- Reports $213.7 million of December

quarters sales, up 43% over the same period last year

- Delivers $38.6 million of December

quarter operating profit, up 123% over the same period last

year

- Guides record first fiscal half 2018

revenue between $419 and $429 million

Kulicke and Soffa Industries, Inc. (NASDAQ: KLIC) (“Kulicke

& Soffa”, “K&S” or the “Company”) today announced results

for its first fiscal quarter ended December 30, 2017. The

Company reported first quarter net revenue of $213.7 million, a

diluted EPS of $(0.98) and a non-GAAP diluted EPS was $0.54.

Quarterly Results - U.S. GAAP

Fiscal Q1 2018

Change vs.

Fiscal Q1 2017

Change vs.

Fiscal Q4 2017

Net Revenue $213.7 million

up 42.8% down 1.0% Gross Profit

$99.0 million up 44.9%

down 5.4% Gross Margin 46.3%

up 60 bps down 220 bps

Income from Operations $38.6 million up 123.1% up 4.6% Operating

Margin 18.1% up 650 bps

up 100 bps Net Loss $(69.3) million down

544.2% down 289.3% Net Margin (32.4)%

down 4280 bps down 4940 bps EPS

– Diluted(a) $(0.98) down

545.5% down 292.2%

(a)

GAAP diluted net earnings per share

reflects any dilutive effect of outstanding restricted stock units

and stock options, but that effect is excluded when calculating

GAAP diluted net (loss) per share because it would be

anti-dilutive. For the three months ended December 30, 2017, 1.2

million shares of restricted stock units and stock options were

excluded due to the Company's net loss.

Quarterly Results - Non-GAAP

Fiscal Q1 2018

Change vs.

Fiscal Q1 2017

Change vs.

Fiscal Q4 2017

Income from Operations $41.8 million

up 122.3% up 3.5% Operating

Margin 19.6% up 700 bps

up 90 bps Net Income $38.8 million up 126.9%

down 3.2% Net Margin 18.2%

up 680 bps down 40 bps EPS - Diluted

$0.54 up 125.0%

down 3.6%

* A reconciliation of the GAAP and non-GAAP adjusted results is

provided in the financial tables included in this release. See also

“Use of Non-GAAP Financial Results” section.

Dr. Fusen Chen, Kulicke & Soffa's President and Chief

Executive Officer, stated, “Strength during the December quarter

was driven by our competitive automotive, LED, memory and image

sensor solutions in addition to the ongoing strong business

environment."

During the December quarter the Company incurred a charge of

$105 million due to the impact of the Tax Cuts and Reform Act of

2017. On a non-GAAP basis, diluted earnings per share increased by

125% over the same period in the prior year.

First Quarter Fiscal 2018 Financial

Highlights

- Net revenue of $213.7 million.

- Gross margin of 46.3%.

- Non-GAAP net income of $38.8 million or

$0.54 per share.

- Cash, cash equivalents, and short-term

investments were $649.7 million as of December 30, 2017.

Second Quarter Fiscal 2018

Outlook

The Company currently expects net revenue in the second fiscal

quarter of 2018 ending March 31, 2018 to be approximately $205

million to $215 million. For the first fiscal half of 2018, this

guidance represents an increase of 21% over the same period in the

prior year.

Looking forward, Dr. Fusen Chen commented, "Our competitive

positions and exposure to higher-growth segments provides

additional upside beyond the already favorable semiconductor unit

growth rate of 8.9%, calendar 2017 through 2021. In addition, we

remain focused to further enhance these long-term growth prospects

through traction with our growing advanced packaging offerings and

share gains within our recurring revenue business."

Use of Non-GAAP Financial

Results

In addition to U.S. GAAP results, this press release also

contains non-GAAP financial results. The Company's non-GAAP results

exclude amortization related to intangible assets acquired through

business combinations, goodwill impairment, costs associated with

restructuring, income tax expense related to the Tax Cuts and Jobs

Act of 2017 as well as tax benefits or expense associated with the

foregoing non-GAAP items. These non-GAAP measures are consistent

with the way management analyzes and assesses the Company’s

operating results. The Company believes these non-GAAP measures

enhance investors’ understanding of the Company’s underlying

operational performance, as well as their ability to compare the

Company’s period-to-period financial results and the Company’s

overall performance to that of its competitors.

Management uses both U.S. GAAP metrics as well as non-GAAP

operating income, operating margin, net income, net margin and net

income per diluted share to evaluate the Company's operating and

financial results. Non-GAAP financial measures may not provide

information that is directly comparable to that provided by other

companies in the Company’s industry, as other companies in the

industry may calculate non-GAAP financial results differently. In

addition, there are limitations in using non-GAAP financial

measures because the non-GAAP financial measures are not prepared

in accordance with GAAP, may be different from non-GAAP financial

measures used by other companies and exclude expenses that may have

a material impact on the Company’s reported financial results. The

presentation of non-GAAP items is meant to supplement, but not

substitute for, GAAP financial measures or information. The Company

believes the presentation of non-GAAP results in combination with

GAAP results provides better transparency to the investment

community when analyzing business trends, providing meaningful

comparisons with prior period performance and enhancing investors'

ability to view the Company's results from management's

perspective. A reconciliation of each available GAAP to non-GAAP

financial measure discussed in this press release is contained in

the attached exhibit.

Earnings Conference Call

Details

A conference call to discuss these results will be held today,

January 31, 2018, beginning at 6:00 pm (EST). To access the

conference call, interested parties may call +1-877-407-8037 or

internationally +1-201-689-8037. The call will also be available by

live webcast at investor.kns.com.

A replay will be available from approximately one hour after the

completion of the call through February 14, 2018 by calling

toll-free +1-877-660-6853 or internationally +1-201-612-7415 and

using the replay ID number of 13675324. A webcast replay will also

be available at investor.kns.com.

About Kulicke &

Soffa

Kulicke & Soffa (NASDAQ: KLIC) is a leading provider of

semiconductor packaging and electronic assembly solutions

supporting the global automotive, consumer, communications,

computing and industrial segments. As a pioneer in the

semiconductor space, K&S has provided customers with market

leading packaging solutions for decades. In recent years,

K&S has expanded its product offerings through strategic

acquisitions and organic development, adding advanced packaging,

electronics assembly, wedge bonding and a broader range of

expendable tools to its core offerings. Combined with its extensive

expertise in process technology and focus on development, K&S

is well positioned to help customers meet the challenges of

packaging and assembling the next-generation of electronic devices

(www.kns.com).

Caution Concerning Results and Forward Looking

Statements

In addition to historical statements, this press release

contains statements relating to future events and our future

results. These statements are “forward-looking” statements within

the meaning of the Private Securities Litigation Reform Act of

1995, and include, but are not limited to, statements that relate

to our future revenue, sustained, increasing, continuing or

strengthening demand for our products, replacement demand, our

research and development efforts, our ability to control costs, and

our ability to identify and realize new growth opportunities within

segments, such as automotive and industrial as well as surrounding

technology adoption such as system in package and advanced

packaging techniques. While these forward-looking statements

represent our judgments and future expectations concerning our

business, a number of risks, uncertainties and other important

factors could cause actual developments and results to differ

materially from our expectations. These factors include, but are

not limited to: the risk that customer orders already received may

be postponed or canceled, generally without charges; the risk that

anticipated customer orders may not materialize; the risk that our

suppliers may not be able to meet our demands on a timely basis;

the volatility in the demand for semiconductors and our products

and services; the risk that identified market opportunities may not

grow or developed as we anticipated; volatile global economic

conditions, which could result in, among other things, sharply

lower demand for products containing semiconductors and for the

Company’s products, and disruption of capital and credit markets;

the risk of failure to successfully manage our operations; the

possibility that we may need to impair the carrying value of

goodwill and/or intangibles established in connection with one or

more of our prior acquisitions; acts of terrorism and violence;

risks, such as changes in trade regulations, currency fluctuations,

political instability and war, which may be associated with a

substantial non-U.S. customer and supplier base and substantial

non-U.S. manufacturing operations; the impact of changes in tax

law; and the factors listed or discussed in Kulicke and Soffa

Industries, Inc. 2017 Annual Report on Form 10-K and our other

filings with the Securities and Exchange Commission. Kulicke and

Soffa Industries, Inc. is under no obligation to (and expressly

disclaims any obligation to) update or alter its forward-looking

statements whether as a result of new information, future events or

otherwise.

KULICKE & SOFFA INDUSTRIES,

INC.

CONSOLIDATED CONDENSED STATEMENTS OF

OPERATIONS

(In thousands, except per share and

employee data)

(Unaudited)

Three months ended December 30, 2017

December 31, 2016 Net revenue $ 213,691 $ 149,639

Cost of sales 114,652 81,321 Gross

profit 99,039 68,318 Operating

expenses: Selling, general and administrative 26,961 28,009

Research and development 30,250 21,505 Amortization of intangible

assets 1,943 1,523 Restructuring 1,314 —

Total operating expenses 60,468 51,037

Income from operations 38,571 17,281 Other income (expense):

Interest income 1,975 1,172 Interest expense (266 )

(262 ) Income before income taxes 40,280 18,191 Income tax expense

109,633 2,608 Share of results of equity-method investee, net of

tax (16 ) — Net (loss)/income $ (69,337 ) $

15,583 Net (loss)/income per share: Basic $ (0.98 ) $

0.22 Diluted $ (0.98 ) $ 0.22 Weighted average

shares outstanding: Basic 70,577 70,854 Diluted 70,577 71,763

Three months ended Supplemental financial data:

December 30, 2017 December 31, 2016 Depreciation and amortization $

4,468 $ 3,944 Capital expenditures 6,257 2,229 Equity-based

compensation expense: Cost of sales 132 141 Selling, general and

administrative 2,323 2,734 Research and development 654

727 Total equity-based compensation expense $

3,109 $ 3,602 As of December 30, 2017

December 31, 2016 Backlog of orders 1 $ 164,968 $ 86,676 Number of

employees 3,181 2,827 1. Represents customer purchase

commitments. While the Company believes these orders are firm, they

are generally cancellable by customers without penalty.

KULICKE & SOFFA INDUSTRIES,

INC.

CONSOLIDATED CONDENSED BALANCE

SHEETS

(In thousands)

(Unaudited)

As of December 30, 2017

September 30, 2017

ASSETS CURRENT ASSETS Cash and

cash equivalents $ 390,661 $ 392,410 Restricted cash 528 530

Short-term investments 259,000 216,000 Accounts and other

receivable, net of allowance for doubtful accounts of $354 and $79

respectively 173,777 198,480 Inventories, net 106,683 122,023

Prepaid expenses and other current assets 22,686

23,939

TOTAL CURRENT ASSETS 953,335 953,382

Property, plant and equipment, net 71,720 67,762 Goodwill

57,063 56,318 Intangible assets, net 60,586 62,316 Deferred income

taxes 12,276 27,771 Equity investments 1,518 1,502 Other assets

2,088 2,056

TOTAL ASSETS $

1,158,586 $ 1,171,107

LIABILITIES AND

SHAREHOLDERS' EQUITY CURRENT LIABILITIES Accounts

payable $ 68,370 $ 51,354 Accrued expenses and other current

liabilities 80,147 132,314 Income taxes payable 18,137

16,780

TOTAL CURRENT LIABILITIES

166,654 200,448 Financing obligation 16,130 16,074 Deferred

income taxes 26,940 26,779 Income taxes payable 89,491 6,438 Other

liabilities 9,000 8,432

TOTAL

LIABILITIES 308,215 258,171

SHAREHOLDERS' EQUITY Common stock, no par value 510,736

506,515 Treasury stock, at cost (160,884 ) (157,604 ) Retained

earnings 496,655 561,986 Accumulated other comprehensive income

3,864 2,039

TOTAL SHAREHOLDERS'

EQUITY 850,371 912,936

TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY $ 1,158,586 $ 1,171,107

KULICKE & SOFFA INDUSTRIES,

INC.

CONSOLIDATED CONDENSED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

Three months ended December 30, 2017 December 31,

2016 Net cash provided by operating activities $ 50,333 $ 30,049

Net cash used in investing activities, continuing operations

(48,183 ) (2,659 ) Net cash (used in) / provided by financing

activities, continuing operations (3,391 ) 142 Effect of exchange

rate changes on cash, cash equivalents and restricted cash

(510 ) 1,987 Changes in cash, cash equivalents and

restricted cash (1,751 ) 29,519 Cash, cash equivalents and

restricted cash, beginning of period* 392,940

423,907 Cash, cash equivalents and restricted cash, end of

period $ 391,189 $ 453,426 Short-term

investments 259,000 124,000 Total cash,

cash equivalents, restricted cash and short-term investments $

650,189 $ 577,426 *Certain time deposits as at

October 1, 2016 were previously reclassified from cash equivalents

to short-term investments for comparative purposes.

Reconciliation of U.S. GAAP Income from

Operating

to Non-GAAP Income from Operation and

Operating Margin

(in thousands, except

percentages)

(unaudited)

Three months ended December 30, 2017 December 31,

2016 September 30, 2017 Net revenue 213,691 149,639 215,892 U.S.

GAAP Income from operations 38,571 17,281 36,904 U.S. GAAP

operating margin 18.0 % 11.5 % 17.1 % Pre-tax non-GAAP

items: Amortization related to intangible assets acquired through

business combination- selling, general and administrative 1,943

1,523 1,989 Restructuring 1,314 — 1,531

Non-GAAP Income from operations 41,828 18,804 40,424

Non-GAAP operating margin 19.6 % 12.6 % 18.7 %

Reconciliation of U.S. GAAP Net Income

to Non-GAAP Net Income and

U.S. GAAP net income per share to

Non-GAAP net income per share

(in thousands, except per share

data)

(unaudited)

Three months ended December 30, 2017 December 31,

2016 September 30, 2017 Net revenue 213,691 149,639 215,892 U.S.

GAAP net (loss)/income (69,337 ) 15,583 36,576 U.S. GAAP net margin

(32.4 )% 10.4 % 16.9 % Pre-tax non-GAAP adjustments:

Amortization related to intangible assets acquired through business

combination- selling, general and administrative 1,943 1,523 1,989

Restructuring 1,314 — 1,531 Income tax expense- Tax Reform 104,955

— — Net income tax benefit on non-GAAP items (36 ) (22 ) (44 )

Total non-GAAP adjustments 108,176 1,501 3,476

Non-GAAP net income 38,839 17,084 40,052

Non-GAAP net margin 18.2 % 11.4 % 18.6 % U.S. GAAP net

(loss)/income per share: Basic (0.98 ) 0.22 0.52 Diluted (a) (0.98

) 0.22 0.51 Non-GAAP adjustments per share: Basic 1.53 0.02

0.05 Diluted 1.51 0.02 0.05 Non-GAAP net income per share:

Basic 0.55 0.24 0.57 Diluted (b) 0.54

0.24 0.56 (a) GAAP diluted net

earnings per share reflects any dilutive effect of outstanding

restricted stock units and stock options, but that effect is

excluded when calculating GAAP diluted net (loss) per share because

it would be anti-dilutive. For the three months ended December 30,

2017, 1.2 million shares of restricted stock units and stock

options were excluded due to the Company's net loss. (b) Non-GAAP

diluted net earnings per share reflects any dilutive effect of

outstanding restricted stock units and stock options.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180131005831/en/

Kulicke & Soffa Industries, Inc.Joseph

ElgindyInvestor Relations & Strategic InitiativesP:

+1-215-784-7518F: +1-215-784-6180

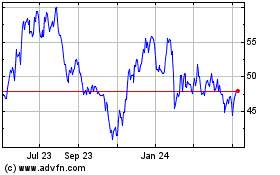

Kulicke and Soffa Indust... (NASDAQ:KLIC)

Historical Stock Chart

From Aug 2024 to Sep 2024

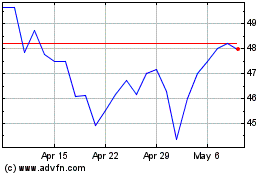

Kulicke and Soffa Indust... (NASDAQ:KLIC)

Historical Stock Chart

From Sep 2023 to Sep 2024