Today's Top Supply Chain and Logistics News From WSJ

January 30 2017 - 7:02AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

The Hunter Harrison takeover of CSX Corp. may be on a fast

track. The freight railroad is discussing a settlement with the

railroad-industry veteran and the activist investor backing him

that could make Mr. Harrison its chief executive, less than two

weeks after they launched a campaign for influence over the

company. The WSJ's Jacquie McNish, David Benoit and Dana Mattioli

report Mr. Harrison presented his vision for CSX to a group that

included the railroad's two independent directors at a meeting in

Atlanta on Friday. CSX's board has come under pressure to replace

Chief Executive Michael Ward since the railroad's stock surged on

news that Mr. Harrison had resigned as Canadian Pacific Railway

Ltd.'s chief to team up with Paul Hilal, a former top official at

Bill Ackman's Pershing Square Capital Management LP. Mr. Harrison

is a vocal advocate for building a transcontinental railroad in

America, so any action on CSX could be a prelude to a new

rail-industry consolidation effort.

Small-business owners are raising bigger concerns over the

import-tax plan known as border adjustment. The provision included

in an overhaul of the U.S. tax code favored by Republicans in the

House of Representatives promises to upend the direction of trade,

and the WSJ's Ruth Simon and Richard Rubin report some

small-business owners fear it may force them to lay off workers and

raise prices as they cope with higher import costs. The proposal

could benefit firms that export or don't import raw materials or

finished products. Under the plan, imports couldn't be deducted as

a cost of doing business, while exports would be exempted. Big

retailers are fighting it. But the bigger impact may be deeper in

the supply chain: More than 95% of U.S. importers have fewer than

250 employees, according to 2014 U.S. Census data, and several

companies say they don't have the cash reserves to ride out the

changes nor the flexibility to shift production and realign their

supply chains to meet the changed economics of trade.

While trade-war talk grows louder, the existing global battle

over steel shipments shows no signs of cooling off. The European

Union is imposing new tariffs on two steel products originating

from China and Taiwan, the WSJ's Viktoria Dendrinou reports,

escalating tensions between the EU and Beijing over Europe's

oversupplied steel sector. The new tariffs come as the U.S. is

moving forward on its own stronger anti-dumping measures against

Chinese steel. Overcapacity in Europe's steel sector has led to

thousands of job losses in the past year while steel producers

around the world have sought government protection from falling

prices amid a global steel glut. China has said it will eliminate

what it calls "outdated" steel manufacturing capacity by the middle

of this year, but it's unclear so far whether the growing tariffs

will eliminate production or simply send China's manufacturers in

search of new markets.

ECONOMY & TRADE

Trade is having an outsize impact on recent U.S. economic growth

trends. Economic output decelerated in the final three months of

the year to a 1.9% growth rate, the WSJ's Ben Leubsdorf reports,

returning to the stubbornly lackluster pace that has prevailed

through most of the current expansion. The expansion last quarter

reflected decent consumer spending, a rebound for home-building and

stronger business investment in both new equipment and

research-and-development projects -- trends that suggest the

goods-moving economy was picking up steam to close out 2016. And

private inventories came back strong, contributing a full

percentage point to the fourth quarter's growth rate. The strong

imports that contributed to a wider trade deficit subtracted 1.7

percentage points from gross domestic product. But those imports

also signal confidence in the consumer demand and the progress of

the U.S. economy, even as the direction of trade comes under

increasingly heated debate.

QUOTABLE

IN OTHER NEWS

Airlines and airports scrambled over the weekend to adjust

staffing in response to President Donald Trump's immigration order,

while businesses in the Middle East braced for the ban's impact.

(WSJ)

Delta Air Lines Inc. flight delays and cancellations stretched

into a second day after computer problems led to widespread

disruptions. (WSJ)

U.S. factory orders for capital goods excluding defense and

aircraft rose 0.8% in December. (WSJ)

Tesco PLC will buy Booker Group PLC for $4.7 billion in a deal

that combines the U.K.'s largest retailer with its largest food

wholesaler. (WSJ)

Wal-Mart Stores Inc. has failed to settle a foreign-bribery

probe that has stretched for five years and cost the company more

than $820 million. (WSJ)

Teen retailer Wet Seal LLC is closing all its stores after it

was unable to nail down fresh capital or a buyer. (WSJ)

A Chinese phone maker's default on some $166 million in bonds is

roiling the world's largest internet investment marketplace.

(WSJ)

Startup Santa Fe Natural Gas plans to invest heavily in Mexico

following the opening of the country's natural gas market.

(WSJ)

American Airlines Group Inc. projected a revenue turnaround this

year as it closes the costly integration work that has dogged it

since its merger with US Airways. (WSJ)

Colgate-Palmolive Co. is undertaking new plans to boost sales

after lackluster growth in the fourth quarter. (WSJ)

Several Florida ports canceled plans to sign a cooperation pact

with a Cuban delegation after Gov. Rick Scott threatened to cut

their funding. (Miami Herald)

Boeing Co. and its machinists' union agreed to a Feb. 15 date

for a vote on unionization at the company's jet factory in South

Carolina. (Reuters)

Residents near a new CSX Corp. double-stack route through

Washington, D.C., say the expansion has disrupted life in the

neighborhood. (Washington Post)

Members of the International Longshoremen's Association slowed

operations at South Carolina's Port of Charleston to protest

automation efforts. (Charleston Post and Courier)

Truckload carrier Heartland Express Inc.'s fourth-quarter net

profit fell 21% on a 14% decline in revenue. (Cedar Rapids

Gazette)

Wal-Mart plans to spend $1.2 billion over the next 10 years

adding distribution centers in Mexico's Yucatan region. (Yucatan

Times)

Orient Overseas Container Line's trans-Pacific volume soared

30.6% in the fourth quarter while Asia-Europe business grew 28%.

(American Shipper)

Agencies and institutions in Michigan, Ohio, and Pennsylvania

formed the "Smart Belt Coalition" to spur efforts to test and

deploy connected vehicles. (Car & Driver)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

January 30, 2017 06:47 ET (11:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

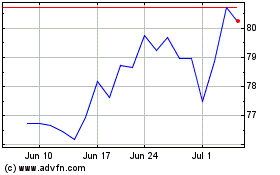

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Aug 2024 to Sep 2024

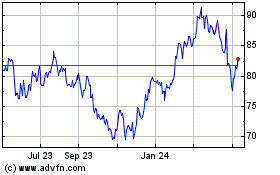

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Sep 2023 to Sep 2024