ROSH HA'AYIN, Israel, November 17 /PRNewswire-FirstCall/ --

RoboGroup T.E.K. Ltd. (NASDAQ:ROBO) today reported financial

results for the third-quarter and first nine months of 2005.

Revenues for the third quarter increased by 26% to NIS 17.7 million

(US$3.8 million) from NIS 14 million (US$3.1 million) for the

comparable quarter in 2004. The NIS 3.7 million increase can be

approximately attributed equally to both YET and the Company's

Educational Division. Gross profit for the third quarter was NIS

7.7 million (US$1.7 million) compared with NIS 6.6 million (US$1.5

million) for the comparable period in 2004. The company reported

third-quarter net profits of NIS 1.4 million (US$0.3 million)

compared with a net loss of NIS 0.6 million (US$0.1 million) in the

third-quarter of 2004. Revenues for the nine-month period totaled

NIS 45.4 million (US$9.9 million) compared with NIS 41.7 million

(US$9.3 million) for the comparable period in 2004. The net loss

for the nine month period decreased significantly to NIS 0.8

million (US$0.2 million) from NIS 6.4 million (US$1.4 million) in

the comparable period in 2004. "We are pleased to announce our

second consecutive quarter of increased revenues and net profit"

said Rafael Aravot, RoboGroup's chief executive officer. "For that

last few quarters we continued to focus our attention on operating

efficiency to ensure that we maximize revenues while controlling

costs. The measures that we have taken over recent years to

increase our efficiency and decrease our costs have enabled us

greater flexibility." "We believe that we offer our customers a

comprehensive, "blended" and unique offering that includes a wide

range of solutions, which are fully integrated. This

includes-learning systems that allow students to take self-learning

courses from home, anytime and anywhere, over the internet (our

LearnMate system) as well as LIVE lessons broadcasted over

satellite or internet (our TrainNet system).We also offer:

Technology Laboratories, that include robots, CNC, Computer

Integrated Manufacturing, and other automation machinery, along

with simulation software for virtual operation of the machines".

"The recently received and reported contract, for the amount of

$1.2 million, is an example of such a successful "blended"

project," said Mr. Aravot. A complete Directors' Report for the

third quarter of 2005 is available on the Company's Website at

http://www.robo-group.com/ or as a PDF file upon request. Please

contact Ayelet Shiloni at Integrated IR, toll-free +1-866-447-8633.

RoboGroup RoboGroup and its subsidiaries are engaged in two major

fields of activity. The first is the field of education devoted to

RoboGroup's training products and e-learning systems. RoboGroup is

a world leader in engineering and manufacturing technology training

systems. The Company is market driven, deriving its growth from

technological leadership, strong partnerships and management

expertise. The other field of activity is the development,

manufacturing and marketing of motion control products for the

industrial market, which is performed through the Company's

subsidiary, Yaskawa Eshed Technologies (YET). For more information,

visit http://www.robo-group.com/. To the extent that this press

release discusses expectations about market conditions or about

market acceptance and future sales of the Company's products, or

otherwise makes statements about the future, such statements are

forward-looking and are subject to a number of risks and

uncertainties that could cause results to differ materially from

the statements made. These factors include the rapidly changing

technology and evolving standards in the industries in which the

Company and its subsidiaries operate, risks associated with the

acceptance of new products by individual customers and by the

market place and other factors discussed in the business

description and management discussion and analysis sections of the

Company's Annual Report on Form 20-F. Company Contact: Michal Afuta

RoboGroup +972-3-900-4112 Agency Contact: Ayelet Shiloni Integrated

IR +1-866-447-8633 RoboGroup T.E.K. Ltd. Balance Sheets NIS in

Thousands September, 30 December, 31 2005 2005 2004 2004 US$ (K)

NIS (K) NIS (K) NIS (K) Unaudited Unaudited Unaudited Audited

Convenience translation to US Reported dollars amounts Reported

amounts ASSETS Current assets Cash and cash equivalents 1,572 7,228

7,054 6,957 Short-term investments 13 61 - 99 Trade receivables

3,202 14,722 13,596 15,282 Other receivables and debit balances 628

2,888 2,946 2,093 Inventories 2,633 12,108 12,751 9,372 8,048

37,007 36,347 33,803 Long-term investments Investments in investee

and other companies - - 15 - Funds in respect of employee rights

upon retirement, net 185 850 329 563 185 850 344 563 Fixed assets

7,684 35,329 36,821 36,548 Other assets and deferred expenses 80

369 690 1,036 15,997 73,555 74,202 71,950 RoboGroup T.E.K. Ltd.

Balance Sheets NIS in Thousands September, 30 December, 31 2005

2005 2004 2004 US$ (K) NIS (K) NIS (K) NIS (K) Unaudited Unaudited

Unaudited Audited Convenience translation to US Reported dollars

amounts Reported amounts LIABILITIES Current liabilities Credit

from banks 3,517 16,172 15,757 15,228 Trade payables 1,331 6,119

5,533 5,853 Other payables and credit balances 2,600 11,955 10,790

10,333 7,448 34,246 32,080 31,414 Long-term liabilities Loans from

banks 3,604 16,571 17,740 17,100 Provision for deferred taxes 32

146 - 163 Liability for termination of employee/employer

relationship, net 41 190 207 139 3,677 16,907 17,947 17,402

Shareholders' equity Share capital 2,479 11,400 11,400 11,400

Capital reserves and premium on shares 9,629 44,273 44,159 44,179

Accumulated deficit (7,064) (32,482) (30,381) (31,656) Treasury

stock (172) (789) (1,003) (789) 4,872 22,402 24,175 23,134 15,997

73,555 74,202 71,950 RoboGroup T.E.K. Ltd. Statement of Operations

NIS in Thousands For the nine months ended September 30 2005 2005

2004 US$ (K) NIS (K) NIS (K) Unaudited Unaudited Unaudited

Convenience translation to US Reported amounts dollars Revenues

9,882 45,438 41,682 Cost of revenues 5,543 25,488 23,044 Gross

profit 4,339 19,950 18,638 Operating expenses Research and

development expenses, net 928 4,265 5,963 Marketing and selling

expenses 1,998 9,185 10,175 Administrative and general expenses

1,330 6,118 7,348 4,256 19,568 23,486 Operating profit (loss) 83

382 (4,848) Financial expenses, net (146) (673) (1,334) Other

income (expenses), net (45) (206) 671 Profit (loss) before taxes on

income (108) (497) (5,511) Income tax expenses 72 329 901 Net

profit (loss) (180) (826) (6,412) Profit (loss) per share ("EPS")

(0.02) (0.08) (0.6) Weighted average number of shares used in

computation of EPS (in thousands) 10,850 10,850 10,745 For the

three months ended September 30 Year ended December, 2005 2004 31,

2004 NIS (K) NIS (K) NIS (K) Unaudited Unaudited Audited Reported

amounts Revenues 17,676 14,001 61,734 Cost of revenues 9,985 7,412

35,843 Gross profit 7,691 6,589 25,891 Operating expenses Research

and development expenses, net 965 1,676 7,619 Marketing and selling

expenses 2,895 3,108 13,204 Administrative and general expenses

2,185 2,328 10,042 6,045 7,112 30,865 Operating profit (loss) 1,646

(523) (4,974) Financial expenses, net (281) (259) (2,111) Other

income (expenses), net 92 173 809 Profit (loss) before taxes on

income 1,457 (609) (6,276) Income tax expenses 57 - 1,411 Net

profit (loss) 1,400 (609) (7,687) Profit (loss) per share ("EPS")

0.13 (0.06) (0.71) Weighted average number of shares used in

computation of EPS (in thousands) 10,850 10,745 10,757 DATASOURCE:

RoboGroup t.e.k. Ltd CONTACT: Company Contact: Michal Afuta,

RoboGroup, , +972-3-900-4112; Agency Contact: Ayelet Shiloni,

Integrated IR, , +1-866-447-8633

Copyright

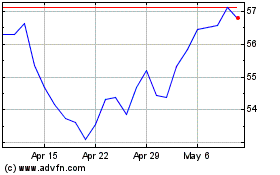

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From Apr 2024 to May 2024

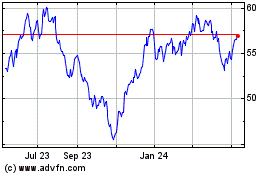

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From May 2023 to May 2024