Deposit Chill Removed From Bergio Common Stock

November 25 2013 - 12:39PM

Marketwired

Deposit Chill Removed From Bergio Common Stock

FAIRFIELD, NJ--(Marketwired - Nov 25, 2013) - Bergio

International, Inc. ("Bergio" or the "Company") (OTCQB: BRGO) -

(http://www.bergio.com/), today announced that The Depository Trust

Company has informed Bergio that it has lifted the "Deposit Chill"

and has resumed accepting deposits of the Company's common stock

for depository and book entry transfer services. All deposit

restrictions have been removed and the Company is now once again

fully "DTC Eligible."

Berge Abajian, Chief Executive Officer of the Company, stated,

"Removing the chill was the Company's top priority. Although it

took slightly longer than anticipated, this is a great step toward

moving Bergio forward. My main focus now is to improve the

stockholder's value. I understand that the share price is selling

significantly below what I feel it should be. I am putting forth

the utmost effort by stopping use of convertible funding and ending

stock dilution as previously stated. But, patience is necessary

until the existing convertible notes are converted."

Mr. Abajian added, "Concerning the negotiations with the large

wholesaler I would like to announce that all negotiations are

ongoing. Due to the hectic holiday season, negotiations have

currently stopped until January 2014. I want all shareholders to be

aware that I have been persistent in finding an agreement which

would benefit both parties involved, but these require further time

to discuss details."

Mr. Abajian concluded, "We are pleased with the collaborative

efforts by our securities counsel, Joseph M. Lucosky and Matthew J.

Walsh of Lucosky Brookman LLP, as well as counsel for DTC and DTC

itself, in working to remove the chill. We are grateful for their

hard work and determination throughout this lengthy process, which

was instrumental in accomplishing the removal of the Deposit

Chill."

About Bergio International, Inc. Bergio International, Inc. is a

leading jeweler creating a diversified jewelry designer and

manufacturer through acquisitions and consolidation in the

estimated $160 billion a year highly fragmented independently owned

jewelry industry. Bergio currently sells its jewelry to

approximately 50 jewelry retailers across the United States. Bergio

has manufacturing control over its line through its manufacturing

facility in New Jersey, as well as subcontracts with facilities in

the United States and Italy.

The information contained herein includes forward-looking

statements. These statements relate to future events or to our

future financial performance, and involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance, or achievements to be materially

different from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking

statements. You should not place undue reliance on forward-looking

statements since they involve known and unknown risks,

uncertainties and other factors which are, in some cases, beyond

our control and which could, and likely will, materially affect

actual results, levels of activity, performance or achievements.

Any forward-looking statement reflects our current views with

respect to future events and is subject to these and other risks,

uncertainties and assumptions relating to our operations, results

of operations, growth strategy and liquidity. We assume no

obligation to publicly update or revise these forward-looking

statements for any reason, or to update the reasons actual results

could differ materially from those anticipated in these

forward-looking statements, even if new information becomes

available in the future.

Contact: Bergio International, Inc. Investor Relations

973-227-3230 Ext13 www.bergio.com

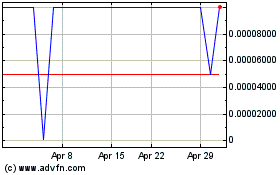

Bergio (PK) (USOTC:BRGO)

Historical Stock Chart

From Aug 2024 to Sep 2024

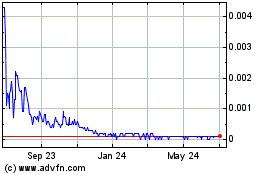

Bergio (PK) (USOTC:BRGO)

Historical Stock Chart

From Sep 2023 to Sep 2024