FONAR Corporation (NASDAQ: FONR), The Inventor of MR Scanning™,

reported today its second quarter financial results of fiscal 2013.

In addition to profitability being greater than $1.5 million for

six straight quarters, the Company has had twelve straight quarters

of income from operations. In spite of Hurricane Sandy reaping

havoc in the area that four of its scanning centers are located,

revenues for FONAR's imaging management division advanced when

compared to a year ago or last quarter. FONAR's business is based

upon utilization of its UPRIGHT® Multi-Position™ MRI, also called

the STAND-UP® MRI.

Statement of Operations Items

- Income from operations for the six months and quarter ended

December 31, 2012, was $3.6 million and $1.7 million, respectively,

as compared to $3.7 million and $1.9 million respectively, for the

same period one year earlier.

- Net income for the six months and quarter ended December 31,

2012, was $3.4 million and $1.6 million, respectively, as compared

to $3.6 million and $1.8 million respectively, for the same period

one year earlier.

- The basic net income per common share available to common

stockholders, for the six months and quarter ended December 31,

2012 was $0.44 and $0.21, as compared to $0.50 and $0.25 for the

six months and quarter ended December 31, 2011.

- The diluted net income per common share available to common

stockholders, for the six months and quarter ended December 31,

2012 was $0.43 and $0.21, as compared to $0.49 and $0.24 for the

six months and quarter ended December 31, 2011.

- Total revenue for the six months and quarter ended December 31,

2012, was $19.1 million and $9.6 million, respectively, as compared

to $18.9 million and $9.3 million for the same period one year

earlier.

- Total operating costs and expenses for the six months and

quarter ended December 31, 2012, were $15.5 million and $7.9

million, respectively, as compared to $15.3 million and $7.4

million for the same period one year earlier.

- Revenue from the management and other fees segment, (HMCA

management of the eleven FONAR UPRIGHT® Multi-Position™ MRI

diagnostic imaging centers segment), for the six months and quarter

ended December 31, 2012, was $11.5 million and $5.7 million

respectively, as compared to $9.8 million and $4.9 million for the

same period one year earlier. These are increases of 17% and 17%

respectively.

- Revenue from the manufacturing and service segments for the

FONAR UPRIGHT® Multi-Position™ MRI for the six months and quarter

ended December 31, 2012, was $7.7 million and $3.9 million,

respectively, as compared to $9.2 million and $4.4 million for the

same period one year earlier.

- Research & development (R&D) and selling, general &

administrative costs (S,G&A) were $2.7 million for the quarter

ended December 31, 2012, as compared to $2.3 million for the

quarter ended December 31, 2011.

Balance Sheet Items

- As of December 31, 2012 total current assets were $29.6

million, total assets were $36.8 million, total current liabilities

were $21.4 million, and total long-term liabilities were $1.3

million.

- As of December 31, 2012, total cash and cash equivalents were

$14.8 million.

- As of December 31, 2012, the total stockholders' equity was

$14.1 million.

See the accompanying tables for more details.

Management Discussion

Raymond V. Damadian, M.D., president and chairman of FONAR said,

"I am quite pleased with the Company's consistent progress since we

redefined our corporate business strategy following the 2008

banking crisis. It is remarkable that we have had 1 1/2 years of

net income and income from operations exceeding $1.5 million. Each

quarter over the past three years we have consistently been

profitable having earned income from operations. Our total assets

have grown from $21.6 million at June 30, 2010 to $36.8 million

most recently, shareholders' equity has climbed to over $14 million

and our long-term liabilities are a low of $1.25 million."

"The eleven UPRIGHT® Multi-Position™ MRI centers that we manage

continue to add scan volume," said Dr. Damadian. "In fact, for the

three months ended December 31, 2012, the number of scans was

10,563 as compared to 10,332 scans over the same period one year

earlier. This occurred in spite of the interruption caused by

Hurricane Sandy which did cause several of our scanning centers to

temporarily stop for a short period."

"Much of our success comes from the management team assembled

that manages the imaging center management business. Key to their

success though is the marketing strength of the FONAR STAND-UP® MRI

(a.k.a. UPRIGHT® Multi-Position™ MRI)," said Dr. Damadian. "We have

a considerable number of customer patients that tell us that they

will never go and have a recumbent MRI again. Currently, we are

managing eleven centers, all in New York and Florida."

"FONAR's UPRIGHT® MRI technology has opened a new frontier in

medical imaging," said Dr. Damadian. "It is the power to make MRI

motion pictures (cinés) of the cerebrospinal fluid (CSF) in the

spinal canal as it flows into and out of the brain of the patient

while Upright. These ciné MRIs of CSF flow in and out of the brain

while the patient is Upright, are uniquely sensitive to the

visualization of any impairments of CSF flow. This often leads to a

better understanding of the problems with the cervical anatomy that

might be contributing to the patient's symptoms."

"An example of the severe need of FONAR's unique UPRIGHT®

Multi-Position™ MRI technology is FONAR's recent discovery of the

potential adverse consequences of cervical spine malalignments.

Such cervical spine degenerations or vertebral malalignments can

obstruct the flow of cerebrospinal fluid (CSF), which in turn can

generate increases of intracranial pressure (ICP) and CSF

'leakages' into the surrounding brain parenchyma. It has been

proposed that CSF 'leakages', such as those shown to be joining the

MS lesions in the MRI images of the MS patients studied, could be

etiologic in the generation of multiple sclerosis (Damadian R.V.,

Chu D., 'The Possible Role of Cranio-Cervical Trauma and Abnormal

CSF Hydrodynamics in the Genesis of Multiple Sclerosis', Physiol.

Chem. Phys. & Med. NMR, September 20, 2011, 41:1-17). The

report showed that the cervical anatomic abnormalities seen in

these MS patients and the resulting CSF flow obstructions were

significantly more severe with the patient in the vertical position

(Table 2A, col. 10 & 11, Physiol. Chem. Phys. & Med. NMR,

September 20, 2011 41:1-17) than with the patient in the recumbent

position. Consequently, it is critical that any assessment of CSF

flow impairment in the brain or spinal column must be assessed with

the patient in the vertical position in order to determine the full

extent of the CSF flow impairment, the extent of treatment needed

and, most importantly, to achieve an accurate assessment

post-treatment of the degree to which satisfactory CSF flow has

been successfully restored. Accordingly," said Dr. Damadian, "we

believe there now exists a genuine hope that if an MS patient can

have their vertical position CSF flow and intracranial pressures

(ICP) monitored and restored to normal, then there is also the

prospect that the symptoms of this MS patient can be restored to

normal."

About FONAR

FONAR (NASDAQ: FONR), Melville, NY, The Inventor of MR

Scanning™, is an AMERICAN COMPANY that was incorporated in 1978,

and is the first, oldest and most experienced MRI company in the

industry. FONAR introduced the world's first commercial MRI in

1980, and went public in 1981. Since its inception, nearly 300

recumbent-OPEN MRIs and over 150 UPRIGHT® Multi-Position™ MRI

scanners have been installed worldwide. FONAR's stellar product is

the UPRIGHT® MRI (also known as the STAND-UP® MRI), the only

whole-body MRI that performs Position™ imaging (pMRI™) and scans

patients in numerous weight-bearing positions, i.e. standing,

sitting, in flexion and extension, as well as the conventional

lie-down position. The FONAR UPRIGHT® MRI often sees the patient's

problem that other scanners cannot because they are lie-down only.

The patient-friendly UPRIGHT® MRI has a near-zero claustrophobic

rejection rate by patients. As a FONAR customer states, "If the

patient is claustrophobic in this scanner, they'll be

claustrophobic in my parking lot." Approximately 85% of patients

are scanned sitting while they watch a 42" flat screen TV. FONAR is

headquartered on Long Island, New York.

UPRIGHT® and STAND-UP® are registered trademarks and The

Inventor of MR Scanning™, Full Range of Motion™, Multi-Position™,

Upright Radiology™, The Proof is in the Picture™, True Flow™,

pMRI™, Spondylography™, Dynamic™, Spondylometry™, CSP™, and

Landscape™, are trademarks of FONAR Corporation.

This release may include forward-looking statements from the

company that may or may not materialize. Additional information on

factors that could potentially affect the company's financial

results may be found in the company's filings with the Securities

and Exchange Commission.

CONDENSED CONSOLIDATED BALANCE SHEETS

(000's OMITTED)

ASSETS

December 31, June 30,

2012 2012

Current Assets: (UNAUDITED)

------------- -------------

Cash and cash equivalents $ 14,760 $ 12,032

Accounts receivable - net 4,920 5,095

Accounts receivable - related party 60 -

Management and other fees receivable - net 4,525 3,782

Management and other fees receivable - related

medical practices - net 1,955 1,311

Costs and estimated earnings in excess of

billings on uncompleted contracts 747 1,129

Inventories 2,239 2,195

Current portion of notes receivable - net 118 116

Prepaid expenses and other current assets 251 206

------------- -------------

Total Current Assets 29,575 25,866

------------- -------------

Property and equipment - net 2,927 3,173

Notes receivable 207 276

Other intangible assets - net 3,609 3,835

Other assets 487 465

------------- -------------

Total Assets $ 36,805 $ 33,615

============= =============

CONDENSED CONSOLIDATED BALANCE SHEETS

(000's OMITTED, except per share data)

LIABILITIES AND STOCKHOLDERS' EQUITY

December 31, June 30,

2012 2012

(UNAUDITED)

------------- -------------

Current Liabilities:

Current portion of long-term debt and capital

Leases $ 1,483 $ 1,854

Accounts payable 2,020 2,077

Other current liabilities 8,179 7,693

Unearned revenue on service contracts 5,536 5,475

Unearned revenue on service contracts - related

Party 55 -

Customer advances 4,138 3,881

Income tax payable - 100

------------- -------------

Total Current Liabilities 21,411 21,080

Long-Term Liabilities:

Accounts payable, non current 10 47

Due to related medical practices 229 229

Long-term debt and capital leases, less current

Portion 634 777

Other liabilities 379 401

------------- -------------

Total Long-Term Liabilities 1,252 1,454

------------- -------------

Total Liabilities 22,663 22,534

------------- -------------

CONDENSED CONSOLIDATED BALANCE SHEETS

(000's OMITTED, except per share data)

STOCKHOLDERS' EQUITY

LIABILITIES AND STOCKHOLDERS' EQUITY December 31, June 30,

(continued) 2012 2012

STOCKHOLDERS' EQUITY: (UNAUDITED)

------------- -------------

Class A non-voting preferred stock $.0001 par

value; 453,000 shares authorized at December

31, 2012 and June 30, 2012, 313,438 issued

and outstanding at December 31, 2012 and June

30, 2012 - -

Preferred stock $.001 par value; 567,000

shares authorized at December 31, 2012 and

June 30, 2012, issued and outstanding - none - -

Common Stock $.0001 par value; 8,500,000

shares authorized at December 31, 2012 and

June 30, 2012, 5,942,905 and 5,912,905 issued

at December 31, 2012 and June 30, 2012,

respectively; 5,931,262 and 5,901,262

outstanding at December 31, 2012 and June 30,

2012, respectively 1 1

Class B Common Stock (10 votes per share)

$.0001 par value; 227,000 shares authorized

at December 31, 2012 and June 30, 2012, 158

issued and outstanding at December 31, 2012

and June 30, 2012 - -

Class C Common Stock (25 votes per share)

$.0001 par value; 567,000 shares authorized

at December 31, 2012 and June 30, 2012,

382,513 issued and outstanding at December

31, 2012 and June 30, 2012 - -

Paid-in capital in excess of par value 174,231 174,084

Accumulated other comprehensive loss (20) (20)

Accumulated deficit (165,533) (168,334)

Notes receivable from employee stockholders (59) (71)

Treasury stock, at cost - 11,643 shares of

common stock

at December 31, 2012 and June 30, 2012 (675) (675)

Non controlling interests 6,197 6,096

------------- -------------

Total Stockholders' Equity 14,142 11,081

------------- -------------

Total Liabilities and Stockholders' Equity $ 36,805 $ 33,615

============= =============

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(000's OMITTED, except per share data)

FOR THE THREE

MONTHS ENDED

DECEMBER 31,

REVENUES 2012 2011

----------- -----------

Product sales - net $ 1,080 $ 1,615

Service and repair fees - net 2,765 2,807

Service and repair fees - related parties - net 28 27

Management and other fees - net 3,775 3,308

Management and other fees - related medical

practices - net 1,965 1,571

----------- -----------

Total Revenues - Net 9,613 9,328

----------- -----------

COSTS AND EXPENSES

Costs related to product sales 904 1,171

Costs related to service and repair fees 894 868

Costs related to service and repair fees -

related parties 9 9

Costs related to management and other fees 2,235 1,887

Costs related to management and other fees -

related medical practices 852 901

Research and development 320 293

Selling, general and administrative 2,352 1,995

Provision for bad debts 325 310

----------- -----------

Total Costs and Expenses 7,891 7,434

----------- -----------

Income From Operations 1,722 1,894

Interest Expense (103) (124)

Investment Income 60 64

Other Expense (4) (1)

Income Before Provision for Income Taxes and Non

Controlling Interests 1,675 1,833

Provision for Income Taxes 55 21

----------- -----------

Net Income 1,620 1,812

Net Income - Non Controlling Interests 271 276

----------- -----------

Net Income - Controlling Interests $ 1,349 $ 1,536

=========== ===========

Net Income Available to Common Stockholders $ 1,259 $ 1,432

=========== ===========

Net Income Available to Class A Non-Voting

Preferred Stockholders $ 67 $ 78

=========== ===========

Net Income Available to Class C Common Stockholders$ 23 $ 26

=========== ===========

Basic Net Income Per Common Share Available to

Common Stockholders $ 0.21 $ 0.25

=========== ===========

Diluted Net Income Per Common Share Available to

Common Stockholders $ 0.21 $ 0.24

=========== ===========

Basic and Diluted Income Per Share-Common C $ 0.06 $ 0.07

=========== ===========

Weighted Average Basis Shares Outstanding 5,926,262 5,728,528

=========== ===========

Weighted Average Diluted Shares Outstanding 6,053,766 5,856,032

=========== ===========

Weighted Average Basic Shares Outstanding - Class C

Common 382,513 382,513

=========== ===========

Weighted Average Diluted Shares Outstanding - Class

C Common 382,513 382,513

=========== ===========

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(000's OMITTED, except per share data)

FOR THE SIX

MONTHS ENDED

DECEMBER 31,

REVENUES 2012 2011

----------- -----------

Product sales - net $ 2,121 $ 3,391

Service and repair fees - net 5,474 5,712

Service and repair fees - related parties - net 55 55

Management and other fees - net 7,544 6,637

Management and other fees - related medical

practices - net 3,930 3,141

----------- -----------

Total Revenues - Net 19,124 18,936

----------- -----------

COSTS AND EXPENSES

Costs related to product sales 1,959 2,646

Costs related to service and repair fees 1,760 1,682

Costs related to service and repair fees -

related parties 18 16

Costs related to management and other fees 4,406 4,072

Costs related to management and other fees -

related medical practices 1,669 1,720

Research and development 650 622

Selling, general and administrative 4,564 4,037

Provision for bad debts 500 485

----------- -----------

Total Costs and Expenses 15,526 15,280

----------- -----------

Income From Operations 3,598 3,656

Interest Expense (179) (231)

Investment Income 120 126

Other (Expense) Income (13) 55

Income Before Provision for Income Taxes and Non

Controlling Interests 3,526 3,606

Provision for Income Taxes 127 21

----------- -----------

Net Income 3,399 3,585

Net Income - Non Controlling Interests 598 535

----------- -----------

Net Income - Controlling Interests $ 2,801 $ 3,050

=========== ===========

Net Income Available to Common Stockholders $ 2,616 $ 2,842

=========== ===========

Net Income Available to Class A Non-voting

Preferred Stockholders $ 138 $ 155

=========== ===========

Net Income Available to Class C Common

Stockholders $ 47 $ 53

=========== ===========

Basic Net Income Per Common Share Available to

Common Stockholders $ 0.44 $ 0.50

=========== ===========

Diluted Net Income Per Common Share Available to

Common Stockholders $ 0.43 $ 0.49

=========== ===========

Basic and Diluted Income Per Share-Common C $ 0.12 $ 0.14

=========== ===========

Weighted Average Basic Shares Outstanding 5,913,762 5,698,645

=========== ===========

Weighted Average Diluted Shares Outstanding 6,041,266 5,826,149

=========== ===========

Weighted Average Basic Shares Outstanding - Class

C Common 382,513 382,513

=========== ===========

Weighted Average Diluted Shares Outstanding -

Class C Common 382,513 382,513

=========== ===========

Contact: Daniel Culver Director of Communications E-mail: Email

Contact www.fonar.com

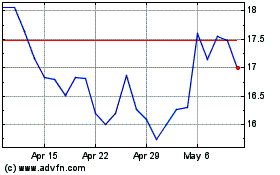

Fonar (NASDAQ:FONR)

Historical Stock Chart

From Apr 2024 to May 2024

Fonar (NASDAQ:FONR)

Historical Stock Chart

From May 2023 to May 2024