Shares of Steel and Aluminum Swing as Gold Surges

March 02 2018 - 5:17PM

Dow Jones News

By Amrith Ramkumar and David Hodari

Shares of companies that produce steel and aluminum swung before

closing higher Friday, a day after rising on the official

announcement of U.S. tariffs on the metals.

U.S. Steel Corp. reversed its early losses and closed up 1.4%,

while Nucor Corp. rose 0.5%. Meantime, Alcoa Corp. closed up 1% and

Century Aluminum Co. added 2.3%. Although analysts have said they

expect U.S. premiums on the two metals to increase, supporting

domestic producers, some think the long-term effects are uncertain

if global demand slows and the market adjusts.

"I think it could potentially slow it down from a longer-term

perspective," said Ed Egilinsky, managing director and head of

alternative investments at ETF and mutual fund issuer Direxion

Investments.

China, the country analysts think will be affected most by

tariffs, is the world's largest consumer of a wide range of

commodities.

Some investors and analysts have said they are waiting to see

the specific details of the tariffs next week to determine the full

impact. Others are monitoring the prospect of other countries

retaliating and waiting to see how countries like Canada and Mexico

might be impacted as talks about overhauling the North American

Free Trade Agreement continue.

For now, some analysts think the effects will be contained in

the U.S.

"If you look at Chinese exports to the U.S. last year, it's not

that high on the list -- the U.S. was the 11th largest recipient,"

said Xiao Fu, head of commodities research at BOCI Global

Commodities. "[The move] is more likely to affect U.S. regional

premiums."

U.S. hot-rolled steel coil prices have risen to about a

seven-year high recently, boosted in part by news of the tariffs,

and rose 0.7% Friday to $800 a ton. Aluminum prices on the London

Metal Exchange were slightly higher for the second straight session

Friday.

Elsewhere in base metals, front-month copper for May delivery

edged down less than 0.1% to $3.1010 a pound. The industrial metal

has fallen from roughly four-year highs hit in late December

alongside oil, stocks and other risky investments.

Among precious metals, gold prices rose from their lowest level

of the year on Friday, as investors bought assets considered to be

safe stores of value following the tariffs amid worries that they

could spark a trade war and contribute to higher inflation. Gold

for April delivery climbed 1.2% to $1,320.20 a troy ounce on the

Comex division of the New York Mercantile Exchange.

Front-month gold for March delivery rose 1.4% to $1,321.10 a

troy ounce on the Comex division of the New York Mercantile

Exchange, its best day since Feb. 14.

Some analysts have said higher-than-expected consumer prices --

as it becomes more expensive for companies to manufacture goods --

could force the Federal Reserve to raise interest rates faster than

expected and contribute to an economic slowdown.

"The market doesn't digest uncertainty too well, that's why

you're seeing a negative reaction," Mr. Egilinsky said.

A weaker dollar was also boosting commodity prices by making raw

materials cheaper for overseas buyers. The WSJ Dollar Index, which

tracks the dollar against a basket of 16 other currencies, was down

0.3%.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com and David

Hodari at David.Hodari@dowjones.com

(END) Dow Jones Newswires

March 02, 2018 17:02 ET (22:02 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

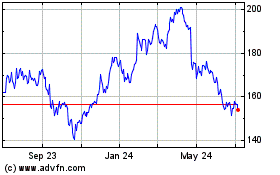

Nucor (NYSE:NUE)

Historical Stock Chart

From Aug 2024 to Sep 2024

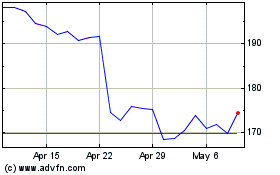

Nucor (NYSE:NUE)

Historical Stock Chart

From Sep 2023 to Sep 2024