Current Report Filing (8-k)

March 07 2016 - 4:42PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report

March 7, 2016

.

ESPEY MFG &

ELECTRONICS CORP.

(Exact name of registrant as specified

in its charter)

|

New York

(State or Other Jurisdiction of Incorporation) |

|

001-04383

(Commission File Number) |

|

14-1387171

(IRS Employer Identification No.) |

|

233 Ballston Avenue, Saratoga Springs, New

York 12866

(Address of principal executive offices) |

|

(518) 584-4100

(Registrant’s telephone number, including

area code) |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers. |

The Employment Agreement dated January 6, 2015

between the Company and Patrick Enright, Jr., the Company’s President and Chief Executive Officer, has been amended to set

revised terms of the calculation of Mr. Enright’s annual incentive bonus. The amendment is effective for the current fiscal

year ending June 30, 2016 and for fiscal years thereafter.

Mr. Enright is entitled to an annual performance-based

cash bonus comprised of three elements, with the maximum amount payable not to exceed his annual base salary. The first component

is purely discretionary based upon an annual assessment determined by the Board of Directors and may not exceed $100,000. The second

component is the increase in combined sales and backlog of the Company as compared to the average of sales and backlog, at fiscal

year end, for the prior three years, multiplied by 0.5%. The third component is the increase in operating earnings as compared

to the average of operating earnings for the prior three years, multiplied by 5%.

Neither the second nor third component individually

may exceed $100,000. Since Mr. Enright’s employment with the Company commenced on February 1, 2015, for purposes of calculating

the second and third components, the fiscal 2016 results will be compared to the fiscal 2015 results only. The fiscal 2017 results

will be compared to the average of the fiscal 2015 and 2016 results and the fiscal 2018 results, and fiscal year results thereafter,

will be compared to the average of the prior three fiscal years. A special rule applies to the contribution of one specified Company

contract to the calculation of the annual bonus.

| Item 9.01 |

Financial Statements, Pro Forma Financial Information and Exhibits |

(c) Exhibits

| Exhibit No. |

Document |

| 10.15(a) |

First Amendment to Employment Agreement with Patrick Enright, Jr. dated March 7, 2016 |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: March 7, 2016 |

|

ESPEY MFG. & ELECTRONICS CORP.

|

| |

By: |

/s/ David O’Neil |

| |

|

David O’Neil

Treasurer and Principal Financial Officer |

FIRST AMENDMENT

TO EMPLOYMENT AGREEMENT

THIS FIRST AMENDMENT dated March

7, 2016 (the “Amendment”) is made to the Employment Agreement dated as of January 6, 2015 (the “Employment Agreement”)

by and between ESPEY MG. & ELECTRONICS CORP., a New York corporation (the “Company”) and PATRICK ENRIGHT, JR. (the

“Executive”).

WHEREAS, the Company and the Executive

desire to amend the provisions of the Employment Agreement providing for the CEO Annual Bonus.

NOW, THEREFORE, the parties hereto agree

as follows:

1. Defined Terms. Capitalized

terms used in this Amendment without definition shall have the respective meanings assigned to such terms in the Employment Agreement.

2. Annual Bonus. The attachment

to this Amendment identified as Exhibit A is substituted for the Exhibit A attached to the Employment Agreement. Effective with

the Company’s fiscal year ending June 30, 2016, the provisions of Exhibit A attached hereto shall govern the determination

of the CEO Annual Bonus. Exhibit A attached hereto shall remain in effect until replaced by further agreement of the Company and

the Executive. The calculation examples included as part of Exhibit A are examples only and not intended to be indicative of the

actual CEO Annual Bonus to which Executive may be entitled for any fiscal year.

3. No Other Amendments. In all

other respects the Employment Agreement is ratified and confirmed.

IN WITNESS WHEREOF, the Company and the

Executive have caused this Agreement to be duly executed effective as of the day and year first above written.

| |

ESPEY MFG. & ELECTRONICS CORP. |

| |

|

|

| |

|

|

| |

By: |

/s/ Howard Pinsley |

| |

|

Name: Howard Pinsley |

| |

|

Title: Chairman of the Board |

| |

|

|

| |

|

|

| |

/s/ Patrick Enright, Jr. |

| |

Patrick Enright, Jr. |

Exhibit A to Employment Agreement with Patrick

Enright, Jr.

(effective for Fiscal Year Ending June 30, 2016 and thereafter)

| Component |

|

|

| A |

Discretionary Bonus

Up to $100k based on non- quantifiable performance as determined

by the board at its sole discretion. |

|

| B |

Increase in sales/ backlog

Dollar increase in combined sales and backlog vs. average of prior

three years times 0.5% |

|

| C |

Increase in operating earnings

Dollar Increase in operating earnings vs average of prior three

years times 5% |

|

| D |

Notes |

Total Earned bonus (A+B+C) shall not exceed CEO base salary.

Neither Component B or C may exceed $100,000

The basis for calculating annual increase in each metric shall be

the average of the prior three years.

However, due to recent tenure of CEO, basis for 2016 shall be 2015.

Basis for FYE 2017 shall be average of 2015/ 2016. Basis for FYE 2018 shall be average of 2015/2016/2017

Incentive on first $20 million of Aberdeen Tactical Power Supply

order is calculated using 10% of backlog related to that order. Full incentive earned on Aberdeen sales and operating earnings.

Calculation of any bonus, or bonus component, shall be as determined

by the Board at its sole discretion.

President/ CEO must be employed as CEO/President on 31 December

of award year.

Executive incentive plan remains in effect until changed by the

Board.

Operating Income/ Sales- Backlog defined as per year end 10K |

CEO ANNUAL BONUS

Calculation Examples

| Component |

|

|

| A |

Discretionary Bonus

Up to $100k based on non- quantifiable performance as determined

by the board at its sole discretion. |

| B |

Increase in sales/backlog

Dollar increase in combined sales and backlog vs. average

of prior three years times 0.5% |

| Example |

Prior three year avg |

Estimated Y/E 2016 |

Diff |

Multiplier |

Metric Bonus |

| Sales Backlog |

$ 27,000,000

$ 36,500,000 |

$ 28,500,000

$ 41,000,000 |

$ 1,500,000

$ 4,500,000 |

|

|

| |

$ 63,500,000 |

$ 69,500,000 |

$ 6,000,000 |

0.50% |

$ 30,000 |

| C |

Increase in operating earnings

Dollar Increase in operating earnings vs average of prior three

years times 5% |

| Example |

Prior three year avg |

Estimated

Y/E 2016 |

Inc/(dec) |

Multiplier |

|

|

| Operating Earnings |

$ 4,400,000 |

$ 5,100,000 |

$ 700,000 |

5% |

Total Metrics |

$ 35,000

$ 65,000 |

| D |

Notes |

Total Earned bonus (A+B+C) shall not exceed CEO base salary.

Neither Component B or C may exceed $100,000

The basis for calculating annual increase in each metric shall be

the average of the prior three years.

However, due to recent tenure of CEO, basis for 2016 shall be 2015.

Basis for FYE 2017 shall be average of 2015/ 2016. Basis for FYE 2018 shall be average of 2015/2016/2017

Incentive on first $20 million of Aberdeen order is calculated using

10% of backlog related to that order. Full incentive earned on Aberdeen sales and operating earnings.

Calculation of any bonus, or bonus component, shall be as determined

by the Board at its sole discretion.

President/ CEO must be employed as CEO/President on 31 December

of award year.

Executive incentive plan remains in effect until changed by the

Board. |

| E |

Definitions |

Operating Income/ Sales- Backlog defined as presented in year-end 10K |

| F |

History |

Year |

Sales |

Backlog |

Operating Earnings |

| |

|

2013 |

$34,298,000 |

$42,100,000 |

$7,782,000 |

| |

|

2014 |

$27,000,000 |

$35,700,000 |

$1,300,000 |

| |

|

2015 |

$27,000,000 |

$36,500,000 |

$4,400,000 |

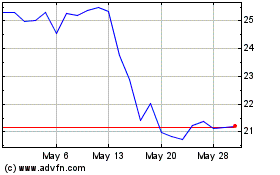

Espey Manufacturing and ... (AMEX:ESP)

Historical Stock Chart

From May 2024 to Jun 2024

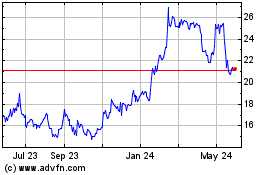

Espey Manufacturing and ... (AMEX:ESP)

Historical Stock Chart

From Jun 2023 to Jun 2024