Current Report Filing (8-k)

July 09 2015 - 8:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 9, 2015

Sanchez Production Partners LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-33147

|

|

11-3742489

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

1000 Main Street, Suite 3000

Houston, TX

|

|

77002

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (713) 783-8000

None

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01Other Events.

On July 9, 2015, Sanchez Production Partners LP (the “Partnership”) issued a press release announcing a 1-for-10 reverse split of the common units of the Partnership. The reverse unit split will take place and be effective at the close of trading on August 3, 2015. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 9.01Financial Statements and Exhibits.

(d) Exhibits.

|

|

1

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release, dated July 9, 2015

|

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SANCHEZ PRODUCTION PARTNERS LP

By: Sanchez Production Partners GP LLC, its general partner

|

|

|

|

|

|

|

Date: July 9, 2015

|

|

|

|

By:

|

|

/s/ Charles C. Ward

|

|

|

|

|

|

|

|

Charles C. Ward

Chief Financial Officer and Secretary

|

EXHIBIT INDEX

|

1

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release, dated July 9, 2015

|

Exhibit 99.1

News Release

General Inquiries: (877) 847-0008

www.sanchezpp.com

Investor Contact: Charles C. Ward

(877) 847-0009

Sanchez Production Partners Initiates Capital

Restructuring with a 1-for-10 Reverse Split

HOUSTON--(BUSINESS WIRE)—July 9, 2015--Sanchez Production Partners LP (NYSE MKT: SPP) (“SPP” or the “Partnership”) today announced that it intends to implement a 1-for-10 reverse split on its common units, effective after the market closes on August 3, 2015.

“Since the summer of 2013, we have worked diligently to better position SPP for future growth by initiating a business development relationship with a committed sponsor, executing management service and related agreements, transitioning employees to Sanchez Oil & Gas Corporation, converting SPP to a limited partnership, and executing our first transaction with Sanchez Energy Corporation,” said Gerald F. Willinger, Interim Chief Executive Officer of the general partner of SPP. “With a solid foundation for SPP built, we are now ready to implement the next set of measures necessary for growth. As we look to expand the Partnership’s asset base by pursuing a larger-scale transaction with a view toward resuming distributions in 2015, we are focused on increased visibility and the deliberate expansion of our unitholder base by attracting institutional investors. The reverse split is supportive of these goals, and represents an important component of our overall strategic plan.”

Pursuant to the reverse split, common unitholders will receive one common unit for every ten common units they own at the close of trading on August 3, 2015. All fractional units created by the reverse split will be rounded to the nearest whole unit. If the fraction created is less than one-half, it will be rounded down to the nearest whole unit. If the fraction is one-half or more, it will be rounded up to the nearest whole unit. Each unitholder will get at least one unit.

The Partnership anticipates that the reverse split will decrease the number of common units outstanding from approximately 31.5 million to 3.1 million.

The Partnership's transfer agent, ComputerShare Investor Services, will adjust its records to reflect each unitholder's post-split position. Unit adjustments to physical unit certificates can be made upon surrender of the certificate

to the transfer agent. Please contact ComputerShare Investor Services for further information at (781) 575-2879 or by E-mail directed to shareholder@computershare.com.

A new CUSIP number for the common units will be issued and announced in connection with the reverse split, and the Partnership’s common units will continue to trade under the symbol “SPP” on NYSE MKT.

Other Information

Additional information on the reverse split and capital restructuring can be found in SPP’s filings with the Securities Exchange Commission (www.sec.gov), which are also available on SPP’s website (www.sanchezpp.com).

About the Partnership

Sanchez Production Partners LP (NYSE MKT: SPP) is a publicly-traded limited partnership focused on the acquisition, development and production of oil and natural gas properties and other integrated assets. The partnership’s proved reserves are currently located in the Cherokee Basin in Oklahoma and Kansas, the Woodford Shale in the Arkoma Basin in Oklahoma, the Central Kansas Uplift in Kansas, and along the Gulf Coast in Texas and Louisiana.

Forward-Looking Statements

We make statements in this news release that are considered forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. These forward-looking statements are largely based on our expectations, which reflect estimates and assumptions made by the management of our general partner. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management's assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this news release are not guarantees of future performance, and we cannot assure you that such statements will be realized or the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors listed in the “Risk Factors” section in our SEC filings and elsewhere in those filings. All forward-looking statements speak only as of the date of this news release. We do not intend to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

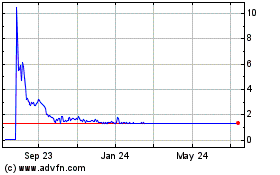

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From May 2024 to Jun 2024

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jun 2023 to Jun 2024