205urg:UnitedStatesMember2023-01-012023-12-310001375205urg:StrataEnergyLanceUraniumMember2020-12-310001375205urg:StrataEnergyLanceUraniumMember2020-01-012020-12-310001375205urg:StrataEnergyLanceUraniumMember2022-03-012022-03-310001375205urg:DisposalFeesMember2022-01-012022-12-310001375205urg:DisposalFeesMember2021-01-012021-12-310001375205urg:DisposalFeesMember2023-01-012023-12-310001375205urg:CustomerBMember2022-01-012022-12-310001375205urg:UThreeOEightSalesMember2023-01-012023-12-310001375205urg:UThreeOEightSalesMember2021-01-012021-12-310001375205urg:UThreeOEightSalesMember2022-01-012022-12-310001375205urg:CustomerBMember2021-01-012021-12-310001375205urg:CustomerBMember2023-01-012023-12-310001375205urg:CustomerAMember2022-01-012022-12-310001375205urg:CustomerAMember2021-01-012021-12-310001375205urg:CustomerAMember2023-01-012023-12-310001375205us-gaap:StockOptionMember2022-01-012022-12-310001375205us-gaap:StockOptionMember2021-01-012021-12-310001375205urg:WarrantsOneMember2021-01-012021-12-310001375205urg:WarrantsOneMember2022-01-012022-12-310001375205urg:WarrantsOneMember2023-01-012023-12-310001375205urg:RestrictedStockUnitsRsuOneMember2021-01-012021-12-310001375205urg:RestrictedStockUnitsRsuOneMember2022-01-012022-12-310001375205urg:RestrictedStockUnitsRsuOneMember2023-01-012023-12-310001375205urg:RestrictedStockUnitsRsuOneMember2023-12-310001375205urg:CommonSharesMember2021-01-012021-12-310001375205urg:CommonSharesMember2022-01-012022-12-310001375205urg:CommonSharesMember2023-01-012023-12-310001375205urg:WarrantsOneMember2023-02-210001375205urg:WarrantsOneMember2020-08-310001375205urg:WarrantsOneMember2018-09-300001375205urg:WarrantsOneMember2021-02-280001375205urg:WarrantsOneMember2021-02-012021-02-280001375205urg:WarrantsOneMember2023-02-012023-02-210001375205urg:WarrantsOneMember2020-08-012020-08-310001375205urg:WarrantsOneMember2018-09-012018-09-300001375205urg:WarrantsOneMember2021-02-012021-02-0400013752052023-02-2100013752052021-02-0400013752052023-02-012023-02-2100013752052021-02-012021-02-040001375205urg:WarrantsMember2021-01-012021-12-310001375205urg:WarrantsMember2023-01-012023-12-310001375205urg:WarrantsExercisePriceRangeThreeMember2023-01-012023-12-310001375205urg:WarrantsExercisePriceRangeTwoOneMember2023-01-012023-12-310001375205urg:WarrantsMember2023-12-310001375205urg:WarrantsExercisePriceRangeThreeMember2023-12-310001375205urg:WarrantsExercisePriceRangeTwoOneMember2023-12-310001375205urg:RedemptionDateFourMemberMember2023-01-012023-12-310001375205urg:RedemptionDateThreeMemberMember2023-01-012023-12-310001375205urg:RedemptionDateFourMemberMember2023-12-310001375205urg:RedemptionDateThreeMemberMember2023-12-310001375205urg:WarrantsExercisePriceRangeTwoMember2023-01-012023-12-310001375205urg:StockOptionExercisePriceRangeOneMember2023-01-012023-12-310001375205urg:StockOptionExercisePriceRangeFiveMember2023-01-012023-12-310001375205urg:WarrantsExercisePriceRangeTwoMember2023-12-310001375205urg:StockOptionExercisePriceRangeOneMember2023-12-310001375205urg:StockOptionExercisePriceRangeFiveMember2023-12-310001375205urg:StockOptionExercisePriceRangeSixMember2023-01-012023-12-310001375205urg:StockOptionExercisePriceRangeSixMember2023-12-310001375205us-gaap:StockOptionMember2023-01-012023-12-310001375205us-gaap:StockOptionMember2023-12-310001375205urg:StockOptionExercisePriceRangeFourMember2023-01-012023-12-310001375205urg:StockOptionExercisePriceRangeFourMember2023-12-310001375205urg:StockOptionExercisePriceRangeThreeMember2023-01-012023-12-310001375205urg:StockOptionExercisePriceRangeThreeMember2023-12-310001375205srt:MaximumMember2023-01-012023-12-310001375205srt:MinimumMember2023-01-012023-12-310001375205urg:February2023TwoThousandTwentyThreeMember2023-12-310001375205urg:FebruaryTwoThousandTwentyThreeWarrantMember2023-12-310001375205urg:FebruaryTwoThousandTwentyThreeWarrantMember2021-01-012021-12-310001375205urg:FebruaryTwoThousandTwentyThreeWarrantMember2022-01-012022-12-310001375205urg:FebruaryTwoThousandTwentyThreeWarrantMember2023-01-012023-12-310001375205urg:FebruaryTwoThousandTwentyThreeWarrantMember2020-12-310001375205urg:FebruaryTwoThousandTwentyThreeWarrantMember2021-12-310001375205urg:FebruaryTwoThousandTwentyThreeWarrantMember2022-12-310001375205urg:FebruaryTwoThousandTwentyOneWarrantMember2023-12-310001375205urg:FebruaryTwoThousandTwentyOneWarrantMember2021-01-012021-12-310001375205urg:FebruaryTwoThousandTwentyOneWarrantMember2022-01-012022-12-310001375205urg:FebruaryTwoThousandTwentyOneWarrantMember2023-01-012023-12-310001375205urg:FebruaryTwoThousandTwentyOneWarrantMember2021-12-310001375205urg:FebruaryTwoThousandTwentyOneWarrantMember2022-12-310001375205urg:FebruaryTwoThousandTwentyOneWarrantMember2020-12-310001375205urg:SeptemberTwoThousandEighteenWarrantMember2023-12-310001375205urg:SeptemberTwoThousandEighteenWarrantMember2021-01-012021-12-310001375205urg:SeptemberTwoThousandEighteenWarrantMember2022-01-012022-12-310001375205urg:SeptemberTwoThousandEighteenWarrantMember2023-01-012023-12-310001375205urg:SeptemberTwoThousandEighteenWarrantMember2020-12-310001375205urg:SeptemberTwoThousandEighteenWarrantMember2021-12-310001375205urg:SeptemberTwoThousandEighteenWarrantMember2022-12-310001375205urg:AugustTwoThousandTwentyWarrantMember2023-12-310001375205urg:AugustTwoThousandTwentyWarrantMember2021-01-012021-12-310001375205urg:AugustTwoThousandTwentyWarrantMember2022-01-012022-12-310001375205urg:AugustTwoThousandTwentyWarrantMember2023-01-012023-12-310001375205urg:AugustTwoThousandTwentyWarrantMember2021-12-310001375205urg:AugustTwoThousandTwentyWarrantMember2022-12-310001375205urg:AugustTwoThousandTwentyWarrantMember2020-12-310001375205urg:DueQuarterlyCommencingFromJanuaryOneTwoThousandFifteenMember2013-10-230001375205urg:DueQuarterlyCommencingFromJanuaryOneTwoThousandFourteenMember2013-10-230001375205urg:SweetwaterIdrBondMember2015-10-012015-10-150001375205urg:TwoThousandTwentyFourMember2023-01-012023-12-310001375205urg:StateBondLoanMember2023-01-012023-12-310001375205urg:RightOfUseAssetsMember2022-12-310001375205urg:RightOfUseAssetsMember2023-12-310001375205urg:InformationTechnologyMember2022-12-310001375205urg:InformationTechnologyMember2023-12-310001375205us-gaap:FurnitureAndFixturesMember2022-12-310001375205us-gaap:FurnitureAndFixturesMember2023-12-310001375205us-gaap:MachineryAndEquipmentMember2022-12-310001375205us-gaap:MachineryAndEquipmentMember2023-12-310001375205urg:EnclosuresMember2022-12-310001375205urg:EnclosuresMember2023-12-310001375205urg:RollingStockMember2022-12-310001375205urg:RollingStockMember2023-12-310001375205urg:PathfinderPropertiesMember2013-01-012013-12-310001375205urg:NfuWyomingLlcMember2005-01-012005-12-310001375205urg:PathfinderPropertiesMember2013-12-310001375205urg:NfuWyomingLlcMember2005-12-310001375205urg:OtherUSPropertiesPropertiesMember2023-12-310001375205urg:OtherUSPropertiesPropertiesMember2023-01-012023-12-310001375205urg:OtherUSPropertiesPropertiesMember2021-01-012021-12-310001375205urg:OtherUSPropertiesPropertiesMember2022-01-012022-12-310001375205urg:OtherUSPropertiesPropertiesMember2020-12-310001375205urg:OtherUSPropertiesPropertiesMember2021-12-310001375205urg:OtherUSPropertiesPropertiesMember2022-12-310001375205urg:ShirleyBasinMember2023-12-310001375205urg:ShirleyBasinMember2023-01-012023-12-310001375205urg:ShirleyBasinMember2021-01-012021-12-310001375205urg:ShirleyBasinMember2022-01-012022-12-310001375205urg:ShirleyBasinMember2020-12-310001375205urg:ShirleyBasinMember2021-12-310001375205urg:ShirleyBasinMember2022-12-310001375205urg:LostCreekPropertyMember2023-12-310001375205urg:LostCreekPropertyMember2023-01-012023-12-310001375205urg:LostCreekPropertyMember2022-01-012022-12-310001375205urg:LostCreekPropertyMember2021-01-012021-12-310001375205urg:LostCreekPropertyMember2021-12-310001375205urg:LostCreekPropertyMember2022-12-310001375205urg:LostCreekPropertyMember2020-12-3100013752052023-09-300001375205us-gaap:SuretyBondMember2022-12-310001375205us-gaap:SuretyBondMember2023-12-310001375205urg:ConversionFacilityInventorysMember2022-12-310001375205urg:ConversionFacilityInventorysMember2023-12-310001375205urg:PlantInventorysMember2022-12-310001375205urg:PlantInventorysMember2023-12-310001375205us-gaap:RetainedEarningsMember2023-12-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001375205urg:ContributedSurplusMember2023-12-310001375205urg:ShareCapitalMember2023-12-310001375205us-gaap:RetainedEarningsMember2023-01-012023-12-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001375205urg:ContributedSurplusMember2023-01-012023-12-310001375205urg:ShareCapitalMember2023-01-012023-12-310001375205us-gaap:RetainedEarningsMember2022-12-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001375205urg:ContributedSurplusMember2022-12-310001375205urg:ShareCapitalMember2022-12-310001375205us-gaap:RetainedEarningsMember2022-01-012022-12-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001375205urg:ContributedSurplusMember2022-01-012022-12-310001375205urg:ShareCapitalMember2022-01-012022-12-3100013752052021-12-310001375205us-gaap:RetainedEarningsMember2021-12-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001375205urg:ContributedSurplusMember2021-12-310001375205urg:ShareCapitalMember2021-12-310001375205us-gaap:RetainedEarningsMember2021-01-012021-12-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001375205urg:ContributedSurplusMember2021-01-012021-12-310001375205urg:ShareCapitalMember2021-01-012021-12-3100013752052020-12-310001375205us-gaap:RetainedEarningsMember2020-12-310001375205us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001375205urg:ContributedSurplusMember2020-12-310001375205urg:ShareCapitalMember2020-12-3100013752052022-01-012022-12-3100013752052021-01-012021-12-3100013752052022-12-3100013752052023-12-3100013752052024-02-2900013752052023-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureurg:integer

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED December 31, 2023 |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD OF _________ TO _________. |

Commission File Number: 001-33905

UR-ENERGY INC. |

(Exact name of registrant as specified in its charter) |

Canada | | Not Applicable |

State or other jurisdiction of incorporation or organization | | (I.R.S. Employer Identification No.) |

10758 West Centennial Road, Suite 200

Littleton, Colorado 80127

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 720-981-4588

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange on which registered |

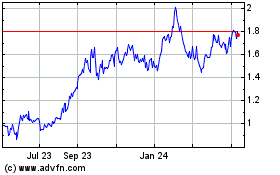

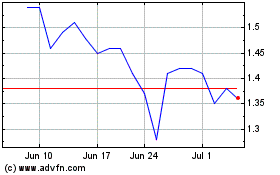

Common Shares, no par value | URG (NYSE American); URE (TSX) | NYSE American; TSX |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐ No ☒

As of February 29, 2024, there were 281,626,324 shares of the registrant’s no par value common shares, the registrant’s only outstanding class of voting securities, outstanding. As of June 30, 2023, the aggregate market value of the registrant’s voting common shares held by non-affiliates of the registrant was approximately $252.3 million based upon the closing sale price of the common shares as reported by the NYSE American. For the purpose of this calculation, the registrant has assumed that its affiliates as of June 30, 2023, including all affiliates, directors and officers collectively held approximately 24.4 million of its outstanding common shares.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required for Items 10, 11, 12, 13 and 14 of Part III of this annual report on Form 10-K is incorporated by reference to the registrant’s definitive proxy statement for the 2024 Annual Meeting of Shareholders.

UR-ENERGY INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

When we use the terms “Ur-Energy,” “we,” “us,” “our,” or the “Company,” we are referring to Ur-Energy Inc. and its subsidiaries, unless the context otherwise requires. We have included technical terms important to an understanding of our business under “Glossary of Common Terms” at the end of this section. Throughout this document we make statements that are classified as “forward-looking.” Please refer to the “Cautionary Statement Regarding Forward-Looking Statements” section of this document for an explanation of these types of assertions.

Cautionary Statement Regarding Forward-Looking Statements

This annual report on Form 10-K contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable Canadian securities laws, and these forward-looking statements can be identified by the use of words such as "expect," "anticipate," "estimate," "believe," "may," "potential," "intend," "plan" and other similar expressions or statements that an action, event or result "may," "could" or "should" be taken, occur or be achieved, or the negative thereof or other similar statements. These statements are only predictions and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance, or achievements expressed or implied by these forward-looking statements. Such statements include, but are not limited to: (i) the ability to maintain operations at Lost Creek in a safe and compliant fashion; (ii) the ability to readily and cost-effectively complete our return to full-production operations at Lost Creek, in the face of labor shortages, inflationary costs and supply chain issues without affecting our production plan or ability to deliver into our sales commitments; (iii) the timing to determine additional development and construction priorities at Lost Creek and Shirley Basin; (iv) the continuing technical and economic viability of Lost Creek, including as set forth in our Initial Assessment of the property (the Lost Creek Report); (v) the timing and outcome of the remaining permitting approval of the amendments to the Lost Creek permit, and processing and completion of future permits and authorizations for ongoing operations; (vi) the ability and timing to complete additional favorable uranium sales agreements, including spot sales as may be warranted; (vii) the production rates and life of the Lost Creek Project and subsequent development of and production from Adjoining Projects within the Lost Creek Property, including plans at LC East; (viii) the potential of exploration targets throughout the Lost Creek Property (including the ability to expand resources); (ix) the potential of our other exploration and development projects, including Shirley Basin, the projects in the Great Divide Basin and Lucky Mc; (x) the technical and economic viability of Shirley Basin, including our expectation that the Lost Creek processing facility will be utilized for processing, drying and packaging uranium for Shirley Basin, and as otherwise set forth in our Initial Assessment of the project (the Shirley Basin Report); (xi) conditions in the uranium market including the major influences of climate change objectives, geopolitics and shifting production schedules of operators, and how they will affect our operations and business; (xii) our ability to obtain remaining routine authorizations for production at Shirley Basin and the ability to meet projections for construction and buildout to operations when a go decision is made; (xiii) the viability of our ongoing research and development efforts, including the timing and cost to implement and operate one or more of them; (xiv) the impacts of the war in Ukraine, and other global conflicts and geopolitical tensions, on the global economy and more specifically on the nuclear fuel industry including U.S. uranium producers; and (xv) continuing effects of the pandemic including on supply chain disruption, labor and inflationary costs. These other factors include, among others, the following: future estimates for production, development and production operations, capital expenditures, operating costs, mineral resources, recovery rates, grades and market prices; business strategies and measures to implement such strategies; competitive strengths; estimates of goals for expansion and growth of the business and operations; plans and references to our future successes; our history of operating losses and uncertainty of future profitability; status as an exploration stage company; the lack of mineral reserves; risks associated with obtaining permits and other authorizations in the U.S.; risks associated with current variable economic conditions; our ability to service our debt and maintain compliance with all restrictive covenants related to the debt facility and security documents; the possible impact of future financings; the hazards associated with mining production; compliance with environmental laws and regulations; uncertainty regarding the pricing and collection of accounts; the possibility for adverse results in potential litigation; uncertainties associated with changes in government policy and regulation; uncertainties associated with a Canada Revenue Agency or U.S. Internal Revenue Service audit of any of our cross border transactions; adverse changes in general business conditions in any of the countries in which we do business; changes in size and structure; the effectiveness of management and our strategic relationships; ability to attract and retain key personnel; uncertainties regarding the need for additional capital; uncertainty regarding the fluctuations of quarterly results; foreign currency exchange risks; ability to enforce civil liabilities under U.S. securities laws outside the United States; ability to maintain our listing on the NYSE American LLC (“NYSE American”) and Toronto Stock Exchange (“TSX”); risks associated with the expected classification as a "passive foreign investment company" under the applicable provisions of the U.S. Internal Revenue Code of 1986, as amended; risks arising from various geopolitical tensions and events including the war in Ukraine and rising tensions between the U.S. and China; risks associated with our investments and other risks and uncertainties described under the heading “Risk Factors” of this annual report.

Cautionary Note to Investors Concerning Disclosure of Mineral Resources

Unless otherwise indicated, all mineral resource estimates included in this annual report on Form 10-K have been prepared in accordance with U.S. securities laws pursuant to Regulation S-K, Subpart 1300 (“S-K 1300”). Prior to 2022, we prepared our estimates of mineral resources in accord with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (“CIM Definition Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for public disclosure an issuer makes of scientific and technical information concerning mineral projects. We are required by applicable Canadian Securities Administrators to file in Canada an NI 43‑101 compliant report at the same time we file an S-K 1300 technical report summary. Our NI 43-101 and S-K 1300 reports (for each of the Lost Creek Property and Shirley Basin Project) are substantively identical to one another except for internal references to the regulations under which the report is made, and certain organizational differences.

Investors should note that the term “mineral resource” does not equate to the term “mineral reserve.” Mineralization may not be classified as a “mineral reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under S-K 1300, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies.

Additionally, as required under S-K 1300, our report on the Lost Creek Property includes two economic analyses to account for the chance that the inferred resources are not upgraded as production recovery progresses and the Company collects additional drilling data; the second economic analysis was prepared which excluded the inferred resources. The estimated recovery excluding the inferred resources also establishes the potential viability at the property, as detailed in the S-K 1300 report. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable.

Glossary of Common Terms and Abbreviations |

|

Mineral Resource Definitions | |

Mineral Resource | is a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. When determining the existence of a Mineral Resource, a Qualified Person, as defined by this section, must be able to estimate or interpret the location, quantity, grade or quality continuity, and other geological characteristics of the Mineral Resource from specific geological evidence and knowledge, including sampling; and conclude that there are reasonable prospects for economic extraction of the Mineral Resource based on an initial assessment, as defined in this section, that he or she conducts by qualitatively applying relevant technical and economic factors likely to influence the prospect of economic extraction. |

| |

Inferred Mineral Resource | is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling; where the term limited geological evidence means evidence that is only sufficient to establish that geological and grade or quality continuity is more likely than not. The level of geological uncertainty associated with an Inferred Mineral Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. A qualified person must have a reasonable expectation that the majority of inferred mineral resources could be upgraded to indicated or measured mineral resources with continued exploration; and should be able to defend the basis of this expectation before his or her peers. |

| |

Indicated Mineral Resource | is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. As used in this subpart, the term adequate geological evidence means evidence that is sufficient to establish geological and grade or quality continuity with reasonable certainty. The level of geological certainty associated with an Indicated Mineral Resource is sufficient to allow a Qualified Person to apply Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. An Indicated Mineral Resource has a lower level of confidence than the level of confidence of a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve. |

| |

Measured Mineral Resource | is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling and, further, the term conclusive geological evidence means evidence that is sufficient to test and confirm geological and grade or quality continuity. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. A Measured Mineral Resource has a higher level of confidence than the level of confidence of either an Indicated Mineral Resource or an Inferred Mineral Resource. |

Additional Defined Terms | |

11e.(2) by-product material | is contaminated solid waste consisting of solid waste contaminated with radioactive material that cannot be decontaminated, as defined by federal and state regulations. This by-product material may consist of filters, filtered fines from the wellfield and wastewater, personal protective equipment, spent resin, piping, etc. |

| |

Cut-off or cut-off grade | when determining economically viable mineral resources, the lowest grade of mineralized material that can be mined |

| |

Formation | a distinct layer of sedimentary or volcanic rock of similar composition |

Grade | quantity or percentage of metal per unit weight of host rock |

| |

Header houses (HH) | are used to distribute lixiviant injection fluid to injection wells and collect pregnant solution from production wells. Each header house is connected to two trunk lines, one for receiving barren lixiviant from the plant and one for conveying pregnant solutions to the plant. The HHs include manifolds, valves, flow meters, pressure gauges, instrumentation, and oxygen for incorporation into the injection lixiviant, as required. Each header house may service up to 90 wells (injection and recovery) depending on pattern geometry. The HHs are also used during the groundwater restoration process to distribute groundwater cleanup injection fluids and receive groundwater to be cleaned in the plant. The HHs will utilize the existing or alternate trunklines for this purpose. |

| |

Host Rock | the rock containing a mineral or an ore body |

| |

Modifying Factors | are the factors that a qualified person must apply to Indicated and Measured Mineral Resources and then evaluate in order to establish economic viability of Mineral Reserves. A qualified person must apply and evaluate modifying factors to convert Measured and Indicated Mineral Resources to Proven and Probable Mineral Reserves. These factors include but are not restricted to mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the modifying factors applied will necessarily be a function of and depend upon the mineral, mine property or project. |

| |

Lithology | is a description of a rock; generally, its physical nature. The description would address such things as grain size, texture, rounding, and even chemical composition. An example of a lithologic description would be “coarse grained well-rounded quartz sandstone with 10% pink feldspar and 1% muscovite.” |

| |

Mineral | a naturally formed chemical element or compound having a definite chemical composition and, usually, a characteristic crystal form. |

| |

Mineralization | a natural occurrence, in rocks or soil, of one or more metal yielding minerals |

| |

Outcrop | is that part of a geologic formation or structure that appears at the surface of the Earth. |

| |

PFN | is a modern geologic logging method known as Prompt Fission Neutron. PFN is considered a direct measurement of true uranium concentration (% U) and is used to verify the grades of mineral intercepts previously reported by gamma logging. PFN logging is accomplished by a down-hole probe in much the same manner as gamma logs, however, only the mineralized interval plus a buffer interval above and below are logged. |

| |

Preliminary Economic Assessment (or PEA) | is a Preliminary Economic Assessment performed under NI 43-101. A Preliminary Economic Assessment is a study, other than a prefeasibility study or feasibility study, which includes an economic analysis of the potential viability of mineral resources. |

| |

Qualified Person (or QP) | is an individual who is a mineral industry professional with at least five years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant; and is an eligible member or licensee in good standing of a recognized professional organization at the time the technical report summary is prepared. Additionally, a third-party firm comprising mining experts, such as professional geologists or mining engineers, may date and sign the technical report summary instead of, and without naming, its employee, member or other affiliated person who prepared the technical report summary. Also referred to as a “QP.” |

Reclamation | is the process by which lands disturbed as a result of mineral extraction activities are modified to support beneficial land use. Reclamation activity may include the removal of buildings, equipment, machinery, and other physical remnants of mining activities, closure of tailings storage facilities, leach pads, and other features, and contouring, covering and re-vegetation of waste rock, and other disturbed areas. |

| |

Restoration | is the process by which aquifers affected by mineral extraction activities are treated in an effort to return the concentration of pre-determined chemicals in the aquifer to pre-mining levels or, if approved by applicable government agencies, a pre-mining class of use such as industrial or livestock. |

| |

Uranium | a heavy, naturally radioactive, metallic element of atomic number 92. Uranium in its pure form is a heavy metal. Its two principal isotopes are U-238 and U-235, of which U-235 is the necessary component for the nuclear fuel cycle. However, “uranium” used in this annual report refers to triuranium octoxide, also called “U3O8” and is produced from uranium deposits. It is the most actively traded uranium-related commodity. Our operations produce and ship “yellowcake” which typically contains 70% to 90% U3O8 by weight. |

| |

Uranium concentrate | a yellowish to yellow-brownish powder obtained from the chemical processing of uranium-bearing material. Uranium concentrate typically contains 70% to 90% U3O8 by weight. Uranium concentrate is also referred to as “yellowcake.” |

| |

U3O8 | a standard chemical formula commonly used to express the natural form of uranium mineralization. U represents uranium and O represents oxygen. U3O8 is contained in “yellowcake” or “uranium concentrate” accounting for 70% to 90% by weight. |

Abbreviations |

AQD | Air Quality Division of the Wyoming Department of Environmental Quality |

BLM | U.S. Bureau of Land Management |

CEQ | Council on Environmental Quality, within the Executive Office of the President of the United States |

CERCLA | Comprehensive Environmental Response and Liability Act |

CIM | Canadian Institute of Mining, Metallurgy and Petroleum |

CWA | Clean Water Act |

DOE | U.S. Department of Energy |

eU3O8 | Equivalent U3O8 as measured by a calibrated gamma instrument |

EMT | East Mineral Trend, located within our LC East Project (Great Divide Basin, Wyoming) |

EPA | U.S. Environmental Protection Agency |

ESA | Endangered Species Act |

GDB | Great Divide Basin, Wyoming |

GPM | Gallons per minute |

GT | Grade x Thickness product (% ft.) of a mineral intercept (expressed without units) |

HALEU | High Assay Low Enriched Uranium |

HH | Header house |

IX | Ion Exchange |

ISR | In Situ Recovery (literally, ‘in place’ recovery) (also known as in situ leach or ISL) |

LQD | Land Quality Division of the Wyoming Department of Environmental Quality |

LT | Long-term (as relates to long-term pricing in the uranium market) |

MMT | Main Mineral Trend, located within our Lost Creek Project (Great Divide Basin, Wyoming) |

MU | Mine Unit (also referred to as wellfield) |

NEPA | U.S. National Environmental Policy Act |

NI 43-101 | Canadian National Instrument 43-101 (“Standards of Disclosure for Mineral Properties”) |

NRC | U.S. Nuclear Regulatory Commission |

NRV | Net realizable value |

PEA | Preliminary Economic Assessment, per NI 43-101 |

PFIC | Passive Foreign Investment Company |

PFN | Prompt Fission Neutron |

PPP QP | Paycheck Protection Program created by the CARES Act (and modified by the Flexibility Act), 2020, administered by the Small Business Administration Qualified Person, as defined in S-K 1300 |

RCRA | Resource Conservation and Recovery Act |

RO | Reverse Osmosis |

ROD | Record of Decision (BLM) |

SBA | U.S. Small Business Administration |

SEC | U.S. Securities Exchange Commission |

S-K 1300 | Regulation S-K, Subpart 1300 “Modernization of Property Disclosure for Mining Registrants” |

TRS TSX | Technical Report Summary, as defined in S-K 1300 Toronto Stock Exchange |

U3O8 | A standard chemical formula commonly used to express the natural form of uranium mineralization. U represents uranium and O represents oxygen. |

UIC | Underground Injection Control (pursuant to U.S. Environmental Protection Agency regulations) |

URP | Wyoming Uranium Recovery Program - WDEQ program name for Agreement State Program approved and effective September 30, 2018 |

USFWS | U.S. Fish and Wildlife Service |

WDEQ | Wyoming Department of Environmental Quality (and its various divisions, LQD/Land Quality Division, URP/Uranium Recovery Program; WQD/Water Quality Division; and AQD/Air Quality Division) |

WGFD | Wyoming Game and Fish Department |

WQD | Water Quality Division of the Wyoming Department of Environmental Quality |

Metric/Imperial Conversion Table

The imperial equivalents of the metric units of measurement used in this annual report are as follows:

Imperial Measure | | Metric Unit | | Metric Unit | | Imperial Measure |

2.4711 acres | | 1 hectare | | 0.4047 hectares | | 1 acre |

2.2046 pounds | | 1 kilogram | | 0.4536 kilograms | | 1 pound |

0.6214 miles | | 1 kilometer | | 1.6093 kilometers | | 1 mile |

3.2808 feet | | 1 meter | | 0.3048 meters | | 1 foot |

1.1023 short tons | | 1 tonne | | 0.9072 tonnes | | 1 short ton |

0.2642 gallons | | 1 litre | | 3.785 litres | | 1 gallon |

In this annual report on Form 10-K, unless otherwise noted, we round approximate acreages to the nearest 10.

Reporting Currency

All amounts in this report are expressed in United States (U.S.) dollars, unless otherwise indicated. The Financial Statements are presented in accordance with accounting principles generally accepted in the U.S.

PART I

Items 1 and 2. BUSINESS AND PROPERTIES

Overview and Corporate Structure

Incorporated on March 22, 2004, we are engaged in uranium mining, recovery and processing activities, including the acquisition, exploration, development and operation of uranium mineral properties in the U.S. Through our Wyoming operating subsidiary, Lost Creek ISR, LLC, we began operation of our first in situ recovery uranium facility at our Lost Creek Project in 2013. Ur-Energy is a corporation continued under the Canada Business Corporations Act on August 8, 2006. Our Common Shares are listed on the NYSE American under the symbol “URG” and on the TSX under the symbol “URE.”

We announced a ramp-up decision in December 2022 to immediately ramp up production to levels sufficient to deliver into sales commitments totalling 570,000 pounds U3O8 annually beginning in 2024. During 2023, we captured 103,487 pounds of U3O8 at our Lost Creek plant. We sold 280,000 pounds U3O8 in 2023 from existing inventory. These sales were our first sales of produced U3O8 since 2019.

We are an “exploration stage issuer,” as that term is defined under S-K 1300, because we have not established proven or probable mineral reserves through the completion of a pre-feasibility or feasibility study for any of our uranium projects. As a result, and even though we commenced recovery of uranium at our Lost Creek Project in 2013, we remain classified as an exploration stage issuer and will continue to remain an exploration stage issuer until such time as proven or probable mineral reserves have been established.

We are engaged in uranium recovery and processing operations, in addition to the exploration for and development of uranium mineral properties. Uranium fuels carbon-free, emission-free nuclear power which is a clean, cost-effective, and reliable form of electrical power. Nuclear power is estimated to provide more than 50 percent of the carbon-free electricity in the U.S. and approximately one-third of carbon-free electricity worldwide. As a uranium producer, we are advancing the interests of clean energy, thereby contributing in positive ways to address the challenges of global climate change.

Ur-Energy has one direct wholly owned subsidiary: Ur-Energy USA Inc. (“Ur-Energy USA”), a company incorporated under the laws of the State of Colorado. It has offices in Colorado and Wyoming and has employees in both states.

Ur-Energy USA has three wholly-owned subsidiaries: Lost Creek ISR, LLC, a limited liability company formed under the laws of the State of Wyoming to hold and operate our Lost Creek Project and certain other of our Lost Creek properties and assets; NFU Wyoming, LLC (“NFU Wyoming”), a limited liability company formed under the laws of the State of Wyoming which acts as our land holding and exploration entity; and Pathfinder Mines Corporation (“Pathfinder”), a company incorporated under the laws of the State of Delaware, which holds, among other assets, the Shirley Basin and Lucky Mc properties in Wyoming. Lost Creek ISR, LLC employs personnel at the Lost Creek Project.

Currently, and at December 31, 2023, our principal direct and indirect subsidiaries, and affiliated entities, and the jurisdictions in which they were incorporated or organized, are as follows:

Our wholly owned Lost Creek Project in Sweetwater County, Wyoming is our flagship property. The project has been fully permitted and licensed since October 2012. We received operational approval from the U.S. Nuclear Regulatory Commission (“NRC”) and started production operation activities in August 2013. Our first sales of Lost Creek production were made in December 2013.

From commencement of operations until 2020, we had multiple term uranium sales agreements in place with U.S. utilities for the sale of Lost Creek production or other yellowcake product at contracted pricing. We completed our initial sales contracts in 2020 when we sold 200,000 pounds of Uranium Oxide (“U3O8”). We did not make any sales of U3O8 inventory in 2021 – 2022.

We sold 100,000 pounds U3O8 to the U.S. Department of Energy (“DOE”) National Nuclear Security Administration (“NNSA”) in January 2023, as a part of the national uranium reserve program. In 2023, we delivered 180,000 pounds U3O8 into one of our sales agreements, for a total of 280,000 pounds U3O8 sold in 2023 for proceeds of $17.3 million. We currently have multi-year sales agreements for delivery of a base quantity ranging between 550,000 and 1,100,000 pounds U3O8 annually beginning in 2024 and continuing until 2030.

Shirley Basin, our other material property, is one of the assets we acquired as a part of the Pathfinder acquisition in 2013. We also acquired all the historic geologic and engineering data for the project. During 2014, we completed a drill program of a limited number of confirmatory holes to complete an NI 43‑101 mineral resource estimate which was released in August 2014; subsequently, an NI 43‑101 Preliminary Economic Assessment for Shirley Basin was completed in January 2015. See also “Shirley Basin ISR Uranium Project S-K 1300 Report,” below. Baseline studies necessary for the permitting and licensing of the project commenced in 2014 and were completed in 2015.

In December 2015, our applications for a permit and license to mine at Shirley Basin was submitted to the State of Wyoming Department of Environmental Quality (“WDEQ”). The Wyoming Uranium Recovery Program (“URP”) issued our source material license and the Land Quality Division (“LQD”) issued the permit to mine for Shirley Basin in 2021. We received approvals for the project from the U.S. Bureau of Land Management (“BLM”) in 2020. Therefore, all major authorizations to construct and operate at Shirley Basin have been received. Work continues on detailed engineering and construction designs pending a decision by the Company to build out the facility.

We utilize in situ recovery (“ISR”) of the uranium at Lost Creek and will do so at other projects where this is possible, including Shirley Basin. The ISR technique is employed in uranium extraction because it allows for a lower cost and effective recovery of roll front mineralization. The ISR technique does not require the installation of tailings facilities or significant surface disturbance. This recovery method utilizes injection wells to introduce a mining solution, called lixiviant, into the mineralized zone. The lixiviant is made of natural groundwater fortified with oxygen as an oxidizer, carbon dioxide for pH control, and may include the addition of sodium bicarbonate as a complexing agent. The complexing agent bonds with the uranium to form uranyl carbonate, which is highly soluble. The dissolved uranyl carbonate is then recovered through a series of production wells and piped to a processing plant where the uranyl carbonate is removed from the solution using ion exchange (“IX”) and captured on resin contained within the IX columns. The groundwater is re-fortified with the oxidizer and, possibly, the complexing agent and sent back to the wellfield to recover additional uranium. A small volume of water, called bleed, is permanently removed from the lixiviant flow to create an inward groundwater gradient. A reverse osmosis (“RO”) process is available to minimize the wastewater stream generated. Brine from the RO process, if used, and bleed are disposed of by means of injection into deep disposal wells. Each wellfield is made up of multiple groupings of injection and production wells installed in patterns to optimize the areal sweep of fluid through the uranium deposit.

Our Lost Creek processing facility includes all circuits for the capture, concentration, drying and packaging of uranium yellowcake for delivery into sales. Our processing facility, in addition to the IX circuit, includes processing trains with separate elution, precipitation, filter press and drying circuits (this contrasts with certain other uranium in situ recovery facilities which operate as a capture plant only, and rely on agreements with other producers for the finishing, drying and packaging of their yellowcake end-product). Additionally, a restoration circuit including an RO unit was installed during initial construction of Lost Creek to complete groundwater restoration once mining is complete.

We continue to make great strides in reducing water consumption. The first such achievement was the implementation of a Class V treatment system which became operational in early 2017. The system includes water treatment and injection of the clean water into a shallow formation where it can be accessed by future generations. Since implementation of the Class V system, the generation of wastewater during production has been reduced by 23 percent. To further reduce water consumption and enhance IX effectiveness, detailed design and engineering work is progressing for a filtration and wastewater treatment facility, together with procurement of equipment. Field construction will occur as appropriate as design work advances. The system, as envisioned, will allow for more effective use of current and future deep disposal wells working in conjunction with the Class V water recycling system while preserving precious water resources. Our goal is to reduce wastewater generation by at least 70 percent.

The elution circuit (the first step after IX) is utilized to transfer the uranium from the IX resin to elution tanks and concentrate the uranium to the point where it is ready for the next phase of processing. The resulting rich eluate is an aqueous solution containing uranyl carbonate, salt and sodium carbonate and/or sodium bicarbonate. The precipitation circuit follows the elution circuit and removes the carbonate from the concentrated uranium solution and combines the uranium with peroxide to create a yellowcake crystal slurry. Filtration and washing is the next step, in which the slurry is loaded into a filter press where excess contaminants such as chloride are removed and a large portion of the water is removed. The final stage occurs when the dewatered slurry is moved to a yellowcake dryer, which further reduces the moisture content, yielding the final dried, product. Refined, salable yellowcake is packaged in 55-gallon steel drums and transported by truck to the conversion facility.

The restoration circuit may be utilized in the production as well as the post-mining phases of the operation. The RO is utilized as a part of our Class V recycling circuit to minimize the wastewater stream generated during production. Once production is complete, the groundwater must be restored to its pre-mining class of use or better. The first step of restoration involves removing a small portion of the groundwater and disposing of it (commonly known as groundwater sweep). Following sweep, the groundwater is treated utilizing RO and re-injecting the clean water. Finally, the groundwater is homogenized and sampled to ensure the cleanup is complete, concluding the restoration process.

Our Lost Creek processing plant was constructed beginning in 2012, with production operations commencing in August 2013. Following receipt of amendments to our source material license in 2021, the licensed capacity of our Lost Creek processing plant allows for up to 2.2 million pounds U3O8 per year, of which up to 1.2 million pounds U3O8 per year may be produced from our wellfields. The Lost Creek plant and the allocation of resources to mine units and resource areas were designed to generate approximately one million pounds of production per year at certain flow rates and uranium concentrations subject to regulatory and license conditions. The excess capacity in the design of the processing circuits of the plant is intended, first, to facilitate routine (and non-routine) maintenance on any particular circuit without hindering production operational schedules. The capacity was also designed to allow us to process uranium from other mineral projects in proximity to Lost Creek if circumstances warrant in the future (e.g., Shirley Basin Project) or, alternatively, to be able to contract to toll mill/process product from other uranium mine sites in the region. The design permits us to conduct either of these activities while Lost Creek is producing and processing uranium and/or in years following Lost Creek production from wellfields during final restoration activities.

We currently expect that the Lost Creek processing facility will be utilized for the drying and packaging of uranium from Shirley Basin, for which we anticipate the need only for a satellite plant. However, the Shirley Basin license and permit allows for the construction of a full processing facility, providing greater construction and operating flexibility as may be dictated by market conditions.

Our Mineral Properties

Below is a map showing our Wyoming projects and the geologic basins in which they are located.

Our current land portfolio in Wyoming includes 12 projects. Ten of these projects are in the Great Divide Basin (“GDB”), Wyoming, including our flagship project, Lost Creek Project. We control nearly 1,800 unpatented mining claims and three State of Wyoming mineral leases for a total of approximately 35,400 acres at our Lost Creek Property, including the Lost Creek permit area (the “Lost Creek Project” or “Lost Creek”) and certain adjoining projects which we refer to as LC East, LC West, LC North, LC South and EN project areas (collectively, with the Lost Creek Project, the “Lost Creek Property”). Five of the projects at the Lost Creek Property contain reported mineral resources: Lost Creek, LC East, LC West, LC South and LC North.

Our Wyoming properties together total approximately 48,000 acres and include our Shirley Basin Project. Other non-material exploration stage projects are located in the GDB and the Lucky Mc Project is in the Gas Hills Uranium District, Wyoming. The Lost Creek Property and the Shirley Basin Project are the only two mineral properties that we deem to be individually material.

Our mineral resources reported pursuant to S-K 1300 for our material properties Lost Creek Property and Shirley Basin Project are summarized here and discussed below at “Lost Creek ISR Uranium Property S-K 1300 Report” and “Shirley Basin ISR Uranium Project S-K 1300 Report.” Variable pricing for each, based upon projections of market analysts and industry experts, and assumptions for operations at each property, including sales contracts, are as shown, and set forth in the respective S-K 1300 Initial Assessments.

| Measured | Indicated | Inferred | |

Project | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Assumed Pricing |

Wyoming Uranium Projects |

Lost Creek Property (after production)(7) | 0.049 | 8,537 | 8,446 | 0.044 | 4,803 | 4,236 | 0.043 | 7,085 | 6,119 | $55.00 to $87.20 |

Shirley Basin Project | 0.275 | 1,367 | 7,521 | 0.118 | 549 | 1,295 | - | - | - | $82.46 to $86.21 |

| MEASURED + INDICATED = | 15,256 | 21,498 | INFERRED = | 6,119 | |

Notes: (please also see notes related to each of the mineral resource summary tables below, for the Lost Creek Property and the Shirley Basin Project)

| 1. | Sum of Measured and Indicated tons and pounds may not add to the reported total due to rounding. |

| 2. | Table shows resources based on grade cutoff of 0.02 % eU3O8 and a grade x thickness cutoff of 0.20 GT. |

| 3. | Mineral processing tests have been conducted historically and by the Company and indicate that recovery should be at or about 80%, which is consistent with industry standards. Recovery at Lost Creek to date has exceeded the industry standard of 80%. |

| 4. | Measured, Indicated, and Inferred (where estimated) Mineral Resources as defined in S-K 1300. |

| 5. | Resources are reported through December 31, 2023. |

| 6. | All reported resources occur below the static water table at Lost Creek and below the historical, pre-mining static water table at Shirley Basin. |

| 7. | 2.838 million lbs. of U3O8 have been produced from the Lost Creek Project HJ Horizon as of December 31, 2023. |

| 8. | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

Mineralization at our uranium properties in Wyoming typically occurs at depth and does not outcrop. Therefore, investigation of the mineralization is accomplished by drilling and related sampling and logging procedures. We maintain standards to routinely calibrate our logging tools (and require similar standards of our logging contractors), as well as utilizing established quality control procedures for sample collection, and detailed logging of drill cuttings by Company geologists to gain an understanding of redox conditions within host sandstones. The security and controls over the preparation of samples and analytical procedures data is typical among U.S. uranium industry professionals. In turn, the controls inherent in the calculation of mineral resources once the data is obtained and analyzed are recognized professional standards, and our methods have routinely been assessed and verified by third party qualified professionals through the preparation of our technical reports.

Lost Creek Property – Great Divide Basin, Wyoming

We acquired the Lost Creek Project area in 2005. Lost Creek is in the GDB, Wyoming. The permit area of the Lost Creek Project covers 4,254 acres (1,722 hectares), comprising 201 lode mining claims and one State of Wyoming mineral lease section. Regional access relies almost exclusively on existing public roads and highways. The local and regional transportation network consists of primary, secondary, local and unimproved roads. Direct access to Lost Creek is mainly on two crown-and-ditched gravel paved access roads to the processing plant. One road enters from the west from Sweetwater County Road 23N (Wamsutter-Crooks Gap Road); the other enters from the east off BLM controlled Sooner Road.

On a wider basis, from population centers, the Lost Creek property area is served by an Interstate Highway (Interstate 80), a US Highway (US 287), Wyoming state routes (SR 220 and 73 to Bairoil), local county roads, and BLM roads. The nearest airport to the Project is Casper-Natrona County International Airport located just north and west of Casper. Both Laramie and Rawlins have smaller regional airports.

The basic infrastructure (power, water, and transportation) necessary to support our ISR operation is located within reasonable proximity. Generally, the proximity of Lost Creek to paved roads is beneficial with respect to transportation of equipment, supplies, personnel and product to and from the property. Existing regional overhead electrical service is aligned in a north-to-south direction along the western boundary of the Lost Creek Project. An overhead power line, approximately two miles in length, was constructed to bring power from the existing Pacific Power line to the Lost Creek plant. Power drops have been made to the property and distributed to the plant, offices, wellfields, and other facilities. Additional power drops will be installed as we continue to expand the wellfield operations.

The Lost Creek Property is located as shown here:

Production Operations

Following receipt of the final regulatory authorization in October 2012, we commenced construction at Lost Creek. Construction included the plant facility and office building, installation of all process equipment, installation of two access roads, additional power lines and drop lines, deep disposal wells, construction of two holding ponds, a multi-purpose warehouse facility, and drill shed building. In August 2013 we received operational approval from the NRC and commenced production operations. See also discussion of the operational methods used at Lost Creek, above, under “Business and Properties.”

All wells to support the originally planned 13 header houses (“HHs”) in Mine Unit 1 (“MU1”) have been completed and have operated, as have the first six HHs in Mine Unit 2 (“MU2”). The first three HHs in MU2 have been producing since 2018; two new HHs came online in 2023 and HH 2-6 came online in early 2024.

Beginning in 2020 Q3 we maintained reduced production operations at Lost Creek. In 2021-2022, we had nominal production at Lost Creek. In December 2022, a ramp-up decision was made to return Lost Creek to commercial level production operations. In 2023, we captured 103,487 pounds U3O8, and began drying and packaging yellowcake.

The production at Lost Creek, for the past three years, is set forth here:

| 2023 | 2022 | 2021 |

Pounds U3O8 Captured | 103,487 | 325 | 251 |

Lost Creek ISR Uranium Property S-K 1300 Report

An updated Initial Assessment Technical Report Summary on the Lost Creek ISR Uranium Property Sweetwater County, Wyoming, USA (the “Lost Creek Report”) is filed with this Annual Report and provides the mineral resource estimates and preliminary economic analysis in respect of the Lost Creek Property. The Lost Creek Report was prepared by WWC Engineering.

The Lost Creek Report reflects the updated mineral resource estimates, production operations, and operational and development costs to December 31, 2023. The Lost Creek Report supersedes and replaces the last Initial Assessment Technical Report Summary on the Lost Creek ISR Uranium Property Sweetwater County, Wyoming, USA (as amended September 19, 2022).

For the Lost Creek Report to accurately reflect existing mineral resources, all mineral resources produced through December 31, 2023 (2.838 million pounds) were subtracted from earlier totals of Measured Resources at Lost Creek where recovery has occurred to date.

The mineral resources at the Lost Creek Property reported in the Lost Creek Report are as follows:

Lost Creek Property - Resource Summary (December 31, 2023)

| Measured | Indicated | Inferred |

Project | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) | Avg Grade % eU3O8 | Short Tons (X 1000) | Pounds (X 1000) |

LOST CREEK | 0.049 | 10,032 | 9,819 | 0.046 | 2,699 | 2,503 | 0.045 | 2,834 | 2,527 |

Production through 12/31/2023 | 0.049 | -2,896 | -2,838 | | | | | | |

LC EAST | 0.052 | 1,401 | 1,465 | 0.042 | 1,883 | 1,568 | 0.042 | 2,954 | 2,481 |

LC NORTH | — | — | — | — | — | — | 0.045 | 644 | 581 |

LC SOUTH | — | — | — | 0.037 | 221 | 165 | 0.039 | 637 | 496 |

LC WEST | — | — | — | — | — | — | 0.109 | 16 | 34 |

EN | — | — | — | — | — | — | — | — | — |

GRAND TOTAL | 0.049 | 8,537 | 8,446 | 0.044 | 4,803 | 4,236 | 0.043 | 7,085 | 6,119 |

| | | MEASURED + INDICATED = | 13,340 | 12,682 | | | |

Notes:

| 1. | Sum of Measured and Indicated tons and pounds may not add to the reported total due to rounding. |

| 2. | % eU3O8 is a measure of gamma intensity from a decay product of uranium and is not a direct measurement of uranium. Numerous comparisons of eU3O8 and chemical assays of Lost Creek rock samples, as well as PFN logging, indicate that eU3O8 is a reasonable indicator of the chemical concentration of uranium. |

| 3. | Table shows resources based on grade cutoff of 0.02 % eU3O8 and a grade x thickness cutoff of 0.20 GT. |

| 4. | Mineral processing tests have been conducted historically and by the Company and indicate that recovery should be at or about 80%, which is consistent with industry standards. Recovery at Lost Creek to date has exceeded the industry standard of 80%. |

| 5. | Measured, Indicated, and Inferred Mineral Resources as defined in S-K 1300. |

| 6. | Resources are reported through December 31, 2023. |

| 7. | All reported resources occur below the static water table. |

| 8. | 2.838 million lbs. U3O8 have been produced from the Lost Creek Project HJ Horizon as of December 31, 2023. |

| 9. | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| 10. | The point of reference for resources is in situ at the Property. |

Information shown in the table above may differ from the disclosure requirements of the Canadian Securities Administrators. See Cautionary Note to Investors Concerning Disclosure of Mineral Resources, above.

As discussed in the Lost Creek Report, the economic analysis upon which the mineral resources were evaluated assumes a variable price per pound U3O8 over the life of the Lost Creek Property. The pricing for anticipated sales in the report ranges from $55.00 to $87.20 per pound U3O8. The sale price for the produced uranium is based on existing and reasonably assumed sales commitments through 2030, and consensus pricing using an annual simple average of the projections of long-term pricing made by expert market analysts. We now have five sales agreements into which we may sell Lost Creek production.

The Lost Creek Property includes six contiguous Projects: Lost Creek Project, LC East Project, LC West Project, LC North Project, LC South Project and EN Project. The fully licensed and operating Lost Creek Project is considered the core project while the others are collectively referred to as the Adjoining Projects in the Lost Creek Report. The Adjoining Projects were acquired by the Company as exploration targets to provide resources supplemental to those recognized at the Lost Creek Project. Most were initially viewed as stand-alone projects but expanded over time such that, collectively, they represent a contiguous block of land along with the Lost Creek Project.

The Main Mineral Trend of the Lost Creek uranium deposit (the “MMT”) is located within the Lost Creek Project. The East Mineral Trend (or “EMT”) is a second mineral trend of significance, in addition to the MMT, identified by historic drilling on the lands forming LC East. Although geologically similar, it appears to be a separate, but closely related, trend from the MMT.

The Lost Creek Report mineral resource estimate includes drill data and analyses of approximately 4,412 historic and current holes and over 2.53 million feet of drilling at the Lost Creek Project alone. With the acquisition of the Lost Creek Project, we acquired logs and analyses representing approximately 360,000 feet of data. Since our acquisition of the project, approximately 3,849 holes and wells have been drilled at Lost Creek. This figure now includes development drilling through 2023. Additionally, drilling from the Adjoining Projects, both historical and our drill programs, is included in the mineral resource estimate. This represents ~2,400 additional drill holes (1.3 million feet).

Regulatory Authorizations and Land Title of Lost Creek

Beginning in 2007, we completed all necessary applications and related processes to obtain the required permitting and licenses for the Lost Creek Project, of which the three most significant are a Source and Byproduct Materials License from the NRC (August 2011); a Plan of Operations with the BLM (Record of Decision (“ROD”))(October 2012); and a Permit and License to Mine from the WDEQ (October 2011)(“WDEQ Permit”). The WDEQ Permit includes the approval of MU1, as well as the Wildlife Management Plan, including a positive determination of the protective measures at the project for the greater sage-grouse species.

Potential risks to the accessibility of the estimated mineral resource at Lost Creek may include changes in the designation of the greater sage-grouse (sage grouse) as an endangered species by the USFWS because the Lost Creek Property lies within a sage grouse core area as defined by the State of Wyoming. (See discussion below under “Government Regulations, Protection of Endangered and Protected Species.”) The Company continues to work closely with the Wyoming Game and Fish Department (“WGFD”) and the BLM to mitigate impacts to the sage grouse.

The timing restrictions developed by the State preclude exploration drilling and other non-operational based activities which may disturb the sage grouse. The sage grouse timing restrictions relevant to ISR production and operational activities at Lost Creek are somewhat different because the State has recognized that mining projects within core areas must be allowed to operate year-round. While our sage grouse adaptive management plan includes certain calendar restrictions on drilling and construction activities, there are no calendar restrictions on production and operational activities in pre-approved disturbed areas within our permit to mine, and the limitations in the sage grouse management plan is not expected to affect our planned production profile.

Additional authorizations from federal, state and local agencies for the Lost Creek project include: WDEQ-Air Quality Division Air Quality Permit and WDEQ-Water Quality Division Class I Underground Injection Control (“UIC”) Permit. Following the plugging of one of our deep disposal wells in 2019, the UIC permit allows Lost Creek to operate up to four Class I injection wells to meet the anticipated disposal requirements for the life of the Lost Creek Project. The Environmental Protection Agency (“EPA”) issued an aquifer exemption for the Lost Creek project. The WDEQ’s separate approval of the aquifer reclassification is a part of the WDEQ Permit. We also received approval from the EPA and the Wyoming State Engineer’s Office for the construction and operation of two holding ponds at Lost Creek. Application has been made to the BLM for a right-of-way for use of portions of an existing regional road.

In 2014, applications for amendments to the Lost Creek license were submitted to federal regulatory agencies, NRC and BLM, for the development and mining of the LC East Project. The BLM issued its ROD authorizing the plan in 2019. The NRC participated in this review as a cooperating agency. In 2018, Wyoming assumed responsibility from the NRC for the regulation of radiation safety at uranium recovery facilities like Lost Creek. The Wyoming State Uranium Recovery Program (“URP”), a part of the WDEQ, oversees the licensing process for source material licenses as well as the operations of licensees in Wyoming. The URP has demonstrated that its integration into the overall WDEQ oversight of uranium recovery streamlines the process of licensing, offers greater consistency in authorizations and oversight, and results in reduced costs in the licensing phase. The URP issued a source material license for LC East in 2021. Also in 2021, we submitted our request for extension of our Lost Creek source material license. The license renewal is proceeding with URP on its technical review.

A permit amendment requesting approval to mine at the LC East Project was also submitted to the WDEQ. Approval will include an aquifer exemption. The air quality permit for Lost Creek will be revised to account for additional surface disturbance. Certain of our earlier Sweetwater County approvals have been amended. Numerous well permits from the State Engineer’s Office will be required. It is anticipated that the remaining permit to mine amendment will be completed in 2024 H1.

During 2016, we received all authorizations for the operation of Underground Injection Control (UIC) Class V wells at Lost Creek, and operation of the circuit began in early 2017. This allows for the onsite reinjection of fresh permeate (i.e., clean water) into relatively shallow Class V wells. Site operators use the RO circuits, which were installed during initial construction of the plant, to treat process wastewater into brine and permeate streams. The brine stream continues to be disposed of in the UIC Class I deep wells while the clean permeate stream is injected into the UIC Class V wells after treatment for radium. These operational procedures have significantly enhanced wastewater capacity at the site, ultimately reducing the injection requirements of our Class I deep disposal wells and extending the life of those valuable assets.

Through our subsidiaries Lost Creek ISR, LLC and NFU Wyoming, we control the federal unpatented lode mining claims and State of Wyoming mineral leases which make up the Lost Creek Property. Title to the mining claims is subject to rights of pedis possessio against all third-party claimants so long as the claims are maintained. The mining claims do not have an expiration date. Affidavits have been timely filed with the BLM and recorded with the Sweetwater County Recorder attesting to the payment for the Lost Creek Property mining claims of annual maintenance fees to the BLM as established by law from time to time.

The state leases have a ten-year term, subject to renewal for successive ten-year terms. The surface of all the unpatented mining claims is controlled by the BLM, and we have the right to use as much of the surface as is necessary for exploration and mining of the claims, subject to compliance with all federal, state and local laws and regulations. Surface use on BLM lands is administered under federal regulations. Similarly, access to state-controlled land is largely inherent within a State of Wyoming mineral lease, with certain additional obligations to those holding surface rights on a lease-specific basis.

There are no royalties at the Lost Creek Project, except on the State of Wyoming mineral lease as provided by law. Currently, there is only limited production planned from the state lease. There is a production royalty of one percent on certain claims of the LC East Project, and other royalties on certain claims at the LC South and EN Projects, as well as the other State of Wyoming mineral leases (LC West and EN projects).

Together with the Lost Creek Project, Five Adjoining Projects Form the Lost Creek Property

The LC East Project (5,750 acres) was added to the Lost Creek Property in 2011-2012. We located additional unpatented lode mining claims in 2014. Our LC East Project, as discussed elsewhere in this annual report, now has a source material license and awaits only the WDEQ permit to mine before all major authorizations are in hand to recover uranium at the project. The Lost Creek Report recommends that we continue to progress all remaining permit amendments to allow for future uranium recovery.

The LC West Project (3,840 acres) was also added to the Lost Creek Property in 2011-2012. The land position here includes one State of Wyoming mineral lease, in addition to the unpatented lode mining claims. We possess data related to historical exploration programs of earlier operators.

The LC North Project (6,260 acres) is located to the north and to the west of the Lost Creek Project. Historical wide-spaced exploration drilling on this project consisted of 175 drill holes. We have conducted two drilling programs at the project. We may conduct exploration drilling at LC North to pursue the potential of an extension of the MMT of the Lost Creek Project.

The map below shows the Lost Creek Property, including the Adjoining Projects.

The LC South Project (10,200 acres) is located to the south and southeast of the Lost Creek Project. Historical drilling on the LC South Project consisted of 488 drill holes. In 2010, we drilled 159 exploration holes (total, 101,270 feet) which confirmed numerous individual roll front systems occurring within several stratigraphic horizons correlative to mineralized horizons in the Lost Creek Project. Also, a series of wide-spaced drill holes were part of this exploration program which identified deep oxidation (alteration) that represents the potential for several additional roll front horizons.

The EN Project (5,160 acres) is adjacent to and east of LC South, including unpatented lode mining claims and one State of Wyoming mineral lease. We have over 50 historical drill logs from the EN project. Some minimal, deep, exploration drilling has been conducted at the project. No mineral resource is yet reported due to the limited nature of the data.

History and Geology of the Lost Creek Property

Uranium was discovered in the Great Divide Basin, where Lost Creek is located, in 1936. Exploration activity increased in Wyoming in the early 1950s after the Gas Hills District discoveries, and continued to increase in the 1960s, with the discovery of numerous additional occurrences of uranium. Wolf Land and Exploration (which later became Inexco), Climax (Amax) and Conoco Minerals were the earliest operators in the Lost Creek area and made the initial discoveries of low-grade uranium mineralization in 1968. Kerr-McGee, Humble Oil, and Valley Development, Inc. were also active in the area. Drilling within the current Lost Creek Project area from 1966 to 1976 consisted of approximately 115 wide-spaced exploration holes by several companies including Conoco, Climax (Amax), and Inexco.

Texasgulf acquired the western half of what is now the Lost Creek Project in 1976 through a joint venture with Climax and identified what is now referred to as the MMT. In 1978, Texasgulf optioned into a 50 percent interest in the adjoining Conoco ground to the east and continued drilling, fully identifying the MMT eastward to the current Project boundary; Texasgulf drilled approximately 412 exploration holes within what is now the Lost Creek Project. During this period Minerals Exploration Company (a subsidiary of Union Oil Company of California) drilled approximately eight exploration holes in what is currently the western portion of the Lost Creek Project. Texasgulf dropped the project in 1983 due to declining market conditions. The ground was subsequently picked up by Cherokee Exploration, Inc. which conducted no field activities.

In 1987, Power Nuclear Corporation (also known as PNC Exploration) acquired 100% interest in the project from Cherokee Exploration, Inc. PNC Exploration conducted a limited exploration program and geologic investigation, as well as an evaluation of previous in situ leach testing by Texasgulf. PNC Exploration drilled a total of 36 holes within the current Project area.

In 2000, New Frontiers Uranium, LLC acquired the property and database from PNC Exploration, but conducted no drilling or geologic studies. New Frontiers Uranium, LLC later transferred the Lost Creek Project-area property along with its other Wyoming properties to its successor NFU Wyoming. In 2005, Ur‑Energy USA purchased 100% ownership of NFU Wyoming.

The Lost Creek Property is situated in the northeastern part of the GDB which is underlain by up to 25,000 ft. of Paleozoic to Quaternary sediments. The GDB lies within a unique divergence of the Continental Divide and is bounded by structural uplifts or fault displaced Precambrian rocks, resulting in internal drainage and an independent hydrogeologic system. The surficial geology in the GDB is dominated by the Battle Spring Formation of Eocene age. The dominant lithology in the Battle Spring Formation is coarse arkosic sandstone, interbedded with intermittent mudstone, claystone and siltstone. Deposition occurred as alluvial-fluvial fan deposits within a south-southwest flowing paleodrainage. The sedimentary source is considered to be the Granite Mountains, approximately 30 miles to the north. Maximum thickness of the Battle Spring Formation sediments within the GDB is 6,000 ft.

Uranium mineralization identified throughout the property occurs as roll front type deposits, typical in most respects of those observed in other Tertiary Basins in Wyoming. Uranium deposits in the GDB are found principally in the Battle Spring Formation, which hosts the Lost Creek Property deposit. Lithology within the Lost Creek deposit consists of approximately 60% to 80% poorly consolidated, medium to coarse arkosic sands up to 50 ft. thick, and 20% to 40% interbedded mudstone, siltstone, claystone and fine sandstone, each generally less than 25 ft. thick. This lithological assemblage remains consistent throughout the entire vertical section of interest in the Battle Spring Formation.