Electromed, Inc. (NYSE Amex: ELMD) today announced financial

results for the three-month period ended December 31, 2011. Net

Revenues for the three months ended December 31, 2011, were

approximately $4,790,000, a 2.2% increase compared to Net Revenues

of approximately $4,686,000 for the same period last year. The

Company also announced Net Income of approximately $25,000, or

$0.00 per basic and diluted share, for the three months ended

December 31, 2011, compared to Net Income of approximately

$292,000, or $0.03 per basic and diluted share, for the same period

last year. The reduction in Net Income results was attributable to

missed sales goals reflecting underperformance by a number of

former Clinical Area Managers. This resulted from

termination-driven turnover of approximately 16% of the sales

force. Management continues to believe that planned increases in

the Company’s sales force, reimbursement and production personnel,

coupled with the expansion of marketing and research and

development efforts, will provide strong impetus for continued

solid annual sales growth.

Robert Hansen, Chairman and CEO, commented on the Company,

saying,

“When some employees fail to achieve planned

goals, the performance of all the employees is compromised. In

Sales, this fact is especially relevant. When momentum falters, the

solution is to make summary changes and to replace weakness with

strength. The Regional Sales Managers of Electromed, Inc. and I

have acted swiftly to recruit new, highly-trained, and experienced

sales staff to succeed the sales staff who failed to keep pace with

the growth needs of the Second Quarter. New and exciting successors

have replaced underperformers. I remain confident that the balance

of Fiscal Year 2012, and the First Half of FY2013, beginning July

1, 2012, will reflect strong sales growth accompanied by continued

profitability.”

Gross Profit decreased to approximately $3,480,000, or 72.6% of

Net Revenues, for the three months ended December 31, 2011,

compared to $3,540,000, or 75.6% for the same period in Fiscal

2011. The decrease in gross profit percentage was primarily the

result of a change in average reimbursement from the mix of

referrals during the three month period. Factors such as diagnoses

that are not assured of reimbursement and insurance programs with

lower allowable reimbursement amounts (for example, state Medicaid

programs) affect average reimbursement received on a short-term

basis. These factors tend to fluctuate on a quarterly basis.

However, management does not believe the results of the quarter

ended December 31, 2011, are indicative of a long-term trend in

decreasing margins.

Operating Expenses, which consist of Selling, General, and

Administrative Expenses and Research and Development expenses, were

approximately $3,380,000 for the three months ended December 31,

2011, an increase of approximately 12.6% over Operating Expenses

for the same period last year. These planned increases resulted

from higher payroll related to increasing the size of the sales

team, increases in reimbursement, administration, patient services

staff, and patient training costs related to the higher Sales

volume, increased expenses relating to being a new public Company,

and increased Research and Development expenses.

Total cash was approximately $1,745,000 as of December 31, 2011.

For the three months ended December 31, 2011, cash used in

financing activities was approximately $86,000, consisting

primarily of $90,000 in payments of long-term debt, capital lease

obligations, and deferred financing fees. An aggregate of $405,000

was used for investing activities during the three months ended

December 31, 2011, for purchases of property and equipment. The

Company used approximately $710,000 in operating activities

composed primarily of an increase in the Company’s accounts

receivables and inventory, which increased approximately $304,000

and $234,000, or 2.9% and 10.8%, respectively. Accounts payable and

accrued liabilities decreased approximately $302,000, or 14.0%,

during the three months ended December 31, 2011.

About Electromed, Inc.Electromed, Inc., founded in 1992

and headquartered in New Prague, Minnesota, manufactures, markets,

and sells products that provide airway clearance therapy, including

the SmartVest® Airway Clearance System and related products, to

patients with compromised pulmonary function. Further information

about the Company can be found at www.electromed.com.

Cautionary StatementsCertain statements found in this

release may constitute forward-looking statements as defined in the

U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements reflect the speaker’s current views with

respect to future events and financial performance and include any

statement that does not directly relate to a current or historical

fact. Forward-looking statements can generally be identified by the

words “believe,” “expect,” “anticipate” or “intend” or similar

words. Forward-looking statements made in this release include the

Company’s plans and expectations regarding sales growth,

profitability, margins, planned increases in sales force,

reimbursement and production personnel, and expansion of marketing

and research and development. Forward-looking statements cannot be

guaranteed and actual results may vary materially due to the

uncertainties and risks, known and unknown, associated with such

statements. Examples of risks and uncertainties for Electromed

include, but are not limited to, the impact of emerging and

existing competitors, the effectiveness of our sales and marketing

initiatives, changes to reimbursement programs, as well as other

factors described from time to time in our reports to the

Securities and Exchange Commission (including our Annual Report on

Form 10-K). Investors should not consider any list of such factors

to be an exhaustive statement of all of the risks, uncertainties or

potentially inaccurate assumptions investors should take into

account when making investment decisions. Shareholders and other

readers should not place undue reliance on “forward-looking

statements,” as such statements speak only as of the date of this

release.

Electromed, Inc. and Subsidiary Condensed

Consolidated Balance Sheets December 31,

June 30, 2011 2011

Assets (Unaudited) Current

Assets Cash and cash equivalents $ 1,745,468 $ 4,091,739 Accounts

receivable (net of allowances for doubtful accounts of $45,000)

10,704,705 9,593,105 Inventories 2,397,634 1,855,957 Prepaid

expenses and other current assets 466,976 371,257 Deferred income

taxes 722,000 722,000

Total current

assets 16,036,783 16,634,058 Property and equipment, net

3,255,311 2,807,082

Finite-life intangible assets, net

1,198,279 1,235,828

Other assets

239,332 191,964

Total assets $

20,729,705 $ 20,868,932

Liabilities and

Shareholders’ Equity Current Liabilities Revolving line of

credit $ 1,768,128 $ 1,768,128 Current maturities of long-term debt

437,297 438,267 Accounts payable 623,370 733,621 Accrued

compensation 702,274 868,229

Warranty reserve 469,624 444,096

Other accrued liabilities

68,753 161,166

Total current

liabilities 4,069,446 4,413,507 Long-term debt, less current

maturities 1,426,934 1,582,102 Deferred income taxes 167,000

167,000

Total liabilities 5,663,380

6,162,609 Commitments and Contingencies Shareholders’ Equity

Common stock, $0.01 par value; authorized: 13,000,000; shares

issued and outstanding: 8,102,252 and 8,100,485 shares respectively

81,023 81,005 Additional paid-in capital 12,861,759 12,794,368

Retained earnings 2,123,543 1,853,450 Common stock subscriptions

receivable for 15,000 shares outstanding as of June 30, 2011

- (22,500 )

Total shareholders’ equity

15,066,325 14,706,323

Total liabilities and

shareholders’ equity $ 20,729,705 $ 20,868,932

Electromed, Inc. and Subsidiary Condensed

Consolidated Statements of Income

(Unaudited)

For the Three Months Ended

For the Six Months Ended

December 31,

December 31,

2011 2010 2011 2010 Net revenues $ 4,790,344 $

4,685,546 $ 10,169,262 $ 8,850,975 Cost of revenues

1,310,416 1,145,391 2,631,734

2,377,092

Gross profit 3,479,928 3,540,155

7,537,528 6,473,883 Operating

expenses Selling, general and administrative 3,129,447 2,778,415

6,527,000 5,265,999 Research and development 250,339

218,703 457,924 417,089

Total

operating expenses 3,379,786 2,997,118

6,984,924 5,683,088

Operating income

100,142 543,037 552,604 790,795 Interest expense, net of interest

income of $1,634, $4,017, $3,662, and $5,988 respectively

43,588 53,165 87,511 112,852

Net income before income taxes 56,554 489,872 465,093

677,943 Income tax expense (32,000 ) (198,000

) (195,000 ) (274,000 )

Net income $

24,554 $ 291,872 $ 270,093 $ 403,943 Earnings

per share attributable to Electromed, Inc. common shareholders:

Basic $ 0.00 $ 0.04 $ 0.03 $ 0.05 Diluted $ 0.00 $ 0.04 $

0.03 $ 0.05 Weighted-average Electromed, Inc. common

shares outstanding: Basic 8,101,745 8,087,885

8,101,330 7,537,342 Diluted 8,125,458

8,115,621 8,121,971 7,573,453

Electromed, Inc. and Subsidiary Condensed Consolidated

Statements of Cash Flows

(Unaudited)

For the Six Months Ended December 31, 2011

2010 Cash Flows From Operating Activities Net income $

270,093 $ 403,943 Adjustments to reconcile net income to net cash

used in operating activities: Depreciation 193,790 162,010

Amortization of finite-life intangible assets 60,199 54,784

Amortization of debt issuance costs 6,066 27,593 Share-based

compensation expense 62,108 86,260 Loss on disposal of property and

equipment 9,865 5,653 Changes in operating assets and liabilities:

Accounts receivable (1,111,600 ) (1,271,774 ) Inventories (541,677

) (64,429) Prepaid expenses and other assets (138,627 ) 4,769

Accounts payable and accrued liabilities (343,091 )

355,257

Net cash used in operating activities

(1,532,874 ) (235,934 ) Cash Flows From Investing

Activities Expenditures for property and equipment (618,966 )

(208,253 ) Expenditures for finite-life intangible assets

(22,650 ) (648,616 )

Net cash used in investing

activities (641,616 ) (856,869 ) Cash

Flows From Financing Activities Net payments on revolving line of

credit - (500,000 ) Principal payments on long-term debt including

capital lease obligations (189,056 ) (215,708 ) Payments of

deferred financing fees (10,526) (4,659 ) Proceeds from warrant

exercises 5,301 - Proceeds from sales of 1.9 million shares of

common stock, net of offering costs of $1,236,287 - 6,363,713

Proceeds from subscription notes receivable 22,500

-

Net cash provided by (used in) financing

activities (171,781) 5,643,346

Net increase (decrease) in cash and cash equivalents

(2,346,271) 4,550,543 Cash and cash equivalents Beginning of period

4,091,739 610,727 End of period $

1,745,468 $ 5,161,270

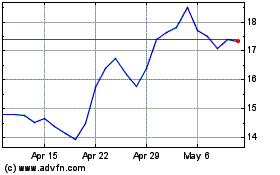

Electromed (AMEX:ELMD)

Historical Stock Chart

From May 2024 to Jun 2024

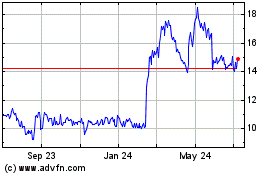

Electromed (AMEX:ELMD)

Historical Stock Chart

From Jun 2023 to Jun 2024