RoboGroup Announces First-Quarter 2005 Financial Results ROSH

HA'AYIN, Israel, May 19 /PRNewswire-FirstCall/ -- RoboGroup T.E.K.

Ltd. (NASDAQ:ROBO) today reported first-quarter 2005 financial

results. Revenues for the first quarter totaled NIS 10.8 million

(US$2.5 million) compared with NIS 14.4 million (US$3.3 million)

for the comparable quarter in 2004. Gross profit for the first

quarter reached NIS 4.2 million (US$1.0 million) compared with NIS

6.1 million (US$1.4 million) in the first quarter of 2004.

Operating expenses for the first quarter decreased to NIS 6.6

million (US$1.5 million) from NIS 8.6 million (US$2.0 million) in

the first quarter of 2004. RoboGroups' first quarter net loss was

reduced to NIS 2.6 million (US$0.6 million) from a net loss of NIS

2.9 million (US$0.7 million) in the first quarter of 2004. Rafael

Aravot, Chief Executive Officer of RoboGroup, commented: "Although

our sales figures in the first quarter were somewhat disappointing

we did our best to minimize our loss mainly by controlling our

expenses. As is evident, our operating expenses this quarter are

substantially lower than the comparable quarter due to the

cost-cutting plan we implemented in the educational sector in

mid-2004. Looking forward, we plan to continue with our efforts to

increase sales, while focusing our attention on operating

efficiency to ensure that we maximize output while controlling our

costs ". A complete Directors' Report for the first quarter of 2005

is available on the Company's Website at http://www.robo-group.com/

RoboGroup and its subsidiaries are engaged in two major fields of

activity. The first is the field of education devoted to

RoboGroup's training products and e-learning systems. RoboGroup is

a world leader in engineering and manufacturing technology training

systems. The Company is market driven, deriving its growth from

technological leadership, strong partnerships and management

expertise. The other field of activity is the development,

manufacturing and marketing of motion control products for the

industrial market, which is performed through the Company's

subsidiary, Yaskawa Eshed Technologies (YET). For more information,

visit http://www.robo-group.com/ To the extent that this press

release discusses expectations about market conditions or about

market acceptance and future sales of the Company's products, or

otherwise makes statements about the future, such statements are

forward-looking and are subject to a number of risks and

uncertainties that could cause results to differ materially from

the statements made. These factors include the rapidly changing

technology and evolving standards in the industries in which the

Company and its subsidiaries operate, risks associated with the

acceptance of new products by individual customers and by the

market place and other factors discussed in the business

description and management discussion and analysis sections of the

Company's Annual Report on Form 20-F. Company Contact: Michal Afuta

RoboGroup +972-3-900-4112 Agency Contact: Ayelet Shiloni Integrated

IR +1-866-447-8633 RoboGroup T.E.K. Ltd. Balance Sheets NIS in

Thousands December, March, 31 31 2005 2005 2004 2004 US$ (K) NIS

(K) NIS (K) NIS (K) Unaudited Unaudited Unaudited Audited

Convenience translation to US Reported dollars amounts Reported

amounts ASSETS Current assets Cash and cash equivalents 1,386 6,044

12,091 6,957 Short-term investments 6 28 - 99 Trade receivables

2,637 11,499 10,480 15,282 Other receivables and debit balances 475

2,073 3,622 2,093 Inventories 2,510 10,946 13,301 9,372 7,014

30,590 39,494 33,803 Long-term investments Investments in investee

and other companies - - 15 - Funds in respect of employee rights

upon retirement, net 162 706 236 563 162 706 251 563 Fixed assets

8,277 36,094 38,115 36,548 Other assets and deferred expenses 231

1,009 1,451 1,036 15,684 68,399 79,311 71,950 RoboGroup T.E.K. Ltd.

Balance Sheets NIS in Thousands December, March, 31 31 2005 2005

2004 2004 US$ (K) NIS (K) NIS (K) NIS (K) Unaudited Unaudited

Unaudited Audited Convenience translation to US Reported dollars

amounts Reported amounts LIABILITIES Current liabilities Credit

from banks 3,654 15,936 15,302 15,228 Trade payables 1,210 5,276

6,298 5,853 Other payables and credit balances 2,295 10,008 11,074

10,333 7,159 31,220 32,674 31,414 Long-term liabilities Loans from

banks 3,746 16,335 18,727 17,100 Provision for deferred taxes 24

106 - 163 Liability for termination of employee/employer

relationship, net 37 163 204 139 3,807 16,604 18,931 17,402

Shareholders' equity Share capital 2,614 11,400 11,399 11,400

Capital reserves and premium on shares 10,140 44,219 44,207 44,179

Accumulated deficit (7,855) (34,255) (26,897) (31,656) Treasury

stock (181) (789) (1,003) (789) 4,718 20,575 27,706 23,134 15,684

68,399 79,311 71,950 RoboGroup T.E.K. Ltd. Statement of Operations

NIS in Thousands Year For the three months ended ended December,

March 31 31 2005 2005 2004 2004 US$ (K) NIS (K) NIS (K) NIS (K)

Unaudited Unaudited Unaudited Audited Convenience translation to US

Reported dollars amounts Reported amounts Revenues 2,480 10,815

14,365 61,734 Cost of revenues 1,524 6,648 8,231 35,843 Gross

profit 956 4,167 6,134 25,891 Operating expenses Research and

development expenses, net 388 1,690 2,302 7,619 Marketing and

selling expenses 674 2,941 3,485 13,204 Administrative and general

expenses 444 1,938 2,792 10,042 1,506 6,569 8,579 30,865 Operating

loss (550) (2,402) (2,445) (4,974) Financial expenses, net (27)

(116) (765) (2,111) Other income, net 7 31 282 809 Loss before

taxes on income (570) (2,487) (2,928) (6,276) Income tax expenses

26 112 - 1,411 Net loss (596) (2,599) (2,928) (7,687) Loss per

share ("EPS") (0.05) (0.24) (0.27) (0.71) Weighted average number

of Shares used in computation of EPS (in thousands) 10,851 10,851

10,744 10,757 DATASOURCE: RoboGroup t.e.k. Ltd CONTACT: Company

Contact: Michal Afuta, RoboGroup, , +972-3-900-4112; Agency

Contact: Ayelet Shiloni, Integrated IR, , +1-866-447-8633

Copyright

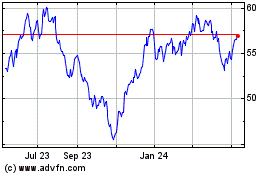

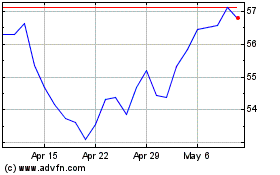

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From Jun 2024 to Jul 2024

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From Jul 2023 to Jul 2024