Ladder Capital Corp Announces Dividend Increase and Fourth Quarter 2016 Dividend to Holders of Class A Common Stock

December 02 2016 - 7:00AM

Business Wire

Ladder Capital Corp (“Ladder” or the “Company”) (NYSE:LADR)

today announced the declaration by its Board of Directors (“Board”)

of a fourth quarter 2016 dividend of $0.46 per share of Class A

common stock.

This declaration reflects a 9.1% increase in Ladder’s recurring

quarterly cash dividend, effective in the current quarter, to $0.30

per share from $0.275 per share.

The fourth quarter dividend also includes an additional year-end

distribution attributable to our 2016 REIT taxable income of

approximately $0.16 per share of Class A common stock. As discussed

below, the full fourth quarter dividend of $0.46 per share will be

paid in a combination of cash and stock on January 24, 2017 to

stockholders of record as of the close of business on December 27,

2016 (the “Record Date”).

Stockholders may elect to receive the fourth quarter 2016

dividend in all cash (a “Cash Election”), or all shares of Ladder’s

Class A common stock (a “Share Election”). Election forms and

materials will be mailed to registered shareholders promptly after

the Record Date, and will be due by January 12, 2017. Stockholders

who do not return an election form, or who otherwise fail to

properly complete an election form, will be deemed to have made a

Share Election.

In no event will any stockholder making a Cash Election receive

less than $0.30 per share of such stockholder’s dividend in cash.

The Board currently intends to continue paying a regular cash

dividend of $0.30 per share in subsequent quarters, subject to

business and market conditions and future Board approvals.

The total amount of cash payable to all stockholders will be

equal to $0.30 multiplied by the total outstanding shares of Class

A common stock as of the Record Date (the “Cash Amount”). If the

aggregate amount of cash to be distributed to stockholders making

Cash Elections exceeds the Cash Amount, then the Cash Amount will

be prorated among such stockholders, and the remaining portion of

the fourth quarter 2016 dividend will be paid to such stockholders

in shares of Ladder’s Class A common stock plus cash in lieu of any

fractional shares.

The total number of shares of Class A common stock to be

distributed pursuant to the fourth quarter 2016 dividend will be

determined based on stockholder elections and the volume weighted

average price per share of Class A common stock on the New York

Stock Exchange for the three trading days after the date that

election forms are due. Shares of Class A common stock distributed

as part of Ladder’s fourth quarter 2016 dividend shall accrue

dividend and other benefits together with all other shares of

Ladder’s Class A common stock.

About Ladder

Ladder is an internally-managed real estate investment trust

that is a leader in commercial real estate finance. Ladder

originates and invests in a diverse portfolio of commercial real

estate and real estate-related assets, focusing on senior secured

assets. Ladder’s investment activities include: (i) direct

origination of commercial real estate first mortgage loans; (ii)

investments in investment grade securities secured by first

mortgage loans on commercial real estate; and (iii) investments in

net leased and other commercial real estate equity. Founded in

2008, Ladder is run by a highly experienced management team with

extensive expertise in all aspects of the commercial real estate

industry, including origination, credit, underwriting, structuring,

capital markets and asset management. Led by Brian Harris, the

Company’s Chief Executive Officer, Ladder is headquartered in New

York City and has branches in Los Angeles and Boca Raton.

Forward-Looking Statements

Certain statements in this release may constitute

“forward-looking” statements. These statements are based on

management’s current opinions, expectations, beliefs, plans,

objectives, assumptions or projections regarding future events or

future results. These forward-looking statements are only

predictions, not historical fact, and involve certain risks and

uncertainties, as well as assumptions. Actual results, levels of

activity, performance, achievements and events could differ

materially from those stated, anticipated or implied by such

forward-looking statements. While Ladder believes that its

assumptions are reasonable, it is very difficult to predict the

impact of known factors, and, of course, it is impossible to

anticipate all factors that could affect actual results. There are

a number of risks and uncertainties that could cause actual results

to differ materially from forward-looking statements made herein

including, most prominently, the risks discussed under the heading

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2015, as well as its consolidated financial

statements, related notes, and other financial information

appearing therein, and its other filings with the U.S. Securities

and Exchange Commission. Such forward-looking statements are made

only as of the date of this release. Ladder expressly disclaims any

obligation or undertaking to release any updates or revisions to

any forward-looking statements contained herein to reflect any

change in its expectations with regard thereto or changes in

events, conditions, or circumstances on which any such statement is

based.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161202005126/en/

InvestorsLadder Capital Corp Investor

Relations917-369-3207investor.relations@laddercapital.com

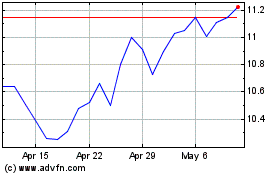

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From Apr 2024 to May 2024

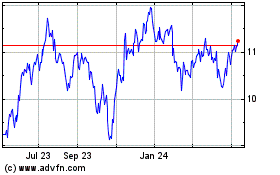

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From May 2023 to May 2024