RoboGroup Announces Fourth-Quarter and Full-Year 2004 Financial

Results Sharp Increase in 4th Quarter Revenues to NIS 20.1 Million;

Sharp Decrease in Net Loss ROSH HA'AYIN, Israel, March 30

/PRNewswire-FirstCall/ -- RoboGroup T.E.K. Ltd. (NASDAQ:ROBO) today

reported fourth-quarter and full-year 2004 financial results.

Revenues for the fourth quarter totaled NIS 20.1 million (US$4.7

million) compared with NIS 11.2 million (US$2.6 million) for the

comparable quarter in 2003. Gross profit for the fourth quarter

increased to NIS 7.3 million (US$1.7 million) from NIS 3.2 million

(US$0.7 million) in the fourth quarter of 2003. During the fourth

quarter the company performed an inventory write off for slow

moving and outdated inventory in the education field, in the amount

of approximately NIS 2.6 million (US$0.6 million), stemming among

other things from the launch of new products. RoboGroups'

fourth-quarter net loss dropped to NIS 1.3 million (US$0.3 million)

from a net loss of NIS 6.3 million (US$1.5 million) in the fourth

quarter of 2003. Rafael Aravot, Chief Executive Officer of

RoboGroup, commented: "Our full-year results reflect increased

revenues, along with significant cost-cuts in G&A and R&D

expenses, which resulted in a substantial decrease in our annual

net loss. In mid 2004, we began to implement a cost-cutting plan to

improve profitability in the educational sector. The plan included

personnel cuts as well as integration of activities. However,

despite the smaller workforce, I am happy to announce that we

succeeded in meeting our high revenue goal of over NIS 20 million

in the fourth quarter, our highest in the last two years. In

addition, in the last quarter of the year, we would have achieved

net income except for the inventory write-off.. Revenues for the

twelve-month period reached NIS 61.7 million (US$14.3 million)

compared to NIS 56.1 million (US$13 million) for the comparable

period in 2003. The increased revenues stem mainly from an increase

in revenues in the education segment and in the industrial motion

control segment by YET. Gross profit for the twelve-month period

reached NIS 25.9 million (US$6 million) compared with NIS 23.5

million (US$5.4 million) for the comparable period in 2003. The

increase is mainly due to the increase in revenues. The net loss

for the twelve month period decreased significantly to NIS 7.7

million (US$1.8 million) from NIS 18.0 million (US$4.2 million) in

the comparable period in 2003. YET's revenues for the year 2004

totaled NIS 21 million (US$4.8) compared to NIS 14 million (US$3.2

million) for the year 2003. RoboGroup's part in YET's revenues is

50%. XtraDrive sales in the European and the Israeli markets began

in 2004, following its launch in these markets in 2003. These sales

were the main reason for YET's increased revenues in 2004. In 2004,

XtraDrive was also launched in the US market. A complete Directors'

Report for the fourth quarter of 2004 is available on the Company's

Website at http://www.robo-group.com/ or as a PDF file upon

request. Please contact Ayelet Shiloni at Integrated IR, toll-free

+1-866-447-8633. RoboGroup and its subsidiaries are engaged in two

major fields of activity. The first is the field of education

devoted to RoboGroup's training products and e-learning systems.

RoboGroup is a world leader in engineering and manufacturing

technology training systems. The Company is market driven, deriving

its growth from technological leadership, strong partnerships and

management expertise. The other field of activity is the

development, manufacturing and marketing of motion control products

for the industrial market, which is performed through the Company's

subsidiary, Yaskawa Eshed Technologies (YET). For more information,

visit http://www.robo-group.com/. To the extent that this press

release discusses expectations about market conditions or about

market acceptance and future sales of the Company's products, or

otherwise makes statements about the future, such statements are

forward-looking and are subject to a number of risks and

uncertainties that could cause results to differ materially from

the statements made. These factors include the rapidly changing

technology and evolving standards in the industries in which the

Company and its subsidiaries operate, risks associated with the

acceptance of new products by individual customers and by the

market place and other factors discussed in the business

description and management discussion and analysis sections of the

Company's Annual Report on Form 20-F. Company Contact: Michal Afuta

RoboGroup +972-3-900-4112 Agency Contact: Ayelet Shiloni Integrated

IR +1-866-447-8633 RoboGroup T.E.K. Ltd. Balance Sheets (NIS in

Thousands) Consolidated December, December, December, 31 31 31 2004

2004 2003 U.S.$ (K) (1) NIS (K) NIS (K) Reported Reported Adjusted

amounts amounts amount (*) (*) (*) ASSETS Current assets Cash and

cash equivalents 1,615 6,957 14,878 Short-term investments 23 99 -

Trade receivables 3,547 15,282 13,217 Other receivables and debit

balances 486 2,093 2,292 Inventories 2,175 9,372 13,603 7,846

33,803 43,990 Long-term investments Investments in investee and

other companies - - 15 Funds in respect of employee rights upon

retirement, net 131 563 81 131 563 96 Fixed assets, net 8,484

36,548 38,233 Other assets and deferred expenses 240 1,036 1,525

16,701 71,950 83,844 (1) Convenience translation into U.S. Dollars.

(*) Discontinuance of the adjustment for the effects of inflation

according to the Israeli CPI as of December 2003 (*) Adjusted

amounts for the Israeli CPI as of December 2003. RoboGroup T.E.K.

Ltd. Balance Sheets (NIS in Thousands) Consolidated December,

December, December, 31 31 31 2004 2004 2003 U.S.$ (K) (1) NIS (K)

NIS (K) Reported Reported Adjusted amounts amounts amount (*) (*)

(*) LIABILITIES Current liabilities Credit from banks 3,535 15,228

15,941 Trade payables 1,359 5,853 5,394 Other payables and credit

balances 2,398 10,333 14,345 7,292 31,414 35,680 Long-term

liabilities Loans from banks 3,969 17,100 17,516 Provision for

deferred taxes 38 163 - Liability for termination of

employee/employer relationship, net 32 139 200 4,039 17,402 17,716

Commitments, contingent liabilities and pledges Shareholders'

equity Share capital 2,646 11,400 11,399 Authorized capital as at

December 31, 2004 and 2003 was 25,000,000 shares of NIS 0.5 par

value of which 11,239,952 and 11,238,352 shares were issued and

outstanding on December 31, 2004 and 2003 respectively Premium on

shares 9,854 42,452 42,214 Capital reserves 401 1,727 1,807

Accumulated deficit (7,348) (31,656) (23,969) Treasury stock (183)

(789) (1,003) 5,370 23,134 30,448 16,701 71,950 83,844 (1)

Convenience translation into U.S. Dollars. (*) Discontinuance of

the adjustment for the effects of inflation according to the

Israeli CPI as of December 2003 (*) Adjusted amounts for the

Israeli CPI as of December 2003. RoboGroup T.E.K. Ltd. Statement of

Operations (NIS in Thousands) Consolidated Year Year Year Year

ended ended ended ended December, December, December, December, 31

31 31 31 2004 2004 2003 2002 U.S.$ (K) NIS (K) (1) NIS (K) NIS (K)

Reported Reported Adjusted Adjusted amounts amounts amount amount

(*) (*) (**) (**) Revenues 14,330 61,734 56,116 86,159 Cost of

revenues 8,320 35,843 32,598 41,412 Gross profit 6,010 25,891

23,518 44,747 Operating expenses Research and development expenses,

net 1,769 7,619 12,651 12,755 Marketing and selling expenses 3,065

13,204 12,622 14,240 Administrative and general expenses 2,331

10,042 14,569 13,630 7,165 30,865 39,842 40,625 Operating income

(loss) (1,155) (4,974) (16,324) 4,122 Financial expenses, net (490)

(2,111) (3,783) (1,402) Other income, net 188 809 2,032 1,640

Income (loss) before taxes on income (1,457) (6,276) (18,075) 4,360

Income tax expenses (income) 327 1,411 (82) 1,051 Income (loss)

before Company's share in results of Investee companies (1,784)

(7,687) (17,993) 3,309 Company's share in losses of Investee

companies - - - - Net income (loss) (1,784) (7,687) (17,993) 3,309

Earnings (loss) per share ("EPS") (0.17) (0.71) (1.67) 0.31 Number

of shares used in computation of EPS (in thousands) 10,757 10,757

10,744 10,731 (1) Convenience translation into U.S. Dollars. (*)

Discontinuance of the adjustment for the effects of inflation

according to the Israeli CPI as of December 2003 (**) Adjusted

amounts for the Israeli CPI as of December 2003. DATASOURCE:

RoboGroup t.e.k. Ltd CONTACT: Company Contact: Michal Afuta,

RoboGroup, , Tel: +972-3-900-4112, Agency Contact: Ayelet Shiloni,

Integrated IR, , Tel: +1-866-447-8633

Copyright

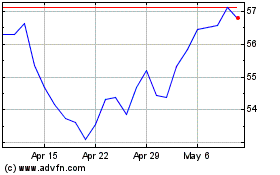

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From Apr 2024 to May 2024

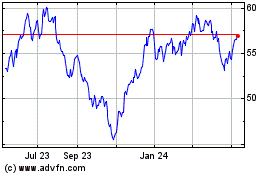

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From May 2023 to May 2024