Interim Results

November 21 2001 - 2:00AM

UK Regulatory

RNS Number:4565N

Ten Alps Communications PLC

21 November 2001

TEN ALPS COMMUNICATIONS PLC ("TEN ALPS")

INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2001

Financial Highlights

Results for six months ended 30 September 2001, during which time (July 27)

the company underwent a reverse takeover and name change from Osprey

Communications to Ten Alps.

* Operating profit of #74,000 up from a corresponding loss of (#647,000)

in the same period last year.

* Net Profit was #71,000 compared to a loss of (#719,000) before

exceptionals in the previous period.

* Turnover from continuing operations up 11% and operating profit from

continuing operations up 63%.

* EBITDA of #159,000 compared to a loss of (#458,000) on turnover of

#3.75m.

* Cash balance at end of period was #2.9m compared to an overdraft of

(# 420,000).

* Net current assets of #2.7m compared to net current liabilities of (#

2.05m) in 2000.

* Equity shareholders' funds were #5.49m compared to a deficit of

(#1.90m).

Operational Highlights

* Increased revenues in advertising businesses, despite general downturn

during the period.

* Client list during month of October 2001 alone for event marketing and

production now includes Sony, Microsoft, BBC, BSkyB, EMI, Ford, NCR,

Flextech and Music Choice.

* Interim results do not include recent acquisition (October 17) of events

company Pacesetter, which showed profits before excess directors' pay of #

419,000 on turnover of #3.17m in year to May 31, 2001.

* Interim results include only two months' contributions from Ten Alps

Broadcasting and Dr Party.

Chairman's Statement

Ten Alps Communications is about 'bringing brands to life,' whether that be

through event marketing or advertising.

It is targeting what many see as a new space in the media between production

and advertising - one which in our view has no dominant, global player.

During the past year, companies now forming the Ten Alps group have served

over 70 companies with such skills. We believe this is a broad client base for

a company this size (roughly one client per employee). This contributed to

reassuringly stable revenues in the face of a wider advertising slowdown.

After an absence of three years profits have now returned to the company.

Profitability, as well as growth, was a key part of the reverse takeover and

renaming of the company as Ten Alps.

We now have a sturdy base going forward. We have a much stronger balance

sheet, substantial cash in the bank, and a focussed management team under

Chief Executive Alex Connock.

We also have considerable depth of experience amongst the managers at

subsidiary level - such as events and branding expert Tim Spencer at

Pacesetter and advertising executive Roger Maber at Osprey RMA. Both have

delivered six-figure profits every year for the last four years.

Building on our client base, we have now targeted international growth around

sporting events such as Formula One Grand Prix. We have also increased our TV

and radio production levels, both because these are profitable undertakings,

and also because they are key commodities in content provision for brands.

We are keeping separate brands at subsidiary level because clients expect

best-in-class services from specialists. So Dr Party can offer corporate

entertainment to Microsoft, whilst Pacesetter can offer the more sober annual

reports presentation service to EMI. Some integration of clients and sharing

of cost bases between divisions is taking place behind the scenes.

During the next six months your board will continue to look at appropriate

acquisitions targeted at strengthening its offering in event marketing.

We will strike a balance between considering the kind of internal investment

that will target steeper revenue growth in the long term, and of pursuing

prudent, shorter-term profit. In these uncertain times, we believe this mix of

prudence and acceleration is appropriate.

Brian Walden

Chairman

Ten Alps Communications PLC

21 November 2001

Financial Overview

Profit and Loss Account

Highlights above show the benefits of the Group's recent restructuring, with

group profitability improving significantly. Interest payments have ceased,

reflecting strong cashflow and the recent share placing. The results reflect

the acquisition of Ten Alps and Dr Party only for the 2 months of August and

September 2001.

Net profit is #71,000 for the six months whilst for the whole financial year

to 31 March 2001 the Group reported losses of (#129,000). The Group has

reported operating profits of #74,000 compared to operating losses of (#

466,000) after discounting the gain on the disposal of the discontinued

operations for the previous year.

Balance Sheet

At 30 September 2001 Group had a cash balance of #2.9m and net current assets

of #2.7m. After the restructuring and share placement the Group's net assets

strengthened from #71,000 to #5.49m as at 30 September 2001.

Due to acquisitions, the Group has goodwill of #2.498m, which is being

amortised over 10 years. The charge for the period was (#45,000).

Nitil Patel

Finance Director

Ten Alps Communications PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

SIX MONTHS ENDED 30 SEPTEMBER 2001

Six months Six months

ended 30 ended 30

September September 2000

2001

Conti- Discont- Contin- Disconti-

nuing inued uing nued

Opera- Acquisi- Opera- Total Opera- Opera- Total

tions tions tions tions tions

Unaud- Unaud- Unaud- Unaud- Unaud- Unaud- Unaud-

ited ited ited ited ited ited ited

Notes #'000 #'000 #'000 #'000 #'000 #'000 #'000

Turnover 3,459 294 3,753 3,112 2,451 5,563

Cost of sales (2,296) (141) (2,437)(2,049) (1,309) (3,358)

_____ _______ _______ _____ ______ ________ _____

Gross profit 1,163 153 1,316 1,063 1,142 2,205

Administrative (1,096) (146) (1,242)(1,022) (1,830) (2,852)

expenses

_____ _______ _______ _____ ______ ________ _____

Operating 67 7 74 41 (688) (647)

profit/(loss)

Profit on - 1,247 1,247

disposal of

businesses

Goodwill

previously

written off to

reserves

written back

on disposal

_____ _______ _______ _____ ______ ________ _____

Profit on 67 7 74 41 559 600

ordinary

activities

before

interest

===== ======= ======= ====== ========

Net interest 20 (72)

receivable/(

(payable)

_____ _____

Profit on 94 528

ordinary

activities

before tax

Tax charge (22) -

_____ _____

Profit on 72 528

ordinary

activities

after tax

Minority (1) -

Interest

_____ _____

Retained 71 528

profit/(loss)

for the period

===== =====

Basic 0.2p 1.76p

earnings/(loss)

per share

Adjusted 0.2p (2.39p)

earnings/(loss)

per share

CONSOLIDATED PROFIT AND LOSS ACCOUNT

YEAR ENDED 31 MARCH 2001

Year ended 31

March 2001

Continuing Discontinued

Operations Operations Total

Audited Audited Audited

Notes #'000 #'000 #'000

Turnover 6,523 2,445 8,968

Cost of sales (4,267) (1,314) (5,581)

_________ _________ _______

Gross profit 2,256 1,131 3,387

Administrative expenses (1,985) (1,868) (3,853)

_________ _________ _______

Operating profit/(loss) 271 (737) (466)

Profit on disposal of businesses - 1,239 1,239

Goodwill previously written off to - (807) (807)

reserves

written back on disposal

Profit on ordinary activities before 271 (305) (34)

interest

======== ========

Net interest receivable/(payable) (95)

_______

Profit on ordinary activities before tax (129)

Tax charge -

_______

Profit on ordinary activities after tax (129)

Minority Interest -

_______

Retained profit/(loss) for the period (129)

=======

Basic earnings/(loss) per share (0.13)p

Adjusted earnings/(loss) per share 0.68p

CONSOLIDATED BALANCE SHEETS

As at As at As at

30 September 2001 30 September 2000 31 March 2001

Unaudited Unaudited Audited

# '000 # '000 # '000

Fixed assets

Intangible 2,498 - 80

Tangible 306 149 140

assets

___________________ _____________________ _____________________

2,804 149 220

_________________ __________________ __________________

Current assets

Work in - 21 34

progress

Debtors 1,357 1,125 1,336

Cash at Bank 2,907 - 115

___________________ _____________________ _____________________

4,264 1,146 1,485

_________________ __________________ __________________

Creditors

Amounts falling 1,538 3,192 1,634

due within one

year

_________________ __________________ __________________

NET CURRENT 2,726 (2,046) (149)

ASSETS/

LIABILITIES

_________________ __________________ __________________

Total assets 5,530 (1,897) 71

less current

liabilities

Creditors

Amounts falling (38) - -

due after more

than one year

_________________ __________________ __________________

5,492 (1,897) 71

================= ================== ==================

Capital and

reserves

Called up share 786 7,516 267

capital

Share premium 5,356 438 527

account

Minority 2 -

Interest

Profit and loss (652) (9,851) (723)

account

_________________ __________________ __________________

Equity 5,492 (1,897) 71

shareholders'

funds

================= ================== ==================

For further information please contact:

Sheila Gunn MBE

Brown Lloyd James

Tel: 0207 591 9610

e-mail: sheilag@blj.co.uk

Alex Connock

Chief Executive

Ten Alps Communications plc

Tel: 0207 627 4190

e-mail: Alex@10Alps.com

Zinc Media (LSE:ZIN)

Historical Stock Chart

From Jun 2024 to Jul 2024

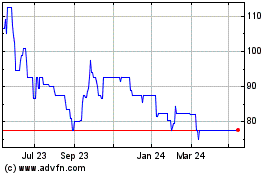

Zinc Media (LSE:ZIN)

Historical Stock Chart

From Jul 2023 to Jul 2024