inTEST: Focus on Valuation - Analyst Blog

May 03 2011 - 7:12AM

Zacks

Ken Nagy, CFA

inTEST: Focus on Valuation

Executive Summary

inTEST Corporation (INTT) is a

designer, manufacturer and marketer of mechanical, thermal and

electrical products that are used by semiconductor manufacturers in

conjunction with automatic test equipment, (ATE), in the testing of

integrated circuits, (ICs). Beyond its blue chip portfolio of

semiconductor manufacturers, the acquisition of Sigma has propelled

the firm to diversify into non-semi thermal testing products. This

has the effect of diversifying revenues and opens the company up to

new markets. In the test equipment world change is good; be it the

broad switch to mobile computing, the march to finer geometries, or

the growth of electronic content in automobiles more chip content

means more testing for inTEST.

Bullish signs

- Complexity in chips increasing. As

chips get smaller and more complex testing is more

important.

- Chip content spread out over mobile

phone, automobile, industrial goods rather than corporate IT.

- Semiconductor market outlook is

solid, not on par with 2010, yet still expect growth

- Non-semiconductor business has

potential for growth as well as revenue

diversification.

Bearish Signs

- More consumers in semiconductor than

ever before. Pressure of macro economy weakness. (although many

items price under $1,000.00)

- Firm is subject to the cyclical

nature of the semiconductor equipment industry. Until

non-semiconductor is large enough to offset.

Enterprise Multiple

The enterprise multiple looks at a firm as a potential acquirer

would. Enterprise value is calculated as market cap plus debt,

minority interest and preferred shares, minus total cash and cash

equivalents. The Firm’s Enterprise multiple is 4.24x compared to

7.88x for the industry. According to the enterprise

multiple INTT appears undervalued compared to

industry.

| Metric |

inTEST |

Industry Average |

| EV/EBITDA |

4.24 |

7.88 |

Two Stage Free Cash Flow to Equity Model

FCFE = Net Income - Net Capital Expenditure - Change in Net Working

Capital + New Debt - Debt Repayment

Assumptions

- The firm is expected to grow at a higher

growth rate in the first period.

- The growth rate will drop at the end of the

first period to the stable growth rate.

Rationale for using the Model.

As the non-semiconductor business ramps up to 50% of total revenues

we expect the firm to grow at a higher overall rate than the

industry. As These products mature and the firm faces more

competition we expect the growth rate to level off.

Weakness of the Model.

As you add more layers to the model it is more sensitive to the

assumptions you make. The growth may look more “lumpy” than we have

it in the model.

Output

We used the following inputs:

- A 5-year period with an earnings growth rate

of 8.0% and a discount rate of 13.77%.

- A continuing period assumed to go on

forever, with earnings growing at 6% and a discount rate of

13.05%.

With these inputs we arrive at a target price of $7.23.

According to the model, the firm appears

undervalued.

Price to Earnings Multiples/ Price to Sales

Multiples

Due to its simplicity the Price/Earnings ratio is easily the most

widely used metric in all of finance. The first strength of the

model is that it is intuitive. It is simply the price paid for

current/future earnings. It can also act as a proxy for other firm

characteristics such as risk and growth. There is a downside to the

P/E ratio in that it has the potential to reflect investor’s mood

rather than the fundamentals of the firm. It also eliminates

assumptions about risk, growth, and retention ratio (something

discounted cash flow models account for.)

While not as popular as Price/Earnings or Price/BV, Price/Sales is

not influenced by accounting decisions in depreciation, inventory

and extraordinary charges. P/S multiples are much less volatile

than P/E multiples. However if the problem with the firm lies in

cost control the P/S ratio will not reflect this flaw.

The firm appears undervalued compared to the

industry.

.jpg)

Our price target of $7.00 per share is the average of 8.65x our

2011 EPS estimate and our two stage model. We would add shares at

these levels.

Investors may want to check in on INTT results on Wednesday, May 4,

2011 at 5:00 p.m. Eastern Time. The contact information is (480)

629-9762. The Pass code for the conference call is 4433870.

There will also be live webcast on the inTEST website.

(www.intest.com)

For a free copy of the full research report, please email

scr@zacks.com with INTT as the subject.

Follow Zacks Small Cap Research on Twitter at

Twitter.com/ZacksSmallCap

INTEST CORP (INTT): Free Stock Analysis Report

Zacks Investment Research

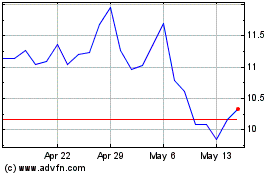

inTest (AMEX:INTT)

Historical Stock Chart

From May 2024 to Jun 2024

inTest (AMEX:INTT)

Historical Stock Chart

From Jun 2023 to Jun 2024