TIDMXAR

RNS Number : 6215M

Xaar PLC

18 August 2011

The headline for the Xaar plc announcement released on 18 August

2011 at 7.00am under RNS No 5647M should read Half Yearly

Report.

The announcement text is unchanged and is reproduced in full

below.

FOR IMMEDIATE RELEASE 18 August 2011

Xaar plc

2011 INTERIM REPORT

Xaar plc ("Xaar"), the inkjet printing technology group

headquartered in Cambridge, has issued its interim report for the 6

months ended 30 June 2011.

Financial summary

Year to December

Six months to June 30 31

------------------------------ ------------------------ -----------------

2011 2010* 2010

------------------------------ ----------- ----------- -----------------

Revenue GBP31.6m GBP23.8m GBP54.7m

------------------------------ ----------- ----------- -----------------

Gross profit GBP13.9m GBP9.4m GBP22.6m

------------------------------ ----------- ----------- -----------------

Gross margin % 44% 39% 41%

------------------------------ ----------- ----------- -----------------

Adjusted** profit before tax GBP4.3m GBP1.4m GBP5.6m

------------------------------ ----------- ----------- -----------------

Reported profit before tax GBP4.1m GBP1.9m GBP5.4m

------------------------------ ----------- ----------- -----------------

Adjusted** diluted earnings 4.3p 1.7 p 6.2p

per share

------------------------------ ----------- ----------- -----------------

Diluted earnings per share 4.1p 2.2 p 6.1p

------------------------------ ----------- ----------- -----------------

Net cash at period end GBP20.6m GBP8.2m GBP22.0m

------------------------------ ----------- ----------- -----------------

Dividend per share 1.0p 1.0p 2.5p

------------------------------ ----------- ----------- -----------------

* H1 2010 restated in relation to recognition of revenue from a

distributor. This restatement is consistent with the 2010 Annual

Report. Further details are provided in note 2.

**Before restructuring provisions, exchange differences on

intra-group transactions, gain on derivative financial instruments,

exceptional commercial agreement costs and the cost of share-based

payments.

Key points

o Strong financial performance; revenue up 33% over H1 2010.

o Growth driven by Platform 3 (P3) products for industrial

applications.

o Profitability has increased with both gross margin and profit

before tax substantially up over H1 2010.

o The Huntingdon expansion programme for P3 production is on

track to deliver further capacity increases during H2 2011 and H1

2012.

o The market for Platform 1 (P1) products is showing signs of

maturity with sales reducing against H1 2010.

Chairman, Phil Lawler commented:

"Our sales performance in the period has validated our

confidence in the market potential for P3 products and we are

pleased to report that our capacity expansion programme remains on

track. We are excited about the opportunities that have emerged and

are committed to pursuing them."

CONTACTS

Xaar plc: 01223-423663

Ian Dinwoodie, Chief Executive www.xaar.com

Alex Bevis, Finance Director

Singer Capital Markets

Limited: 020-3205-7626

Shaun Dobson

Bankside Consultants:

Simon Bloomfield or James

Irvine-Fortescue 020-7367-8888

CHAIRMAN'S STATEMENT

Introduction

During the first half of 2011, revenues have continued to

increase and were up 33% compared with H1 2010. The growth over H1

2010 reflects the substantial demand for Platform 3 ("P3") for

industrial applications, which has been satisfied through a

combination of productivity gains and the completion of the early

stages of the capacity expansion programme at our Huntingdon

facility. Against the same period, Platform 1 ("P1") sales have

fallen, reflecting market maturity and some loss of market

share.

The geographic spread of our sales has continued to shift

towards continental Europe through the growth in P3. Our increasing

exposure to Euro-denominated revenues (37% of H1 sales versus 25%

of sales in 2010) is partly mitigated by Euro capital expenditure

related to capacity expansion as well as normal Euro-denominated

costs.

Royalty revenue from our licensees has increased slightly (6%

over H1 2010).

The Group is profitable and growing. Adjusted profit before tax

trebled against the same period last year to GBP4.3m (H1 2010

restated: GBP1.4m).

The Group's net cash reduced as expected during the period as a

result of capital investment related to the capacity expansion

programme which remains on track to deliver further incremental P3

capacity during the second half of 2011 and first half of 2012.

Results

Revenues for the six months ended 30 June 2011 were GBP31.6m (H1

2010 restated: GBP23.8m; H2 2010: GBP30.9m). Product sales were

GBP28.2m (H1 2010 restated: GBP20.5m; H2 2010: GBP26.8m). Royalty

revenue was GBP3.3m (H1 2010: GBP3.1m; H2 2010: GBP3.9m).

Development income continues to be immaterial.

Adjusted gross margin at 44% has continued to improve (H1 2010

restated: 41%; H2 2010: 43%), reflecting production efficiencies

and revenue growth.

Adjusted profit before tax for the period was GBP4.3m (H1 2010

restated: GBP1.4m; H2 2010: GBP4.2m). Reported profit before tax

was GBP4.1m (H1 2010 restated: GBP1.9m; H2 2010; GBP3.5m).

After payment of the final dividend for 2010 of GBP1.1m and

GBP5.2m of capital investment (excluding capitalised development

costs), net cash reduced by GBP1.4m during the period to GBP20.6m

(31 December 2010: GBP22.0m; 30 June 2010: GBP8.2m).

Business Commentary

The geographic spread of our business, in terms of revenue, is

now EMEA 57% (H1 2010 restated: 42%; H2 2010: 48%), Asia 32% (H1

2010 restated: 43%; H2 2010: 39%), and the Americas 11% (H1 2010

restated: 15%; H2 2010: 13%). Whilst we have benefited during the

past few years from the majority of sales coming from a high growth

region (Asia), this also increased the risks associated with more

volatile markets. We have now established reasonable volume in both

Asia and EMEA and expect to capitalise on the improved balance that

now exists in the business.

Continued success with P3 in industrial applications has enabled

us to establish a major market for that product family in EMEA,

with potential for other regions. Manufacturing efficiencies and

increased shift patterns, coupled with the first deliveries of new

processing equipment, have all helped to achieve a better than

expected P3 revenue in the first half of the year. Platform 2

("P2") sales remain a small proportion of our business although

they increased over the same period last year. As already

announced, this product family has been largely superseded by P3

and hence further volume increases are not expected. P1 sales have

been disappointing and have declined more quickly than planned.

This reflects a number of factors including reduced product

replacement orders as older P1 based printers are superseded by

newer versions, not always with Xaar printheads. This market is

very mature and the P1 product family refreshes have not been as

successful or as dominant as we had planned. Royalty revenues have

increased over the same period last year, reflecting a switch of P1

market share to some licensees.

Industrial sector growth continues with sales increasing by 132%

over H1 2010. Growth in the Packaging sector was a more modest 12%

over H1 2010, reflecting the adoption of P3 in one sub sector and

maturing market decline of P1 in another. Graphic Arts growth of 1%

compared to H1 2010, which also represents a decline against H2

2010 sales, is disappointing. Work continues in this area to

improve results.

Good progress has been made with the expansion programme which

we began in November 2010, with all constituent elements going

according to plan. This involves a major development of our

facility in Huntingdon, including the construction of a full third

clean-room. In addition to the facilities upgrade and expansion, we

have ordered a range of high value, sophisticated processing, test

and measurement equipment, some of it unique to Xaar.

The successful installation and commissioning of this equipment

continues to receive a high degree of focus and attention and is

fundamental to our being able to increase P3 manufacturing capacity

as planned. Inevitably, such changes are not without their

challenges but we are on track and remain confident that this

expansion programme will be successfully concluded during 2012 as

previously announced.

Aligned with this physical expansion has been a significant

increase in employee recruitment. This increase covers many

disciplines and we have been successful in attracting the skill

sets and calibre of people required. Headcount increases of this

size require a great deal of effort, not just in recruitment but

also in the resulting organisational expansion, integration and

training. We have been successful in this area which continues to

receive the appropriate attention.

Progress has been made in improving the management of new

product development, manufacturing and integration. This in turn

has enabled a refocusing of resource back on to future product

versions and technologies that will sustain our growth for the

longer term. We continue to manage our patent portfolio closely,

and we regularly monitor possible conflicts and competitive

activity.

As a result of our formal strategy review, held early this year,

we confirmed that our approach remains niche with our commercial

focus entirely on a few applications and leading OEMs where we can

make the most impact.

Dividend

Based on the continuing cash generation of the business, an

unchanged interim dividend of 1.0p per share will be paid on 23rd

September 2011 to shareholders on the register at close of business

on 26th August 2011.

Board

As previously reported Rob Eckelmann, non-executive and senior

independent director, decided to retire from the board at the

company's Annual General Meeting in May of this year, and was

replaced by David Cheesman. I would like to thank Rob for the

benefit of his considerable experience and almost six years of wise

counsel. Robin Williams, non-executive director, was appointed

Senior Independent Director in May.

Also as previously reported, Phil Eaves, Sales and Marketing

Director, has notified the company of his intention to retire in

mid 2012. A process is underway to ensure an appropriate successor

is in place during the second quarter of 2012.

Outlook

We continue to live in an economically challenged world where

growth is uncertain. For Xaar, the successful expansion of our

manufacturing capacity, as planned, will represent a major

milestone achieved. Although uncertainties remain, we believe that

the market for P3 products will continue to be strong and that our

new manufacturing capacity will enable us to capitalise on this

demand. Our competitive advantage is the result of supplying a

product capable of delivering significant benefits to our customers

in selected segments of the inkjet printing market. Although we

assume that competition will develop over time, the barriers to

entry are high and we believe that our disruptive technology,

combined with our management experience, technical skill, talent

and resources, will enable us to maintain our competitive edge for

a sustained period.

Phil Lawler

Chairman

18 August 2011

DIRECTORS' RESPONSIBILITIES STATEMENT

We confirm that to the best of our knowledge:

(a) the condensed set of financial statements has been prepared

in accordance with IAS 34 "Interim Financial Reporting" as adopted

by the EU.

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R:

(i) an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed set of financial statements, and

(ii) a description of principal risks and uncertainties for the

remaining six months of the year.

(c) the interim management report includes a fair review of the

information required by DTR 4.2.8R:

(i) related parties transactions that have taken place in the

first six months of the current financial year that have materially

affected the financial position or performance of the Group in that

period, and

(ii) any changes in the related parties transactions described

in the Annual Report 2010 that could have a material effect on the

financial position or performance of the group in the current

period.

By order of the board

IAN DINWOODIE

CHIEF EXECUTIVE

ALEX BEVIS

FINANCE DIRECTOR

18 August 2011

Condensed consolidated income statement

for the six months ended 30 June 2011

Six Six Twelve

months months months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

(reviewed,

restated,

(reviewed) note 2) (audited)

Notes GBP'000 GBP'000 GBP'000

------------------------------ ------ ----------- ----------- ------------

Revenue 3 31,593 23,820 54,678

Cost of sales (17,732) (14,338) (32,085)

Restructuring costs - (111) -

------------------------------ ------ ----------- ----------- ------------

Gross profit 13,861 9,371 22,593

Distribution costs (2,161) (1,863) (3,623)

Administrative expenses (7,615) (6,771) (14,596)

Restructuring costs - 1,172 1,107

------------------------------ ------ ----------- ----------- ------------

Operating profit 4,085 1,909 5,481

Investment income 34 14 42

Finance costs (48) (50) (92)

------------------------------ ------ ----------- ----------- ------------

Profit before tax 4,071 1,873 5,431

Tax 4 (1,048) (449) (1,442)

------------------------------ ------ ----------- ----------- ------------

Profit for the period

attributable to

shareholders 3,023 1,424 3,989

------------------------------ ------ ----------- ----------- ------------

Earnings per share

Basic 5 4.3p 2.3p 6.3p

Diluted 5 4.1p 2.2p 6.1p

------------------------------ ------ ----------- ----------- ------------

Dividends paid in the period amounted to GBP1,062,000 or 1.5p

per share 2010 final dividend (six months to 30 June 2010:

GBP928,000 or 1.5p per share 2009 final dividend; twelve months to

31 December 2010: GBP1,545,000 or 2.5p per share being 1.5p per

share 2009 final dividend and 1.0p per share 2010 interim

dividend).

Reconciliation of adjusted financial measures

for the six months ended 30 June 2011

Six Six Twelve

months months months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

(reviewed,

restated,

(reviewed) note 2) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ----------- ----------- ------------

Gross profit 13,861 9,371 22,593

Restructuring costs - 111 -

Exceptional commercial agreement

costs - 192 271

-------------------------------------- ----------- ----------- ------------

Gross profit (adjusted) 13,861 9,674 22,864

-------------------------------------- ----------- ----------- ------------

Profit before tax 4,071 1,873 5,431

Restructuring costs (5) (1,061) (1,107)

Exceptional commercial agreement

costs - 382 461

Exchange differences on intra-group

transactions (353) 207 (462)

Gain on derivative financial

instruments - (39) (39)

Share-based payment charges 573 46 1,276

-------------------------------------- ----------- ----------- ------------

Profit before tax (adjusted) 4,286 1,408 5,560

-------------------------------------- ----------- ----------- ------------

Six Six Twelve

months months months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

(reviewed,

(reviewed) restated) (audited)

Per share Per share Per share

-------------------------------------- ----------- ----------- ------------

Diluted earnings per share 4.1p 2.2p 6.1p

-------------------------------------- ----------- ----------- ------------

Restructuring costs - (1.6p) (1.7p)

Exceptional commercial agreement

costs - 0.6p 0.7p

Exchange differences on intra-group

transactions (0.5p) 0.3p (0.7p)

Gain on derivative financial

instruments - (0.1p) (0.1p)

Share-based payment charges 0.8p 0.1p 2.0p

Tax effect of adjusting items (0.1p) 0.2p (0.1p)

-------------------------------------- ----------- ----------- ------------

Diluted earnings per share (adjusted) 4.3p 1.7p 6.2p

-------------------------------------- ----------- ----------- ------------

This reconciliation is provided to enable a better understanding

of the Group's results and is not a primary statement.

Condensed consolidated statement of comprehensive income

for the six months ended 30 June 2011

Six Six Twelve

months months months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

(reviewed,

(reviewed) restated) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ----------- ----------- ------------

Profit for the period 3,023 1,424 3,989

-------------------------------------- ----------- ----------- ------------

Exchange differences on translation

of net investment (245) (65) (391)

Gain/(loss) on cash flow hedges - 74 (87)

Tax relating to components of other

comprehensive income - 242 14

-------------------------------------- ----------- ----------- ------------

Other comprehensive income for the

period (245) 251 (464)

-------------------------------------- ----------- ----------- ------------

Total comprehensive income for the

period 2,778 1,675 3,525

-------------------------------------- ----------- ----------- ------------

Condensed consolidated statement of changes in equity

for the six months ended 30 June 2011

Hedging

and

Share Share Own Other translation Retained

capital premium shares reserves reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- -------- --------- ------------ --------- --------

Balance at 1

January 2011 7,237 23,534 (4,465) 4,014 440 23,516 54,276

---------------- -------- -------- -------- --------- ------------ --------- --------

Profit for the

period - - - - - 3,023 3,023

Exchange

differences on

translation of

net

investment - - - - (245) - (245)

Total

comprehensive

income for the

period - - - - (245) 3,023 2,778

Issue of share

capital 26 188 - - - - 214

Dividends - - - - - (1,062) (1,062)

Deferred tax

benefit on

share option

gains - - - - - 113 113

Credit to

equity for

equity-settled

share-based

payments - - - 520 - - 520

---------------- -------- -------- -------- --------- ------------ --------- --------

Balance at 30

June 2011 7,263 23,722 (4,465) 4,534 195 25,590 56,839

---------------- -------- -------- -------- --------- ------------ --------- --------

Hedging

and

Share Share Own Other translation Retained

capital premium shares reserves reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- -------- -------- --------- ------------ --------- --------

Balance at 1

January 2010 (as

reported in 2010

interim report)

Prior period

adjustment (note 6,351 10,525 (4,465) 3,140 904 20,769 37,224

2) - - - - - (761) (761)

----------------- -------- -------- -------- --------- ------------ --------- --------

Balance at 1

January 2010

(as restated in

2010 annual

report) 6,351 10,525 (4,465) 3,140 904 20,008 36,463

----------------- -------- -------- -------- --------- ------------ --------- --------

Profit for the

period - - - - - 1,424 1,424

Exchange

differences on

translation of

net investment - - - - (65) - (65)

Gains on cash

flow hedges - - - - 74 - 74

Tax on items

taken directly

to equity - - - - 13 - 13

Tax benefit

taken directly

to equity - - - - - 229 229

----------------- -------- -------- -------- --------- ------------ --------- --------

Total

comprehensive

income for the

period - - - - 22 1,653 1,675

----------------- -------- -------- -------- --------- ------------ --------- --------

Dividends - - - - - (928) (928)

Credit to equity

for

equity-settled

share-based

payments - - - 46 - - 46

----------------- -------- -------- -------- --------- ------------ --------- --------

Balance at 30

June 2010

(restated) 6,351 10,525 (4,465) 3,186 926 20,733 37,256

----------------- -------- -------- -------- --------- ------------ --------- --------

Condensed statement of financial position

as at 30 June 2011

As at As at

30 June 31 December

2011 2010

(reviewed) (audited)

GBP'000 GBP'000

------------------------------------- ----------- ------------

Non-current assets

Goodwill 720 720

Other intangible assets 4,048 4,349

Property, plant and equipment 20,800 17,385

Investments 1,261 1,261

Deferred tax asset 996 995

------------------------------------- ----------- ------------

27,825 24,710

------------------------------------- ----------- ------------

Current assets

Inventories 11,438 10,715

Trade and other receivables 7,887 9,301

Current tax asset - 381

Cash and cash equivalents 21,665 23,344

40,990 43,741

------------------------------------- ----------- ------------

Total assets 68,815 68,451

------------------------------------- ----------- ------------

Current liabilities

Trade and other payables (8,301) (10,969)

Other financial liabilities (100) (217)

Current tax liabilities (776) -

Obligations under finance leases (271) (265)

Provisions (770) (797)

------------------------------------- ----------- ------------

(10,218) (12,248)

------------------------------------- ----------- ------------

Net current assets 30,772 31,493

------------------------------------- ----------- ------------

Non-current liabilities

Deferred tax liabilities (693) (695)

Other financial liabilities (331) (361)

Obligations under finance leases (734) (871)

------------------------------------- ----------- ------------

Total non-current liabilities (1,758) (1,927)

------------------------------------- ----------- ------------

Total liabilities (11,976) (14,175)

------------------------------------- ----------- ------------

Net assets 56,839 54,276

------------------------------------- ----------- ------------

Equity

Share capital 7,263 7,237

Share premium 23,722 23,534

Own shares (4,465) (4,465)

Other reserves 4,534 4,014

Hedging and translation reserves 195 440

Retained earnings 25,590 23,516

------------------------------------- ----------- ------------

Equity attributable to shareholders 56,839 54,276

------------------------------------- ----------- ------------

Total equity 56,839 54,276

------------------------------------- ----------- ------------

Condensed consolidated cash flow statement

for the six months ended 30 June 2011

Six Six Twelve

months months months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

(reviewed,

(reviewed) restated) (audited)

Note GBP'000 GBP'000 GBP'000

------------------------------- ----- ----------- ----------- ------------

Net cash from operating

activities 6 4,687 1,004 5,524

------------------------------- ----- ----------- ----------- ------------

Investing activities

Investment income 34 14 42

Purchases of property, plant

and equipment (5,195) (2,843) (6,488)

Proceeds on disposal of

property, plant and

equipment - 1 10

Expenditure on capitalised

product development (220) (48) (359)

------------------------------- ----- ----------- ----------- ------------

Net cash used in investing

activities (5,381) (2,876) (6,795)

------------------------------- ----- ----------- ----------- ------------

Financing activities

Dividends paid (1,062) (928) (1,546)

Loan financing - 1,388 1,389

Proceeds from issue of

ordinary share capital 214 - 15,025

Fees for issue of ordinary

share capital - - (1,130)

Finance costs (30) (81) (80)

Repayments of borrowings (248) (298) (537)

------------------------------- ----- ----------- ----------- ------------

Net cash (used in)/ from

financing activities (1,126) 81 13,121

------------------------------- ----- ----------- ----------- ------------

Net (decrease)/increase in

cash and cash equivalents (1,820) (1,791) 11,850

Effect of foreign exchange

rate changes 141 48 (27)

Cash and cash equivalents at

beginning of period 23,344 11,521 11,521

------------------------------- ----- ----------- ----------- ------------

Cash and cash equivalents at

end of period 21,665 9,778 23,344

------------------------------- ----- ----------- ----------- ------------

Notes to the interim financial information

for the six months ended 30 June 2011

1. Basis of preparation and accounting policies

Basis of preparation

These interim financial statements have been prepared in

accordance with the accounting policies set out in the group's

annual report and accounts 2010 on pages 40 to 45 and were approved

by the board of directors on 18 August 2011. The interim financial

statements for the six months ended 30 June 2011 have been prepared

in accordance with IAS 34 "Interim Financial Reporting" as adopted

by the European Union. The interim financial statements do not

include all the information and disclosures in the annual financial

statements and should be read in conjunction with the group's

annual financial statements as at 31 December 2010.

The financial information in these interim financial statements

does not constitute statutory financial statements as defined in

section 434 of the Companies Act 2006. The group's annual report

for the year ended 31 December 2010 has been delivered to the

Registrar of Companies and the auditor's report on those financial

statements was not qualified and did not contain statements made

under section 498(2) or (3) of the Companies Act 2006.

The interim financial statements are unaudited but have been

reviewed by the auditor Deloitte LLP. The report of the auditor to

the group is set out on page 15.

Significant accounting policies

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the group's annual

financial statements for the year ended 31 December 2010.

Risks and uncertainties

An outline of the key risks and uncertainties faced by the group

was outlined in the 2010 financial statements on page 15, including

anticipating technology trends, retaining key staff and

successfully executing business growth initiatives. It is

anticipated that the risk profile will not significantly change for

the remainder of the year. Risk is an inherent part of doing

business and the strong cash position of the group along with the

underlying profitability of the core business leads the directors

to believe that the group is well placed to manage business risks

successfully.

Going concern

The group's forecasts and projections, taking account of

reasonably possible changes in trading performance, support the

conclusion that there is a reasonable expectation that the company

and the group have adequate resources to continue in operational

existence for the foreseeable future. Accordingly, the going

concern basis of preparation has been adopted in preparing the

interim financial statements.

2. Restatement of prior periods

The financial statements for the period 1 January 2010 to 30

June 2010 include a prior period restatement, as also presented in

the 2010 annual report, in relation to the recognition of revenue

from a distributor. In prior periods revenue (and associated

profits) was recognised at the point of receipt of goods by the

distributor. The restated financial statements recognise revenue

(and associated profits) at the point of resale by the distributor

which is when risk and rewards of ownership of inventory has

transferred.

Segment results in note 3 reflect this restatement which only

impacted printheads and related products.

Outlined below are the corrections made for each financial

statement line affected.

CONDENSED CONSOLIDATED INCOME STATEMENT (extracts)

30 June 30 June 30 June

2010 2010 2010

as

reported adjustment restated

GBP'000 GBP'000 GBP'000

-------------------------------------------- --------- ----------- -----------

Revenue 23,863 (43) 23,820

Cost of sales (14,468) 130 (14,338)

Restructuring costs (111) - (111)

-------------------------------------------- --------- ----------- -----------

Gross profit 9,284 87 9,371

-------------------------------------------- --------- ----------- -----------

Operating profit 1,822 87 1,909

-------------------------------------------- --------- ----------- -----------

Profit before tax 1,786 87 1,873

Tax (425) (24) (449)

-------------------------------------------- --------- ----------- -----------

Profit for the period attributable to

shareholders 1,361 63 1,424

-------------------------------------------- --------- ----------- -----------

Earnings per share

Basic 2.2p 2.3p

Diluted 2.1p 2.2p

-------------------------------------------- --------- ----------- -----------

NOTES TO THE CASH FLOW STATEMENT (extracts)

30 June 30 June 30 June

2010 2010 2010

as

reported adjustment restated

GBP'000 GBP'000 GBP'000

Profit before tax 1,786 87 1,873

-------------------------------------------- --------- ----------- -----------

Operating cash flows before movements in

working capital 2,472 87 2,559

-------------------------------------------- --------- ----------- -----------

Increase in inventories (452) (130) (582)

Increase in receivables (1,223) (7) (1,230)

Increase in payables 727 - 727

-------------------------------------------- --------- ----------- -----------

3. Business segments

For management reporting purposes, the group's operations are

currently analysed according to product type. These product groups

are the basis on which the group reports its primary segment

information.

Segment information about these product types is presented

below:

Six Six Twelve

months months months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

(reviewed,

(reviewed) restated) (audited)

GBP'000 GBP'000 GBP'000

--------------------------------- ----------- ----------- ------------

Revenue

Printheads and related products 28,174 20,546 47,237

Development fees 81 126 459

Licence fees and royalties 3,338 3,148 6,982

--------------------------------- ----------- ----------- ------------

Total revenue 31,593 23,820 54,678

--------------------------------- ----------- ----------- ------------

Six Six Twelve

months months months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

(reviewed,

(reviewed) restated) (audited)

GBP'000 GBP'000 GBP'000

------------------------------------ ----------- ----------- ------------

Result

Printheads and related products 94 (861) (1,029)

Development fees - 43 179

Licence fees and royalties 3,338 2,565 5,999

------------------------------------ ----------- ----------- ------------

Total segment result 3,432 1,747 5,149

Net unallocated corporate income 653 162 332

------------------------------------ ----------- ----------- ------------

Operating profit 4,085 1,909 5,481

Investment income 34 14 42

Finance costs (48) (50) (92)

------------------------------------ ----------- ----------- ------------

Profit before tax 4,071 1,873 5,431

Tax (1,048) (449) (1,442)

------------------------------------ ----------- ----------- ------------

Profit for the period attributable

to shareholders 3,023 1,424 3,989

------------------------------------ ----------- ----------- ------------

Unallocated corporate income relates to administrative

activities which cannot be directly attributed to any of the

principal product groups.

Assets in the printheads and related products segment have

increased by GBP1.3m over the period and assets in the licence fees

and royalties segment have increased by GBP0.8m over the period;

there have been no other material movements in segment assets

during the period.

4. Income tax

The major components of income tax expense in the income

statement is as follows:

Six Six Twelve

months months months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

(reviewed,

(reviewed) restated) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ----------- ----------- ------------

Current income tax

Income tax charge 938 49 1,244

Deferred income tax

Relating to origination and reversal

of temporary differences 110 400 198

-------------------------------------- ----------- ----------- ------------

Income tax expense 1,048 449 1,442

-------------------------------------- ----------- ----------- ------------

5. Earnings per ordinary share - basic and diluted

The calculation of basic and diluted earnings per share is based

upon the following data:

Six Six Twelve

months months months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

(reviewed,

(reviewed) restated) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ----------- ----------- ------------

Earnings

Earnings for the purposes of earnings

per share being net profit

attributable to equity holders of

the parent 3,023 1,424 3,989

-------------------------------------- ----------- ----------- ------------

Number of shares

Weighted average number of ordinary

shares for the purposes of basic

earnings per share 70,722,976 61,797,389 63,009,082

Effect of dilutive potential ordinary

shares:

Share options 3,007,608 1,548,756 2,311,031

-------------------------------------- ----------- ----------- ------------

Weighted average number of ordinary

shares for the purposes of diluted

earnings per share 73,730,584 63,346,145 65,320,113

-------------------------------------- ----------- ----------- ------------

6. Notes to the cash flow statement

Six Six Twelve

months months months

ended ended ended

30 June 30 June 31 December

2011 2010 2010

(reviewed,

restated,

(reviewed) note 2) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ----------- ----------- ------------

Profit before tax 4,071 1,873 5,431

Adjustments for:

Share-based payments 520 46 874

Depreciation of property, plant and

equipment 2,230 1,859 3,686

Movements on cash flow hedge

valuations - 47 (39)

Finance costs 48 31 92

Amortisation of intangible assets 521 540 1,119

Investment income (34) - (42)

Foreign exchange gains (585) - (649)

Loss on disposal of property, plant

and equipment - 25 25

Decrease in provisions (27) (1,862) (1,209)

-------------------------------------- ----------- ----------- ------------

Operating cash flows before movements

in working capital 6,744 2,559 9,288

Increase in inventories (626) (582) (3,988)

Decrease/(increase) in receivables 1,407 (1,230) (3,621)

(Decrease)/increase in payables (3,041) 727 5,389

-------------------------------------- ----------- ----------- ------------

Cash generated by operations 4,484 1,474 7,068

Income taxes refunded / (paid) 203 (470) (1,544)

-------------------------------------- ----------- ----------- ------------

Net cash from operating activities 4,687 1,004 5,524

-------------------------------------- ----------- ----------- ------------

Cash and cash equivalents (which are presented as a single class

of asset on the face of the balance sheet) comprise cash at bank

and other short term highly liquid investments with a maturity of

three months or less.

7. Date of approval of interim financial statements

The interim financial statements cover the period 1 January 2011

to 30 June 2011 and were approved by the board on 18 August

2011.

Further copies of the interim financial statements are available

from the company's registered office, 316 Science Park, Cambridge

CB4 0XR, and can be accessed on the Xaar plc website,

www.xaar.com.

Independent review report

for the six months ended 30 June 2011

Introduction

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2011 which comprises the condensed

consolidated income statement, reconciliation of adjusted financial

measures, condensed consolidated statement of comprehensive income,

condensed consolidated statement of financial position, condensed

consolidated statement of changes in equity, condensed consolidated

cash flow statement and related notes 1 to 7. We have read the

other information contained in the half-yearly financial report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

This report is made solely to the company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Auditing Practices

Board. Our work has been undertaken so that we might state to the

company those matters we are required to state to it in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company, for our review work, for this

report, or for the conclusions we have formed.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure and Transparency Rules of the United Kingdom's

Financial Services Authority.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting," as adopted by the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making inquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2011 is not prepared, in all material respects, in accordance

with International Accounting Standard 34 as adopted by the

European Union and the Disclosure and Transparency Rules of the

United Kingdom's Financial Services Authority.

Deloitte LLP

Chartered Accountants and Statutory Auditor

Cambridge

18 August 2011

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PPMTTMBIBBLB

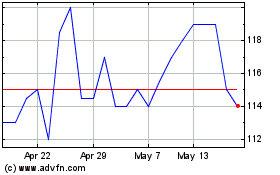

Xaar (LSE:XAR)

Historical Stock Chart

From Jul 2024 to Aug 2024

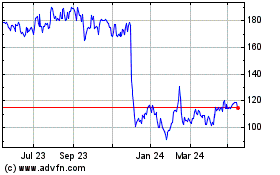

Xaar (LSE:XAR)

Historical Stock Chart

From Aug 2023 to Aug 2024