Company reports $182.3 million in

revenue for the second quarter

Second quarter non-GAAP net income of $8

million, or $0.15 per diluted share; and GAAP net loss

of $23 million, or ($0.55) per diluted share

Company provides update to financial

guidance

Stratasys Ltd. (NASDAQ:SSYS) today announced financial

results for the second quarter of 2015.

Q2-2015 Financial Results Summary:

- Revenue for the second quarter of 2015

was $182.3 million, compared to $178.5 million for the same

period last year;

- GAAP net loss for the second quarter

was $22.9 million, or ($0.55) per diluted share, compared to GAAP

net loss of $173,000, or ($0.00) per diluted share, for the same

period last year.

- Non-GAAP net income for the second

quarter was $8 million, or $0.15 per diluted share, compared

to non-GAAP net income of $28.0 million, or $0.55 per diluted

share, reported for the same period last year.

- The Company invested a net amount

of $22.5 million in R&D projects (non-GAAP basis)

during the second quarter, representing 12% of revenues.

- The Company used $15.6

million in cash for operations during the second quarter, and

currently holds approximately $502.6 million in cash and cash

equivalents, and short term bank deposits. The cash balance

includes a $175 million drawdown on the Company’s revolving credit

facility.

- Non-GAAP EBITDA for the second quarter

amounted to $12.1 million.

- The Company sold 6,731 3D printing and

additive manufacturing systems during the second quarter, and has

sold a total of 135,928 systems worldwide as of June 30, 2015,

on a pro forma combined basis.

“The merger between Stratasys and Objet in 2012 created

synergies that combined with the heightened level of mainstream

media attention within our industry, have contributed to a period

of extraordinary growth for our company and industry over the past

two years,” said David Reis, chief executive officer of Stratasys.

“We believe our industry is transitioning through a period of

slower growth, as users digest their investments in 3D printing and

expand the utilization of recently acquired capacity. Despite these

headwinds, and certain ongoing macroeconomic challenges in Asia, we

are encouraged by sequential improvement in areas of our business,

and remain optimistic about our longer-term growth prospects.”

Business Highlights:

- Strengthened presence in Germany,

Switzerland, and Austria through the acquisition of a key German

channel partner, RTC Rapid Technologies GmbH; and made

additional North American channel enhancements with the addition of

W.D. Distributing, WYNIT, and Sam’s Club.

- Partnered with CAD industry leader PTC,

to provide improved integration between PTC Creo product design

software and Stratasys 3D Printing Solutions.

- Enhanced high-end system capabilities

with release of the Objet1000 Plus 3D Production System, providing

significant speed improvements; as well as introduced a new

high-volume filament packaging solution for Fortus 3D Production

Systems.

- Observed significant expansion within

the dental vertical, including the further adoption of our

Stratasys PolyJet based solutions for the production of custom-made

orthodontic products.

- Announced a multi-year collaboration

with the Kangshua Group that includes providing up to 1,000

Solidscape high precision 3D printers to equip multiple new service

bureaus and innovation centers in China; as well as the opening of

a manufacturing facility, by Kangshua, to locally assemble

Solidscape 3D printers for the Chinese market.

- Reorganized the MakerBot channel in

Europe and Asia to help leverage the existing Stratasys

go-to-market infrastructure within those regions.

- Completed a customer event for

Stratasys Direct Manufacturing (SDM) that reached 239 customers and

introduced the combined SDM organization as a total solution

provider that focuses on applications from prototype to

production.

“We are observing positive indicators and are beginning to see

tangible results that reaffirm our strategy of developing targeted

solutions within key market verticals,” continued Reis.

“Short-term, we will continue to make adjustments to our expenses

to align with current market conditions. Long-term, we remain

committed to our growth initiatives that include enhancing vertical

solution capabilities, expanding customer support services,

accelerating product development, and growing the sales and

marketing infrastructure – all of which are designed to drive

future growth.”

2015 Guidance

Due to the Company’s limited visibility regarding the timing of

improvements in growth, the Company has withdrawn its previously

delivered full year 2015 financial guidance, and instead has

provided financial guidance for the third quarter of 2015 as

follows:

- Total revenue in the range of $175 to

$190 million, with non-GAAP net income in the range of $1.5 to $7.0

million, or $0.03 to $0.13 per diluted share.

- GAAP net loss of $27.0 million to $22.5

million, or ($0.52) to ($0.43) per share.

- Non-GAAP earnings guidance excludes $18

million of projected amortization of intangible assets; $9.5

million to $10.0 million of share-based compensation expense; $7

million to $8 million in non-recurring expenses related to

acquisitions; and includes $6.0 million to $6.5 million in tax

expenses related to non-GAAP adjustments.

Stratasys Ltd. Q2-2015 Conference Call Details

Stratasys will hold a conference call to discuss its second

quarter financial results on July 30, 2015 at 8:30 a.m. (ET).

The investor conference call will be available via live webcast

on the Stratasys Web site at www.stratasys.com under the

"Investors" tab; or directly at the following web address:

http://edge.media-server.com/m/p/izi2aqma.

To participate by telephone, the domestic dial-in number is

800-901-5241 and the international dial-in is 617-786-2963. The

access code is 55067799.

Investors are advised to dial into the call at least ten minutes

prior to the call to register. The webcast will be available for 90

days on the "Investors" page of the Stratasys Web site or by

accessing the provided web address.

Cautionary Statement Regarding Forward-Looking

Statements

Certain statements in this press are "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933, and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements are characterized by the use of forward-looking

terminology such as "will," "expects," "anticipates," "continues,"

"believes," "should," "intended," "projected," “guidance,”

“preliminary,” “future,” “planned,” “committed,” and other similar

words. These forward-looking statements include, but are not

limited to, statements relating to the company's objectives, plans

and strategies, statements of preliminary or projected results of

operations or of financial condition and all statements that

address activities, events or developments that the company

intends, expects, projects, believes or anticipates will or may

occur in the future. Forward-looking statements are not guarantees

of future performance and are subject to risks and uncertainties.

The company has based these forward-looking statements on

assumptions and assessments made by its management in light of

their experience and their perception of historical trends, current

conditions, expected future developments and other factors they

believe to be appropriate. Important factors that could cause

actual results, developments and business decisions to differ

materially from those anticipated in these forward-looking

statements include, among other things: the company's ability to

efficiently and successfully integrate the operations of Stratasys,

Inc. and Objet Ltd. after their merger as well as MakerBot, Solid

Concepts, and Harvest Technologies after their acquisitions and to

successfully put in place and execute an effective post-merger

integration plans; the overall global economic environment; the

impact of competition and new technologies; general market,

political and economic conditions in the countries in which the

company operates; projected capital expenditures and liquidity;

changes in the company's strategy; government regulations and

approvals; changes in customers' budgeting priorities; litigation

and regulatory proceedings; the company's ability to satisfy the

financial covenants under its revolving credit facility; and those

factors referred to under "Risk Factors", "Information on the

Company", "Operating and Financial Review and Prospects", and

generally in the company's annual report on Form 20-F for the year

ended December 31, 2014 filed with the U.S. Securities and Exchange

Commission (the "SEC"), and in other reports that the company has

filed with or furnished to the SEC on the date hereof. Readers are

urged to carefully review and consider the various disclosures made

in the company's SEC reports, which are designed to advise

interested parties of the risks and factors that may affect its

business, financial condition, results of operations and prospects.

Any guidance and other forward-looking statements in this press

release are made as of the date hereof, and the company undertakes

no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

Non-GAAP Discussion Disclosure

The information discussed within this release includes financial

results and projections that are in accordance with accounting

principles generally accepted in the United States of

America (GAAP). In addition, certain non-GAAP financial

measures have been provided excluding certain charges, expenses and

income. The non-GAAP measures should be read in conjunction with

the corresponding GAAP measures and should be considered in

addition to, and not as an alternative or substitute for, the

measures prepared in accordance with GAAP. The non-GAAP financial

measures are included in an effort to provide information that

investors may deem relevant to evaluate results from the company's

core business operations and to compare the company's performance

with prior periods. The non-GAAP financial measures primarily

identify and exclude certain discrete items, such as merger-related

expenses, amortization of intangible assets, one time write off of

deferred tax assets, impairment charges, reorganization and other

related costs, and expenses associated with share-based

compensation required under ASC 718. The company uses these

non-GAAP financial measures for evaluating comparable financial

performance against prior periods.

This release is available on the Stratasys web site

at www.stratasys.com

Stratasys Ltd. (Nasdaq:SSYS), headquartered in Minneapolis,

Minnesota and Rehovot, Israel, is a leading global provider of 3D

printing and additive manufacturing solutions. The company's

patented FDM® and PolyJet™ 3D Printing technologies produce

prototypes and manufactured goods directly from 3D CAD files or

other 3D content. Systems include 3D printers for idea development,

prototyping and direct digital manufacturing. Stratasys

subsidiaries include MakerBot and Solidscape, and the company

operates the digital parts manufacturing service Stratasys Direct

Manufacturing. Stratasys has more than 2,900 employees, holds over

800 granted or pending additive manufacturing patents globally, and

has received more than 30 awards for its technology and leadership.

Online at: http://www.stratasys.com or

http://blog.stratasys.com.

Stratasys Ltd. Consolidated Balance

Sheets (in thousands)

June 30,

December 31, 2015 2014

ASSETS Current assets Cash and cash

equivalents $ 352,268 $ 442,141 Short-term bank deposits 150,370

595 Accounts receivable, net 136,970 150,806 Inventories 137,394

123,385 Net investment in sales-type leases 10,091 8,170 Prepaid

expenses 9,898 7,931 Deferred income taxes 30,567 25,697 Other

current assets 31,420 37,903

Total current assets 858,978 796,628

Non-current assets Goodwill 1,172,125 1,323,502 Other

intangible assets, net 517,085 597,903 Property, plant and

equipment, net 185,992 157,036 Net investment in sales-type leases

- long term 19,093 14,822 Other non-current assets 10,960

9,216 Total non-current assets

1,905,255 2,102,479

Total assets

$ 2,764,233 $ 2,899,107

LIABILITIES AND

EQUITY Current liabilities Accounts payable $

40,687 $ 37,359 Short term debt 175,000 50,000 Accrued expenses and

other current liabilities 50,990 47,760 Accrued compensation and

related benefits 45,230 42,332 Obligations in connection with

acquisitions 12,003 28,092 Deferred revenues 48,821

45,023 Total current liabilities

372,731 250,566

Non-current

liabilities Obligations in connection with acquisitions - long

term 12,761 26,461 Deferred tax liabilities 36,293 55,835 Deferred

revenues - long-term 6,069 5,946 Other non-current liabilities

26,677 25,091 Total non-current

liabilities 81,800 113,333

Total liabilities 454,531 363,899

Redeemable non-controlling interests 2,564

3,969

Equity Ordinary shares, NIS 0.01 nominal value,

authorized 180,000 shares; 51,669 and 50,923 shares issued and

outstanding at June 30, 2015 and December 31, 2014, respectively

140 139 Additional paid-in capital 2,587,168 2,568,149 Accumulated

deficit (273,090 ) (33,871 ) Accumulated other comprehensive loss

(7,429 ) (3,647 ) Equity attributable to Stratasys

Ltd. 2,306,789 2,530,770 Non-controlling interest 349 469

Total equity 2,307,138 2,531,239

Total liabilities and equity $ 2,764,233 $ 2,899,107

Stratasys Ltd. Consolidated

Statements of Operations (in thousands, except per share

data)

Three Months Ended June 30, Six Months Ended June 30,

2015 2014 2015 2014 (unaudited)

(unaudited) (unaudited)

(unaudited) Net sales Products $ 134,490 $ 154,090 $

261,157 $ 283,342 Services 47,832 24,375

93,896 46,064 182,322 178,465

355,053 329,406

Cost of sales Products 67,666 73,394

166,037 134,416 Services 31,748 13,437

60,020 25,628 99,414 86,831 226,057

160,044

Gross profit 82,908

91,634 128,996 169,362

Operating expenses Research

and development, net 25,506 18,957 52,744 35,728 Selling, general

and administrative 97,581 77,929 200,189 145,546 Goodwill

impairment - - 150,400 - Change in the fair value of obligations in

connection with acquisitions (6,680 ) 628

(19,936 ) (6,867 ) 116,407 97,514 383,397 174,407

Operating loss (33,499 ) (5,880

) (254,401 ) (5,045 )

Financial income (expense) (711

) 337 (5,835 ) (999 )

Loss before

income taxes (34,210 ) (5,543 ) (260,236 ) (6,044 )

Income tax benefit (11,066 ) (5,370 ) (20,688

) (9,958 )

Net income (loss) (23,144 ) (173 )

(239,548 ) 3,914 Net loss attributable to non-controlling

interest (213 ) - (329 ) -

Net income (loss) attributable to Stratasys Ltd. $

(22,931 ) $ (173 ) $ (239,219 ) $ 3,914

Net income

(loss) per ordinary share attributable to Stratasys Ltd. Basic

$ (0.48 ) $ (0.00 ) $ (4.71 ) $ 0.08 Diluted (0.55 ) (0.00 ) (4.77

) 0.08

Weighted average ordinary shares outstanding

Basic 51,405 49,373 51,181 49,323 Diluted 51,870 49,373 51,413

51,238

Stratasys Ltd. Reconciliation

of GAAP to Non-GAAP Results of Operations (in thousands,

except per share data)

Three Months Ended

June 30, 2015 Three Months Ended June 30, 2014

GAAP Non-GAAP GAAP Non-GAAP

(unaudited) Adjustments*

(unaudited) (unaudited)

Adjustments* (unaudited) Net

sales Products $ 134,490 $ - $ 134,490 $ 154,090 $ - $ 154,090

Services 47,832 - 47,832

24,375 - 24,375 182,322 -

182,322 178,465 - 178,465

Cost of sales Products

67,666 (15,975 ) 51,691 73,394 (14,739 ) 58,655 Services

31,748 (841 ) 30,907 13,437

(340 ) 13,097 99,414 (16,816 ) 82,598 86,831

(15,079 ) 71,752

Gross

profit 82,908 16,816 99,724 91,634 15,079 106,713

Operating expenses Research and development, net 25,506

(3,016 ) 22,490 18,957 (1,318 ) 17,639 Selling, general and

administrative 97,581 (24,020 ) 73,561 77,929 (17,617 ) 60,312

Change in the fair value of obligations in connection with

acquisitions (6,680 ) 6,680 -

628 (628 ) - 116,407 (20,356 ) 96,051

97,514 (19,563 ) 77,951

Operating income (loss) (33,499 ) 37,172 3,673 (5,880 )

34,642 28,762

Financial income (expense) (711 ) -

(711 ) 337 - 337

Income (loss) before income taxes (34,210 ) 37,172 2,962

(5,543 ) 34,642 29,099 Income taxes (benefit) (11,066

) 6,279 (4,787 ) (5,370 ) 6,475

1,105

Net income (loss) (23,144 )

30,893 7,749 (173 ) 28,167 27,994 Net loss attributable to

non-controlling interest (213 ) - (213

) - - - Net income (loss)

attributable to Stratasys Ltd. $ (22,931 ) $ 30,893 $ 7,962

$ (173 ) $ 28,167 $ 27,994

Net income

(loss) per ordinary share attributable to Stratasys Ltd. Basic

$ (0.48 ) $ 0.15 $ (0.00 ) $ 0.57 Diluted (0.55 ) 0.15 (0.00 ) 0.55

Weighted average ordinary shares outstanding Basic

51,405 51,405 49,373 49,373 Diluted 51,870 52,705 49,373 51,196

The Company considers these non-GAAP

measures to be indicative of its core operating results and

facilitates a comparison of operating results across reporting

periods. The Company uses these non-GAAP measures when evaluating

its financial results as well as for internal planning and

forecasting purposes, however these measures should not be viewed

as a substitute for the Company’s GAAP results.

* Refer to the "Reconciliation of Non-GAAP

Adjustments" herein for further information regarding

adjustments.

Stratasys Ltd. Reconciliation of

GAAP to Non-GAAP Results of Operations (in thousands,

except per share data)

Six Months Ended June

30, 2015 Six Months Ended June 30, 2014

GAAP Adjustments*

Non-GAAP GAAP Adjustments*

Non-GAAP Net sales Products $ 261,157 $

- $ 261,157 $ 283,342 $ 235 $ 283,577 Services 93,896

- 93,896 46,064 -

46,064 355,053 - 355,053 329,406 235 329,641

Cost of sales Products 166,037 (61,887 ) 104,150

134,416 (28,468 ) 105,948 Services 60,020

(2,250 ) 57,770 25,628 (774 )

24,854 226,057 (64,137 ) 161,920 160,044 (29,242 )

130,802

Gross

profit 128,996 64,137 193,133 169,362 29,477 198,839

Operating expenses Research and development, net 52,744

(5,833 ) 46,911 35,728 (2,813 ) 32,915 Selling, general and

administrative 200,189 (56,864 ) 143,325 145,546 (31,140 ) 114,406

Goodwill impairment 150,400 (150,400 ) - - - - Change in the fair

value of obligations in connection with acquisitions (19,936

) 19,936 - (6,867 ) 6,867

- 383,397 (193,161 ) 190,236 174,407 (27,086 )

147,321

Operating

income (loss) (254,401 ) 257,298 2,897 (5,045 ) 56,563 51,518

Financial expense (5,835 ) - (5,835 ) (999 ) - (999 )

Income (loss) before

income taxes (260,236 ) 257,298 (2,938 ) (6,044 ) 56,563 50,519

Income taxes (benefit) (20,688 ) 8,093

(12,595 ) (9,958 ) 11,884 1,926

Net income (loss) (239,548 ) 249,205 9,657

3,914 44,679 48,593 Net loss attributable to non-controlling

interest (329 ) - (329 ) -

- - Net income (loss)

attributable to Stratasys Ltd. $ (239,219 ) $ 249,205 $

9,986 $ 3,914 $ 44,679 $ 48,593

Net income (loss) per ordinary share attributable to Stratasys

Ltd. Basic $ (4.71 ) $ 0.20 $ 0.08 $ 0.99 Diluted (4.77 ) 0.19

0.08 0.95

Weighted average ordinary shares

outstanding Basic 51,181 51,181 49,323 49,323 Diluted 51,413

52,524 51,238 51,221

The Company considers these non-GAAP

measures to be indicative of its core operating results and

facilitates a comparison of operating results across reporting

periods. The Company uses these non-GAAP measures when evaluating

its financial results as well as for internal planning and

forecasting purposes, however these measures should not be viewed

as a substitute for the Company’s GAAP results.

* Refer to the "Reconciliation of Non-GAAP

Adjustments" herein for further information regarding

adjustments.

Stratasys Ltd. Reconciliation of

Non-GAAP Adjustments (in thousands)

Three Months Ended June

30, Six Months Ended June 30, 2015 2014

2015 2014 Net sales, products Deferred revenue

step-up $ - $ - $ - $ 235

Cost of sales, products

Acquired intangible assets amortization (12,301 ) (14,029 ) (27,206

) (27,254 ) Other intangible assets impairment - - (29,782 ) -

Non-cash stock-based compensation expense (1,237 ) (710 ) (2,462 )

(1,214 ) Reorganization and other related costs (2,437 )

- (2,437 ) - (15,975 ) (14,739 )

(61,887 ) (28,468 )

Cost of sales, services Non-cash

stock-based compensation expense (560 ) (324 ) (1,168 ) (732 )

Reorganization and other related costs (75 ) - (75 ) - Merger and

acquisition related expense (206 ) (16 )

(1,007 ) (42 ) (841 ) (340 ) (2,250 ) (774 )

Research and

development, net Non-cash stock-based compensation expense

(1,506 ) (885 ) (3,374 ) (1,823 ) Reorganization and other related

costs (617 ) - (617 ) - Merger and acquisition related expense

(893 ) (433 ) (1,842 ) (990 ) (3,016 )

(1,318 ) (5,833 ) (2,813 )

Selling, general and

administrative Acquired intangible assets amortization (5,684 )

(5,507 ) (12,140 ) (10,871 ) Non-cash stock-based compensation

expense (6,261 ) (5,159 ) (12,320 ) (10,045 ) Merger and

acquisition related expense (5,937 ) (6,951 ) (12,842 ) (10,224 )

Reorganization and other related costs (6,138 ) - (6,139 ) -

Impairment charges - - (13,423 )

- (24,020 ) (17,617 ) (56,864 ) (31,140 )

Goodwill impairment - - (150,400 ) -

Change in the

fair value of obligations in connection with acquisitions

Change in the fair value of obligations in connection with

acquisitions 6,680 (628 ) 19,936 6,867

Income taxes

Tax expense related to non-GAAP adjustments 6,279 6,475 8,093

11,884

Net income $

30,893 $ 28,167 $ 249,205 $ 44,679

Stratasys Ltd. Reconciliation of

GAAP to Non-GAAP Forward Looking Guidance Three

Months Ended September 30, 2015 (in millions, except per

share data)

GAAP net loss ($27) to ($22.5)

Adjustments

Stock-based compensation expense $9.5 to $10 Intangible assets

amortization expense $18 Merger related expense $7 to $8 Tax

expense related to Non-GAAP adjustments ($6) to ($6.5)

Non-GAAP net income $1.5 to $7

GAAP loss per

share ($0.52) to ($0.43)

Non-GAAP diluted earnings

per share $0.03 to $0.13

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150730005332/en/

Stratasys Ltd.Shane Glenn, 952-294-3416VP Investor

Relationsshane.glenn@stratasys.com

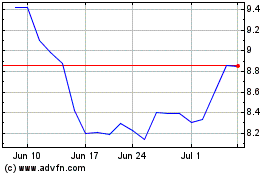

Stratasys (NASDAQ:SSYS)

Historical Stock Chart

From Oct 2024 to Oct 2024

Stratasys (NASDAQ:SSYS)

Historical Stock Chart

From Oct 2023 to Oct 2024