TIDMWJG

RNS Number : 6766A

Watkin Jones plc

09 June 2016

For immediate release 9 June 2016

Watkin Jones plc

('Watkin Jones' or the 'Group')

Half year results for the six months to 31 March 2016

Watkin Jones plc (AIM:WJG), a leading UK developer and

constructor of multi occupancy property assets, with a focus on the

student accommodation sector, announces its maiden half year

results for the six months ended 31 March 2016. The Board is

pleased to report a successful first six months of the financial

year with trading in line with its expectations.

Financial Highlights

H1 2016 H1 2015 Movement

Revenue GBP145.9 million GBP103.8 million +40.6%

Operating profit

before exceptional

IPO costs GBP17.0 million GBP9.3 million +83.5%

Adjusted EBITDA(1) GBP17.3 million GBP9.5 million +82.0%

Adjusted basic

EPS(2) 5.2 pence 2.8 pence +87.0%

Notes

1 Adjusted EBITDA comprises operating profit before exceptional

IPO costs, adding back charges for depreciation and

amortisation.

2 Adjusted basic EPS is calculated using the profit for the

period from continuing operations excluding exceptional IPO

costs.

-- Strong revenue and profit performance during the half year

driven by student accommodation developments

-- 1.33 pence per share proposed interim dividend; in line with IPO guidance

-- GBP15.4 million net cash at 31 March 2016 (GBP4.0 million net debt at 31 March 2015)

-- New GBP40 million five year Revolving Credit Facility and

GBP10 million Working Capital Facility with HSBC put in place at

IPO to provide development funding flexibility and working capital

headroom. Unutilised at 31 March 2016.

Business Highlights

-- Successful admission to AIM on 23 March 2016, with business

continuing to deliver strong operational performance through the

process

-- GBP114 million development value of six student accommodation

developments (1,660 beds) forward sold since 1 October 2015

-- GBP90 million development value in legal negotiations for

forward sale of three further student accommodation developments

(1,234 beds)

-- Planning permissions for nine student developments (3,478

beds) obtained since 1 October 2015, including five obtained since

admission to AIM (1,733 beds)

-- Development pipeline - Over 11,300 student beds in the

pipeline across 31 sites, with 17 forward sold and four more in

legal negotiations or under offer

-- Delivery pipeline -

-- 2016 deliveries - All forward sold and on target to be

completed ahead of the 2017 academic year

-- 2017 deliveries - All sites secured with planning and only

one remaining to sell which is in legal negotiations

-- 2018 deliveries - All sites secured and progressing satisfactorily

-- 2019/20 deliveries - four sites secured and a number of

additional site acquisitions progressing

-- Fresh Student Living Limited ("Fresh") acquired for GBP15

million prior to IPO and successfully integrated into the Group.

Fresh is engaged in the operational management of purpose built

student accommodation assets

-- Fresh student accommodation beds under management already

contracted to increase from 8,310 beds in FY 2016 to 17,924 beds by

FY 2020

-- Five Nine Living Limited established for the management of

multi occupancy property assets in the Private Rented Sector

('PRS'), leveraging the expertise of Fresh

-- Watkin Jones plc Board formally established, comprising

Grenville Turner (Chairman); Simon Laffin (non-executive director);

Mark Watkin Jones (CEO) and Philip Byrom (CFO).

Commenting on the results, Mark Watkin Jones, Chief Executive

Officer of Watkin Jones plc, said: "Following on from our

successful admission to AIM in March this year, we are delighted to

report such a strong maiden set of half year results today. Our

student accommodation development business remains positively

underpinned by the fundamentals of the student accommodation market

and the forward sale model provides us with excellent visibility as

to future earnings and cash flow. The current student accommodation

pipeline of 31 development sites underpins the business outlook to

FY 2018, with 16 of the 17 developments for delivery by the end of

FY 2017 already forward sold. We are at advanced positions

regarding the acquisition of a number of site opportunities that

will be for delivery in FY 2019 and beyond.

An opportunity exists for our residential business, with the

potential for Watkin Jones to apply its student accommodation model

to the development and management of purpose built PRS schemes.

These strong interim results, coupled with the status of the

forward sold student accommodation pipeline and the fact that all

developments for this year's delivery are progressing

satisfactorily, provide the Board with confidence for the Group's

performance going forward."

Chief Executive's Statement

Admission to AIM

Watkin Jones plc was admitted to trading on AIM, a market

operated by the London Stock Exchange, on 23 March 2016, following

a successful IPO process which valued the Group at GBP255 million

on Admission.

It is pleasing to report that no significant disruption was

caused to the running of the Group's business during the IPO

process, which is a reflection of the breadth and experience of the

operational management teams in place within the business.

Results for the six months to 31 March 2016

The Board is pleased to report that revenue from continuing

operations has increased by 40.5% to GBP145.9 million for the six

months to 31 March 2016, compared to the same period last year (H1

2015: GBP103.8 million). Operating profit before exceptional IPO

costs has increased by 83.5% to GBP17.0 million (H1 2015: GBP9.3

million).

The growth in revenue reflects an underlying increase in the

value of student accommodation projects in development, combined

with excellent progress in the construction of the nine

developments in build for completion in the current financial year.

In addition, Group revenues have benefitted from higher sales of

residential properties and from the sale of commercial property

that was in inventory at the start of the period.

The overall gross margin for the period was in line with

management expectations at 16.1%, compared to 14.7% for the

equivalent period last year, reflecting the Group's progressive

shift away from lower margin contracting work towards higher margin

own development opportunities.

Overhead costs for the period amounted to GBP6.5 million,

compared to GBP6.0 million for H1 2015. This is a modest increase

given the higher operating activity for the period, with the

underlying overhead structure for the business substantially

unchanged.

Costs associated with the IPO include transaction related fees

and commissions amounting to GBP6.5 million. In addition, the

pre-IPO reorganisation referred to in the Group's Admission

Document resulted in a net cost to the Group of GBP20.1 million

relating to settling the various share based management incentive

arrangements that triggered on completion of the IPO. These items

have been charged as an operating exceptional cost.

After accounting for the exceptional IPO costs and net finance

costs of GBP0.3 million, the Group has reported a loss before tax

for the period of GBP9.9 million (H1 2015 GBP9.0 million profit).

Excluding the exceptional IPO costs, the adjusted profit before tax

for the period was GBP16.7 million.

Adjusted basic earnings per share for continuing operations,

excluding the exceptional IPO costs, was 5.2 pence for the period,

an increase of 87% on the like for like calculated figure of 2.8

pence for the same period last year.

Segmental review

Student accommodation development

Revenues from student accommodation development for the period

amounted to GBP122.6 million, an increase of 26% on the comparative

period last year (H1 2015: GBP97.3 million).

The gross margin for the period on student accommodation

developments amounted to 17.9%, compared to 14.8% for H1 2015. This

significant improvement reflects the progressive move to own

development projects away from lower margin contracting

opportunities. The margin in the second half is expected to

strengthen further as the contribution from higher margin

developments increases.

The student accommodation pipeline is robust. All developments

for completion in the current financial year are forward sold and

there is only one development for completion in FY 2017 remaining

to be sold, which is currently in legal negotiations. All

developments for completion in FY 2017 have planning consents and

all development sites for FY 2018 have been secured. Five of these

already have planning consents and the remainder are progressing

satisfactorily through the planning process.

In all, the Group currently has 31 development sites in the

pipeline, representing in excess of 11,300 beds and with an

appraised total development value in excess of GBP850 million. Of

these, 27 are for delivery by FY 2018 and four are for delivery in

FY 2019 and beyond. A number of other sites are under offer with a

view to building up the secured pipeline for FY 2019.

Since 1 October 2015, six development sites have been forward

sold (1,660 beds) and three are in legal negotiations (1,234 beds),

with a total development value in excess of GBP200 million.

Watkin Jones has also been successful in continuing to secure

planning consents, with nine planning consents being achieved since

1 October 2015 (3,478 beds) and of these, five planning consents

have been achieved since the Group was admitted to AIM (1,733

beds).

The Group's development sites are geographically spread across

the UK and the operating divisions responsible for building the

schemes are organised on this basis. The steps taken to negotiate

national procurement terms with key sub-contractors and to

standardise development layouts is continuing to ensure that build

costs are kept under control.

Student accommodation management

Student accommodation management services are provided by Fresh

Student Living Limited ('Fresh'), which was acquired by the Group

on 25 February 2016 for a consideration of GBP15.0 million. Fresh

is a working capital light business and the consideration paid was

largely attributable to the value of intangible assets. Fresh has

been successfully integrated into the Group.

Fresh provides ongoing student letting and operational

management services for a variety of clients under contracts which

are typically for between three and seven years, although some are

for longer. Fresh also provides consultancy and mobilisation

services to clients for new schemes which are in development. This

is a key part of the complete development and management solution

which Watkin Jones is able to offer to its clients.

As of 31 March 2016, Fresh was contracted to manage 8,310 beds

across 32 schemes, with an annual management fee income of GBP2.3

million. By FY 2020, Fresh is currently contracted to manage 17,924

beds across 59 schemes.

For the one month period post-acquisition, Fresh contributed

revenue of GBP0.4 million and a gross margin of GBP0.26 million. On

a like for like basis, Fresh' revenues for the six months to 31

March 2016 amounted to GBP2.2 million, compared to GBP1.2 million

for the comparative period last year. The gross margin achieved is

approximately 65%.

Residential development

In the six months to 31 March 2016, the residential development

business achieved 79 sales completions, compared to 26 for the same

period last year, and generated revenues of GBP16.4 million (H1

2015: GBP6.4 million).

The residential business develops the full range of private

residential property, from starter homes to larger executive

properties and apartment developments. Traditionally, the

division's activities have been focused on the North Wales and

North West region, as well as providing the residential element of

mixed use planning consents. Going forward the division will also

be responsible for the Group's developments in the Private Rented

Sector ('PRS'), which the Board sees as a key part of the Group's

future growth strategy. The division is currently undertaking its

first purpose built PRS development in Leeds, which is scheduled

for completion in FY 2017.

The gross margin for the residential business was relatively

modest at 7.4% for the period (H1 2015: 13.1%), but this is

suppressed by the fact that the division achieved a key objective

in the period, which was to complete the sale of apartments at

Gorse Stacks in Chester and the ongoing sale of homes at the canal

marina development at Droylsden, Manchester. These are legacy

development sites for which the sales are at nil margin, but

importantly generate cash from brought forward inventory. Sales

from these two developments in the period totalled GBP9.8 million.

The gross margin for the residential business will continue to

strengthen as more profitable developments come on stream.

Dividend

The Board proposes a maiden interim dividend for the period of

1.33 pence per share. This is in line with the guidance provided in

the Group's Admission Document, which indicated that the Board

intend to make an interim and final dividend payment for each

financial year, split as to one third for the interim payment and

two thirds for the final payment, with a total dividend of 4.0

pence per Ordinary Share being paid for the year ending 30

September 2016. This is also in line with the Board's stated

intention at IPO, giving an initial dividend yield of 6%,

calculated by reference to the Placing Price of GBP1 per Ordinary

Share, and is an enhanced dividend equal to two thirds of the full

year equivalent, taking into account that the Admission took place

near the end of the first half year to 31 March 2016.

It is proposed that the maiden interim dividend will be paid on

30 June 2016 to shareholders on the register at the close of

business on 17 June 2016. The shares will go ex-dividend on 16 June

2016.

Balance sheet and borrowings

The Group had net cash at 31 March 2016 of GBP15.4 million,

comprising cash of GBP32.6 million less borrowings of GBP17.2

million. This compares favourably to the guidance provided at the

time of the IPO, which indicated that net cash at Admission would

be at least GBP10 million. The Group's net cash position has

increased by GBP19.3 million compared to 31 March 2015, even after

absorbing the exceptional costs of GBP26.6 million associated with

the IPO, the GBP15 million cost of acquiring Fresh and a GBP10

million dividend paid to the existing shareholders prior to

Admission. The strong cash generation reflects the strength of the

Group's forward sale business model for its student accommodation

developments. In addition, progress has continued to be made in

releasing cash from inventory and work in progress, particularly

associated with legacy residential and commercial developments.

Inventory and work in progress has been reduced by GBP29.7 million

since 30 September 2015.

Prior to the IPO, the Group successfully concluded with HSBC a

new GBP40 million five year revolving credit facility agreement

('RCF') and a GBP10 million working capital facility. The RCF is

available to support the Group's ongoing land procurement and

development opportunities and will be used for strategic land

acquisitions or to fund discrete developments activities where

required alongside the forward sale funding model. As at 31 March

2016 the RCF and working capital facility were unutilised.

Outlook

The Group's student accommodation development business remains

positively underpinned by the fundamentals of the student

accommodation market and the forward sale model provides the Group

with excellent visibility as to future earnings and cash flow. The

current student accommodation pipeline of 31 development sites

underpins the business outlook to FY 2018, with 16 of the 17

developments for delivery by the end of FY 2017 already forward

sold.

Watkin Jones is at advanced positions regarding the acquisition

of a number of site opportunities that will be for delivery in FY

2019 and beyond. The Group also has several major schemes

progressing through planning. The student accommodation management

business through Fresh is expected to start making an increasing

contribution to the Group's results, with the annuity nature of its

revenue stream and high visibility on the growth of its contracted

management income providing a very positive addition.

An opportunity exists for the Group's residential business, with

the potential for Watkin Jones to apply its student accommodation

model to the development and management of purpose built PRS

schemes. The Group is currently involved in negotiations regarding

a number of PRS opportunities. Five Nine Living Limited, the

Group's recently established PRS management business, is already

receiving significant levels of interest as a management company

for existing PRS developments, given its affiliation to Fresh.

The strong set of results for the first six months of the year,

coupled with the status of the forward sold student accommodation

pipeline and the fact that all developments for this year's

delivery are progressing satisfactorily, provide the Board with

confidence for the Group's performance going forward.

Mark Watkin Jones

Chief Executive Officer

8 June 2016

For further information:

Watkin Jones plc

Mark Watkin Jones, Chief Executive Tel: +44 (0) 1248 362 516

Officer

Philip Byrom, Chief Financial www.watkinjonesplc.com

Officer

Zeus Capital Limited (Nominated Adviser

& Joint Broker)

Corporate Finance

Dan Bate / Nick Cowles / Jamie Peel Tel: +44 (0) 161 831 1512

Corporate Broking Tel: +44 (0) 20 3829 5000

Dominic King / Benjamin Robertson www.zeuscapital.co.uk

Peel Hunt LLP (Joint Broker) Tel: +44 (0) 20 7418 8900

Mike Bell / Matthew Brooke-Hitching www.peelhunt.com

Media enquiries:

Buchanan

Henry Harrison-Topham / Richard Oldworth Tel: +44 (0) 20 7466 5000

/ Stephanie Watson

watkinjones@buchanan.uk.com www.buchanan.uk.com

Notes to Editors

Watkin Jones is a leading UK developer and constructor of multi

occupancy property assets, with a focus on the student

accommodation sector. The Group has strong relationships with

institutional investors, and a good reputation for successful,

on-time-delivery of high quality developments. Since 1999, Watkin

Jones has delivered over 28,000 student beds across 88 sites,

making it a key player and leader in the UK purpose built student

accommodation market. In addition, Watkin Jones has been

responsible for over 50 residential developments, ranging from

starter homes to executive housing and apartments.

The Group's competitive advantage lies in its experienced

management team and business model, which enables it to offer an

end to end solution for investors, delivered entirely in-house with

minimal reliance on third parties, across the entire life cycle of

an asset. Key components of the business model are:

-- Site identification - extensive experience of site

identification and acquisition facilitates high quality sites being

acquired;

-- Planning consents - in depth knowledge and experience of the

planning consent process specific to this type of asset facilitates

high success rates on planning applications;

-- In-house construction and delivery - in-house construction

expertise, management and delivery limits reliance on third parties

and, together with favourable contractual relationships with key

suppliers, enhances control of cost;

-- Funding structure - forward sale model reduces risk for

Watkin Jones and provides security and visibility of the asset

pipeline for investors. The Group has strong relationships with

blue chip investors, including a number that are repeat investors

in Watkin Jones developments; and

-- Asset management - dedicated property management division

provides a continued service solution to investors post development

completion and completes the 'end to end' business model.

Consolidated Statement of Comprehensive Income

for the six month period ended 31 March 2016 (unaudited)

12 months to

6 months to 6 months to 30 September

31 March 2016 31 March 2015 2015

Notes GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 145,888 103,815 244,246

Cost of sales (122,359) (88,533) (200,198)

---------------- ---------------- --------------

Gross profit 23,529 15,282 44,048

Administrative expenses (6,042) (5,309) (10,611)

Distribution costs (464) (697) (981)

---------------- ---------------- --------------

Operating profit before exceptional costs 17,023 9,276 32,456

Operating exceptional costs 6 (26,561) - -

Operating(loss)/ profit (9,538) 9,276 32,456

Share of profit in joint ventures - - 1,165

Finance income 127 35 95

Finance costs (466) (294) (810)

---------------- ---------------- --------------

(Loss)/Profit before tax from continuing operations (9,877) 9,017 32,906

Income tax expense 7 (3,348) (1,943) (6,296)

---------------- ---------------- --------------

(Loss)/Profit for the period from continuing operations (13,225) 7,074 26,610

---------------- ---------------- --------------

Discontinued operations

Profit/(Loss) after tax for the period from discontinued

operations 86 (1,298) (4,433)

---------------- ---------------- --------------

(Loss)/Profit for the period attributable to ordinary

equity holders of the parent (13,139) 5,776 22,177

================ ================ ==============

Other comprehensive income

Net gain on available-for-sale financial assets 87 70 112

---------------- ---------------- --------------

Total comprehensive (loss)/ income for the period

attributable to ordinary equity holders

of the parent (13,052) 5,846 22,289

================ ================ ==============

Earnings per share for the period attributable to Pence Pence Pence

ordinary equity holders of the parent (restated) (restated)

Basic earnings per share 8 (5.152) 2.265 8.696

================ ================ ==============

Basic earnings per share for continuing operations 8 (5.186) 2.774 10.434

================ ================ ==============

Adjusted basic earnings per share for continuing

operations (excluding operating exceptional

costs) 8 5.201 2.774 10.434

================ ================ ==============

Consolidated Statement of Financial Position

as at 31 March 2016 (unaudited)

31 March 31 March 30 September

2016 2015 2015

Notes GBP'000 GBP'000 GBP'000

Non-Current assets

Intangible assets 10 15,572 3,193 -

Property, plant and equipment 4,648 5,008 4,807

Investment in joint ventures 5,077 8,394 7,220

Deferred tax asset 1,369 684 1,514

Other financial assets 2,505 1,116 1,169

29,171 18,395 14,710

----------- --------- ---------------

Current assets

Inventory and work in progress 90,022 114,361 119,683

Trade and other receivables 20,761 35,305 20,553

Other financial assets - 52 -

Cash at bank and in hand 12 32,604 17,200 59,270

143,387 166,918 199,506

----------- --------- ---------------

Total assets 172,558 185,313 214,216

=========== ========= ===============

Current liabilities

Trade and other payables (59,421) (58,405) (69,696)

Provisions (339) (388) (339)

Other financial liabilities (56) - (47)

Interest-bearing loans and borrowings (16,329) (9,241) (9,759)

Current tax liabilities (3,165) (3,717) (7,077)

(79,310) (71,751) (86,918)

----------- --------- ---------------

Non-Current liabilities

Interest-bearing loans and borrowings (912) (11,935) (10,424)

Deferred tax liabilities (1,463) (355) (396)

Provisions (2,124) (2,518) (2,124)

Other non-current liabilities - (2,147) (1,304)

(4,499) (16,955) (14,248)

----------- --------- -------------

Total Liabilities (83,809) (88,706) (101,166)

=========== ========= =============

Net assets 88,749 96,607 113,050

=========== ========= =============

Equity

Share capital 2,550 1,000 1,000

Share premium 84,612 6,300 6,300

Merger reserve (75,383) - -

Available-for-sale reserve 240 111 153

Retained earnings 76,730 89,196 105,597

Total Equity 88,749 96,607 113,050

=========== ========= ===============

Consolidated Statement of Changes In Equity

for the six month period ended 31 March 2016 (unaudited)

Share Merger Available-for-sale

capital Share premium reserve reserve Retained earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

30 September 2014 1,000 6,300 - 41 83,420 90,761

Profit for the period - - - - 5,776 5,776

Other comprehensive

income - - - 70 - 70

Balance at 31 March 2015 1,000 6,300 - 111 89,196 96,607

======== ============= ========= ========================= ================= =========

Profit for the period - - - - 16,401 16,401

Other comprehensive

income - - - 42 - 42

Balance at 30 September

2015 1,000 6,300 - 153 105,597 113,050

======== ============= ========= ========================= ================= =========

Dividend paid prior to

IPO (note 9) - - - - (10,000) (10,000)

Share restructuring prior

to IPO 1,695 167,864 - - - 169,559

Capital reduction prior

to IPO - (167,864) - - 167,864 -

Issue of shares on IPO 855 84,586 - - - 85,441

Issue of shares to

employees of Fresh

Student Living Limited - 26 - - - 26

Merger accounting on

aggregation of Watkin

Jones plc and Watkin

Jones Group Limited (1,000) (6,300) (75,383) - (173,592) (256,275)

Loss for the period - - - - (13,139) (13,139)

Other comprehensive

income - - - 87 - 87

Balance at 31 March 2016 2,550 84,612 (75,383) 240 76,730 88,749

======== ============= ========= ========================= ================= =========

Consolidated Statement of Cash Flows

for the six month period ended 31 March 2016 (unaudited)

12 months

6 months to 6 months to to

31 March 31 March 30 September

2016 2015 2015

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash generated from/ (used

in) operations 11 6,907 (14,161) 32,008

Interest received 127 35 95

Interest paid (382) (294) (875)

Interest element of finance

lease rental payments (12) (13) (20)

Tax paid (6,911) (927) (2,777)

----------- ----------- -------------

Net cash inflow/(outflow)

from operating activities (271) (15,360) 28,431

=========== =========== =============

Cash flows from investing

activities

Movement in loans from

joint ventures - - 1,339

Acquisition of property,

plant and equipment (5) - (50)

Proceeds on disposal of

property, plant and equipment 1 31 70

Acquisition of Fresh Student

Living Limited (15,075) - -

Cash in Fresh Student Living

Limited at acquisition 579 - -

Loan repayment from joint

venture 2,143 - -

Purchase of other financial

assets (1,024) (78) (378)

Net cash (outflow)/inflow

from investing activities (13,381) (47) 981

=========== =========== =============

Cash flows from financing

activities

Dividend paid (10,000) - -

Issue of Shares prior to

IPO 88,151 - -

Issue of Shares on IPO 85,441 - -

Acquisition of shares in

Watkin Jones Group Limited (173,592) - -

Capital element of finance

lease rental payments (180) (203) (393)

Proceeds from borrowings - 7,894 8,940

Repayment of borrowings (2,834) (1,022) (4,627)

----------- ----------- -------------

Net cash (outflow)/inflow

from financing activities (13,014) 6,669 3,920

=========== =========== =============

Net (decrease)/increase

in cash (26,666) (8,738) 33,332

Cash and cash equivalents

at

beginning of the period 59,270 25,938 25,938

----------- ----------- -------------

Cash and cash equivalents

at

end of the period 12 32,604 17,200 59,270

=========== =========== =============

Notes to the consolidated financial information

1. General information

Watkin Jones plc (the 'Company') is a limited company

incorporated in the United Kingdom under the Companies Act 2006

(Registration number 09791105). The Company is domiciled in the

United Kingdom and its registered address is Units 21-22, Llandygai

Industrial Estate, Bangor Gwynedd, LL57 4YH.

The Company was incorporated as HDCO3 Limited on 23 September

2015.

The Company acquired all the issued shares in Watkin Jones Group

Limited on 15 March 2016. This was achieved through a combination

of a share for share exchange over 319,247 shares in Watkin Jones

Group Limited, involving the issue of 81,407,985 ordinary shares in

the Company at an issue price of GBP1 per share, and the completion

of an agreement to purchase the remaining 680,753 shares for an

amount of GBP173,592,015 in cash. The transaction valued Watkin

Jones Group Limited at GBP255,000,000. On the same day the Company

was re-registered as Watkin Jones plc.

On 23 March 2016 the Company completed an Initial Public

Offering by way of a placing of 85,440,493 Ordinary Shares at 100

pence per share and a Vendor Placing of 45,900,100 Ordinary Shares

at 100 pence per share. The Company's shares were admitted to trade

on the Alternative Investment Market ('AIM') of the London Stock

Exchange on 23 March 2016.

The principal activities of the Company and its subsidiaries

(collectively the 'Group') are those of property development and

the management of properties for multiple residential

occupation.

The consolidated interim financial statements of the Group for

the six month period ended 31 March 2016 comprises the Company and

the subsidiaries that were acquired by the Company before the

listing of the Company's shares on AIM. The basis of preparation of

the consolidated interim financial statements is set out in note 2

below.

The financial information for the 6 months ended 31 March 2016

is unaudited. It does not constitute statutory financial statements

within the meaning of Section 434 of the Companies Act 2006. The

consolidated interim financial statements should be read in

conjunction with the financial information for the year ended 30

September 2015 that is presented in the Company's Admission

Document dated 16 March 2016, which has been prepared in accordance

with IFRSs as adopted by the European Union. The report of the

auditors on those financial statements was unqualified, did not

contain an emphasis of matter paragraph and did not contain any

statement under section 434 of the Companies Act 2006.

This report was approved by the directors on 8 June 2016.

2. Basis of preparation

The consolidated interim financial statements of the Group for

the six months ended 31 March 2016 and the comparatives for the six

months ended 31 March 2015 and the 12 months ended 30 September

2015 have been prepared on the basis that Watkin Jones plc was in

existence throughout these periods. The terms of the acquisition of

the shares in Watkin Jones Group Limited were such that the group

reconstruction should be accounted for as a continuation of the

existing group rather than an acquisition. Accordingly the interim

financial statements and all comparative periods have been prepared

on that basis.

The Group has not previously prepared financial statements in

accordance with IFRS but the intention is to transition to IFRS in

the Group's consolidated financial statements for the period to 30

September 2016.

The interim financial statements have been presented as of 31

March 2016 and 30 September 2015 and for the periods then ended to

provide an indication of the comparative information that will be

included in the Group's consolidated financial statements and

interim financial statements for the periods ended 30 September

2016 and 31 March 2017 assuming that the Group adopts IFRS with a

date of transition of 1 October 2014. The interim financial

statements for the period ended 31 March 2015 have been presented

to provide comparative information for the interim financial

statements for the period ended 31 March 2016 and have been

prepared on the same basis. The financial information has been

prepared based on IFRS that is expected to exist at the date on

which the Group prepares its 30 September 2016 financial

statements. To the extent that IFRS at 30 September 2016 does not

reflect the assumptions made in preparing the financial statements,

those financial statements may be subject to change.

The interim financial statements have been prepared on a going

concern basis and under the historical cost convention.

The interim financial statements have been presented in pounds

sterling and all values are rounded to the nearest thousand

(GBP'000), except when otherwise indicated.

The preparation of financial information in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual events may ultimately differ from those

estimates.

The interim financial statements do not include all financial

risk information and disclosures required in the annual financial

statements and they should be read in conjunction with the

financial information that is presented in the Company's Admission

Document dated 16 March 2016. There has been no significant change

in any risk management policies since the date of the Admission

Document.

3. Accounting policies

With the exception of the accounting policy for intangible

assets other than goodwill, which has been adopted for the first

time in the preparation of these interim financial statements and

is set out below, the accounting policies used in preparing these

interim financial statements are the same as those set out and used

in preparing the financial information that is presented in the

Company's Admission Document dated 16 March 2016.

3.1 Other intangible assets

Intangible assets other than goodwill are stated at cost less

accumulated amortisation and impairment losses. Amortisation is

charged to the consolidated statement of comprehensive income on a

straight-line basis over the estimated useful lives of the

intangible assets as follows:-

Customer relationships - 11 years

Brand - 10 years

4. Acquisition of Fresh Student Living Limited

On 25 February 2016 Founded Living Limited, a subsidiary of

Watkin Jones Group Limited, acquired the 750 Ordinary Shares in

Fresh Student Living Limited ("Fresh") held by Mark and Glyn Watkin

Jones, who were both directors of and shareholders in Watkin Jones

Group Limited, for a cash consideration of GBP11,835,512. The

shares acquired represented 77.48% of the issued shares of the

company.

On 23 March 2016, on satisfaction of the condition of Admission

to AIM of Watkin Jones plc, Founded Living Limited acquired the 218

A Ordinary Shares held by various directors and senior managers of

Fresh, for a cash consideration of GBP3,164,488. The shares

acquired represented the remaining issued shares of the company. As

a condition of the acquisition of these shares, the vendor

shareholders were required to invest GBP1,397,609, being 50% of the

net of tax proceeds received, in shares in Watkin Jones plc as part

of the IPO.

The total consideration paid for the shares in Fresh was

therefore GBP15,000,000, plus stamp duty of GBP75,010. Fresh is

engaged in the management of purpose built student accommodation.

Its services include the letting and operational management of

properties, for which the company is engaged under a management

agreement and receives a management fee, as well as consultancy and

mobilisation services provided during the development phase of a

student property.

The resulting goodwill of GBP9,516,106 arising on the

acquisition has been capitalised and is subject to an annual

impairment review by management. Goodwill is attributed to Fresh's

knowledge and expertise in the letting and management of purpose

built student accommodation and in the synergy with the Group's

student accommodation development business.

The book and fair value of the net assets acquired in respect of

Fresh were as follows:

Book Fair value Fair

value adjustment value

GBP'000 GBP'000 GBP'000

Non-Current assets

Intangible assets

Customer relationships - 5,604 5,604

Brand - 499 499

Goodwill - 9,516 9,516

Property, plant and equipment 90 - 90

Deferred tax asset 261 - 261

Other financial assets 150 54 204

501 15,673 16,174

--------- ------------ ----------

Current assets

Trade and other receivables 1,262 - 1,262

Cash at bank and in hand 579 - 579

1,841 - 1,841

--------- ------------ ----------

Total assets 2,342 15,673 18,015

========= ============ ==========

Current liabilities

Trade and other payables (1,830) (10) (1,840)

(1,830) (10) (1,840)

--------- ------------ ----------

Non-Current liabilities

Deferred tax liabilities - (1,100) (1,100)

- (1,100) (1,100)

--------- ------------ ----------

Total Liabilities (1,830) (1,110) (2,940)

========= ============ ==========

Net assets 512 14,563 15,075

========= ============ ==========

In the period since acquisition, Fresh contributed revenue of

GBP407,000 and an operating profit of GBP53,000.

5. Segmental reporting

The Group has identified three segments for which it reports

under IFRS 8 'Operating segments'. The following represents the

segments that the Group operates in:

a. Student Accommodation Development - Purpose built student accommodation developments.

b. Residential Development - The development of traditional

residential and private rented sector property.

c. Student Accommodation Management - The management of student

accommodation property. This segment was established following the

acquisition of Fresh Student Living Limited on 25 February

2016.

Corporate - central revenue and costs not solely attributable to

any one division.

All revenues arise in the UK.

Performance is measured by the Board based on gross profit as

reported in the management accounts.

6 months ended Student Student

31 March 2016 Accommodation Residential Accommodation

(unaudited) Development Development Management Corporate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental revenue 122,587 16,398 407 6,496 145,888

Segmental gross profit 21,971 1,217 261 80 23,529

Administration expenses - - (208) (5,834) (6,042)

Distribution costs - - - (464) (464)

Operating exceptional costs - - - (26,561) (26,561)

Finance income - - - 127 127

Finance costs - - - (466) (466)

--------------- ------------- --------------- ---------- ---------

Profit/(loss) before tax 21,971 1,217 53 (33,118) (9,877)

Taxation - - - (3,348) (3,348)

--------------- ------------- --------------- ---------- ---------

Profit/(loss) for the period 21,971 1,217 53 (36,466) (13,225)

=============== ============= =============== ========== =========

Inventory and work in progress 25,060 56,618 - 5,303 86,981

--------------- ------------- --------------- ---------- ---------

Inventory and work in progress - discontinued - - - - 3,041

--------------- ------------- --------------- ---------- ---------

Total inventory and work in progress - - - - 90,022

--------------- ------------- --------------- ---------- ---------

6 months ended Student

31 March 2015 Student Accommodation Residential Accommodation

(unaudited) Development Development Management Corporate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental revenue 97,345 6,372 - 98 103,815

Segmental gross profit 14,436 837 - 9 15,282

Administration expenses - - - (5,309) (5,309)

Distribution costs - - - (697) (697)

Finance income - - - 35 35

Finance costs - - - (294) (294)

---------------------- ------------- --------------- ---------- --------

Profit/(loss) before tax 14,436 837 - (6,256) 9,017

Taxation - - - (1,943) (1,943)

---------------------- ------------- --------------- ---------- --------

Profit/(loss) for the period 14,436 837 - (8,199) 7,074

====================== ============= =============== ========== ========

Inventory and work in progress 31,887 53,473 - 5,144 90,504

---------------------- ------------- --------------- ---------- --------

Inventory and work in progress -

discontinued - - - - 23,857

---------------------- ------------- --------------- ---------- --------

Total inventory and work in progress - - - - 114,361

---------------------- ------------- --------------- ---------- --------

6. Operating exceptional costs

12 months to

6 months to 6 months to 30 September

31 March 2016 31 March 2015 2015

GBP'000 GBP'000 GBP'000

Exceptional IPO costs

IPO transaction costs 6,500 - -

Management incentive payments 20,061 - -

---------------- ---------------- ---------------

Total exceptional IPO costs 26,561 - -

================ ================ ===============

The charge for management incentive payments comprises amounts

payable to certain senior management of Watkin Jones Group Limited

in connection with various share based incentive arrangements which

fell due on the Admission to AIM of Watkin Jones plc. The amount

comprises a total charge of GBP21,735,400, plus stamp duty costs of

GBP98,440, less an amount previously provided of GBP1,773,200. Of

the total incentive payments made, management agreed to invest

GBP13,942,984 in shares in Watkin Jones plc as part of the IPO.

7. Income taxes

The tax expense for the period has been calculated by applying

the estimated tax rate for the financial year ending 30 September

2016 of 20.3% to the profit before exceptional IPO costs. The tax

credit on the exceptional IPO costs has been restricted to 1.6% as

the majority of these costs are considered not deductible for tax

purposes. An adjustment to the tax charge has been made for known

deferred tax movements in the period.

8. Earnings per share

Basic earnings per share amounts are calculated by dividing the

net profit or loss for the year attributable to ordinary equity

holders of the parent by the weighted average number of ordinary

shares outstanding during the year, except that for the six month

period ended 31 March 2016 and for the prior comparative periods,

the number of shares in issue at 31 March 2016 has been used in the

calculations in order to give the basic earnings per share

attributable to ordinary equity holders of the parent following the

IPO.

There is no difference between basic earnings per share and

diluted earnings per share as there are no dilutive share option

arrangements in place at 31 March 2016.

The following table reflects the income and share data used in

the basic EPS computations:

Period Period Year

ended 31 ended 31 ended 30

March March September

2016 2015 2015

GBP'000 GBP'000 GBP'000

(Loss)/Profit attributable to ordinary equity holders of the parent (13,139) 5,776 22,177

(Loss)/Profit from continuing operations attributable to ordinary equity

holders of the parent (13,225) 7,074 26,610

Adjusted profit from continuing operations attributable to ordinary

equity holders of the

parent (excluding operating exceptional costs) 13,264 7,074 26,610

(Restated) (Restated)

Weighted average number of ordinary shares for basic earnings per share 255,026,325 255,026,325 255,026,325

Pence Pence Pence

(Restated) (Restated)

Basic earnings per share

Basic (loss)/ profit for the period attributable to ordinary equity

holders of the parent (5.152) 2.265 8.696

Basic earnings per share for continuing operations

Basic (loss)/ profit for the period attributable to ordinary equity

holders of the parent (5.186) 2.774 10.434

Adjusted basic earnings per share for continuing operations (excluding

operating exceptional

costs)

Basic profit for the period attributable to ordinary equity holders of

the parent 5.201 2.774 10.434

9. Dividends

An interim dividend of GBP14.689615 per ordinary Share was paid

to the holders of E and F Ordinary Shares in Watkin Jones Group

Limited on 1 March 2016. The total dividend paid amounted to

GBP10,000,000.

10. Intangible assets

Customer

Relationships Brand Goodwill Total

GBP'000 GBP'000 GBP'000 GBP'000

Cost:

As at 1 October

2014 - - 3,193 3,193

As at 31 March

2015 - - 3,193 3,193

=============== ======== ========= ========

As at 1 April

2015 - - 3,193 3,193

Impairment during

the period - - (3,193) (3,193)

--------------- -------- --------- --------

As at 30 September

2015 - - - -

=============== ======== ========= ========

As at 1 October

2015 - - - -

Arising on acquisition

of Fresh Student

Living 5,604 499 9,516 15,619

As at 31 March

2016 5,604 499 9,516 15,619

=============== ======== ========= ========

Amortisation:

As at 1 October

2014 - - - -

As at 31 March

2015 - - - -

=============== ======== ========= ========

As at 1 April

2015 - - - -

As at 30 September

2015 - - - -

=============== ======== ========= ========

As at 1 October

2015 - - - -

Amortisation for

the period (43) (4) - (47)

As at 31 March

2016 (43) (4) - (47)

=============== ======== ========= ========

Net book value:

As at 31 March

2015 - - 3,193 3,193

=============== ======== ========= ========

As at 30 September

2015 - - - -

=============== ======== ========= ========

As at 31 March

2016 5,561 495 9,516 15,572

=============== ======== ========= ========

The impairment during the year ended 30 September 2015 arose in

July 2015 following a review carried out by the Board as a

consequence of the decision to discontinue the activities of the

construction contracting division.

11. Reconciliation of operating profit to net cash flows from operating activities

6 months 6 months Year

ended 31 ended 31 ended 30

March March September

2016 2015 2015

GBP'000 GBP'000 GBP'000

(Loss)/profit before tax

from continuing operations (9,877) 9,017 32,906

Profit/(loss) before tax

from discontinued operations 108 (1,663) (4,753)

--------- --------- ----------

(Loss)/Profit before tax (9,769) 7,354 28,153

Depreciation 253 244 489

Amortisation of intangible

assets 47 - -

Goodwill impairment - - 3,193

Loss/(Profit) on sale of

plant and equipment 2 (9) (40)

Finance income (127) (35) (95)

Finance costs 466 294 810

Share of profit in joint

ventures - - (1,165)

Decrease/(increase) in inventory

and work in progress 29,539 (22,731) (28,026)

Interest capitalised in

development land, inventory

and work in progress 122 28 329

Decrease/(increase) in trade

and other receivables 1,054 (2,822) 13,314

(Decrease)/increase in trade

and other payables (14,680) 3,516 15,489

Provision for property lease

commitment - - (443)

Net cash inflow/(outflow)

from operating activities 6,907 (14,161) 32,008

========= ========= ==========

12. Analysis of net cash

6 months 6 months 12 months

ended 31 ended 31 ended 30

March 2016 March 2015 September 2015

GBP'000 GBP'000 GBP'000

Cash at bank and in hand 32,604 17,200 59,270

Finance leases (358) (728) (538)

Bank loans (16,883) (20,448) (19,645)

----------------- ----------------- ---------------------

Net cash 15,363 (3,976) 39,087

================= ================= =====================

- Ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SSIFUAFMSEEM

(END) Dow Jones Newswires

June 09, 2016 02:00 ET (06:00 GMT)

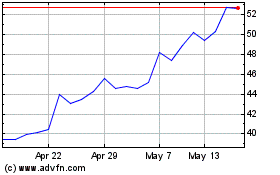

Watkin Jones (LSE:WJG)

Historical Stock Chart

From Jun 2024 to Jul 2024

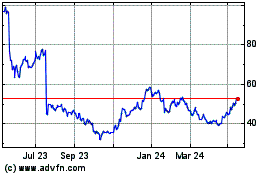

Watkin Jones (LSE:WJG)

Historical Stock Chart

From Jul 2023 to Jul 2024