4G chipmaker Sequans Communications S.A. (NYSE:SQNS) today

announced financial results for the fourth quarter and full year

ended December 31, 2015.

Fourth Quarter 2015 Highlights:

Revenue: Revenue of $11.0 million increased 18% compared

to the third quarter of 2015, with lower product sales offset by

higher other revenue, including both license and service revenues.

Revenue increased 68% compared to the fourth quarter of 2014 due to

higher sales of products for the LTE markets, as well as higher

other revenue.

Gross margin: Gross margin was 43.4% (51.8% on a non-IFRS

basis) compared to gross margin of 40.8% in the third quarter of

2015, and compared to 6.1% (34.7% on a non-IFRS basis) in the

fourth quarter of 2014, due to a more favorable revenue mix.

Non-IFRS gross margin excludes a provision for writing down the

remaining WiMAX inventory.

Operating loss: Operating loss was $5.1 million compared

to an operating loss of $4.2 million in the third quarter of 2015

and an operating loss of $9.2 million in the fourth quarter of

2014, reflecting higher revenues and higher gross profit offset by

higher operating expenses.

Net loss: Net loss was $9.7 million, or ($0.16) per

diluted share/ADS, compared to a net loss of $2.4 million, or

($0.04) per diluted share/ADS in the third quarter of 2015 and a

net loss of $9.0 million, or ($0.15) per diluted share/ADS in the

fourth quarter of 2014.

Non-IFRS Net loss: Excluding the non-cash items of

stock-based compensation, the provision for WiMAX inventory, the

fair-value and effective interest adjustments related to the

convertible debt and its embedded derivative, and the impact of

revaluation of an interest-free government loan, non-IFRS net loss

was $4.2 million, or ($0.07) per diluted share/ADS, compared to a

non-IFRS net loss of $4.6 million, or ($0.08) per diluted share/ADS

in the third quarter of 2015, and a non-IFRS net loss of $7.0

million, or ($0.12) per diluted share/ADS, in the fourth quarter of

2014.

Cash and cash equivalents: Cash position of $8.7 million

reflects the partial impact from strategic cooperation transactions

finalized during the fourth quarter. At least $7 million in cash is

expected to be received during the first quarter, of which over $5

million was received in January 2016.

In millions of US$ except percentages, shares and per

share amounts

Key Metrics

Q4 2015 %* Q3 2015

%* Q4 2014 %*

Full year 2015 %*

Full year 2014 %* Revenue

$11.0 $9.4 $6.6

$32.7 $22.6 Gross profit

4.8 43.4% 3.8 40.8%

0.4 6.1%

13.3 40.5% 6.8 30.2% Operating loss

(5.1) (46.6%) (4.2) (45.3%) (9.2) (139.2%)

(23.6)

-72.2% (34.1) (150.7%) Net loss

(9.7) (87.6%) (2.4)

(26.0%) (9.0) (137.6%)

(23.6) -72.2% (34.1) (150.7%)

Diluted EPS

($0.16) ($0.04) ($0.15)

($0.46) ($0.58)

Weighted average number of diluted shares/ADS

59,145,393

59,144,741 59,144,741

59,144,905 59,141,716 Cash flow used

in operations

(2.2) (2.4) (5.7)

(16.4) (24.4) Cash,

cash equivalents and short-term deposit at quarter-end

8.7

11.6 12.5

8.7 12.5 Additional information on non-cash

items: - WiMAX inventory provision

0.8

-

1.9

0.8 1.9 - Stock-based compensation included in operating

result

0.2 0.2 0.2

0.9 1.3 - Change in the fair value

of convertible debt embedded derivative

4.2 (2.5)

-

2.0 - - Interest on convertible debt

0.3 0.3 -

0.7 - - Impact of revaluation of interest-free government

loan - (0.1) -

(0.1) - Non-IFRS diluted EPS (excludes

stock-based compensation, inventory provision, fair value and

effective interest adjustments related to the convertible debt and

its embedded derivative, and the impact of revaluation of

interest-free government loan)

($0.07) ($0.08)

($0.12)

($0.39) ($0.52)

*

Percentage of revenue

“We are pleased to report revenue growth of 45% in 2015,

primarily from the home and mobile router business,” said Georges

Karam, Sequans CEO. “In addition to continued growth from this

traditional market, we expect revenue from the M2M/IoT business to

begin ramping in 2016 thanks to our LTE CAT1 leadership and secured

design wins.

“Another major goal for 2016 is to remain at the forefront of

LTE technology by introducing new LTE-M narrowband solutions that

will further expand our available market, enable new product

categories and help fuel revenue growth in the years to come.

During Q4 we finalized three new strategic partnerships, including

Verizon and Socle-Foxconn, with numerous benefits including the

ability to accelerate time-to-market for new products, access to

complementary technology, expanding our sales channels and global

reach, as well as providing financial advantages. We are gratified

that these successful companies have chosen to partner with

Sequans, validating our leadership in single-mode LTE technology,”

added Karam.

2016 Outlook

The following statements are based on management’s current

assumptions and expectations. These statements are forward-looking

and actual results may differ materially. Sequans undertakes no

obligation to update these statements.

Sequans expects revenue for the first quarter of 2016 to be in

the range of $9.5 to $11.5 million, primarily reflecting typical

seasonality, with non-IFRS gross margin above 40%. Based on this

revenue range and expected gross margin, non-IFRS net loss per

diluted share/ADS is expected to be between ($0.08) and ($0.10) for

the first quarter of 2016, based on approximately 59.2 million

weighted average number of diluted shares/ADSs. Non-IFRS EPS

guidance excludes the impact of stock based compensation, the

non-cash fair-value and effective interest adjustments related to

the convertible debt and its embedded derivative, the impact of

revaluation of an interest-free government loan and any other

relevant non-cash or non-recurring expenses.

Meaningful sequential revenue growth is expected beginning in

the second quarter as new devices are launched in addition to the

product already shipping. In addition, discussions with several

potential strategic partners are continuing. When finalized, these

alliances are expected to contribute to company financing and

incremental revenue.

Conference Call and Webcast

Sequans plans to conduct a teleconference and live webcast to

discuss the financial results for the fourth quarter of 2015 today,

February 4, 2016 at 8:00 a.m. EST /14:00 CET. To participate in the

live call, analysts and investors should dial 800-230-1059 (or +1

612-234-9959 if outside the U.S.). A live and archived webcast of

the call will be available from the Investors section of the

Sequans website at www.sequans.com/investors/. A replay of the

conference call will be available until March 4, 2016 by dialing

toll free 800-475-6701 in the U.S., or +1 320-365-3844 from outside

the U.S., using the following access code: 382913.

Forward-Looking Statements

This press release contains projections and other

forward-looking statements regarding future events or our future

financial performance. All statements other than present and

historical facts and conditions contained in this release,

including any statements regarding our future results of operations

and financial positions, business strategy, plans and our

objectives for future operations, are forward-looking statements

(within the meaning of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of

1934, as amended). These statements are only predictions and

reflect our current beliefs and expectations with respect to future

events and are based on assumptions and subject to risk and

uncertainties and subject to change at any time. We operate in a

very competitive and rapidly changing environment. New risks emerge

from time to time. Given these risks and uncertainties, you should

not place undue reliance on these forward-looking statements.

Actual events or results may differ materially from those contained

in the projections or forward-looking statements. Some of the

factors that could cause actual results to differ materially from

the forward-looking statements contained herein include, without

limitation: (i) the contraction or lack of growth of markets in

which we compete and in which our products are sold, including LTE

and WiMAX markets, (ii) unexpected increases in our expenses,

including manufacturing expenses, (iii) our inability to adjust

spending quickly enough to offset any unexpected revenue shortfall,

(iv) delays or cancellations in spending by our customers, (v)

unexpected average selling price reductions, (vi) the significant

fluctuation to which our quarterly revenue and operating results

are subject due to cyclicality in the wireless communications

industry and transitions to new process technologies, (vii) our

inability to anticipate the future market demands and future needs

of our customers, (viii) our inability to achieve new design wins

or for design wins to result in shipments of our products at levels

and in the timeframes we currently expect, and (ix) other factors

detailed in documents we file from time to time with the Securities

and Exchange Commission. Forward-looking statements in this release

are made pursuant to the safe harbor provisions contained in the

Private Securities Litigation Reform Act of 1995.

Use of Non-IFRS/non-GAAP Financial Measures

To supplement our unaudited consolidated financial statements

prepared in accordance with IFRS, we disclose certain non-IFRS, or

non-GAAP, financial measures. These measures exclude non-cash

charges relating to stock-based compensation, the non-cash

financial expense related to the convertible debt and its embedded

derivative issued in April 2015 and the impact of revaluation of an

interest-free government loan. We believe that these measures can

be useful to facilitate comparisons among different companies.

These non-GAAP measures have limitations in that the non-GAAP

measures we use may not be directly comparable to those reported by

other companies. We seek to compensate for this limitation by

providing a reconciliation of the non-GAAP financial measures to

the most directly comparable IFRS measures in the table attached to

this press release.

About Sequans Communications

Sequans Communications S.A. (NYSE:SQNS) is a 4G chipmaker and

leading provider of single-mode LTE chipset solutions to wireless

device manufacturers worldwide. Founded in 2003, Sequans has

developed and delivered six generations of 4G technology and its

chips are certified and shipping in 4G networks, both LTE and

WiMAX, around the world. Today, Sequans offers two LTE product

lines: StreamrichLTE™, optimized for feature-rich mobile computing

and home/portable router devices, and StreamliteLTE™, optimized for

M2M devices and other connected devices for the Internet of Things.

Sequans is based in Paris, France with additional offices in the

United States, United Kingdom, Israel, Hong Kong, Singapore,

Taiwan, South Korea, and China. Visit Sequans online

at www.sequans.com; www.facebook.com/sequans; www.twitter.com/sequans

Condensed financial tables follow

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Three months ended (in thousands of US$, except

share and per share amounts) Dec 31, Sept 30,

Dec 31, 2015

2015 2014 Revenue :

Product revenue $ 6,551 $ 7,887 $ 5,759 Other revenue

4,496 1,471

813

Total revenue

11,047 9,358

6,572 Cost of revenue

Cost of product revenue 5,628 5,153 6,036 Cost of other revenue

621 391

133

Total cost of revenue

6,249 5,544

6,169 Gross profit

4,798

3,814 403

Operating expenses : Research and development 6,892 5,525

6,595 Sales and marketing 1,509 1,406 1,255 General and

administrative 1,540 1,119 1,704

Total operating expenses

9,941

8,050 9,554

Operating loss (5,143 )

(4,236 )

(9,151 ) Financial income (expense): Interest

income (expense), net (541 ) (509 ) (23 ) Other financial expense

(4 ) - - Change in the fair value of convertible debt embedded

derivative (4,249 ) 2,488 - Foreign exchange gain (loss)

234 (91 )

164

Loss before income taxes

(9,703 ) (2,348

) (9,010 ) Income tax

expense (benefit) (23 )

81 34

Loss

$ (9,680 ) $ (2,429 )

(9,044 ) Attributable to : Shareholders of the

parent (9,680 ) (2,429 ) (9,044 ) Minority interests

- -

- Basic loss per share ($0.16 )

($0.04 ) ($0.15 ) Diluted loss

per share ($0.16 ) ($0.04

) ($0.15 ) Weighted average number of shares

used for computing: — Basic 59,145,393 59,144,741 59,144,741 —

Diluted 59,145,393

59,144,741 59,144,741

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

Year ended December 31, (in thousands of US$, except

share and per share amounts) 2015

2014 Revenue : Product revenue $ 24,669

$ 19,836 Other revenue 8,040

2,766

Total revenue

32,709 22,602

Cost of revenue Cost of product revenue 17,970 15,435

Cost of other revenue 1,481

346

Total cost of revenue

19,451 15,781

Gross profit 13,258

6,821 Operating

expenses : Research and development 25,445 28,634 Sales and

marketing 5,985 5,278 General and administrative 5,428 6,969

Total operating

expenses 36,858

40,881 Operating loss

(23,600 )

(34,060 ) Financial income (expense): Interest

income (expense), net (1,516 ) (20 ) Other financial expense (145 )

- Change in the fair value of convertible debt embedded derivative

(2,036 ) - Foreign exchange gain 249

118

Loss before income taxes

(27,048 )

(33,962 ) Income tax expense (benefit) 177 162

Loss (27,225 ) (34,124 )

Attributable to : Shareholders of the parent (27,225 )

(34,124 ) Minority interests -

- Basic loss per share

($0.46 ) ($0.58 ) Diluted loss per share

($0.46 ) ($0.58 )

Weighted average number of shares used for

computing:

— Basic 59,144,905 59,141,716 — Diluted

59,144,905 59,141,716

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION At

December 31, (in thousands of US$)

2015 2014 ASSETS

Non-current assets Property, plant and equipment $ 7,116 $

8,743 Intangible assets 5,255 3,440 Deposits and other receivables

345 320 Available for sale assets 321

597

Total non-current assets

13,037 13,100

Current assets Inventories 4,065 9,199 Trade

receivables 16,674 7,749 Prepaid expenses and other receivables

3,170 2,988 Recoverable value added tax 541 447 Research tax credit

receivable 2,838 3,443 Deposit maturing in less than 90 days 393

160 Cash and cash equivalents 8,288

12,329

Total current assets

35,969 36,315

Total assets $ 49,006 $

49,415 EQUITY AND LIABILITIES Equity

Issued capital, euro 0.02 nominal value, 59,166,741 shares

authorized, issued and outstanding at December 31, 2015 (59,144,741

at December 31, 2014) $ 1,568 $ 1,568 Share premium 165,536 165,507

Other capital reserves 16,864 15,997 Accumulated deficit (184,589 )

(157,363 ) Other components of equity (450 )

(594 )

Total equity (deficit)

(1,071 ) 25,115

Non-current liabilities Government grant advances, loans and

other liabilities 8,615 4,013 Finance lease obligations - 9

Provisions 1,396 1,228 Deferred tax liabilities 10 2 Convertible

debt and accrued interest 8,984

-

Total non-current liabilities

19,005 5,252

Current liabilities Trade payables 9,498 11,231

Interest-bearing receivables financing 6,472 2,133 Convertible debt

embedded derivative 6,091 - Government grant advances 916 603

Finance lease obligations 12 202 Other current liabilities 4,604

4,017 Deferred revenue 3,162 314 Provisions

317 548

Total current

liabilities 31,072

19,048

Total equity and liabilities $

49,006 $ 49,415

SEQUANS COMMUNICATIONS S.A. UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS Year

ended December 31, (in thousands of US$)

2015 2014 Operating

activities Loss before income taxes

$ (27,048

) $ (33,962 ) Non-cash adjustment to

reconcile income before tax to net cash from (used in) operating

activities Depreciation and impairment of property, plant and

equipment 3,408 3,510 Amortization and impairment of intangible

assets 1,867 1,790 Share-based payment expense 867 1,276 Increase

(decrease) in provisions 152 308 Financial expense (income) 1,516

20 Change in the fair value of convertible debt embedded derivative

2,036 - Other financial expenses 145 - Foreign exchange loss (gain)

(340 ) (15 ) Loss (Gain) on disposal of property, plant and

equipment 5 34 Working capital adjustments Decrease (Increase) in

trade receivables and other receivables (9,268 ) (1,619 ) Decrease

(Increase) in inventories 5,134 (2,617 ) Decrease (Increase) in

research tax credit receivable 605 4,563 Increase (Decrease) in

trade payables and other liabilities 2,041 3,424 Increase

(Decrease) in deferred revenue 2,848 (29 ) Increase (Decrease) in

government grant advances (197 ) (816 ) Income tax paid (172 ) (273

)

Net cash flow used in operating activities (16,401

) (24,406 ) Investing activities

Purchase of intangible assets and property, plant and equipment

(5,483 ) (6,242 ) Sale (purchase) of financial assets 345 652 Sale

of short-term investments (233 ) (160 ) Interest received 26 125

Net cash flow used in investments activities (5,345

) (5,625 ) Financing activities

Public equity offering, net of costs - (300 ) Proceeds from issue

of warrants and exercise of stock options/warrants 29 23 Proceeds

from Interest-bearing receivables financing 4,339 2,133 Proceeds

from interest-bearing research project financing - 3,648 Proceeds

from government loans, net of transaction cost 2,134 - Proceeds

from convertible debt, net of transaction cost 11,572 - Repayment

of borrowings and finance lease liabilities (183 ) (244 ) Interest

paid (181 ) (139 )

Net cash flows from financing activities

17,710 5,121 Net increase (decrease) in cash

and cash equivalents (4,036 ) (24,910 ) Net foreign exchange

difference (5 ) (5 ) Cash and cash equivalent at January 1 12,329

37,244

Cash and cash equivalents at end of the period

$ 8,288 $ 12,329

SEQUANS COMMUNICATIONS S.A.

UNAUDITED RECONCILIATION OF NON-IFRS FINANCIAL

RESULTS

Three months ended (in thousands of US$,

except share and per share amounts) Dec 31, Sept

30, Dec 31, 2015

2015 2014 Net IFRS loss as

reported $ (9,680 ) $ (2,429

) $ (9,044 ) Add back WiMAX

inventory provision (1) 760 - 1,875 Stock-based compensation

expense according to IFRS 2 (2) 246 186

217

Change in the fair value of convertible debt embedded derivative

4,249 (2,488 ) - Interest on Convertible debt and loans 267 254 -

Impact of revaluation of interest-free government loan - (121 ) -

Non-IFRS loss adjusted $ (4,158

) $ (4,598 )

$ (6,952 ) IFRS basic loss per

share as reported ($0.16 ) ($0.04 ) ($0.15 ) Add back WiMAX

inventory provision $ 0.01 - $ 0.03 Stock-based compensation

expense according to IFRS 2 $ 0.00 $ 0.00 $ 0.00 Change in the fair

value of convertible debt embedded derivative $ 0.07 ($0.04 ) -

Interest on Convertible debt and loans $ 0.01 $ 0.00 - Impact of

revaluation of interest-free government loan -

($0.00 ) -

Non-IFRS basic loss per share ($0.07 )

($0.08 ) ($0.12 ) IFRS diluted

loss per share ($0.16 ) ($0.04 ) ($0.15 ) Add back WiMAX inventory

provision $ 0.01 - $ 0.03 Stock-based compensation expense

according to IFRS 2 $ 0.00 $ 0.00 $ 0.00 Change in the fair value

of convertible debt embedded derivative $ 0.07 ($0.04 ) - Interest

on Convertible debt and loans $ 0.01 $ 0.00 - Impact of revaluation

of interest-free government loan -

($0.00 ) -

Non-IFRS diluted loss per share ($0.07 )

($0.08 ) ($0.12 )

(1) All included in cost of goods sold in the IFRS loss (2)

Included in the IFRS loss as follows: Cost of product revenue $ 3 $

3 $ 9 Research and development 107 81 110 Sales and marketing 29 29

(18 ) General and administrative 107 73 116

SEQUANS COMMUNICATIONS S.A.

UNAUDITED RECONCILIATION OF NON-IFRS FINANCIAL RESULTS

Year ended

December 31, (in thousands of US$, except share and per

share amounts) 2015 2014 Net IFRS loss as

reported (27,225 ) (34,124 ) Add

back WiMAX inventory provision (1) 760 1,875 Stock-based

compensation expense according to IFRS 2 (2) 867 1,277 Change in

the fair value of convertible debt embedded derivative 2,036 -

Interest on Convertible debt and loans 737 - Impact of revaluation

of interest-free government loan (121 ) -

Non-IFRS loss

adjusted (22,946 )

(30,972 ) IFRS basic loss per

share as reported ($0.46 ) ($0.58 ) Add back WiMAX inventory

provision $ 0.02 $ 0.03 Stock-based compensation expense according

to IFRS 2 $ 0.01 $ 0.03 Change in the fair value of convertible

debt embedded derivative $ 0.03 - Interest on Convertible debt and

loans $ 0.01 - Impact of revaluation of interest-free government

loan ($0.00 ) -

Non-IFRS basic loss per share ($0.39 )

($0.52 ) IFRS diluted loss per share ($0.46 ) ($0.58

) Add back WiMAX inventory provision $ 0.02 $ 0.03 Stock-based

compensation expense according to IFRS 2 $ 0.01 $ 0.03 Change in

the fair value of convertible debt embedded derivative $ 0.03 -

Interest on Convertible debt and loans $ 0.01 - Impact of

revaluation of interest-free government loan

($0.00 ) - Non-IFRS diluted loss per

share ($0.39 ) ($0.52 )

(1) All included in cost of goods sold in the IFRS loss (2)

Included in the IFRS loss as follows: Cost of product revenue

$

17

$

47 Research and development 372 559 Sales and marketing 132 166

General and administrative 346 505

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160204005573/en/

Sequans Communications S.A.Media Relations:Kimberly Tassin,

+1-425-736-0569Kimberly@sequans.comorInvestor Relations:Claudia

Gatlin, +1-212-830-9080Claudia@sequans.com

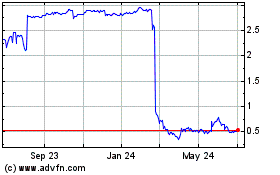

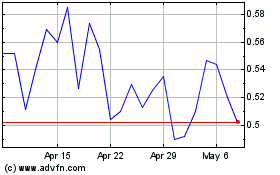

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Sep 2023 to Sep 2024