Wake Up, This Stock is Under-Valued! - Analyst Blog

November 03 2011 - 10:55AM

Zacks

Wake Up, This Stock is Under-Valued!

Ken Nagy, CFA

On November 2, 2011, inTest Corporation

(INTT), an independent designer,

manufacturer and marketer of semiconductor automatic test equipment

interface solutions and temperature management products, reported

financial results for its fiscal 2011 third quarter and nine

months, ended September 30, 2011.

A solid third quarter by the Company resulted in quarterly revenues

increasing by 3.3 percent or $376,000 year over year to $11.681

million, which compares to revenues of $11.305 million for the

three months ended September 30, 2010.

inTest reported that third quarter bookings were $10.5

million, down from its second quarter 2011 bookings of $13.5

million but up year over year compared to its third quarter 2010

bookings of $9.8 million.

inTest’s third quarter 2011 net income soared $3.504 million

to $5.182 million from $1.678 million during the three months ended

September 30, 2010. Still, third quarter net earnings per share

would have resulted in $0.22 per diluted share absent the valuation

allowance as the impact of the reversal of the valuation allowance

increased diluted net earnings per share by $0.28 per diluted

share.

The jump in year over year net income was primarily due to improved

gross margin as well as a reversal of the valuation allowance

against deferred tax assets resulting in an income tax benefit of

$2.762 million in the third quarter of 2011 compared to an income

tax expense of $16,000 for the comparable quarter of 2010.

Gross margin increased year over year from 48.2 percent to 52.5

percent for the three months ended September 30, 2011.The increase

in gross margin was mainly due to a more favorable product mix in

the Company’s Mechanical Products segment.

Based on a weighted average number of diluted shares outstanding of

10.297 million, diluted net income per share resulted in $0.50 per

share. This compared to diluted net income per share of $0.17

on a weighted average number of diluted shares of 10.195 million

during the three months ended September 30, 2010.

inTest’s balance sheet continued to improve with cash and

equivalents increasing sequentially by $3.185 million to $12.064

million and working capital improving by $3.007 million to $18.618

million for the period ended September 30, 2011.

The increase in cash was due to strong cash collections during the

third quarter and management predicts that cash will increase to

between $14 to $15 million by December 31, 2011.

Similarly, total stockholder’s equity improved sequentially by over

25 percent or $5.146 million to $25.441 million.

Additionally, management reported that it anticipates net revenue

for its fourth quarter ended December 31, 2011 will be in the range

of $9.5 million to $10.5 million and that net earnings will be in

the range of $0.03 to $0.10 per diluted share.

The Company further believes that the diversification of its served

markets via its thermal group, improved efficiency and reduced

operating costs attributable to its relocation of facilities are

all strengths it can leverage moving forward. Along the same lines

the Company continues to expand upon its diversification strategy

by leveraging its thermal division and Sigma Systems

acquisition.

inTest believes it continues to make significant process in

diversifying its end market penetration through its thermal

products which offer an effective way to expand the Company’s

available markets by acquiring non semiconductor business in the

aerospace, automotive, medical and telecommunications markets.

As a result of this diversification strategy, non-semi related

bookings consisted of 18 percent of the Company’s consolidated

bookings at the beginning of the year which compares to third

quarter non-semi bookings comprising of 41 percent of

inTest’s consolidated bookings.

The Company expects this trend to continue and predicts that non

semiconductor related products will play an even greater role in

company’s success going forward.

The firm has a diversified portfolio that includes

non-semiconductor markets. This revenue should be a bit more

inelastic and run on a different cyclical time frame than the

semiconductor business. The firm’s goal is to grow Non-Semi revenue

to 50% of revenue. The potential for Non-Semi is enormous

because it incorporates any market that uses thermal. We

value the firm using several metrics

Enterprise Multiple

The enterprise multiple looks at a firm as a potential acquirer

would. The ratio takes debt into account, which is an item which

other multiples do not include. Enterprise value is calculated as

market cap plus debt, minority interest and preferred shares, minus

total cash and cash equivalents. The Firm’s Enterprise multiple is

2.54x compared to 4.79x for the industry. According to the

enterprise multiple INTT appears undervalued compared to

industry.

Two Stage Free Cash Flow to Equity Model

FCFE = Net Income - Net Capital Expenditure - Change in Net

Working Capital + New Debt - Debt Repayment

Assumptions

- The firm is expected to grow at a higher growth rate in

the first period.

- The growth rate will drop at the end of the first period to the

stable growth rate.

- The free cash flow to equity is the correct measure of expected

cash flows to stockholders. (rather than dividends)

Rationale for using the Model

As the non-semiconductor business ramps up to 50% of total revenues

we expect the firm to grow at a higher overall rate than the

industry. As These products mature and the firm faces more

competition we expect the growth rate to level off.

Weakness of the Model

As you add more layers to the model it is more sensitive to the

assumptions you make. The growth may look more “lumpy” than we have

it in the model.

Output

We used the following inputs:

- A 5-year period with an earnings growth rate

of 8.0% and a discount rate of 13.77%.

- A continuing period assumed to go on

forever, with earnings growing at 6% and a discount rate of

13.05%.

With these inputs we arrive at a target price of $7.23.

According to the model, the firm appears

undervalued.

Price to Earnings Multiples/ Price to Sales

Multiples

Due to its simplicity the Price/Earnings ratio is easily the most

widely used metric in all of finance. The first strength of the

model is that it is intuitive. It is simply the price paid for

current earnings. It can also act as a proxy for other firm

characteristics such as risk and growth. There is a downside to the

P/E ratio in that it has the potential to reflect investor’s mood

rather than the fundamentals of the firm. It also eliminates

assumptions about risk, growth, and retention ratio (something

discounted cash flow models account for.)

While not as popular as Price/Earnings or Price/BV, Price/Sales is

not influenced by accounting decisions in depreciation, inventory

and extraordinary charges. P/S multiples are much less volatile

than P/E multiples. However if the problem with the firm lies in

cost control the P/S ratio will not reflect this flaw.

The firm appears undervalued compared to the

industry.

.jpg)

*source for background and General information on valuation

models: Investment Valuation, Aswath Damodaran

Our price target of $7.00 per share is the average of 10.1x our

2011 EPS estimate and our two stage model. We would add shares at

these levels.

To view our most recent research reports and subscribe to

our daily morning email alert, visit http://scr.zacks.com/. Please

email scr@zacks.com with NGNM as the subject to request a copy

of the full research report.

Follow Zacks Small Cap Research on Twitter at

Twitter.com/ZacksSmallCap

INTEST CORP (INTT): Free Stock Analysis Report

Zacks Investment Research

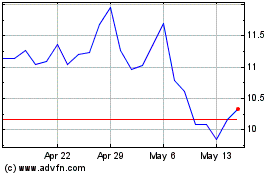

inTest (AMEX:INTT)

Historical Stock Chart

From Sep 2024 to Oct 2024

inTest (AMEX:INTT)

Historical Stock Chart

From Oct 2023 to Oct 2024