Casino Stocks Stumble as Macau Gaming Revenues in May See Slowest Rate of Growth in Almost 3 Years

July 02 2012 - 8:20AM

Marketwired

In recent years major casino companies have looked to Macau for a

large portion of their revenues. The has been growing speculation

that visa restrictions and limits on Chinese credit cards have been

major causes for the recent slowdown in Macau's gaming revenue

growth. The Paragon Report examines investing opportunities in the

Resorts and Casinos Industry and provides equity research on MGM

Resorts International (NYSE: MGM) and Melco Crown Entertainment

Ltd. (NASDAQ: MPEL).

Access to the full company reports can be found at:

www.ParagonReport.com/MGM www.ParagonReport.com/MPEL

"Recent weakness in Macau gaming revenue and visitation growth

could be partially explained by the visa restrictions and reduction

in China UnionPay limits highlighted by the Macau Daily," Cameron

McKnight, Wells Fargo & Co. analyst, said in a recent research

note. "While expectations have recently moderated, we believe

outperformance in the Macau stocks is likely to be limited

here."

Gambling revenue in May saw just a 7.3 percent increase, the

slowest rate in almost 3 years. According to Bloomberg, visitors

from mainland China boosted casino revenues in Macau by 42 percent

in 2011. Last year roughly 16 million people visited Macau from

mainland China.

Paragon Report releases regular market updates on the Resorts

& Casinos Industry so investors can stay ahead of the crowd and

make the best investment decisions to maximize their returns. Take

a few minutes to register with us free at www.ParagonReport.com and

get exclusive access to our numerous stock reports and industry

newsletters.

MGM Resorts International holds a 51 percent interest in MGM

China Holdings, Limited, which owns the MGM Macau resort and

casino. MGM China earned net revenue of $702 million, an 18 percent

increase over the prior year quarter, and an operating income of

$68 million.

Melco Crown Entertainment is an owner and developer of casino

gaming and entertainment resort facilities that are focused on the

rapidly expanding gaming market found in Macau. Net revenue for the

first quarter of 2012 was $1,026.9 million, representing an

increase of approximately 27 percent from $806.6 million for the

comparable period in 2011.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at:

http://www.ParagonReport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

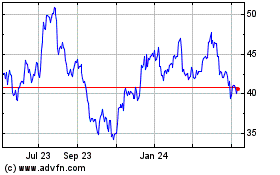

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Apr 2024 to May 2024

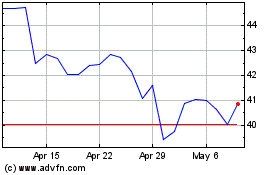

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From May 2023 to May 2024