As filed with the Securities and Exchange Commission on July 11, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM T-3

APPLICATION FOR QUALIFICATION OF INDENTURE

UNDER THE TRUST INDENTURE ACT OF 1939

ENERGY FUELS

INC.

(Name of Applicant)

225 Union

Boulevard, Suite 600

Lakewood, Colorado 80228

(Address of Principal Executive Offices)

SECURITIES TO BE ISSUED UNDER THE

INDENTURE TO BE QUALIFIED

|

|

|

|

|

Title of Class

|

|

Amount

|

|

Floating Rate Convertible Unsecured

Subordinated Debentures due 2020

|

|

CDN$22,000,000

|

Approximate date of proposed issuance: As soon as practicable after the date of this Application for Qualification.

Name and address of agent for service:

David C. Frydenlund

Senior Vice President, General Counsel and

Corporate Secretary

Energy Fuels Resources (USA) Inc.

225 Union Boulevard, Suite 600

Lakewood, Colorado 80228

(303) 974-2140

With a copy

to:

Richard Raymer

Dorsey & Whitney LLP

161

Bay Street, Suite 4310

Toronto, Ontario, Canada M5J 2S1

(416) 367-7370

Applicant

hereby amends this application for qualification on such date or dates as may be necessary to delay its effectiveness until (i) the 20th day after the filing of an amendment which specifically states that it shall supersede this application, or

(ii) such date as the Securities and Exchange Commission, acting pursuant to Section 307(c) of the Trust Indenture Act of 1939, may determine upon the written request of the Applicant.

|

(a)

|

Form of organization

.

Energy Fuels Inc. (the “Company”) is a corporation

.

|

|

(b)

|

State or other sovereign power under the laws of which organized.

The Company is incorporated under the laws of Ontario, Canada.

|

|

2.

|

Securities Act Exemption Applicable

|

Pursuant to a Convertible Debenture Indenture (the “Original

Indenture”) dated as of July 24, 2012 between the Company and BNY Trust Company of Canada (the “Canadian Trustee”), the Company issued CDN$22,000,000 aggregate principal amount of its Floating Rate Convertible Unsecured

Subordinated Debentures due 2017 (the “Debentures”). Pursuant to the terms of the Original Indenture and the Management Information Circular dated as of July 5, 2016 (the “Circular”), attached hereto as Exhibit T3E1, the

Company will solicit consents (the “Consent Solicitation”) from the holders of the Debentures to an amendment and restatement of the Original Indenture (the “Amended Indenture”) and the Debentures (“Amended

Debentures”), attached hereto as Exhibit T3C. Debentureholders voting to approve the Amended Indenture and Amended Debentures will be entitled to a consent fee of CDN$20.00 per CDN$1,000 principal amount of Debentures provided that certain

conditions required for the payment of the Consent Fee are satisfied as described in the Circular. The Circular is expected to be mailed to Debentureholders on or about July 11, 2016.

The Company has structured the exchange that may be deemed to occur upon the completion of the Consent Solicitation and the amendment of the Original

Indenture and Debentures to be exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to the provisions of Section 3(a)(9) thereof based on the following facts:

|

|

•

|

|

The issuer of the Debentures and of the Amended Debentures is the same.

|

|

|

•

|

|

No sales of securities of the same class as the Amended Debentures have been or are to be made by the Company or by or through an underwriter at or about the same time as the Amended Debentures for which the exemption

is claimed.

|

|

|

•

|

|

No consideration has been, or is to be given, directly or indirectly, to any person in connection with the Amended Indenture and Amended Debentures, except for the payments of (i) fees and expenses of legal

advisors for their legal services, (ii) customary payments to be made with respect to preparation, printing and mailing of the Circular and related documents, (iii) a customary financial advisor services fee made to a nationally recognized

investment bank for advisory services rendered in connection with the Consent Solicitation and (iv) fees charged by the Canadian Trustee under the Original Indenture and by the Canadian Trustee and The Bank of New York Mellon (the “U.S.

Trustee”) under the Amended Indenture for their services as co-trustees. The compensation payable to the agents and advisors is not conditioned on the results of the Consent Solicitation.

|

|

|

•

|

|

No holder or beneficial owner of the Debentures has made or will be requested to make any cash payment to the Company in connection with the Consent Solicitation.

|

AFFILIATIONS

Furnish a list or diagram of all affiliates of the applicant and indicate the respective

percentages of voting securities or other basis of control.

|

(a)

|

An organizational chart showing the Company’s direct and indirect subsidiaries is contained in Exhibit 99.1 and incorporated by reference herein.

|

|

(b)

|

Certain directors and officer of the Company may be deemed to be “affiliates” of the Company by virtue of their positions with the Company. See Item 4, “Directors and Executive Officers”

|

1

MANAGEMENT AND CONTROL

|

4.

|

Directors and Executive Officers

|

List the names and complete mailing addresses of all directors and

executive officers of the applicants and all persons chosen to become directors and executive officers. Indicate all offices held or to be held by each person named.

The following table lists the names and offices held by all directors and executive officers of the Company as of July 5, 2016.

|

|

|

|

|

Name

|

|

Office

|

|

Stephen P. Antony

|

|

President, Chief Executive Officer and Director

|

|

Daniel G. Zang

|

|

Chief Financial Officer

|

|

J. Birks Bovaird

|

|

Chairman of the Board and Director

|

|

Hyung Mun Bae

|

|

Director

|

|

Ames Brown

|

|

Director

|

|

Paul A. Carroll

|

|

Director

|

|

Glenn J. Catchpole

|

|

Director

|

|

Bruce D. Hansen

|

|

Director

|

|

Dennis L. Higgs

|

|

Director

|

|

Ron F. Hochstein

|

|

Director

|

|

Mark S. Chalmers

|

|

Chief Operating Officer

|

|

David C. Frydenlund

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

|

W. Paul Goranson

|

|

Executive Vice President, ISR Operations

|

|

Harold R. Roberts

|

|

Executive Vice President, Conventional Operations

|

|

Curtis H. Moore

|

|

Vice President, Marketing and Corporate Development

|

The mailing address for each of the executive officers and directors listed above is:

c/o Energy Fuels Inc.

225 Union

Boulevard, Suite 600

Lakewood, Colorado 80228

|

5.

|

Principal Owners of Voting Securities

|

With respect to each person owning 10 percent or more of the

voting securities of the applicants, list the names and complete mailing addresses, title of class of owned, amount owned and percentage of voting securities owned.

As of July 5, 2016 to the best of the Company’s knowledge no person beneficially owns 10% or more of its voting securities.

2

UNDERWRITERS

Give the name and complete mailing address of (a) each person who, within three

years prior to the date of filing the application, acted as an underwriter of any securities of the obligor which were outstanding on the date of filing the application, and (b) each proposed principal underwriter of the securities proposed to

be offered. As to each person specified in (a), give the title of each class of securities underwritten.

|

(a)

|

The following table sets forth the name and mailing address of each person who, within three years prior to the date of filing this Application, acted as an underwriter of the Company’s securities and the title of

each security underwritten:

|

|

|

|

|

|

Underwriter’s Name and Mailing Address

|

|

Security (or Securities) Underwritten

|

|

|

|

|

Cantor Fitzgerald Canada Corporation

181

University Avenue, Suite 1500

Toronto, Ontario M5H 3M7 Canada

|

|

Common Shares, Warrants

|

|

|

|

|

Haywood Securities Inc.

200 Burrard Street,

Suite 700

Vancouver, British Columbia V6C 3L6 Canada

|

|

Common Shares, Warrants

|

|

|

|

|

Roth Capital Partners, LLC

888 San Clemente

Drive

Newport Beach, California 92660

|

|

Common Shares, Warrants

|

|

|

|

|

Dundee Securities Ltd

1 Adelaide Street East,

Suite 2100

Toronto, Ontario M5C 2V9 Canada

|

|

Common Shares, Warrants

|

|

|

|

|

Raymond James Ltd

925 West Georgia Street,

Suite 2100

Vancouver, British Columbia V6C 3L2

|

|

Common Shares, Warrants

|

|

|

|

|

Rodman & Renshaw, a unit of H.C. Wainwright & Co., LLC

430 Park Avenue, 4

th

Floor

New York, New York 10022

|

|

Common Shares, Warrants

|

|

|

|

|

Cantor Fitzgerald & Co.

499 Park

Avenue

New York, New York 10022

|

|

Common Shares

|

|

(b)

|

No person is acting, or proposed to be acting, as principal underwriter of the New Debentures proposed to be offered pursuant to the Amended Indenture.

|

3

CAPITAL SECURITIES

|

(a)

|

Furnish the following information as to each authorized class of securities of the applicant

.

|

The following table sets forth information with respect to each authorized class of securities of the applicants as of July 5, 2016:

|

|

|

|

|

|

|

Title of Class

|

|

Amount Authorized

|

|

Amount Outstanding

|

|

Common Shares, no par value*

|

|

unlimited

|

|

57,653,872

|

|

Series A Preferred Shares

|

|

unlimited

|

|

Nil

|

|

Floating Rate Convertible Unsecured Subordinated Debentures due 2017

|

|

CDN$22,000,000

|

|

CDN$22,000,000

|

|

*

|

In addition, we have issued and outstanding at July 5, 2016: (a) options outstanding to purchase up to 2,209,593 common shares at exercise prices ranging from $2.12 to $15.61; (b) restricted stock units

redeemable for 1,152,641 common shares; and (c) 4,547,598 warrants outstanding to purchase common shares at exercise prices ranging from $3.20 to $10.23. Options and warrants which were granted and are reported in Canadian dollars are expressed

in U.S. dollars based on the noon exchange rate on July 5, 2016 as quoted by the Bank of Canada which was Cdn$1.00 = $0.7723 US dollar.

|

|

(b)

|

Give a brief outline of the voting rights of each class of voting securities referred in paragraph (a) above

.

|

The holders of the Company’s common shares are entitled to one vote per common share at all meetings of shareholders. The holders of Company’s

Series A Preferred Shares are not entitled to vote at a meeting of shareholders.

INDENTURE SECURITIES

|

8.

|

Analysis of Indenture Provisions

|

The Amended Debentures will be created by the adoption of the Amended

Indenture, which is expected to be entered into between the Company, BNY Trust Company of Canada, as Canadian trustee (the “Canadian Trustee”), and The Bank of New York Mellon, as U.S. trustee (the “U.S. Trustee”), and become

effective on or before August 4, 2016. The following analysis is not a complete description of the Amended Indenture provisions discussed and is qualified in its entirety by reference to the Amended Indenture and Amended Debentures, attached

hereto as Exhibit T3C and incorporated by reference herein. Capitalized terms used below but not defined herein have the meanings assigned to them in the Amended Indenture.

|

(a)

|

Events of Default; Withholding of Notice

|

Each of the following events constitutes an “Event of

Default”:

(i) failure for 10 days to pay interest on the Debentures after such interest is due;

(ii) failure to pay principal or premium, if any, when due on the Debentures whether at maturity, upon redemption, by declaration or

otherwise;

(iii) default in the delivery, when due, of all cash and any Common Shares or other consideration, payable on conversion,

redemption or maturity of the Debentures, which default continues for 15 days;

(iv) default in the observance or performance of any

covenant or condition of the Indenture by the Company and the failure to cure (or obtain a waiver for) such default for a period of 60 days after notice in writing has been given by the Trustees or from holders of not less than 25% in aggregate

principal amount of the Debentures to the Company specifying such default and requiring the Company to rectify such default or obtain a waiver for same;

(v) if a decree or order of a Court having jurisdiction is entered adjudging the Company a bankrupt or insolvent under the

Bankruptcy and

Insolvency Act

(Canada) or any other bankruptcy, insolvency or analogous laws, or issuing sequestration or process of execution against, or against any substantial part of, the property of the Company, or appointing a receiver of, or of any

substantial part of, the property of the Company or ordering the winding-up or liquidation of its affairs, and any such decree or order continues unstayed and in effect for a period of 60 days;

4

(vi) if the Company institutes proceedings to be adjudicated a bankrupt or insolvent, or consents

to the institution of bankruptcy or insolvency proceedings against it under the

Bankruptcy and Insolvency Act

(Canada) or any other bankruptcy, insolvency or analogous laws, or consents to the filing of any such petition or to the appointment

of a receiver of, or of any substantial part of, the property of the Company or makes a general assignment for the benefit of creditors, or admits in writing its inability to pay its debts generally as they become due;

(vii) if a resolution is passed for the winding-up or liquidation of the Company except in the course of carrying out or pursuant to a

transaction in respect of which the conditions of Section 11.1 of the Indenture (“Corporation May Consolidate, Etc., Only on Certain Terms”) are duly observed and performed;

(viii) if, after the date of the Indenture, any proceedings with respect to the Company are taken with respect to a compromise or arrangement,

with respect to creditors of the Company generally, under the applicable legislation of any jurisdiction; or

(ix) any failure by the

Company to comply with the terms of any indebtedness of the Company or its Subsidiaries in an aggregate amount of at least $10,000,000 (or the foreign currency equivalent) where such failure to comply results in an acceleration of such indebtedness

prior to maturity.

then: (x) in each and every such event listed above, the Trustees may, in their discretion, and shall, upon receipt of a request

in writing signed by the holders of not less than 25% in principal amount of the Debentures then outstanding, subject to the provisions of Section 8.3 of the Indenture (“Waiver of Default”), by notice in writing to the Company declare

the principal of and interest and premium, if any, on all Debentures then outstanding and all other monies outstanding thereunder to be due and payable and the same shall thereupon forthwith become immediately due and payable to the Trustees, and on

the occurrence of an Event of Default under clause (v), (vi), (vii) or (viii) above, the principal of and interest and premium, if any, on all Debentures then outstanding thereunder and all other monies outstanding thereunder, shall

automatically without any declaration or other act on the part of the Trustees or any Debentureholder become immediately due and payable to the Trustees and, in either case, upon such amounts becoming due and payable in either (x) or

(y) above, the Company shall forthwith pay to the Trustees for the benefit of the Debentureholders such principal, accrued and unpaid interest and premium, if any, and interest on amounts in default on such Debenture and all other monies

outstanding thereunder, together with subsequent interest at the rate borne by the Debentures on such principal, interest, premium and such other monies from the date of such declaration or event until payment is received by the Trustees, such

subsequent interest to be payable at the times and places and in the manner mentioned in and according to the tenor of the Debentures. Such payment when made shall be deemed to have been made in discharge of the Company’s obligations thereunder

and any monies so received by the Trustees shall be applied in the manner provided in Section 8.6 of the Indenture (“Application of Moneys Held by Trustees”).

For greater certainty, for the purposes of Section 8.1 of the Indenture (“Events of Default”), a series of Debentures shall be in default in

respect of an Event of Default if such Event of Default relates to a default in the payment of principal, premium, if any, or interest on the Debentures of such series in which case references to Debentures in Section 8.1 of the Indenture

(“Events of Default”) refer to Debentures of that particular series.

For purposes of Article 8 of the Indenture (“Default”), where

the Event of Default refers to an Event of Default with respect to a particular series of Debentures as described in Section 8.1 of the Indenture (“Events of Default”), then Article 8 of the Indenture (“Default”) shall apply

mutatis mutandis to the Debentures of such series and references in Article 8 of the Indenture (“Default”) to the Debentures shall mean Debentures of the particular series and references to the Debentureholders shall refer to the

Debentureholders of the particular series, as applicable. If an Event of Default shall occur and be continuing the Trustees shall, within 30 days after it receives written notice of the occurrence of such Event of Default, give notice of such Event

of Default to the Debentureholders in the manner provided in Section 14.2 of the Indenture (“Notice to Debentureholders”), provided that notwithstanding the foregoing, unless the Trustees shall have been requested to do so by the

holders of at least 25% of the principal amount of the Debentures then outstanding, the Trustees shall not be required to give such notice if the Trustees in good faith shall have determined that the withholding of such notice is in the best

interests of the Debentureholders and shall have so advised the Company in writing. Notice to holders under Section 8.2 of the Indenture (“Notice of Events of Default”) will be given in the manner and to the extent provided in

Section 313(c) of the Trust Indenture Act.

|

(b)

|

Authentication and Delivery of the Notes; Use of Proceeds

|

All Debentures shall be signed (either

manually or by electronic signature) by any one authorized director or officer of the Company holding office at the time of signing. An electronic signature upon a Debenture shall for all purposes of the Indenture be deemed to be the signature of

the Person whose signature it purports to be.

5

Notwithstanding that any Person whose signature, either manual or electronic, appears on a Debenture as a

director or officer may no longer hold such office at the date of the Debenture or at the date of the certification and delivery thereof, such Debenture shall be valid and binding upon the Company and entitled to the benefits of the Indenture.

No Debenture shall be issued or, if issued, shall be obligatory or shall entitle the holder to the benefits of the Indenture, until it has been manually

certified by or on behalf of the Trustees substantially in the form set out in the Indenture, in the relevant supplemental indenture, or in some other form approved by the applicable Trustee. Such certification on any Debenture shall be conclusive

evidence that such Debenture is duly issued, is a valid obligation of the Company and the holder is entitled to the benefits thereof.

The Company will

not receive any proceeds as a result of the Consent Solicitation or the deemed exchange of the Debentures for the Amended Debentures.

|

(c)

|

Release and Substitution of Property Subject to the Lien of the Indenture

|

The Amended Debentures are

unsecured obligations of the Company. Accordingly the Indenture does not provide for release or release and substitution of property.

|

(d)

|

Satisfaction and Discharge of the Indenture

|

The Trustees shall at the written request of the Company

release and discharge the Indenture and execute and deliver such instruments as it shall be advised by Counsel are requisite for that purpose and to release the Company from its covenants therein contained (other than pursuant to the provisions

relating to the indemnification of the Trustees), upon proof (delivery to the Trustees of an opinion of Counsel and an Officers’ Certificate stating that all conditions precedent therein provided relating to the discharge of the Indenture have

been complied with) being given to the reasonable satisfaction of the Trustees that the principal of, premium (if any) and interest (including interest on amounts in default, if any), on all the Debentures and all other monies payable or Common

Shares issuable thereunder have been paid, satisfied or delivered that all the Debentures having matured or having been duly called for redemption, payment of the principal of and interest (including interest on amounts in default, if any) on such

Debentures and of all other monies payable thereunder has been duly and effectually provided for in accordance with the provisions hereof.

The Company

shall be deemed to have fully paid, satisfied and discharged all of the outstanding Debentures of any series and the Trustees, at the expense of the Company, shall execute and deliver proper instruments acknowledging the full payment, satisfaction

and discharge of such Debentures, when, with respect to all of the outstanding Debentures or all of the outstanding Debentures of any series, as applicable:

(i) the Company has deposited or caused to be deposited with the Trustees as trust funds or property in trust for the purpose of making

payment on such Debentures, an amount in money or Common Shares, if applicable, sufficient to pay, satisfy and discharge the entire amount of principal of, premium, if any, and interest, if any, to maturity, or any repayment date or Redemption

Dates, or any Change of Control Purchase Date, or upon conversion or otherwise as the case may be, of such Debentures;

(ii) the Company

has deposited or caused to be deposited with the Trustees as trust property in trust for the purpose of making payment on such Debentures:

(A) if the Debentures are issued in Canadian dollars, such amount in Canadian dollars of direct obligations of, or obligations

the principal and interest of which are guaranteed by, the Government of Canada or Common Shares, if applicable; or

(B) if

the Debentures are issued in a currency or currency unit other than Canadian dollars, cash in the currency or currency unit in which the Debentures are payable and/or such amount in such currency or currency unit of direct obligations of, or

obligations the principal and interest of which are guaranteed by, the Government of Canada or the government that issued the currency or currency unit in which the Debentures are payable or Common Shares, if applicable;

as will, together with the income to accrue thereon and reinvestment thereof, be sufficient to pay and discharge the entire amount of principal of, premium,

if any on, and accrued and unpaid interest to maturity or any repayment date, as the case may be, of all such Debentures; or

(iii) all

Debentures authenticated and delivered (other than (A) Debentures which have been destroyed, lost or stolen and which have been replaced or paid as provided in Section 2.11 of the Indenture (“Mutilation, Loss, Theft or

Destruction”) and (B) Debentures for whose payment has been deposited in trust and thereafter repaid to the Company as provided in Section 9.3 of the Indenture (“Repayment of Unclaimed Monies or Common Shares”) have been

delivered to the Trustees for cancellation;

so long as in any such event:

6

(x) the Company has paid, caused to be paid or made provisions to the satisfaction of the

Trustees for the payment of all other sums payable or which may be payable with respect to all of such Debentures (together with all applicable expenses of the Trustees in connection with the payment of such Debentures); and

(y) the Company has delivered to the Trustees an opinion of Counsel and an Officers’ Certificate stating that all conditions precedent

provided in the Indenture relating to the payment, satisfaction and discharge of all such Debentures have been complied with.

Any deposits with the

Trustees referred to in Section 9.5 of the Indenture (“Satisfaction”) shall be irrevocable, subject to Section 9.6 (“Continuance of Rights, Duties and Obligations”), and shall be made under the terms of an escrow and/or

trust agreement in form and substance satisfactory to the Trustees and which provides for the due and punctual payment of the principal of, premium, if any, and interest on the Debentures being satisfied.

Upon the satisfaction of the conditions set forth in Section 9.5 of the Indenture (“Satisfaction”) with respect to all the outstanding

Debentures, or all the outstanding Debentures of any series, as applicable, the terms and conditions of the Debentures, including the terms and conditions with respect thereto set forth in the Indenture (other than those contained in Article 2

(“The Debentures”) and Article 4 (“Redemption and Purchase of Debentures”) and the provisions of Article 1 (“Interpretation”) pertaining thereto ) shall no longer be binding upon or applicable to the Company.

Any funds or obligations deposited with the Trustees pursuant to Section 9.5 of the Indenture (“Satisfaction”) shall be denominated in the

currency or denomination of the Debentures in respect of which such deposit is made.

If the Trustees are unable to apply any money or securities in

accordance with Section 9.5 of the Indenture (“Satisfaction”) by reason of any legal proceeding or any order or judgment of any court or governmental authority enjoining, restraining or otherwise prohibiting such application, the

Company’s obligations under the Indenture and the affected Debentures shall be revived and reinstated as though no money or securities had been deposited pursuant to Section 9.5 of the Indenture (“Satisfaction”) until such time

as the Trustees are permitted to apply all such money or securities in accordance with Section 9.5 of the Indenture (“Satisfaction”), provided that if the Company has made any payment in respect of principal of, premium, if any, or

interest on Debentures or, as applicable, other amounts because of the reinstatement of its obligations, the Company shall be subrogated to the rights of the holders of such Debentures to receive such payment from the money or securities held by the

Trustees.

|

(e)

|

Evidence Required to be Furnished by the Company to the Trustees as to Compliance with the Conditions and Covenants Provided for in the Indenture

|

The Company will deliver to the Trustees within 120 days after the end of each fiscal year a certificate from the principal executive officer, principal

financial officer or principal accounting officer of the Company stating whether or not such officer knows of any default with respect to the Debentures that occurred during such period. If the signer know of any default, the certificate shall

describe the default, its status and what such the Company is taking or proposes to take with respect thereto. The Company also shall comply with Section 314(a)(4) of the Trust Indenture Act. The Company shall deliver to the Trustees such

additional information, documents and other reports as is required by Section 314 of the Trust Indenture Act.

The Company shall notify the Trustees

immediately upon obtaining knowledge of any default or Event of Default hereunder, and in any event within 30 days after the Company becomes aware or should reasonably become aware of the occurrence of a default or Event of Default hereunder, an

Officers’ Certificate setting forth the details of the default, and the action which the Company proposes to take with respect thereto.

Every

certificate or opinion with respect to compliance with a condition or covenant shall include a statement that each individual signing such certificate or opinion has read such covenant or condition and the definitions relating thereto, a brief

statement as to the nature and scope of the examination or investigation upon which the statements or opinions contained in such certificate or opinion are based, a statement that, in the opinion of each such individual, he or she has made such

examination or investigation as is necessary to enable him to express an informed opinion as to whether or not such covenant or condition has been complied with, and a statement as to whether, in the opinion of such individual, such condition or

covenant has been complied with.

Upon any request or application by the Company to the Trustees to take any action under the Indenture, the Company shall

furnish to the Trustees (i) an Officers’ Certificate stating that, in the opinion of the signers, all conditions precedent, if any, provided for in the Indenture relating to the proposed action have been complied with and (ii) an

opinion of Counsel stating that all such conditions precedent have been complied with. Each certificate or opinion with respect to compliance with a condition or covenant provided for in the Indenture must include (a) statement that each person

signing the certificate or opinion has read the covenant or condition and the related definitions, (b) a brief statement as to the nature and scope of the examination or investigation upon which the statement or opinion contained in the

certificate or opinion is based, (c) a statement that, in the opinion of each such person, that person has made such examination or investigation as is necessary to enable the person to express an informed opinion as to whether or not such

covenant or condition has been complied with, and (d) a statement as to whether or not, in the opinion of each such person, such condition or covenant has been complied with.

7

Give the name and complete mailing address of any person, other than the applicants,

who is an obligor upon indentured securities.

None.

Content of Application for Qualification

. This application for qualification comprises:

|

(a)

|

Pages numbered 1 to 9 consecutively.

|

|

(b)

|

The statement of eligibility of the U.S. Trustee under the Amended Indenture to be qualified on Form T-1 (filed herewith as Exhibit 25.1).*

|

|

(c)

|

The following exhibits in addition to those filed as part of the statement of eligibility and qualification of the U.S. Trustee:

|

|

|

|

|

|

List of Exhibits

|

|

|

|

|

|

|

Exhibit T3A.1

|

|

Articles of Continuance (Incorporated by reference to Exhibit 3.1 of the Company’s Form F-4 filed with the United States Securities and Exchange Commission (the “SEC”) on May 8, 2015).

|

|

|

|

|

Exhibit T3A.2

|

|

Articles of Amendment (Incorporated by reference to Exhibit 3.2 of the Company’s Form F-4 filed with the SEC on May 8, 2015).

|

|

|

|

|

Exhibit T3B

|

|

Bylaws of the Company (Incorporated by reference to Exhibit 3.3 of the Company’s Form F-4 filed with the SEC on May 8, 2015).

|

|

|

|

|

Exhibit T3C*

|

|

Form of Amended and Restated Convertible Debenture Indenture between the Company, BNY Trust Company of Canada and The Bank of New York Mellon, including form of Amended Debenture.

|

|

|

|

|

Exhibit T3D

|

|

Not Applicable.

|

|

|

|

|

Exhibit T3E1*

|

|

Management Information Circular, dated July 5, 2016, Form of Appointment of Proxyholder and Form of Consent

|

|

|

|

|

Exhibit T3E2

|

|

Press Release of the Company dated June 17, 2016 (incorporated by reference to Exhibit 99.1 of the Company Current Report on Form 8-K filed with the SEC on June 20, 2016)

|

|

|

|

|

Exhibit T3F*

|

|

A cross reference sheet showing the location in the Indenture of the provisions inserted therein pursuant to Section 310 through 318(a), inclusive, of the Trust Indenture Act.

|

|

|

|

|

Exhibit 25.1*

|

|

Statement of Eligibility of The Bank of New York Mellon, as trustee relating to the form of Amended and Restated Convertible Debenture Indenture, on Form T-1.

|

|

|

|

|

Exhibit 99.1*

|

|

Organization Chart of Subsidiaries

|

*Filed herewith.

8

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939, the applicant, Energy Fuels Inc., a corporation organized and existing under

the laws of Ontario, has duly caused this application to be signed on its behalf by the undersigned, thereunto duly authorized, and its seal to be hereunto affixed and attested, all in the City of Lakewood, and State of Colorado on the 11th day of

July, 2016.

|

|

|

|

|

|

|

|

|

(Seal)

|

|

ENERGY FUELS INC.

|

|

|

|

|

|

|

|

By:

|

|

/s/ Daniel G. Zang

|

|

|

|

Name:

|

|

Daniel G. Zang

|

|

|

|

Title:

|

|

Chief Financial Officer

|

Attest:

|

|

|

|

|

By:

|

|

/s/ David C. Frydenlund

|

|

Name:

|

|

David C. Frydenlund

|

|

Title:

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

9

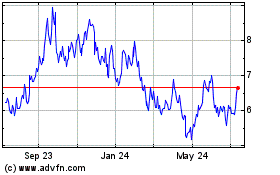

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Aug 2024 to Sep 2024

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Sep 2023 to Sep 2024