false

0000896493

0000896493

2024-05-21

2024-05-21

0000896493

AULT:CommonStock0.001ParValueMember

2024-05-21

2024-05-21

0000896493

AULT:Sec13.00SeriesDCumulativeRedeemablePerpetualPreferredStockParValue0.001PerShareMember

2024-05-21

2024-05-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

____________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

___________________________________________________________________

Date of Report (Date of earliest event reported): May

21, 2024

AULT ALLIANCE,

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-12711 |

|

94-1721931 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

11411 Southern Highlands Parkway, Suite 240,

Las Vegas, NV 89141

(Address of principal executive offices) (Zip Code)

(949) 444-5464

(Registrant's telephone number, including area

code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

|

AULT |

|

NYSE American |

| 13.00% Series D Cumulative Redeemable Perpetual Preferred Stock, par value $0.001 per share |

|

AULT PRD |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On May 21, 2024, Ault

Alliance, Inc. (the “Company”) issued a press release announcing its financial

results for its first quarter ended March 31, 2024 (the “Press Release”). A copy of the Press Release

is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The

information contained in this Item 2.02 and in the Press Release furnished as Exhibit 99.1 to this Current Report on Form 8-K shall not

be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the

liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item

2.02 and in the Press Release furnished as Exhibit 99.1 to this Current Report on Form 8-K shall not be incorporated by reference into

any filing with the Securities and Exchange Commission made by the Company whether made before or after the date hereof, except as expressly

set forth by specific reference in such a filing.

The Securities and Exchange

Commission encourages registrants to disclose forward-looking information so that investors can better understand the future prospects

of a registrant and make informed investment decisions. This Current Report on Form 8-K and exhibits may contain these types of statements,

which are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and which

involve risks, uncertainties and reflect the Registrant’s judgment as of the date of this Current Report on Form 8-K. Forward-looking

statements may relate to, among other things, operating results and are indicated by words or phrases such as “expects,” “should,”

“will,” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual

results to differ materially from those anticipated at the date of this Current Report on Form 8-K. Investors are cautioned not to rely

unduly on forward-looking statements when evaluating the information presented within.

Where You Can Find

Additional Information

Investors and security

holders will be able to obtain documents filed with the Securities and Exchange Commission free of charge at the Commission’s website, www.sec.gov. Security

holders may also read and copy any reports, statements and other information filed by the Company with the Commission, at the SEC public

reference room at 100 F Street, N.E., Washington D.C. 20549. Please call the Commission at 1-800-SEC-0330 or visit the Commission’s

website for further information on its public reference room.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Press Release issued on May 21, 2024. |

| 101 |

|

Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language). |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AULT ALLIANCE, INC. |

|

| |

|

|

| |

|

|

| Dated: May 21, 2024 |

/s/ Henry Nisser |

|

| |

Henry Nisser

President and General Counsel |

|

-3-

Exhibit 99.1

Ault Alliance

Achieves Profitability in the First Quarter of 2024; Revenue Increases by 55% to $45 Million

LAS VEGAS--(BUSINESS WIRE) – May 21, 2024

-- Ault Alliance, Inc. (NYSE American: AULT), a diversified

holding company (“Ault Alliance,” or the “Company”), reported its financial results for the first

quarter ended March 31, 2024, which were disclosed on a quarterly report on Form 10-Q filed yesterday with the Securities and Exchange

Commission.

First quarter 2024 highlights include:

| • | Total revenue increased 55% to $44.9 million, compared to $28.9 million in the prior year’s first

fiscal quarter; |

| • | Revenue of approximately $3 million from Ault Global Real Estate Equities, Inc. (“AGREE”),

was not included in the total revenue of $44.9 million as the assets of AGREE were classified as discontinued operations as they were

previously held for sale; |

| • | Revenue from digital assets mining increased 56% to $11.4 million, compared to $7.3 million in the prior

year’s first fiscal quarter; |

| • | Revenue from lending and trading activities increased to $9.1 million, compared to negative $4.9 million

in the prior year’s first fiscal quarter; |

| • | Gross margins improved to 43%, compared to 9% in the prior year’s first fiscal quarter; |

| • | Operating expenses declined 41% to $19.1 million, compared to $32.3 million in the prior year’s

first fiscal quarter; |

| • | Income from operations improved to $0.4 million, compared to a loss from operations of $29.9 million in

the prior year’s first fiscal quarter; |

| • | Total assets of $299.8 million as of March 31, 2024; and |

| • | Net income available to common stockholders of $2.5 million, compared to a net loss available to common

stockholders of $48.9 million in the prior year first fiscal quarter. |

Milton “Todd” Ault III, the Founder

and Executive Chairman of Ault Alliance, expressed optimism about the Company’s trajectory, noting, “We are beginning to see

the results of our commitment to focusing on and strengthening our key assets, as three of our main reporting segments, Sentinum, Inc.

(“Sentinum”), Technology and Finance (“Fintech”) and Energy and Infrastructure (“Energy”),

all reported positive income from operations for the fiscal quarter ended March 31, 2024. Only the Energy segment reported positive income

from operations during the comparable period for the prior quarter. However, we recognize that the next few quarters may present fluctuations

in our results, due to variables such as Bitcoin volatility and difficulty as well as the dynamic, evolving artificial intelligence (“AI”)

industry, which we anticipate will significantly impact our future operations.”

Further emphasizing its commitment to technological

advancement, Sentinum has made substantial investments in its Michigan data center (the “MI Facility”), aiming to extract

the maximum possible value from the growing AI industry. This state-of-the-art facility spans 34.5 acres with 617,000 square feet, including

14 acres under roof, and boasts a current capacity of approximately 30 megawatts (“MWs”) of power. However, the MI

Facility has the opportunity to expand to 300 MW, subject to the Company’s receipt of necessary approvals and adequate funding,

which it may or may not obtain. The Company expects the MI Facility to dramatically enhance sales and profitability. Sentinum is seeking

to enter into long-term leases with AI tenants for the MI Facility, which will be expected to range between seven and ten years, positioning

this center to be a long-term major growth engine for the Company.

Ault Alliance is strategically positioning itself

to capitalize on technological advancements in AI, with its Sentinum business segment expected to be a key growth driver. “The AI

revolution is underway, and our investments in the MI Facility are positioning us to be a significant player in this burgeoning industry,”

added Mr. Ault.

Ault Alliance is committed to minimizing equity

issuance and currently plans to finance the significant expansion of the MI Facility primarily through debt. This strategy aligns with

the Company’s fiscal goals and supports the expanding AI industry, ensuring capital efficiency and sustainable growth.

The Company also notes that its Fintech segment

continues to experience, and is expected to continue to experience, wide fluctuations in its profitability as its positions are marked

to the market.

Reflecting on the strategic plan launched in 2017

to acquire assets and grow the Company’s topline across multiple sectors, Mr. Ault highlighted the long-term vision, “It has

been a bumpy road, but we remain steadfast in our mission to build on our core businesses and capitalize on emerging opportunities. By

the end of 2027, assuming that we leased the Michigan data center and the power generated there were upgraded to 300 MW, we would expect

revenues to exceed $500 million with gross margins in excess of 50%. The Company expects the large majority of this growth to be driven

by Sentinum and its data center operations.”

For more information on Ault Alliance and its

subsidiaries, Ault Alliance recommends that stockholders, investors, and any other interested parties read Ault Alliance’s public

filings and press releases available under the Investor Relations section at www.Ault.com or

available at www.sec.gov.

About Ault Alliance,

Inc.

Ault Alliance, Inc.

is a diversified holding company pursuing growth by acquiring undervalued businesses and disruptive technologies with a global impact.

Through its wholly and majority-owned subsidiaries and strategic investments, Ault Alliance owns and operates a data center at which it

mines Bitcoin and offers colocation and hosting services for the emerging artificial intelligence ecosystems and other industries, and

provides mission-critical products that support a diverse range of industries, including metaverse platform, oil exploration, crane services,

defense/aerospace, industrial, automotive, medical/biopharma, hotel operations and textiles. In addition, Ault Alliance extends credit

to select entrepreneurial businesses through a licensed lending subsidiary. Ault Alliance’s headquarters are located at 11411 Southern

Highlands Parkway, Suite 240, Las Vegas, NV 89141; www.Ault.com.

Forward-Looking Statements

This press release

contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements generally include statements that are predictive

in nature and depend upon or refer to future events or conditions, and include words such as “believes,” “plans,”

“anticipates,” “projects,” “estimates,” “expects,” “intends,” “strategy,”

“future,” “opportunity,” “may,” “will,” “should,” “could,” “potential,”

or similar expressions. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based

on current beliefs and assumptions that are subject to risks and uncertainties.

Forward-looking statements speak only

as of the date they are made, and the Company undertakes no obligation to update any of them publicly in light of new information or future

events. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors. More

information, including potential risk factors, that could affect the Company’s business and financial results are included in the

Company’s filings with the U.S. Securities and Exchange Commission, including, but not limited to, the Company’s Forms 10-K,

10-Q and 8- K. All filings are available at www.sec.gov and on the Company’s website

at www.Ault.com.

Ault Alliance Investor Contact:

IR@Ault.com or 1-888-753-2235

v3.24.1.1.u2

Cover

|

May 21, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 21, 2024

|

| Entity File Number |

001-12711

|

| Entity Registrant Name |

AULT ALLIANCE,

INC.

|

| Entity Central Index Key |

0000896493

|

| Entity Tax Identification Number |

94-1721931

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

11411 Southern Highlands Parkway

|

| Entity Address, Address Line Two |

Suite 240

|

| Entity Address, City or Town |

Las Vegas

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89141

|

| City Area Code |

(949)

|

| Local Phone Number |

444-5464

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.001 par value |

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

AULT

|

| Security Exchange Name |

NYSE

|

| 13.00% Series D Cumulative Redeemable Perpetual Preferred Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

13.00% Series D Cumulative Redeemable Perpetual Preferred Stock, par value $0.001 per share

|

| Trading Symbol |

AULT PRD

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AULT_CommonStock0.001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AULT_Sec13.00SeriesDCumulativeRedeemablePerpetualPreferredStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

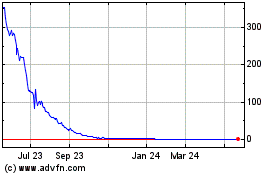

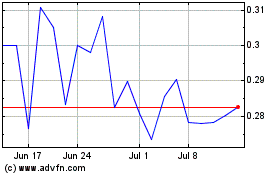

Ault Alliance (AMEX:AULT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ault Alliance (AMEX:AULT)

Historical Stock Chart

From Nov 2023 to Nov 2024