RNS Number:6545F

Xaar PLC

16 February 2000

Xaar plc

RESULTS FOR 1999 : RECORD TURNOVER

Xaar plc ("Xaar"), the ink jet printing technology group

headquartered in Cambridge, has announced its preliminary audited

results for the year ended 31 December 1999.

Key points :

* Excellent progress was made in 1999 by Xaar on technology,

commercial partnerships and trading.

* Record turnover of #15.1m (1998: #1.5m); pre-tax profits of

#0.5m, a turn round from a 1998 loss of #4.6m.

* Licence and development fees increased to #5.9m (1998: #0.1m)

with significant development income from Agfa Gevaert and

Kyocera, Xaar's key development partners for the A4 page wide

printhead. Licence income arose from licence upgrades by

existing licensees, and an ink licence with Toyo Ink.

* Turnover from the manufacture of printheads increased to #8.5m

(1998: #0.4m) reflecting both an initial contribution and good

trading performance from XaarJet AB in Sweden (acquired in

March 1999; formerly called MIT) as well as an uplift in

manufacturing volume in the UK.

* Progress continues with the page wide printhead with Agfa

making a stage milestone' payment after a successful

demonstration of the technology in October 1999. Kyocera is

collaborating on manufacture and DuPont is developing new inks

for this project.

* Balance sheet remains strong with cash of #4.2m after providing

for capital investment and acquisitions. Net assets were

#12.8m.

* On outlook, Chairman, Arie Rosenfeld stated :

"The market for digital printing solutions continued to grow

enormously in 1999, and ink jet is widely viewed as the

technology most likely to succeed across a broad range of

digital printing applications in the future. We have taken a

significant step in 1999 towards our long-term goal of making

Xaar the technology provider of choice for companies involved

in all aspects of printing."

Graham Wylie, Chief Executive or Jonathan Lowe,

Finance Director at Xaar on : 020 7-466-5000 today

01223-423663 thereafter

Steve Liebmann or Lisa Baderoon at Buchanan

Communications on : 020 7-466-5000

CHAIRMAN'S SSTATEMENT

Introduction

I am delighted to report that 1999 was a year of excellent progress

for Xaar. We secured a number of key commercial partnerships,

achieved some important technical milestones and made a

significant acquisition in Sweden. The combined effect of these

was the delivery of strong revenue growth for the year, a clear

sign of the increasing market acceptance of Xaar's technology.

It is also pleasing to be able to report a profit for the year.

Results and Finance

Turnover for the period was a record #15.1m (1998: #1.5m) which

resulted in a profit before tax of #542,000 (1998: loss #4.6m).

The revenue profile was well balanced in 1999 between technology

revenues (licensing, royalties and development fees) and trading

revenues (printhead and ink sales); this is an important trend

that now makes us less reliant than before on the unpredictable

nature of licence fees. Capital expenditure of #1.4m was lower

than in the previous year (#2.6m) when we had incurred the costs

of moving to new facilities in Cambridge. The cost of acquiring

MIT was #2m (net of the investment of #1.2m from Olympus of

Japan). At year-end Xaar had a strong balance sheet with net

assets of #12.8m and cash of #4.2m.

Business Strategy

We approach each of the principal markets open to Xaar in a

distinct way in order to exploit most effectively the enormous

opportunities that they present - technology licensing for the

home and office printing markets; direct supply of printheads and

inks through XaarJet for industrial printing markets; and

development and distribution alliances with leading corporations

for the next generation of Xaar's technology in commercial

digital printing markets.

There is much satisfaction to be gained from progress in each of

these three areas in the last year; we have seen renewed interest

in technology licensing with a new ink licensee and significant

licence upgrades in 1999; our combined XaarJet business has shown

considerable revenue growth; and our important next-generation

development programme (page wide printheads) has seen the

successful achievement of a number of early technical and

commercial milestones. In his Chief Executive's review Graham

Wylie reports further on the substantial progress made in each of

these three areas in 1999.

Acquisition

Our acquisition in March 1999 of Stockholm-based MIT (now renamed

XaarJet AB) has proved a great success, far exceeding our initial

expectations. It achieved turnover of #7.1m and an operating

profit of #853,000 in the 9 month period to December 1999. We

were delighted to welcome Jan Fineman, the Managing Director of

XaarJet AB, to the Xaar plc board in August 1999 as Operations

Director, assuming responsibility for XaarJet operations in

Cambridge as well as in Sweden.

Outlook

The market for digital printing solutions continued to grow

enormously in 1999, and ink jet is widely viewed as the

technology most likely to succeed across a broad range of digital

printing applications in the future. We have taken a significant

step in 1999 towards our long-term goal of making Xaar the

technology provider of choice for companies involved in all

aspects of printing.

Our goal for 2000 and beyond is to sustain the momentum that has

been created in 1999. We believe that, with Xaar's combination

of a sound strategy, world-class business partners, excellent

facilities and a committed and enthusiastic staff, we are well

placed to succeed.

Arie Rosenfeld

Chairman

15 February 2000

CHIEF EXECUTIVE'S REVIEW

1999 was a year of substantial growth for the Xaar group of

companies and we are confident that we can capitalise on the

progress made in 1999 and deliver the results in future years

that will substantiate our belief in the exciting prospects for

the company.

2000 has started well and there is clear evidence of the growing

interest in Xaar's ink jet technology, further confirming our

position as one of the fastest growing ink jet companies.

Xaar Business Strategy

The acquisition in March 1999 of MIT (now renamed XaarJet AB) has

enhanced progress towards meeting the central strategy for the

company's ink jet system to be a core technology in the office,

commercial and industrial printing markets. We will continue

with the development of the technology which, with the

demonstration of an A4 page wide prototype printhead, made

significant advances in 1999. We believe that many more

applications for the Xaar system will emerge as the development

of our products, both manufactured and licensed, continues. The

Xaar technology is now proving to be the most flexible ink jet

technology although there is still much development to be done to

take full advantage of the opportunities that will arise.

We continue to operate the group through three divisions, Xaar

Technology, XaarJet and Xaar Digital.

Xaar Technology

Xaar Technology focuses on licensing Xaar technology to major

corporations involved in the manufacture of office equipment.

The majority of potential licensees are based in Japan and Xaar

suffered, along with many other companies, from the downturn in

the Japanese economy in 1998. In the last few months of 1999, we

have seen a strong uplift in the interest being shown by Japanese

companies in investing in future ink jet products using the Xaar

technology.

We have learned over the years that licensees take longer to

launch products containing newly licensed technology than we

would ideally like. The office and home ink jet printer market

is very competitive and still dominated by Canon, Hewlett Packard

and Epson. To gain significant market share, new printers must

be capable of faster, higher quality colour printing while being

competitively priced with those already available. Xaar's

technology offers licensees this opportunity, but product

development takes time. In 1999, some new products were released

by licensees and royalties have continued to grow on a like for

like basis. However, we understand that there are several new

products in the pipeline that will have an impact on the market

and we hope to see these launched in 2000, although the release

plans for these products are within the sole control of our

licensees.

In 1999 we signed a new ink manufacturing licence with Toyo Ink

Manufacturing Company of Japan and we are now in the process of

qualifying the first inks to be produced under the licence by

Toyo. Dainippon Screen of Japan, an existing licensee, committed

to proceed to full manufacture of printheads which triggered an

additional licence stage payment and another Japanese licensee

agreed a significant upgrade to their licence rights.

A combination of these factors led to a substantial increase in

income for the year for Xaar Technology.

We will continue to seek new licensees for the technology and

this process has been given a significant boost by the

appointment on 1st December 1999 of Dr Tokuya Ohta as Director of

Xaar Japan. Dr Ohta was previously Advisory Director and Deputy

Chief Executive of BubbleJet Operations at Canon and was

responsible for the development of Canon's BubbleJet ink jet

printing system which has been one of the market leaders for

several years. Dr Ohta is working full time for Xaar, based in

Tokyo and through his many contacts and acknowledged expertise in

ink jet we believe that the number of opportunities for Xaar to

close new licence deals will increase.

XaarJet

XaarJet is the division through which Xaar's own manufactured ink

jet printing systems are marketed.

In the Cambridge headquarters we currently manufacture the

XaarJet 500 range of printheads targeted specifically at

industrial printing applications. Although in 1999 we did not

achieve the planned manufacturing yields or throughput, we did

ship more printheads than ever before and we have seen an

increase in the number of applications which are only possible

with the Xaar ink jet system. We now have customers using

XaarJet to print digitally onto products as diverse as ceramic

tiles, cardboard cartons and extruded plastics.

In August 1999, we appointed Jan Fineman, Managing Director of

XaarJet AB, to the position of Operations Director, with the

particular target of improving the manufacturing operation at

Cambridge. We are now beginning to see the real benefits of this

appointment and anticipate that 2000 will see an improvement in

manufacturing performance in respect of XaarJet 500 printheads.

This business remains a key element of our future plans and has

been complemented by the acquisition of XaarJet AB in Sweden.

XaarJet AB employs around 90 people at a facility extending to

some 60,000 sq. ft., based just outside Stockholm. The focus for

XaarJet AB has been the manufacture of 64 and 128 line printheads

for industrial and commercial printing. In particular the

product has established a strong market position in wide and

grand format printing. This market has grown substantially over

the last few years. The facility offers the opportunity to

expand both the volume and range of products being produced. We

have plans to utilise this capacity more fully in 2000 on the

back of a growing demand for the established product and the

potential to manufacture customised printheads under contract

from major companies, some of which are currently in the early

stages of development. We were convinced that acquiring MIT

would be a good deal for Xaar, especially under the terms

negotiated. In the event, the first nine months have exceeded

even our expectations in terms of revenues and profits. The

management and staff in Sweden have joined the Xaar group with

enthusiasm and there is much more benefit to be derived from that

company.

Xaar Digital

Xaar Digital was established to commercially exploit the

development of a printhead and ink system capable of printing

over 120 A4 pages per minute in full colour.

In 1999, this major development programme continued and it

culminated in the first prototype Page Wide Array (PWA) printing

an A4 page in monochrome at a line speed of 156 pages per minute.

The PWA has 3300 active printing channels and when compared with

the XaarJet 500 and 128 channel printheads, the quantum leap of

this development can be appreciated. We are now involved in

making further and better prototype printheads. Confidence in

the project remains high, but there is unlikely to be a product

in the market containing the PWA until the end of 2001.

Successful completion of this development will represent a major

step by Xaar into converting the commercial printing market to

the benefits of ink jet.

The strategy of Xaar Digital is to work with world class partners

to bring the PWA and inks into reality. In 1999, the key

commercial event was the Joint Development Agreement signed with

Agfa-Gevaert, one of the world's leading photographic and imaging

companies. Agfa agreed to part fund the development with an

initial payment followed by a first milestone payment on

successful demonstration of the prototype PWA. In due course,

Agfa intends to incorporate the PWA system in digital and

photographic printing products. Kyocera, of Japan, also signed a

Joint Development Agreement with Xaar under which, following

proof of design, they will manufacture commercial quantities of

the PWA. Kyocera has also provided Xaar with income to assist in

the development process and we have agreed outline terms for

Kyocera to take a manufacturing licence when they are satisfied

that the PWA is manufacturable at a yield and a cost which meets

both their own and Xaar's expectations. We have a specific ink

development programme running with DuPont Ink jet Inks of the

USA, which is aimed at producing an ink capable of operating at

the speeds that the PWA has been shown to be capable of jetting

the ink.

2000 will be a year in which we will continue to improve and

develop the design and manufacturing processes for the PWA and

also discuss potential exploitation of the finished product with

other commercial partners.

Intellectual Property Rights

During the year, Xaar completed the patent litigation against

CalComp Inc. A financial settlement was reached and Xaar more

than recovered its costs. The outcome of our dispute with

CalComp was commercially satisfactory and just as importantly

demonstrated the validity of Xaar's patents.

We continue to expand our patent portfolio, including new filings

in respect of the PWA development, and we now have a total of 475

patents and patent applications.

People

In addition to the appointment of Jan Fineman to the main board

of Xaar, we have found the injection of new manufacturing

expertise which resides in XaarJet AB to be of considerable

benefit to the Cambridge manufacturing operation. After having

gone through several years of difficulties, the staff in Sweden

have taken well to being part of the Xaar group and their efforts

since acquisition have been very encouraging.

All of the staff at Xaar work hard towards the aim of the company

achieving the level of success of which the technology is

capable. My thanks go particularly to the staff, and the

executive management team for their support and for delivering a

very good 1999.

We look forward with renewed confidence to 2000.

Graham Wylie

Chief Executive

CONSOLIDATED PROFIT AND LOSS ACCOUNT

for the year ended 31 December 1999

Notes 1999 1998

#'000 #'000

(audited) (audited)

Turnover

Continuing operations 7,981 1,504

Acquisitions 1 7,083 -

-------- --------

Total turnover 1 15,064 1,504

Cost of sales (6,957) -

--------- --------

Gross profit 8,107 1,504

Other operating expenses (net) (7,781) (6,957)

--------- --------

Operating profit/(loss)

Continuing operations (527) (5,453)

Acquisitions 853 -

-------- --------

Total operating profit/(loss) 326 (5,453)

Interest receivable 272 870

Interest payable (56) (43)

------- --------

Profit/(loss) on ordinary

activities before taxation 542 (4,626)

Tax on profit/(loss) for the

financial year (338) (10)

-------- -------

Retained profit/(loss) for the 204 (4,636)

financial year

====== =======

Earnings/(loss) per share - 2 0.4p (8.9p)

basic

------- -------

Earnings/(loss) per share - 2 0.4p (8.9p)

diluted

------- -------

Consolidated statement of total

recognised gains and losses

Profit/(loss) for the financial

year 204 (4,636)

Loss on foreign currency

translation (80) -

-------- -------

Total recognised gains and

losses relating to the year 124 (4,636)

======== =======

CONSOLIDATED BALANCE SHEET

as at 31 December 1999

1999 1998

#'000 #'000

(audited) (audited)

Fixed assets

Goodwill 1,272 -

Tangible assets 4,789 3,430

Investments 20 20

------- -------

6,081 3,450

------- -------

Current assets

Stocks 842 38

Debtors 5,709 1,214

Cash and liquid resources 4,217 8,739

------- ------

10,768 9,991

Creditors: amounts falling due (3,682) (2,030)

within one year

------ -------

Net current assets 7,086 7,961

------ -------

Total assets less current 13,167 11,411

liabilities

Creditors: amounts falling due

after more than one year (415) (227)

------- -------

Net assets 12,752 11,184

======= =======

Capital and reserves

Called-up share capital 5,568 5,201

Share premium account 10,116 9,111

Other reserves 1,010 938

Accumulated deficit (3,942) (4,066)

------ -------

Shareholders' funds - all equity 12,752 11,184

======== ========

CONSOLIDATED CASH FLOW STATEMENT

for the year ended 31 December 1999

1999 1998

#'000 #'000

(audited) (audited)

Net cash outflow from operating (2,210) (3,485)

activities

-------- ---------

Returns on investments and

servicing of finance 275 851

Capital expenditure and financial

investment (581) (1,744)

Acquisitions (net of cash acquired) (2,942) -

---------- --------

Cash outflow before management

of liquid resources and financing (5,458) (4,378)

---------- --------

Management of liquid resources 5,728 4,287

Financing 960 (180)

---------- --------

Increase/(decrease) in cash in the 1,230 (271)

year

======== =========

Notes

1 Segment information

Turnover by class of business:

1999 1998

#'000 #'000

Licence and development fees 5,852 125

Royalties (includes #148,000 in respect of

MIT (1998: #598,000)) 721 1,011

Printheads and related products 8,491 368

------ ------

15,064 1,504

====== ======

The acquisition of XaarJet AB (formerly MIT) had the effect of

increasing sales of printheads and related products by

#7,083,000. Royalties in 1998 and the period to 31 March

1999 (the date of acquiring MIT) include pre-acquisition

royalty income from MIT, as disclosed above.

Turnover by geographical segment:

1999 1998

#'000 #'000

Europe 3,871 959

Rest of World 11,193 545

------ -----

15,064 1,504

====== =====

The acquisition of XaarJet AB had the effect of increasing sales

by origin in Europe by #7,083,000 and sales by destination to

Europe by #1,032,000 and to the Rest of World by #6,051,000.

Otherwise all turnover originates in the UK.

2. Earnings/(loss) per share - basic and diluted

The calculation of earnings/(loss) per share is based on the

profit/(loss) for the financial year after taxation and on the

weighted average number of ordinary shares in issue during the

year of 54,256,720 (1998: 51,904,762) in respect of basic

earnings/(loss) per share, and 57,580,244 in respect of diluted

earnings per share (the only difference being in relation to

exercises of share options). Due to the loss incurred in 1998 no

share options were deemed to be dilutive.

3. Financial information

The financial information contained in this preliminary

announcement of audited results does not constitute the group's

statutory accounts for the years ended 31 December 1999 or 31

December 1998. The accounts for the year ended 31 December 1998

have been delivered to the Registrar of Companies.

The statutory accounts for the years ended 31 December 1999 and

1998 have been reported on by the company's auditors; the reports

on these accounts were unqualified and they did not contain any

statement under section 237(2) or (3) of the Companies Act 1985.

The accounts for the year ended 31 December 1999 are expected to

be posted to shareholders in due course and will be delivered to

the Registrar of Companies after they have been laid before the

company in a general meeting on 21 March 2000.

Copies will also be available from the registered office of the

company, Science Park, Cambridge, CB4 0XR. The registered number

of Xaar plc is 3320972.

END

FR UVSWRRNRUAAR

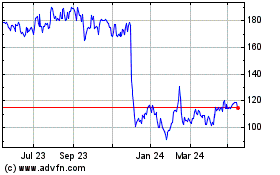

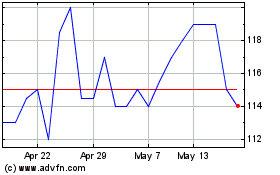

Xaar (LSE:XAR)

Historical Stock Chart

From Jul 2024 to Aug 2024

Xaar (LSE:XAR)

Historical Stock Chart

From Aug 2023 to Aug 2024