Espey Mfg & Electronics Corp - Securities Registration: Employee Benefit Plan (S-8)

January 15 2008 - 4:32PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on January 15, 2008.

Registration Statement No. 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ESPEY MFG. & ELECTRONICS CORP.

(Exact name of registrant as specified in its charter)

New York 14-1387171

(State or other jurisdiction (I.R.S. Employer

of incorporation or organization) Identification No.)

|

233 Ballston Avenue

Saratoga Springs, New York 12866

(Address of Principal Executive Offices, including zip code)

Espey Mfg. & Electronics Corp. 2007 Stock Option

and Restricted Stock Plan

(Full title of the plan)

Howard Pinsley

President and Chief Executive Officer

233 Ballston Avenue

Saratoga Springs, New York 12866

(518) 584-4100

(Name, address and telephone number, including area code, of agent for service)

Copies to:

Lawrence A. Goldman, Esq.

Gibbons P.C.

One Gateway Center

Newark, New Jersey 07102-5310

(973) 596-4500

-----------------------------------------------------------------------------------------------------

Proposed Proposed

Title of Each Class Amount Maximum Offering Maximum Amount of

of Securities To Be Price Aggregate Registration

to be Registered Registered(1) Per Share(3) Offering Fee(3)

Price(3)

-----------------------------------------------------------------------------------------------------

Common Stock, par value $0.33 1/3 per 400,000 (2) $18.75 $7,500,000 $238.01

share

-----------------------------------------------------------------------------------------------------

|

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as

amended, this registration statement also covers additional shares of Common

Stock pursuant to the anti-dilution provisions of the Plan.

(2) Includes 77,000 shares (the "Carryover Shares") previously

registered for issuance, offer or sale under the 2000 Stock Option Plan (the

"2000 Plan") on a Registration Statement on Form S-8 filed on October 11, 2005

(Registration No. 333-128922) (the `Initial Registration Statement") covering

129,700 shares. The Carryover Shares have not been issued and may be offered and

sold under the 2007 Plan. In connection with the Initial Registration Statement,

the registrant paid a total registration fee of $532.00 of which $315.84 related

to the Carryover Shares. Pursuant to Interpretation 89 under Section G of the

Division of Corporation Finance's Manual of Publicly available Telephone

Interpretations dated July 1997 and Instruction E to the General Instructions of

Form S-8, the registrant has carried forward the registration fee related to the

Carryover Shares. Therefore, no further registration fee is required with

respect to the Carryover Shares. The registrant is concurrently filing a

Post-Effective Amendment No. 1 to Registration Statement on the Initial

Registration Statement to deregister 77,000 unissued shares.

(3) Estimated in accordance with Rule 457(c) solely for the purposes of

calculating the registration fee, based on the average high and low prices per

share of the Registrant's Common Stock as reported on The American Stock

Exchange on January 9, 2008.

-2-

EXPLANATORY NOTE

On November 30, 2007, the stockholders of Espey Mfg. & Electronics

Corp. (the "Company") approved the 2007 Stock Option and Restricted Stock Plan

(the "2007 Plan"), which replaced the Company's 2000 Stock Option Plan (the

"2000 Plan"). The 2000 Plan has 77,000 shares of Common Stock that would

otherwise be available for grant under such plan (the "Carryover Shares") now

available for issuance, offer and sale under the 2007 Plan.

This registration statement on Form S-8 relates to the 400,000 shares

of Common Stock that may be issued under the 2007 Plan, inclusive of the

Carryover Shares. None of the Carryover Shares may be issued under the 2000

Plan; such Carryover Shares may only be issued, offered and sold under the 2007

Plan.

In accordance with the principals set forth in Interpretation 89 under

Section G of the Division of Corporation Finance's Manual of Publicly Available

Telephone Interpretations dated July 1997 and Instruction E to the General

Instructions of Form S-8, this Registration Statement on Form S-8 carries

forward the $315.84 registration fee previously paid with respect to the

Carryover Shares. The Company is filing a Post-Effective Amendment to the

Registration Statement on Form S-8 (Registration No. 333-128922) to deregister

the Carryover Shares contemporaneously with the filing of this Registration

Statement.

-3-

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

Espey Mfg. & Electronics Corp. ("we", "us", "our" or the "Company")

incorporates by reference in this registration statement the following documents

previously filed by us with the Securities and Exchange Commission (the

"Commission"):

(1) Our Annual Report on Form 10-K for the year ended June 30,

2007;

(2) The description of our common stock, $.33 1/3 par value per

share (the "Common Stock"), set forth in our report on Form

8-K filed with the Commission on October 7, 2005, including

any amendment or report filed for the purpose of updating such

description; and

(3) All documents subsequently filed by us pursuant to Sections

13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of

1934, prior to the filing of a post-effective amendment which

indicates that all securities offered have been sold or which

deregisters all securities then remaining unsold, shall be

deemed to be incorporated by reference in this Registration

Statement and to be a part hereof from the respective date of

filing of such documents. Any statement contained in a

document incorporated by reference herein is modified or

superseded for all purposes to the extent that a statement

contained in this Registration Statement or in any other

subsequently filed document which is incorporated by reference

modifies or replaces such statement.

Item 4. Description of Securities

Not applicable.

Item 5. Interests of Named Experts and Counsel

Not applicable.

Item 6. Indemnification of Directors and Officers.

Our Certificate of Incorporation, as amended, provides that the Company

will indemnify each director and officer of the Company and the estate of each

such person, against the reasonable expense, including attorneys' fees, incurred

in connection with the defense of any action, suit or proceeding to which such

person is a party by reason of being an officer or director of the Company or of

any corporation which he or she served at the request of the Company. The right

of indemnification includes indemnification for the reasonable cost of a

settlement made with a view to avoiding costs of litigation. Indemnification

shall not be available if it shall be adjudged in any action, suit or proceeding

that the officer or director is liable for negligence or misconduct in the

performance of his or her duties.

The determination of the amount payable by way of indemnification shall

be made either by the applicable court or by a vote of the majority of the

entire Board of Directors, excluding the vote of the affected directors. If the

determination of an indemnification payment is made by the Board of Directors or

in any manner other than by court order, the Company is obligated, within 18

months from the date of

-4-

payment, to mail to stockholders of record entitled to vote for the election of

directors a statement specifying the person paid, the amount of the payments and

the final disposition of the litigation.

Our Amended and Restated Bylaws provide that the Company shall

indemnify any director or officer who is a party or is threatened to be made a

party to any threatened, pending or completed action, proceeding or suit,

whether civil or criminal, by reason of the fact that such person was serving

the Company as a director or officer or serving any other entity at the request

of the Company, against judgments, fines, amounts paid in settlement and

expenses, including attorney fees.

It is a condition to indemnification that the officer or director acted

in good faith for a purpose which he or she reasonably believed to be in or not

opposed to the best interests of the Company and, in criminal action, that the

person had no reason to believe that his or her conduct was unlawful. The Bylaws

further provide that no indemnification shall be made if a judgment or other

final adjudication adverse to the director or officer establishes that the

person's acts were committed in bad faith or were the result of active and

deliberate dishonesty or that the person gained a financial profit or other

advantage to which he or she was not entitled.

The right to indemnification under the Amended and Restated Bylaws is

not exclusive to any rights that a director or officer may be entitled or the

Company provides.

The Amended and Restated Bylaws also authorize the Company to advance

expenses to any director or officer to the fullest extent permitted by the New

York Business Corporation Law ("BCL") and authorize the Company to purchase and

maintain insurance for indemnification of directors and officers. The Company

maintains such insurance.

Section 722(b) of the BCL provides that the termination of any civil or

criminal action or proceeding by judgment, settlement, conviction or upon a plea

of nolo contendere, or its equivalent, shall not itself create a presumption

that any director or officer did not act in good faith, for a purpose which he

or she reasonably believed to be in the best interests of the Company or, in

criminal proceedings, not opposed to the best interests of the Company.

Section 725 of the BCL provides that expenses incurred or advanced in

defending a civil or criminal action or proceeding shall be repaid in case the

person receiving the advancement is found not to be entitled to indemnification

or to the extent the amount of the advancement exceeds the indemnification to

which the person is entitled.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits

Exhibit No. Description

----------- -----------

5.1 Opinion of Gibbons P.C.

10.1 2007 Stock Option and Restricted Stock Plan incorporated

by reference to the Company's Definitive Proxy Statement

dated October 23, 2007 for the November 30, 2007 annual

meeting.

|

-5-

23.1 Consent of Rotenberg & Company, LLP

23.2 Consent of Gibbons P.C. (included in Exhibit 5.1)

24.1 Powers of Attorney

|

Item 9. Undertakings.

The Company hereby undertakes:

(1) To file, during any period in which offers or sales are being made,

a post-effective amendment to this registration statement:

(i) To include any prospectus required by section 10(a)(3) of the

Securities Act of 1933, as amended;

(ii) To reflect in the prospectus any facts or events arising after

the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate,

represent a fundamental change in the information set forth in the registration

statement;

(iii) To include any material information with respect to the plan

of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement.

Provided, however, that paragraphs (1)(i) and (1)(ii) above do not

apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in periodic reports filed with the Commission

by the Company pursuant to Section 13 or Section 15(d) of the Securities

Exchange Act of 1934, as amended, that are incorporated by reference in this

registration statement.

(2) That, for the purpose of determining any liability under the

Securities Act of 1933, as amended, each such post-effective amendment shall be

deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be

the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment

any of the securities being registered which remain unsold at the termination of

the offering.

The Company hereby undertakes that, for purposes of determining any

liability under the Securities Act of 1933, each filing of the Company's annual

report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act

of 1934, as amended, (and where applicable, each filing of an employee benefit

plan's annual report pursuant to Section 15(d) of the Securities Exchange Act of

1934, as amended) that is incorporated by reference in the registration

statement shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities

Act of 1933, as amended, may be permitted to directors, officers and controlling

persons of the Company pursuant to the foregoing procedures, or otherwise, the

Company has been advised that in the opinion of the Securities and Exchange

Commission such indemnification is against public policy as expressed in the

Securities Act of 1933, as amended, and is, therefore, unenforceable. In the

event that a claim for indemnification against

-6-

such liabilities (other than the payment by the Company of expenses incurred or

paid by a director, officer or controlling person of the Company in the

successful defense of any action, suit or proceeding) is asserted by such

director, officer or controlling person in connection with the securities being

registered, the Company will, unless in the opinion of its counsel the matter

has been settled by controlling precedent, submit to a court of appropriate

jurisdiction the question whether such indemnification by it is against public

policy as expressed in the Securities Act of 1933, as amended, and will be

governed by the final adjudication of such issue.

-7-

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended,

the undersigned registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-8 and has duly caused

this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in Saratoga Springs, State of New York, on this 15th

day of January, 2008.

ESPEY MFG. & ELECTRONICS CORP.

By: /s/ Howard Pinsley

-------------------------------------

Howard Pinsley

President and Chief Executive Officer

|

Pursuant to the requirements of the Securities Act of 1933, as amended,

this Registration Statement has been signed by the following persons in the

capacities and on the dates indicated.

Signature Title Date

--------- ----- ----

/s/ Howard Pinsley Chairman of the Board, President January 15, 2008

----------------------- and Chief Executive Officer

Howard Pinsley

/s/ Barry Pinsley* Director January 15, 2008

-----------------------

Barry Pinsley

/s/ Seymour Saslow* Director January 15, 2008

-----------------------

Seymour Saslow

/s/ Michael W. Wool* Director January 15, 2008

-----------------------

Michael W. Wool

/s/ Alvin O. Sabo* Director January 15, 2008

-----------------------

Alvin O. Sabo

/s/ Carl Helmetag* Director January 15, 2008

-----------------------

Carl Helmetag

/s/ Paul J. Corr* Director January 15, 2008

-----------------------

Paul J. Corr

/s/ David O'Neil Principal Accounting Officer January 15, 2008

-----------------------

David O'Neil

-----------------------

|

*By Howard Pinsley

Attorney in Fact

-8-

EXHIBIT INDEX

No. Description Method of Filing

5.1 Opinion of Gibbons P.C. Filed with this Registration

Statement

10.1 2007 Stock Option and Incorporated by reference to the

Restricted Stock Plan Company's Definitive Proxy

Statement dated October 23, 2007

23.1 Consent of Rotenberg & Filed with this Registration

Company, LLP Statement

23.2 Consent of Gibbons P.C. Included in Exhibit 5.1

24.1 Powers of Attorney Filed with this Registration

Statement

|

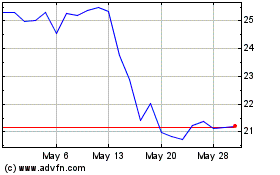

Espey Manufacturing and ... (AMEX:ESP)

Historical Stock Chart

From May 2024 to Jun 2024

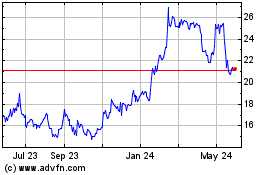

Espey Manufacturing and ... (AMEX:ESP)

Historical Stock Chart

From Jun 2023 to Jun 2024