CEMEX Announces Pricing of U.S. $800 Million in Floating Rate Notes

March 29 2011 - 11:00PM

Business Wire

CEMEX, S.A.B. de C.V. (CEMEX) (NYSE: CX), announced today the

pricing of U.S. $800 million aggregate principal amount of floating

rate senior secured notes (the “Notes”) denominated in U.S.

Dollars.

The Notes will mature on September 30, 2015, will pay interest

quarterly at three-month U.S. Dollar LIBOR plus 500 basis points,

and will be issued at a price of 99.001% of face value. The closing

of the offering is expected to occur on April 5, 2011, subject to

satisfaction of customary closing conditions.

CEMEX intends to use the net proceeds from the offering to

prepay principal outstanding under its Financing Agreement

completed on August 14, 2009, as amended. As a result of this

expected prepayment and, taking into account other prepayments,

CEMEX will have (i) addressed all maturities under the agreement

until December 2013, (ii) repaid approximately 50% of the original

balance outstanding under the agreement, significantly improving

CEMEX’s debt maturity profile, and (iii) repaid approximately 98%

of the total amount required to be repaid by December 31, 2011 to

reach the second milestone under the agreement, which would enable

CEMEX to avoid the remaining 50 basis points increase in the

agreement’s annual interest rate.

The Notes will share in the collateral pledged for the benefit

of the lenders under the Financing Agreement and other secured

obligations having the benefit of such collateral, and will be

guaranteed by CEMEX Mexico, S.A. de C.V., CEMEX España, S.A. and

New Sunward Holding B.V.

The Notes and the guarantees thereof have not been and will

not be registered under the U.S. Securities Act of 1933, as amended

(the "Securities Act"), or any state securities laws, and they may

not be offered or sold in the United States absent registration or

an applicable exemption from the registration requirements of the

Securities Act.

THE NOTES HAVE NOT BEEN AND WILL NOT BE REGISTERED WITH THE

NATIONAL SECURITIES REGISTRY (REGISTRO NACIONAL DE VALORES)

MAINTAINED BY THE MEXICAN NATIONAL BANKING AND SECURITIES

COMMISSION (COMISIÓN NACIONAL BANCARIA Y DE VALORES, OR CNBV), AND

MAY NOT BE OFFERED OR SOLD PUBLICLY, OR OTHERWISE BE THE SUBJECT OF

BROKERAGE ACTIVITIES, IN MEXICO, EXCEPT THAT THE NOTES MAY BE

OFFERED IN MEXICO PURSUANT TO A PRIVATE PLACEMENT EXEMPTION SET

FORTH UNDER ARTICLE 8 OF THE MEXICAN SECURITIES MARKET LAW (LEY DEL

MERCADO DE VALORES), TO MEXICAN INSTITUTIONAL AND QUALIFIED

INVESTORS. UPON THE ISSUANCE OF THE NOTES, WE WILL NOTIFY THE CNBV

OF THE ISSUANCE OF THE NOTES, INCLUDING THE PRINCIPAL

CHARACTERISTICS OF THE NOTES AND THE OFFERING OF THE NOTES OUTSIDE

MEXICO. SUCH NOTICE WILL BE DELIVERED TO THE CNBV TO COMPLY WITH A

LEGAL REQUIREMENT AND FOR INFORMATION PURPOSES ONLY, AND THE

DELIVERY TO AND THE RECEIPT BY THE CNBV OF SUCH NOTICE DOES NOT

CONSTITUTE OR IMPLY ANY CERTIFICATION AS TO THE INVESTMENT QUALITY

OF THE NOTES OR OF OUR SOLVENCY, LIQUIDITY OR CREDIT QUALITY OR THE

ACCURACY OR COMPLETENESS OF THE INFORMATION SET FORTH HEREIN. THE

INFORMATION CONTAINED IN THE DOCUMENTS USED FOR THE OFFERING OF THE

NOTES IS THE EXCLUSIVE RESPONSIBILITY OF CEMEX AND HAS NOT BEEN

REVIEWED OR AUTHORIZED BY THE CNBV.

This press release contains forward-looking statements and

information that are necessarily subject to risks, uncertainties

and assumptions. Many factors could cause the actual results,

performance or achievements of CEMEX to be materially different

from those expressed or implied in this release, including, among

others, changes in general economic, political, governmental and

business conditions globally and in the countries in which CEMEX

does business, changes in interest rates, changes in inflation

rates, changes in exchange rates, the level of construction

generally, changes in cement demand and prices, changes in raw

material and energy prices, changes in business strategy and

various other factors. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

herein. CEMEX assumes no obligation to update or correct the

information contained in this press release.

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Apr 2024 to May 2024

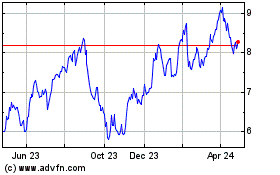

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From May 2023 to May 2024