false000117115500011711552023-12-222023-12-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 22, 2023 |

RADIANT LOGISTICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35392 |

04-3625550 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Triton Towers Two 700 S. Renton Village Place Seventh Floor |

|

Renton, Washington |

|

98057 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 425 462-1094 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 Par Value |

|

RLGT |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Radiant Logistics, Inc. (“the Company”) announced the departure of an officer.

On December 22, 2023, the Company announced the departure of John W. Sobba, its Senior Vice President and General Counsel. In connection with his separation from service, the Company and Mr. Sobba executed a Separation Agreement and General Release providing for a severance payment and benefits to Mr. Sobba consistent with the terms and conditions of Mr. Sobba’s executive employment agreement with the Company, dated as of April 27, 2018, which are salary continuation at base salary level prior to such termination, plus a continuation of the medical benefits and car allowance benefits, for a period of six months. In addition, the Separation Agreement and General Release provides for the vesting of Restricted Stock Unit grants on a pro rata basis for all awards granted to Mr. Sobba more than twelve months prior to his separation date. The description of the Separation Agreement and General Release is qualified in its entirety by reference to the full text of such agreement, a copy of which is filed herewith as Exhibit 10.1 and is incorporated by reference herein.

The Company announced the appointment of an officer.

On December 22, 2023, the Company appointed Jaime Becker, to serve as its Senior Vice-President and General Counsel. Ms. Becker, age 43, brings with her over a decade of experience in supporting both publicly and privately held domestic and international companies in the technology, logistics, construction, and oil and gas industries. Ms. Becker was a part of the legal team at Amazon, followed most recently by her role at Convoy. Ms. Becker holds a Bachelor of Arts degree from Pepperdine University and a Juris Doctorate from Pepperdine University School of Law.

We entered into an employment agreement with Ms. Becker (“Employment Agreement”) setting forth the terms and conditions of her employment. Pursuant to the Employment Agreement, the Company will pay her an annual base salary of $250,000, subject to annual evaluation and adjustment. Incentive compensation will be awarded to Ms. Becker under the Company’s general management compensation plans, based upon the achievement of corporate and individual objectives at the discretion of our audit and executive oversight committee.

In addition to customary employment benefits that are broadly provided to our employees, such as participation in our stock option plans and life insurance, hospitalization, major medical and other health benefits, Ms. Becker is entitled to six months of severance in the form of salary continuation payments in the event her employment is terminated as a result of her death or disability, or by the Company other than for cause; or twelve months of severance if within nine months following a “Change of Control”, she voluntary terminates her employment for “Good Reason” or her employment is terminated by the Company other than for cause. For the purposes of the Employment Agreement, a “Change of Control” shall be deemed to occur if there occurs a sale, exchange, transfer or other disposition of substantially all of our assets to another entity, except to an entity controlled directly or indirectly by us, or a merger, consolidation or other reorganization in which the Company is not the surviving entity, or a plan of liquidation or dissolution of the Company other than pursuant to bankruptcy or insolvency laws. Additionally, “Good Reason” shall be deemed to occur upon either (i) a breach of the Employment Agreement by us, or (ii) a reduction in salary without Ms. Becker’s consent, unless any such reduction is otherwise part of an overall reduction in executive compensation experienced on a pro rata basis by other similarly situated employees.

The description of the Employment Agreement is qualified in its entirety by reference to the full text of such agreement, a copy of which is filed herewith as Exhibit 10.2 and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Radiant Logistics, Inc. |

|

|

|

|

Date: |

December 22, 2023 |

By: |

/s/ Todd Macomber |

|

|

|

Todd Macomber

Chief Financial Officer |

Exhibit 10.1

SEPARATION AGREEMENT AND GENERAL RELEASE

This Separation Agreement and General Release (the “Agreement”) is made and entered into by and between Radiant Logistics, Inc. (the “Company”) and John W. Sobba (“Executive”).

Executive and Company shall be collectively referred to as (the “Parties”).

RECITALS

WHEREAS, Executive was employed by Company in the position of Senior Vice President, General Counsel through December 22, 2023 (“Separation Date”);

WHEREAS, the Company and Executive desire that Executive separates his service from the Company as of the Separation Date;

WHEREAS, Executive will continue receiving group health coverage with Company (medical, dental, and/or vision coverage and/or any health care flexible spending accounts, health savings accounts, or dependent care flexible spending accounts) through the end of month in which Separation Date occurs;

WHEREAS, Executive will be paid for all accrued but unused vacation days through the Separation Date, and will be reimbursed for any previously unreimbursed business expenses incurred by him prior to the Separation Date in accordance with the Company’s expense reimbursement policy;

WHEREAS, in an effort to demonstrate good faith and in an effort to assist Executive in his transition, and pursuant to Executive’s Employment Agreement, the Company has offered Executive this Agreement;

WHEREAS, the Parties desire to compromise settle and release all claims, whether known or unknown, arising out of Executive’s employment with and separation from Company;

NOW, THEREFORE, for good and valuable consideration of the mutual promises and covenants hereinafter set forth, the Parties agree as follows:

AGREEMENT

1.Termination of Employment, Resignation from Office. Under and subject to the terms of this Agreement, the parties hereto do agree that Executive’s service to the Company is to terminate as of the Separation Date. In conjunction with the termination of services of the Executive to the Company, Executive hereby resigns in all capacities in which he served as an officer, employee and/or director of the Company, and any affiliates or subsidiaries of the Company, as of the Separation Date, and does thereby relinquish any of the powers, duties or authorities otherwise bestowed upon an officer, employee and/or director of the Company, and any affiliates or subsidiaries of the Company, under either any arrangements and/or agreements by which Executive was employed by the Company or under applicable federal law or the laws of the State of Delaware. In that regard, Executive does hereby confirm that any such resignation and termination of employment are not related to or as a result of, a disagreement relating to the operations, policies or practices of the Company, or any of the affiliates or subsidiaries of the Company.

2.Consideration/Separation Payment. In exchange for a general release, the Company agrees to provide Executive with a separation package consisting of: (1) the continuation of

Executive’s base salary for six months following the Separation Date, totaling One Hundred Twenty

-Five Thousand Dollars ($125,000.00), less all applicable statutory withholdings (“Severance

Payment”); (2) the continuation of Executive’s current car allowance equal to $1,000 per month for six months following the Separation Date totaling Six Thousand Dollars ($6,000) (“Car Allowance”);

(3) payment of Executive’s COBRA premiums for up to six months following the Separation Date

(“COBRA Premium Reimbursement”) following Executive’s election of COBRA coverage; and (4) the acceleration of Executive’s Restricted Stock Units (“RSU Acceleration”). Collectively, the Severance Payment, Car Allowance, COBRA Premium Reimbursement, and RSU Acceleration shall be referred to as (“Consideration”).

a.The Company shall pay the Severance Payment in equal installments on the

Company’s regularly scheduled pay dates until paid in full beginning on the next payroll processing date following the Company’s receipt of this signed Agreement so long as the revocation period in Paragraph 15 has expired.

b.The RSU Acceleration will be administered as follows: RSU grants that the Company granted to Executive more than 12 months prior to the Separation Date will vest pro rata from the Date of Grant through the Separation

Date. RSUs that were granted less than one year (1) before the Separation Date will be canceled. Executive’s RSU grants, therefore, will vest as follows:

|

|

|

|

|

|

|

|

Grant Date |

Vest Date |

Separation Date |

Months from Grant |

Percent vested |

RSU grant amount |

|

Number of units to vest per Agreement |

9/8/2021 |

9/15/2024 |

12/22/2023 |

27 |

75% |

16,229 |

|

12,172 |

|

|

|

|

|

|

|

|

9/9/2022 |

9/15/2025 |

12/22/2023 |

15 |

42% |

16,925 |

|

7,052 |

|

|

|

|

|

|

|

|

9/11/2023 |

9/11/2026 |

12/22/2023 |

3 |

|

11,353 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

44,507 |

|

19,224 |

c.Executive further understands that if Executive breaches any of the promises made in this Agreement, the Company will have no obligation to tender (or continue to tender) any portion of the Consideration as provided for in this paragraph.

3.No Admission of Liability. The Parties acknowledge that the Consideration does not constitute an admission of liability, express or implied, on the part of the Company with respect to any fact or matter pertaining to Executive’s employment with the Company. Executive acknowledges that the Company is providing Executive with the Consideration solely for the purpose of resolving any and all controversies that are the subject of Executive’s employment with, and separation from, the Company and to assist Executive in Executive’s transition after the Separation Date.

4.Tax Liability. Executive generally and specifically acknowledges that the Company

2

Confidential Separation Agreement

did not provide Executive with any tax advice. Executive agrees that Executive is liable for the payment of all federal and state taxes that may be due as the result of the consideration received in the payment described above, and that such payment is made for the settlement of disputed claims as set forth herein.

5.No Authority Following Separation Date. Executive understands and agrees that effective as of the Separation Date, Executive is no longer authorized to incur any expenses, obligations or liabilities on behalf of Company or to act on behalf of or represent himself as an executive of Company.

6.Release. The Executive makes this Agreement on behalf of the Executive and the Executive’s successors, assigns, heirs, beneficiaries, executors, administrators, creditors,

representatives, agents and Affiliates (the “Releasing Parties”). The release set forth herein is given to the Company and its parents, subsidiaries, affiliates, partners, and each of their predecessors, successors, and assigns and each and all of their respective past, present or future members, officers, directors, equity holders, trustees, representatives, employees, principals, agents, insurers, partners, lenders, attorneys, and other advisors; and any employee benefit plan established or maintained by the foregoing entities and their plan administrators (collectively, the “Released Parties”). In consideration of the promises and covenants set forth herein, Executive hereby fully, finally and irrevocably releases, acquits and forever discharges the Released Parties forever and unconditionally of and from any and all claims, demands or liabilities whatsoever, whether known or unknown or suspected to exist by Executive, which Executive ever had or may now have against any of the Released Parties, arising at any time in any jurisdiction from the beginning of time to the date Executive signs this Agreement, including, without limitation, any claims, demands or liabilities in connection with Executive’s employment with any of the Released Parties or the termination thereof, including wrongful termination, constructive discharge, breach of express or implied contract, tort,

unpaid wages, benefits, attorney’s fees or pursuant to any federal, state, or local employment laws, regulations, or executive orders prohibiting discrimination or retaliation or less favorable treatment on any grounds including, inter alia, age, race, color, sex, national origin, religion, handicap, veteran status, disability or whistleblowing, including, without limitation, the Age Discrimination in Employment Act, the Older Workers Benefit Protection Act, Title VII of the Civil Rights Act of 1964, as amended by the Civil Rights Act of 1991, the Civil Rights Act of 1866, the Employee Retirement Income Security Act of 1974, the Genetic Information Nondiscrimination Act of 2008, the Uniformed Services Employment and Reemployment Rights Act, Fair Labor Standards Act, Family Leave and Medical Act, Employee Retirement Income Security Act of 1974 (except for any vested benefits under any qualified benefit plan), Immigration Reform and Control Act, Worker Adjustment and Retraining Notification Act, Fair Credit Reporting Act, Equal Pay Act, the Americans with Disabilities Act of 1990, the Washington Industrial Welfare Act, the Washington Law Against Discrimination, the Washington Family Leave Act, the Washington Leave Law; the Washington Minimum Wage Requirements and Labor Standards Act, Title 49 of the Revised Code of Washington, the Washington Equal Pay Opportunity Act; the Washington Fair Chance Act, the State Constitution of Idaho, the Idaho Human Rights Act (IHRA), and any and all state or local laws regarding employment discrimination and/or federal, state or local laws of any type or description regarding employment as well as any claim for breach of contract, wrongful discharge, breach of any express or implied promise, misrepresentation, fraud, retaliation, violation of public policy, infliction of emotional distress, defamation, promissory estoppel, invasion of privacy or any other theory or claim, whether legal or equitable, including but not limited to any claims arising from or derivative of Executive’s employment with the Company and the termination of Executive’s

3

Confidential Separation Agreement

employment from the Company or otherwise.

This means that by signing this Agreement, Executive understands that Executive will have waived any right Executive may have to bring a lawsuit or make any claim of any kind whatsoever against any released party based on any actions or omissions of the Company or any released party up to the effective date of this Agreement.

This release does not affect any legal rights that Executive may have arising after the Effective Date of this Agreement.

7.Waiver. By this Release, Executive does not waive the right to file a charge with a government administrative agency (“Agency”) enforcing civil rights laws, such as the Equal Employment Opportunity Commission, or to participate in any investigation or proceeding

conducted by such an agency, nor shall any provision in this Agreement adversely affect Executive’s right to engage in such conduct. Nevertheless, pursuant to this paragraph, Executive waives the right to obtain any monetary relief or other recovery as a result of or with regard to the matters alleged in the charge or to collect any monies or compensation as a result of filing or participating in such a charge or complaint.

8.Complete Satisfaction. Executive represents that this Agreement provides complete satisfaction of any and all claims, whether known, suspected, or unknown, that Executive may have or has had against any of the Released Parties as of the date of this Agreement, and he hereby waives any and all relief for such claims not explicitly provided for herein.

9.No Pending Action. Executive represents that there are no outstanding administrative or judicial claims, complaints, charges, lawsuits or proceedings of any kind against any of the Released Parties to which he is a party or which were filed on Executive’s behalf. And that Executive is not aware of any facts that could give rise to a charge or Claim against any Released Parties.

10.Group Medical Insurance. Executive’s group health coverage with Company (medical, dental, and/or vision coverage and/or any health care flexible spending accounts, health savings accounts, or dependent care flexible spending accounts) will continue for up to six months following the Separation Date. Pursuant to federal COBRA law, the Company agrees to pay

Executive’s COBRA premiums for continuation coverage in accordance with election materials and other COBRA notices to be sent to Executive by the plans’ designated administrator.

11.Confidentiality/Trade Secrets. Executive agrees that at all times hereafter, he will hold in the strictest confidence, and will not use or disclose to any person, firm or corporation, any Confidential Information of the Company. Executive understands that “Confidential Information” means any Company proprietary information, technical data, trade secrets or know-how, including, but not limited to, sales and pricing information, research, product plans, products, services, customer requirements, customer lists and customers, markets, software, developments, inventions, processes, formulas, technology, designs, drawings, engineering, hardware configuration information, marketing, finances, or other business information disclosed to Executive by the Company, either directly or indirectly in writing, orally or by drawings or observation of parts or equipment. Executive understands that “Confidential Information” does not include any of the

4

Confidential Separation Agreement

foregoing items which has become publicly known and made generally available through no wrongful act of his or of others who were under confidentiality obligations as to the item or items involved or improvements or new versions thereof. Executive understands and acknowledges that a breach of this Paragraph 11 would injure the Company irreparably in a way which could not be adequately compensated for by damages. Executive therefore agrees that in the event of any breach or threatened breach by him, the Company will be entitled to an injunction, without bond, restraining such breach, as well as costs and attorneys’ fees relating to any such proceeding or any other legal action to enforce this Paragraph 11. Nothing herein will be construed, however, as prohibiting the Company or its assignee or successor from pursuing other available remedies or recovering on any claim for damages for such breach or threatened breach.

Pursuant to the Defend Trade Secrets Act of 2016, Executive acknowledges that he may not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a Trade Secret that: (a) is made (i) in confidence to a Federal, State, or Local government official, either directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (b) is made in a complaint or other document that is filed in a lawsuit or other proceeding, if such filing is made under seal.

12.Confidentiality of Agreement. To the extent permissible under applicable law, Executive agrees that the existence of this Agreement and the terms of this Agreement, including but not limited to the Consideration and the amount thereof are absolutely confidential. Executive agrees he will not communicate or disclose the existence of this Agreement and/or the amount of the Consideration made by Company with any individual or third party, including current or former employees of Company. Executive represents that he has not disclosed and agrees he will not disclose the existence of this Agreement or any of the terms or conditions herein to anyone other than his attorney and tax or financial advisor, spouse, or as may be required pursuant to legal process; provided, however, that he will advise any such individuals beforehand of the existence of his confidentiality obligations under this Agreement and their corresponding obligations. Executive further agrees to take reasonable steps to ensure that any information concerning this Agreement which is disclosed to his attorney, spouse, and/or tax or financial advisor will not be disclosed to any other third party. Any violation of this confidentiality requirement by his attorney, spouse, and/or tax or financial advisor will be treated as a violation of this Agreement by Executive. Notwithstanding the above, Executive acknowledges that the Company is a public company who has an obligation under federal securities laws to describe the arrangements covered by this Agreement and to file a copy of this Agreement, with the Securities and Exchange Commission

13.Liquidated Damages. Executive agrees that if he breaches his promise to maintain the confidentiality of this Agreement, including without limitation disclosing the amount of the Consideration, then the resulting damages would be impracticable or extremely difficult to determine because of the uncertain effect of the disclosure of such information on Company. Because of the difficulty of determining the damages resulting from the breach of the confidentiality provision in Paragraph 12 of this Agreement by Executive, the Parties agree that in the event of such a breach by Executive, Company shall be entitled to liquidated damages in the amount of Twelve Thousand Five Hundred Dollars ($12,500) for each breach. Executive and Company represent and agree that the liquidated damages provision contained in this paragraph is fair and reasonable as confidentiality of this Agreement is of utmost concern to Company.

14.Return of Property. As a material condition of receiving and being entitled to retain the Consideration, Executive agrees that he will promptly return to the Company all Company

5

Confidential Separation Agreement

property (without retaining any copies) including, but not limited to laptops, reports, files, records, keys, computer disks and software, credit cards, telephones, cellular phones, and any and all other physical or personal property provided to Executive by the Company during the course of his employment. By executing this Agreement, Executive represents and warrants that Executive has returned all Company property to the Company at the time of execution.

15.Mutual Non-Disparagement or Harm. Executive agrees that he will not make any comments or statements relating to the Company or any Releasee that are negative, critical or derogatory and that would denigrate, disparage or otherwise injure the business or reputation of any of them. Similarly, the Company will instruct its executive leadership team not to make any comments or statements that are negative, critical or derogatory against Executive.

Nothing in Paragraphs 12 and 15 prevents Executive from discussing or disclosing information about alleged or perceived improper acts in the workplace. Further, nothing in Paragraphs 12 and 15 prevent Executive from discussing Executive’s employment with, and separation from, the Company with any government administrative agency, such as the National Labor Relations Board (“NLRB”), Security Exchange Commission (“SEC”), Equal Employment Opportunity Commission (“EEOC”) or other agency, whether as part of a report, complaint, investigation, or for some other purpose.

16.Release of Age Discrimination Claims. Executive acknowledges with Executive’s signature on this Agreement that Executive has had at least twenty-one (21) calendar days within which to consider this Agreement but may voluntarily waive that 21-day period and immediately sign the Agreement if Executive so chooses. Executive further acknowledges that Executive has been advised that Executive has seven (7) calendar days after Executive’s execution of this Agreement to revoke it. Any such revocation must be in writing and delivered by hand, e-mail or facsimile (receipt confirmed) to the Vice President of Human Resources, Renee Kiss, at rkiss@radiantdelivers.com “I hereby revoke the Separation Agreement and General Release and forfeit any right to a severance payment.” Executive further acknowledges that Executive has read this Agreement in its entirety and that Executive fully understands all of the terms and conditions contained herein.

Executive further acknowledges that Executive is entering into this Agreement knowingly, voluntarily and of Executive’s own free will. This Agreement shall not become effective and enforceable until the seven-calendar day revocation period has expired.

17.Reference. If requested to provide a reference for Executive, the Company shall confirm Executive’s dates of employment, position and salary only and provide no other information.

18.Applicable Law and Forum Selection Clause. This Agreement shall be interpreted, governed and enforced under the laws of the State of Washington. The parties agree that any and all disputes arising under or related to this Agreement will and can only be brought in a court of competent jurisdiction within the State of Washington.

19.Severability. If any provision or provisions of this Agreement shall be held invalid, illegal or unenforceable, the validity, legality and/or enforceability of the remaining provisions shall not in any way be affected or impaired thereby. If any terms or sections of this Agreement are determined to be unenforceable, they shall be modified so that the unenforceable term or section is enforceable to the greatest extent possible.

20.Counterparts/By Facsimile. This Agreement may be executed in counterparts by

6

Confidential Separation Agreement

facsimile copy, each of which will be deemed an original, and all of which together will constitute but one and the same instrument.

21.Unemployment Benefits. The Company will support and not contest Employee’s right to apply for and receive unemployment insurance benefits.

22.Entire Agreement. This Agreement constitutes the entire agreement between the parties pertaining to the subject matter contained herein and supersedes any and all prior and contemporaneous written or oral agreements, representations and understandings of the parties.

Radiant Logistics, Inc.

|

|

By: |

/s/ Bohn H. Crain |

|

Bohn Crain, Founder, Chairman and Chief Executive Officer |

I acknowledge receipt of this Agreement on December 22, 2023, and I hereby agree to and accept this Agreement.

|

|

|

|

/s/ John W. Sobba |

|

12/22/2023 |

|

John W. Sobba |

|

Date |

|

7

Confidential Separation Agreement

Exhibit 10.2

November 2, 2023

Ms. Jaime Becker

Email: jfbecker11@gmail.com

Re: Employment Agreement

Dear Jaime:

Radiant Global Logistics, Inc. (the “Company”) is pleased to confirm your conditions of employment with the Company.

1.Position and Commencement Date. As the Company’s Assistant General Counsel, you will perform duties consistent with the position as well as such other duties as may be assigned to you from time to time by the CEO of the Company, to whom you will directly report. Your position will be in the Renton, Washington office of the Company and to commence on November 13, 2023, or at such other time as is mutually agreed to between you and the Company.

2.Compensation. You will be employed at a base annual salary of $250,000, payable, subject to applicable tax withholdings and otherwise in accordance with payroll practices adopted by the Company from time to time. Your base salary will be evaluated for adjustment on an annual basis. In addition to your base salary, you will be eligible to participate the Company's annual incentive compensation programs in the following manner:

3.Management Short Term Incentive Plan. You will be eligible to participate in the Quarterly Management STIP, effective January 1, 2024. The program is based upon your ability to contribute to overall company success and profitability. Potential maximum annual payout is of 35% of your base salary with actual payout based upon Radiant’s EBITDA results relative to target and individual employee performance. You must be employed by the Company at the time of payout (quarterly) in order to be eligible. The Company reserves the right to change payout and eligibility guidelines in whole or part at any time subject to management discretion and business needs.

4.Management Long Term Incentive Plan. You will be eligible to participate in the Long-Term Incentive Program LTIP. The amount of your LTIP, if any, will be determined in the sole discretion of Radiant, with a target of 35% of your base compensation if all individual and Company management business objectives are achieved. The bonus would be based upon management’s subjective view of a combination of (i) your individual contribution to Radiant and (ii) the overall performance of Radiant. The Company performance must be at least 75% for a pay-out to occur but can also flex up to 150% based on performance. This bonus will be paid by issuing Restricted Stock Units that vest at the third anniversary of the grant. You must be employed by the Company at the time of award (annually) in order to be eligible. The Company

700 S. Renton Village Place • Seventh Floor • Renton, WA 98057 • (T) 425-462-1094 • (F) 425 462-0768

www.radiantdelivers.com

reserves the right to change the program and eligibility guidelines in whole or part at any time subject to management discretion and business needs.

5.Annual Performance Stock Unit Award. You will be eligible to participate in the Annual Performance Stock Unit Award Program for Senior Leadership at the time you transition to the role of General Counsel. The program as currently designed measures Individual and Company performance over a Three-Year Performance Period. Your Award will be settled in shares of Common Stock based on achievement of minimum, target, maximum and/or such other performance levels as determined by the Audit and Executive Oversight Committee of the Board of Directors of the Company.

6.Benefits. As an employee of the Company, you will also be eligible to participate in such life insurance, hospitalization, major medical and other health benefits generally offered by the Company to its employees in your general job classification level. This presently includes participation in the Company's medical and dental insurance plans, however, these benefit programs are subject to termination or modification from time-to-time. You will also be eligible for a $1,000 per month car allowance benefit and to participate in the Company’s 401K plan, subject to its terms.

7.Vacations and Holidays. You will be entitled to receive 3 weeks of paid vacation in each calendar year. Such vacation to be taken in accordance with company policies and at times that do not unreasonably interfere with the performance of your duties as assigned.

8.Expenses. You will be reimbursed for all reasonable expenses incurred by you in furtherance of your position with the Company, including travel and entertainment expense, upon submission of the appropriate documentation.

9.Employee-at-Will. This offer does not guarantee continued employment for any specified period of time, nor does it require that a dismissal be based on “cause.” Your employment and compensation with the Company are “at will” in that they can be terminated with or without cause, and with or without notice, at any time, at the option of either the Company or yourself, except as provided by law. The terms of this offer letter, therefore, do not and are not intended to create either an express and/or implied contract of employment with the Company.

10.Severance. Provided you have been employed by the Company for six months, should your employment be terminated as a result of: (i) your death; (ii) an illness or disability that the Company, in its sole discretion, determines prevents you from carrying out your employment duties; (iii) by the Company for no cause, i.e., if the termination was not a result of any misconduct on your part, then you will be entitled to receive severance payments from the Company in the form of salary continuation at your base salary level prior to such termination, plus a continuation of the medical benefits and car allowance benefits to which you were entitled at the time of such termination during the period of such severance payments. The severance payments shall continue for a period of 6 months from the date of your termination under this Section. However, should your employment be terminated by the Company for no cause or by you for Good Reason (as hereinafter defined), either of which occur within nine months following a Change of Control, then: (i) the severance payments will continue instead for a period of 12 months from the date of your termination under this Section; and (ii) the vesting of any and all

Stock Options or other such grants or awards shall be deemed to have been accelerated as of the date of such termination to include the period for which such severance payments shall cover (i.e., for a period of 12 months of service). “Good Reason” for purposes of this offer letter is (i) a breach of this offer letter by the Company; or (ii), a reduction in your salary without your consent, unless any such reduction is otherwise part of an overall reduction in executive compensation experienced on a pro rata basis by other similarly situated senior vice presidents of the Company. Notwithstanding the foregoing, Good Reason shall not be deemed to exist unless and until you have given the Company thirty (30) days' written notice and an opportunity to cure. As a condition to the receipt of any severance payments from the Company, you shall be required to execute a separation agreement that shall include the broadest form of a waiver and release of all claims against the Company. For the purposes of this Section, a “Change of Control” shall be deemed to occur if there occurs a sale, exchange, transfer or other disposition of substantially all of the assets of the Company to another entity, except to an entity controlled directly or indirectly by the Company, or a merger, consolidation or other reorganization of the Company in which the Company is not the surviving entity, or a plan of liquidation or dissolution of the Company other than pursuant to bankruptcy or insolvency laws.

Should your employment be terminated as a result of: (i) your voluntary resignation; or (ii) by the Company as a result of actions taken, or omissions to act, by you that the Company, in its sole discretion, determines as misconduct by you, then the Company's only obligation shall be to pay you such portion of your base salary as may be accrued but unpaid on the date of termination.

11.Indemnification. In addition, the Company shall indemnify and defend you and your heirs, executors and administrators against any costs or expense (including reasonable attorneys' fees and amounts paid in settlement, if such settlement is approved by the Company), fine, penalty, judgment and liability reasonably incurred by or imposed upon you in connection with any action, suit or proceeding, civil or criminal, to which you may be made a party or with which you shall be threatened, by reason of your being or having been an officer or director, unless with respect to such matter you shall have been adjudicated in any proceeding not to have acted in good faith or in the reasonable belief that the action was in the best interests of the Company, or unless such indemnification is precluded by law, public policy, or in the judgment of the Company's Board of Directors, such indemnification is being sought as a result of your actions which were either: (i) grossly negligent; (ii) reflective of your misconduct; (iii) in violation of rules, regulations or laws applicable to the Company; or (iv) in disregard of Company's policies.

12.Full-Time Position. You agree that your employment hereunder will be full time, to the exclusion of any other employment that would impede your full-time duties hereunder. You will conscientiously and diligently perform all required acts and duties to the best of your ability, and in a manner satisfactory to the Company. You will faithfully discharge all responsibilities and duties entrusted to you.

13.Confidentiality, Non-Competition and Non-Solicitation. In recognition of the matter of trust and fiduciary capacity in which you will be employed by the Company, you will be expected, during your term of employment and thereafter, not to disclose to any third party any “Confidential Information” you receive relative to the Company. For this purpose, the term Confidential Information includes information relative to the Company's method of operations,

customer base, strategies and objectives, pricing information, financial information, proprietary or licensed data, identity of vendors utilized by the Company, computer programs, system documentation, product offerings, software or hardware, manuals, formulae, processes, methods, inventions or other information or materials relating to the Company's affairs that are not otherwise publicly available. You also acknowledge that such Confidential Information constitutes a major asset of the Company, and that the use, misappropriation or disclosure of Confidential Information would constitute a breach of trust and could cause irreparable injury to the Company and that it is essential for the protection of the Company's goodwill and maintenance of the Company's competitive position that the Confidential Information be kept secret and that you neither disclose the Confidential Information to others nor use the Confidential Information to your own advantage or to the advantage of others. In addition, you shall not: (i) engage in any activities that may be viewed as competitive with the Company during your employment and any period in which severance payments are made or offered to you (which in the case of a lump sum payment, includes any period of salary continuation over which the payment was to have related) and (ii) for a period of 12 months following employment, directly or indirectly, solicit any business from, or relationships with, any past, present or prospective employees, customers or suppliers of the Company.

(a)This Agreement is intended to comply with the requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”). Payments of Non-Qualified Deferred Compensation (as such term is defined under Code Section 409A and the regulations promulgated thereunder) may only be made under this Agreement upon an event and in a manner permitted by Code Section 409A. For purposes of Code Section 409A, the right to a series of installment payments under this Agreement shall be treated as a right to a series of separate payments. All reimbursements and in-kind benefits provided under this Agreement shall be made or provided in accordance with Code Section 409A including, where applicable, the requirement that (i) any reimbursement is for expenses incurred during the period of time specified in this Agreement, (ii) the amount of expenses available for reimbursement, or the in-kind benefits provided, during a calendar year may not affect the expenses eligible for reimbursement, or in-kind benefits provided, in any other calendar year, (iii) the reimbursement of an eligible expense will be made no later than the last day of the calendar year following the year in which the expense in incurred, and (iv) the right to reimbursement or in-kind benefits is not subject to liquidation or exchange for another benefit.

(b)To the extent required by Code Section 409A, and notwithstanding any other provision of this Agreement to the contrary, no payment of Non-Qualified Deferred Compensation will be provided to, or with respect to, the Employee on account of his separation from service until the first to occur of (i) the date of the Employee’s death or (ii) the date which is one day after the six (6) month anniversary of his separation from service, and in either case only if he is a “specified employee” (as defined under Code Section 409A(a)(2)(B)(i) and the regulations promulgated thereunder) in the year of his separation from service. Any payment that is delayed pursuant to the provisions of the immediately preceding sentence shall instead be paid in a lump sum (subject to all applicable withholding) promptly following the first to occur of the two dates specified in such immediately preceding sentence.

(c)Any payment of Non-Qualified Deferred Compensation made under this Agreement pursuant to a voluntary or involuntary termination of the Employee’s employment with the Company shall be withheld until the Employee incurs both (i) a termination of his employment relationship with the Company and (ii) the first instance of a “separation from service” with the Company, as such term is defined in Treas. Reg. Section 1.409A-1(h).

(d)The preceding provisions of this paragraph 14 shall not be construed as a guarantee by the Company of any particular tax effect to the Employee under this Agreement, under any plan or program sponsored or maintained by the Company or under any other agreement by and between the Employee and the Company. The Company shall not be liable to the Employee for any additional tax, penalty or interest imposed under Code Section 409A nor for reporting in good faith any payment made under this Agreement or under any such other plan, program or agreement as an amount includible in gross income under Code Section 409A.

15.Developments. You acknowledge that the Company will be the sole owner of all the results and products of your work efforts, including all written, audio and/or visual materials relating to the Company's business (collectively, the “Developments”) which you develop or create during the term of your employment, either alone or with others and whether or not during normal business hours. You acknowledge that all copyrightable Developments will be considered works “made for hire” or commissioned works under the Federal Copyright Act. You hereby assign all such Developments to the Company, and agree that you will execute or cooperate with the Company in any copyright or patent applications, and do all other acts, as the Company reasonably deems necessary to establish, protect, enforce or defend the Company's right, title and interest in such Developments.

16.Injunctive Relief. You acknowledge that irreparable injury or damage shall result to the Company in the event of a breach or threatened breach by you of Sections 13 or 15 of this offer letter and that the Company shall be entitled to an injunction restraining you from engaging in any activity constituting such breach or threatened breach. Nothing contained herein shall be construed as prohibiting the Company from pursuing any other remedies available to the Company at law or in equity for breach or threatened breach of Sections 13 or 15 of this offer letter, including but not limited to, the recovery of damages from you and, the termination of your employment with the Company for cause in accordance with the terms and provisions of this offer letter.

17.Validity. If any provision, or portion thereof, of this offer letter is deemed by a court of competent jurisdiction to be unenforceable, illegal or in conflict with any federal, state or local law, the validity of the remaining terms and provisions of this offer letter shall continue to exist and remain in full force and effect.

18.No Prior Agreements. In order to induce the Company to offer you this position of employment, you are hereby confirming for us that you are not a party to or otherwise subject to or bound by the terms of any contract, agreement or understanding that in any manner would limit or otherwise affect your ability to perform your obligations hereunder. You further represent and warrant that your employment by the Company would not under any circumstances require you to disclose or use any Confidential Information belonging to any third parties, or to engage in any conduct which may potentially interfere with contractual, statutory or common-law rights of third parties.

19.Entire Agreement. The terms of this offer letter constitute the complete and exclusive agreement among the parties and supersedes all proposals, oral and written, and other communications between the parties relating to the subject matter hereof.

20.Governing Law. This Agreement shall be construed and interpreted in accordance with the laws of the State of Washington. Any dispute arising between the parties relating in any manner to this Agreement shall be brought in a federal or state court located in Seattle, Washington.

21.Counterparts. This offer of employment may be executed in one or more counterparts, each of which shall be deemed an original but which together shall constitute the same instrument. Each party agrees to be bound by its own telecopy or facsimile signature, and agrees that it accepts the telecopy or facsimile signature of the other party hereto.

If you agree to accept the terms of this offer of employment, would you kindly sign this letter and return it to us by no later than your start date.

|

|

|

|

|

|

|

|

RADIANT GLOBAL LOGISTICS, INC. |

|

|

|

By: |

/s/ Bohn H. Crain |

|

|

|

|

Chief Executive Officer |

|

|

|

|

ACKNOWLEDGED AND ACCEPTED BY: |

|

|

|

By: |

/s/ Jaime Becker |

|

Date: |

11/13/2023 |

|

Jaime Becker |

|

|

|

v3.23.4

Document And Entity Information

|

Dec. 22, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 22, 2023

|

| Entity Registrant Name |

RADIANT LOGISTICS, INC.

|

| Entity Central Index Key |

0001171155

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-35392

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

04-3625550

|

| Entity Address, Address Line One |

Triton Towers Two

|

| Entity Address, Address Line Two |

700 S. Renton Village Place

|

| Entity Address, Address Line Three |

Seventh Floor

|

| Entity Address, City or Town |

Renton

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98057

|

| City Area Code |

425

|

| Local Phone Number |

462-1094

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 Par Value

|

| Trading Symbol |

RLGT

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

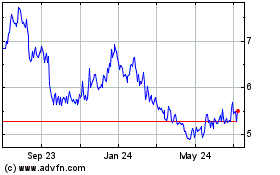

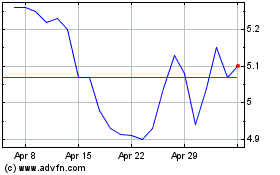

Radiant Logistics (AMEX:RLGT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Radiant Logistics (AMEX:RLGT)

Historical Stock Chart

From Nov 2023 to Nov 2024