The Charles Schwab Corporation announced today that its net

income was $195 million for the first quarter of 2012, up 20%

from $163 million for the fourth quarter of 2011, and down 20% from

$243 million for the year-earlier quarter.

Three Months Ended

--March 31,--

%

Financial Highlights

2012

2011

Change

Net revenues (in millions) $ 1,189 $ 1,207 (1

)% Net income (in millions) $ 195 $ 243 (20 )% Diluted earnings per

share $ .15 $ .20 (25 )% Pre-tax profit margin 26.3 % 32.6 % Return

on stockholders’ equity (annualized) 10 % 15 %

President and CEO Walt Bettinger said, “The power of our

‘through clients’ eyes’ strategy helped us deliver strong results

in the first quarter. Our client metrics included

$26.9 billion in core net new assets, the highest since the

first quarter of 2008. Clients also opened 240,000 new

brokerage accounts during the quarter, and net new enrollments in

our retail advisory offerings totaled $2.7 billion, bringing

overall advised balances to $118.4 billion at month-end March,

up 7% from a year ago. We finished the quarter serving a record

$1.83 trillion in total client assets, 8.6 million active

brokerage accounts, 801,000 banking accounts, and 1.52 million

corporate retirement plan participants.”

“Both interest rates and equity market valuations picked up

during the first quarter before declining thus far in April,” Mr.

Bettinger noted. “The improved first quarter environment and our

ongoing success in building stronger client relationships helped

revenues grow 7% sequentially, with increases in all three major

categories. Our ongoing expense discipline limited sequential

growth in costs to 2%, and our pre-tax profit margin improved by

nearly 4 percentage points from the fourth quarter of 2011 to

26.3%.”

Mr. Bettinger concluded, “Our momentum in expanding Schwab’s

client service capabilities continues unabated. We are leveraging

last year’s accelerated spending with a reduced but still

significant project budget this year to drive a number of

initiatives to completion and into clients’ hands. Already in 2012,

we’ve launched Schwab Index Advantage™, our unique index-based

401(k) offering; bolstered our mortgage lending program with

Quicken Loans as our new service provider; and added three new

platforms to our integrated technology initiative for independent

advisors. These are a few of the latest steps in Schwab’s

continuing tradition of finding a better way to serve investors – a

tradition that helps our full-service, high-value brokerage model

resonate with clients and supports individual investor loyalty

scores that are the highest we’ve ever recorded.”

CFO Joe Martinetto said, “Easing environmental headwinds

immediately allow the ongoing growth in our client base to be

reflected in the company’s financial performance. First quarter

2012 asset management and administration fees, net interest revenue

and trading revenue were 6, 10 and 4% higher, respectively, than

the preceding period. Reflecting the company’s operating leverage

and earnings power, net income rose by 20%. Overall, revenues were

right where we expected them to be given the environment, and our

expenses are on track with our 2012 plan. By carefully balancing

our spending against environmental conditions, we are poised to

deliver both expanded client service capabilities and improving

revenues and earnings throughout 2012 if interest rates at least

stabilize.”

“During the first quarter we took the opportunity to bolster our

capital flexibility through a cost-effective, non-dilutive

preferred stock offering,” Mr. Martinetto noted. “We are positioned

to support potentially strong balance sheet growth in 2012 as our

client initiatives drive ongoing business momentum and we strive to

optimize net interest revenue in a volatile environment.”

____________________________

Core net new assets exclude significant one-time flows, such as

acquisitions or extraordinary mutual fund clearing transfers

Business highlights for the first

quarter (data as of quarter-end unless otherwise

noted):

Investor Services

- Net new accounts for the quarter

totaled approximately 44,000, up 19% year-over-year. Total accounts

reached 6.1 million as of March 31, 2011, up 9%

year-over-year.

- Opened a second independent branch,

part of the company’s franchising initiative designed to make

financial advice and guidance more accessible in local communities

across the country.

- Launched the newly expanded Learning

Center on schwab.com, making it easier and more intuitive for

clients to find the education resources they need.

Institutional Services

Advisor Services

- Launched three technology platforms as

part of the Schwab Intelligent Integration™ initiative – Schwab

Openview Integrated Office™, a turnkey solution, and two versions

of Schwab Openview Gateway™, which take a flexible,

open-architecture approach – to enable data integration between

Schwab systems and those of third-party technology providers.

- Announced support for The Depository

Trust & Clearing Corporation’s Alternative Investment Products

service. This service is expected to improve industry

standardization for the custody and trading of alternative

investments.

Other Institutional Services

- Launched Schwab Index Advantage, a

unique 401(k) plan offer designed to lower costs, simplify

investing and help workers better prepare for retirement.

Products and Infrastructure

- For Charles Schwab Bank:

- Balance sheet assets =

$67.8 billion, up 22% year-over-year.

- Outstanding mortgage and home equity

loans = $9.0 billion, up 5% year-over-year.

- Launched a nationwide first-mortgage

lending offer with new partner Quicken Loans. First mortgage

originations by Quicken Loans and Schwab during the quarter =

$748 million.

- Delinquency, nonaccrual, and loss

reserve ratios for Schwab Bank’s loan portfolio = 0.76%, 0.48% and

0.51%, respectively, at month-end March.

- Schwab Bank High Yield Investor

Checking® accounts = 612,000, with $11.1 billion in

balances.

- Client assets managed by Windhaven™

totaled $10.3 billion; up 20% from year-end 2011.

- Total assets under management in Schwab

ETFs™ = $6.6 billion. Total assets in Schwab Managed

Portfolios-ETFs = $2.6 billion.

Supporting schedules are either attached or located at:

www.aboutschwab.com/investor_relations/financial_reports/

Forward Looking Statements

This press release contains forward looking statements relating

to the ongoing growth of the company’s client base; the impact of

the easing of environmental headwinds on the company’s financial

performance; the company’s delivery of expanded client service

capabilities and improving revenues and earnings; strong balance

sheet growth; and net interest revenue. Achievement of these

expectations is subject to risks and uncertainties that could cause

actual results to differ materially from the expressed

expectations. Important factors that may cause such differences

include, but are not limited to, the company’s ability to attract

and retain clients and grow client assets/relationships;

competitive pressures on rates and fees; general market conditions,

including the level of interest rates, equity valuations and

trading activity; the level of client assets, including cash

balances; the company’s ability to develop and launch new products,

services and capabilities in a timely and successful manner;

capital needs; level of expenses; the impact of changes in market

conditions on money market fund fee waivers, revenues, expenses and

pre-tax margins; the effect of adverse developments in litigation

or regulatory matters and the extent of any charges associated with

legal matters; any adverse impact of financial reform legislation

and related regulations; and other factors set forth in the

company’s Form 10-K for the period ended December 31,

2011.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading

provider of financial services, with more than 300 offices and

8.6 million active brokerage accounts, 1.52 million

corporate retirement plan participants, 801,000 banking

accounts, and $1.83 trillion in client assets. Through its

operating subsidiaries, the company provides a full range of

securities brokerage, banking, money management and financial

advisory services to individual investors and independent

investment advisors. Its broker-dealer subsidiary, Charles Schwab

& Co., Inc. (member SIPC, www.sipc.org), and affiliates offer a

complete range of investment services and products including an

extensive selection of mutual funds; financial planning and

investment advice; retirement plan and equity compensation plan

services; referrals to independent fee-based investment advisors;

and custodial, operational and trading support for independent,

fee-based investment advisors through Schwab Advisor Services. Its

banking subsidiary, Charles Schwab Bank (member FDIC and an Equal

Housing Lender), provides banking and mortgage services and

products. More information is available at www.schwab.com and

www.aboutschwab.com.

THE CHARLES SCHWAB CORPORATION

Consolidated Statements of

Income (In millions, except per share amounts) (Unaudited)

Three Months Ended March 31,

2012 2011

Net Revenues

Asset management and administration fees $ 484 $ 502 Interest

revenue 472 481 Interest expense (38 ) (45 ) Net

interest revenue 434 436 Trading revenue 243 241 Other 46 39

Provision for loan losses - (4 ) Net impairment losses on

securities (1) (18 )

(7 ) Total net revenues 1,189

1,207

Expenses Excluding

Interest Compensation and benefits 465 437 Professional

services 96 92 Occupancy and equipment 76 71 Advertising and market

development 67 60 Communications 58 56 Depreciation and

amortization 48 35 Other 66

62 Total expenses excluding interest

876 813

Income before taxes on income 313 394 Taxes on income

(118 ) (151 )

Net

Income $ 195 $ 243

Weighted-Average Common Shares Outstanding — Diluted

1,273 1,207

Earnings Per Share — Basic $ .15 $ .20

Earnings

Per Share — Diluted $ .15

$ .20 (1) Net impairment losses on securities

include total other-than-temporary impairment losses of $2 million

and $0 million, net of $(16) million and $(7) million recognized in

other comprehensive income, for the three months ended March 31,

2012 and 2011, respectively. See Notes to Consolidated

Statements of Income, Financial and Operating Highlights, and Net

Interest Revenue Information. THE CHARLES SCHWAB CORPORATION

Financial and Operating Highlights (Unaudited)

Q1-12 %

change

2012 2011 vs. vs. First Fourth Third Second First (In

millions, except per share amounts and as noted) Q1-11 Q4-11

Quarter Quarter Quarter Quarter Quarter

Net Revenues Asset management and administration fees (4 %)

6 % $ 484 $ 458 $ 466 $ 502 $ 502 Net interest revenue - 10 % 434

395 443 451 436 Trading revenue 1 % 4 % 243 233 248 205 241 Other

18 % 12 % 46 41 45 35 39 Provision for loan losses (100 %) (100 %)

- (5 ) (8 ) (1 ) (4 ) Net impairment losses on securities 157 % 100

% (18 ) (9 ) (13 )

(2 ) (7 ) Total net revenues (1 %) 7 % 1,189

1,113 1,181

1,190 1,207

Expenses

Excluding Interest Compensation and benefits 6 % 5 % 465 442

423 430 437 Professional services 4 % (3 %) 96 99 104 92 92

Occupancy and equipment 7 % (4 %) 76 79 78 73 71 Advertising and

market development 12 % (3 %) 67 69 48 51 60 Communications 4 % 7 %

58 54 56 54 56 Depreciation and amortization 37 % - 48 48 39 33 35

Class action litigation and regulatory reserve - - - - - 7 - Other

6 % (6 %) 66 70 73

64 62 Total

expenses excluding interest 8 % 2 % 876

861 821 804

813 Income before taxes on income (21 %) 24 % 313 252

360 386 394 Taxes on income (22 %) 33 % (118 )

(89 ) (140 ) (148 ) (151

)

Net Income (20 %) 20 % $ 195 $ 163

$ 220 $ 238 $ 243 Basic

earnings per share (25 %) 15 % $ .15 $ .13 $ .18 $ .20 $ .20

Diluted earnings per share (25 %) 15 % $ .15 $ .13 $ .18 $ .20 $

.20 Dividends declared per common share $ .06 $ .06 $ .06 $ .06 $

.06 Weighted-average common shares outstanding - diluted 5 % -

1,273 1,271 1,229

1,210 1,207

Performance Measures Pre-tax profit margin 26.3 % 22.6 %

30.5 % 32.4 % 32.6 % Return on stockholders’ equity (annualized)

10 % 8 % 12 % 14 %

15 %

Financial Condition (at quarter end, in

billions) Cash and investments segregated 16 % 3 % $ 26.9 $ 26.0 $

27.0 $ 23.8 $ 23.1 Receivables from brokerage clients (1 %) 1 % $

11.2 $ 11.1 $ 11.1 $ 11.6 $ 11.3 Loans to banking clients 8 % - $

9.8 $ 9.8 $ 9.7 $ 9.5 $ 9.1 Total assets (1) 17 % 3 % $ 111.5 $

108.6 $ 102.9 $ 97.6 $ 94.9 Deposits from banking clients 21 % 2 %

$ 62.3 $ 60.9 $ 54.1 $ 52.3 $ 51.3 Payables to brokerage clients 13

% 3 % $ 36.4 $ 35.5 $ 36.6 $ 33.9 $ 32.1 Long-term debt - - $ 2.0 $

2.0 $ 2.0 $ 2.0 $ 2.0 Stockholders' equity (2) 28 % 8 % $ 8.3

$ 7.7 $ 7.7 $ 6.7

$ 6.5

Other Full-time equivalent employees (at

quarter end, in thousands) 7 % (1 %) 14.0 14.1 13.9 13.2 13.1

Annualized net revenues per average

full-time equivalent employee (in thousands)

(8 %) 8 % $ 340 $ 316 $ 350 $ 361 $ 371

Capital expenditures - cash purchases of

equipment, office facilities, and property, net (in millions)

(8 %) (38 %) $ 34 $ 55 $ 54

$ 44 $ 37

Clients’ Daily Average

Trades (in thousands) Revenue trades (3) - 4 % 318.4 307.4

323.1 264.9 319.9 Asset-based trades (4) 10 % 17 % 53.7 45.9 50.6

43.6 48.8 Other trades (5) - (2 %) 104.1

106.3 101.7 88.6

103.8 Total 1 % 4 % 476.2

459.6 475.4

397.1 472.5

Average Revenue Per

Revenue Trade (3) 2 % 1 % $ 12.35 $ 12.21

$ 12.04 $ 12.23 $ 12.12

(1)

Total assets as of March 31, 2012,

December 31, 2011, and September 30, 2011, reflect preliminary

purchase accounting for the assignment of fair values to

optionsXpress Holdings, Inc.'s assets and liabilities acquired.

Amounts are subject to refinement as information relative to the

closing date fair values becomes available.

(2)

In the first quarter of 2012, the Company

issued and sold 400,000 shares of fixed-to-floating rate

non-cumulative perpetual preferred stock, Series A, $0.01 par

value, with a liquidation preference of $1,000 per share for a

total of $400 million.

(3) Includes all client trades that generate either commission

revenue or revenue from principal markups (i.e., fixed income);

also known as DART. (4) Includes eligible trades executed by

clients who participate in one or more of the Company's asset-based

pricing relationships. (5) Includes all commission free trades,

including Schwab Mutual Fund OneSource® funds and ETFs, and other

proprietary products. See Notes to Consolidated Statements

of Income, Financial and Operating Highlights, and Net Interest

Revenue Information. THE CHARLES SCHWAB CORPORATION

Net

Interest Revenue Information (In millions) (Unaudited)

Three Months Ended March 31, 2012

2011 Average

Balance

Interest

Revenue/

Expense

Average

Yield/

Rate

Average

Balance

Interest

Revenue/

Expense

Average

Yield/

Rate

Interest-earning assets: Cash

and cash equivalents $ 6,246 $ 4 0.26 % $ 4,955 $ 3 0.25 % Cash and

investments segregated 26,847 10 0.15 % 23,191 14 0.24 %

Broker-related receivables (1) 315 - 0.09 % 373 - 0.16 %

Receivables from brokerage clients 10,200 106 4.18 % 10,335 117

4.59 % Securities available for sale (2) 36,197 145 1.61 % 25,016

106 1.72 % Securities held to maturity 14,972 99 2.66 % 17,138 140

3.31 % Loans to banking clients 9,864 79 3.22 % 9,009 75 3.38 %

Loans held for sale 53 1

4.15 % 113 1

3.59 % Total interest-earning assets

104,694 444 1.71 %

90,130 456 2.05 % Other interest

revenue 28

25 Total

interest-earning assets $ 104,694 $ 472

1.81 % $ 90,130 $ 481

2.16 %

Funding sources: Deposits from banking clients $

61,105 $ 10 0.07 % $ 50,329 $ 17 0.14 % Payables to brokerage

clients 30,560 1 0.01 % 27,055 1 0.01 % Long-term debt

2,001 27 5.43 %

2,005 27 5.46 % Total

interest-bearing liabilities 93,666

38 0.16 % 79,389

45 0.23 % Non-interest-bearing funding sources

11,028

10,741

Total funding sources $ 104,694 $ 38

0.14 % $ 90,130 $ 45 0.20

%

Net interest revenue $

434 1.67 %

$ 436 1.96 % (1)

Interest revenue was less than $500,000 in the period or

periods presented. (2) Amounts have been calculated based on

amortized cost. See Notes to Consolidated Statements of

Income, Financial and Operating Highlights, and Net Interest

Revenue Information.

Notes to Consolidated

Statements of Income, Financial and Operating Highlights,

and Net Interest Revenue

Information

(Unaudited)

The Company The consolidated statements

of income, financial and operating highlights, and net interest

revenue information include The Charles Schwab Corporation (CSC)

and its majority-owned subsidiaries (collectively referred to as

the Company), including Charles Schwab & Co., Inc. and Charles

Schwab Bank. Certain prior year amounts have been reclassified to

conform to the 2012 presentation. The consolidated statements of

income, financial and operating highlights, and net interest

revenue information should be read in conjunction with the

consolidated financial statements and notes thereto included in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2011. ********** THE CHARLES SCHWAB CORPORATION

Asset

Management and Administration Fees Information (In millions)

(Unaudited) Three Months Ended March 31, 2012

2011 Average

Client

Assets

Revenue

Average

Fee

Average

Client

Assets

Revenue

Average

Fee

Schwab money market funds before

fee waivers $ 156,614 $ 222 0.57 % $ 152,402 $ 211 0.56 % Fee

waivers (163 )

(112 ) Schwab money market funds

156,614 59 0.15 % 152,402 99 0.26 % Equity and bond funds (1)

45,630 32 0.28 % 41,207 29 0.29 % Mutual Fund OneSource ®

215,350 166 0.31 %

215,967 172 0.32 % Total mutual funds

(2) $ 417,594 257 0.25 % $

409,576 300 0.30 % Advice solutions (2)

$ 115,496 139 0.48 % $ 109,093 129 0.48 % Other (3)

88 73

Total asset management and administration

fees $ 484

$ 502 (1)

Includes Schwab ETFs. (2)

Advice solutions include separately

managed accounts, customized personal advice for tailored

portfolios, and specialized planning and full-time portfolio

management offered through the Company's Schwab Private Client,

Schwab Managed Portfolio and Managed Account Select programs.

Advice solutions also includes Schwab Advisor Network, Schwab

Advisor Source, and Windhaven. Average client assets for advice

solutions may also include the asset balances contained in the

three categories of mutual funds listed above.

(3) Includes various asset based fees, such as trust fees, 401k

record keeping fees, and mutual fund clearing and other service

fees. THE

CHARLES SCHWAB CORPORATION

Growth in Client Assets and

Accounts (Unaudited)

Q1-12 %

Change

2012 2011 vs. vs. First Fourth Third Second First (In billions, at

quarter end, except as noted) Q1-11 Q4-11 Quarter

Quarter Quarter Quarter Quarter

Assets in

client accounts

Schwab One®, other cash equivalents and

deposits from banking clients

18 % 2 % $ 98.8 $ 96.4 $ 90.9 $ 86.5 $ 83.7 Proprietary funds

(Schwab Funds® and Laudus Funds®): Money market funds 1 % (3 %)

154.4 159.8 155.5 152.0 152.2 Equity and bond funds (6 %) 20 %

45.8 38.2 34.3

49.6 48.9 Total

proprietary funds - 1 % 200.2 198.0

189.8 201.6

201.1 Mutual Fund Marketplace® (1) Mutual Fund

OneSource® - 11 % 219.5 198.6 187.9 220.8 219.7 Mutual fund

clearing services 197 % 22 % 127.0 104.2 98.6 43.7 42.8 Other

third-party mutual funds 9 % 9 % 334.1

305.9 290.4 314.2

307.7 Total Mutual Fund Marketplace 19 % 12 %

680.6 608.7 576.9

578.7 570.2 Total

mutual fund assets 14 % 9 % 880.8 806.7

766.7 780.3

771.3 Equity and other securities (1) 9 % 13 % 685.0

607.9 552.9 624.5 631.0 Fixed income securities 5 % 1 % 179.4 176.9

176.4 175.1 171.5 Margin loans outstanding (1 %) 3 % (10.5 )

(10.2 ) (10.5 ) (10.9 )

(10.6 )

Total client assets 11 % 9 %

$

1,833.5 $ 1,677.7

$ 1,576.4 $ 1,655.5

$ 1,646.9 Client

assets by business Investor Services 5 % 8 % $ 753.3 $ 697.9 $

655.4 $ 711.6 $ 714.8 Advisor Services 7 % 8 % 735.9 679.0 640.1

697.8 688.6 Other Institutional Services 41 % 14 % 344.3

300.8 280.9

246.1 243.5

Total client

assets by business 11 % 9 %

$ 1,833.5

$ 1,677.7 $

1,576.4 $ 1,655.5

$ 1,646.9 Net growth in assets in

client accounts (for the quarter ended)

Net new assets

Investor Services (2) 4 % 11 % $ 5.9 $ 5.3 $ 11.6 $ 2.0 $ 5.7

Advisor Services (11 %) 37 % 12.6 9.2 10.6 10.6 14.2 Other

Institutional Services (3) N/M 191 % 20.4

7.0 63.8 2.8

3.1

Total net new assets 69 % 81

%

38.9 21.5

86.0 15.4

23.0 Net market gains (losses) 137 % 46 %

116.9 79.8 (165.1

) (6.8 ) 49.4

Net growth

(decline) 115 % 54 %

$ 155.8

$ 101.3 $ (79.1 )

$ 8.6 $ 72.4

New brokerage accounts (in thousands, for the

quarter ended) (4) 7 % 18 %

240 203 506

205 224 Clients (in thousands) Active

Brokerage Accounts 7 % 1 %

8,639 8,552 8,510

8,140 8,072 Banking Accounts 11 % 3 %

801

780 769 745 719 Corporate Retirement

Plan Participants 5 % 2 %

1,516

1,492 1,462

1,439 1,444

(1) Excludes all proprietary money

market, equity, and bond funds. (2) Includes inflows of $7.5

billion in Investor Services from the acquisition of optionsXpress

Holdings, Inc. in the third quarter of 2011. (3)

Includes inflows of $12.0 billion and

$60.9 billion from mutual fund clearing services clients in the

first quarter of 2012 and third quarter of 2011, respectively.

Includes outflows of $2.1 billion from a mutual fund clearing

services client in the first quarter of 2011.

(4) Includes 315,000 new brokerage accounts from the acquisition of

optionsXpress Holdings, Inc. in the third quarter of 2011. N/M Not

meaningful

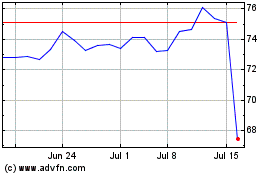

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From May 2024 to Jun 2024

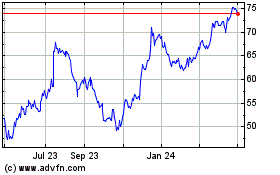

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Jun 2023 to Jun 2024