Ahead of the Tape: Costco Shares Are No Bargain -- WSJ

September 29 2016 - 3:02AM

Dow Jones News

By Steven Russolillo

Buying in bulk isn't as attractive as it used to be -- at least

when it comes to Costco Wholesale Corp.'s stock.

The warehouse retailer's shares are essentially unchanged over

the past 18 months, its longest period of stagnation since the

financial crisis. Lackluster sales growth, slowing foot traffic and

a late-to-the-game push into e-commerce have hurt results.

More of the same is expected Thursday when Costco reports fiscal

fourth-quarter results. Analysts expect earnings of $1.73 a share,

matching the year-earlier figure. Revenue is expected to have

increased 3%.

Business at the world's second-largest retailer by revenue

behind Wal-Mart Stores Inc. has been hurt by falling food prices

and rising competition. Costco's same-store sales were flat in the

16 weeks ended Aug. 30 compared with a year earlier, missing

analysts' expectations.

Perhaps Costco's biggest concern now is Amazon.com Inc. The

online behemoth's annual revenue is expected to surpass Costco's

for the first time this year. By comparison, Amazon had less than

half of Costco's annual revenue six years ago.

Over the past five years, Costco's shares have trailed Amazon's,

while outperforming Wal-Mart. The contrast has only grown starker

over the past 18 months as Costco's stock has treaded water while

Amazon's has more than doubled.

Granted, one big difference between Costco and Amazon is

profitability. Even with five consecutive quarters in the black,

Amazon lags far behind.

Costco's competitive edge lies in limited product selection,

loyal customers and fee income. Its roughly 81 million card holders

spent around $2.5 billion in membership fees in fiscal 2015,

comprising the bulk of Costco's $3.6 billion in operating

income.

But Costco is arguably paying more now than ever for that

growth. Capital expenditures rose to $2.4 billion in fiscal 2015,

more than double their level six years earlier. Meanwhile,

same-store sales growth has slowed for four years in a row.

While Costco is still attracting new members, growth in fee

revenue decelerated to 4.3% in fiscal 2015, the least since 2009,

as exchange rates weighed and past fee-increases faded.

Even so, the stock remains rich. Fetching 25 times projected

earnings over the next 12 months, Costco's stock is still pricier

than Wal-Mart, Kroger Co. and Target Corp.

Investors might find a better price elsewhere.

Write to Steven Russolillo at steven.russolillo@wsj.com

(END) Dow Jones Newswires

September 29, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

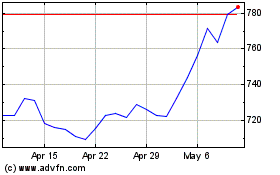

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Aug 2024 to Sep 2024

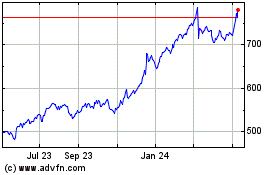

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Sep 2023 to Sep 2024