TIDMVP.

Press Release 5 June 2014

Vp plc

("Vp" or the "Group" or the "Company")

Final Results

Vp plc, the equipment rental specialist, today announces its Final

Results for the year ended 31 March 2014.

Highlights

-- Significant improvement in profit before tax and amortisation by 16% to

GBP20.1 million (2013: GBP17.4 million)

-- Revenues increased 10% to GBP183.1 million (2013: GBP167.0 million)

-- Basic earnings per share pre-amortisation rose 18% to 42.0 pence

-- Return on capital employed improved to 13.5% (2013: 13.3%) maintained

above target threshold of 12% for 10 consecutive years

-- Continued strong cash flow generation with EBITDA increasing to GBP44.3

million (2013: GBP41.0 million)

-- Increase in net debt to GBP53.0 million (2013: GBP45.3 million) after

funding:

-- Capital investment in the fleet of GBP38.2 million

-- Successful GBP4.6 million acquisition of Mr Cropper in September

2013

-- Final dividend proposed of 10.4 pence per share, making a total of 14.0

pence for the full year (2013: 12.25 pence), an increase of 14%

Jeremy Pilkington, Chairman of Vp plc, commented:

"It has been another highly successful year for the Group with

significant progress in revenue, profits, earnings per share and

dividends.

Economic indicators in the UK and mainland Europe now appear more

positive than for some time and all businesses within the Group are

identifying significant opportunities for growth and investment.

We believe that our established financial discipline combined with the

active pursuit of growth opportunities will continue to deliver quality

returns for shareholders.

We look forward to the year ahead with confidence."

- Ends -

Enquiries:

Vp plc

Jeremy Pilkington, Chairman Tel: +44 (0) 1423 533 405

jeremypilkington@vpplc.com

Neil Stothard, Group Managing Director Tel: +44 (0) 1423 533 445

neil.stothard@vpplc.com

Allison Bainbridge, Group Finance Director Tel: +44 (0) 1423 533 445

allison.bainbridge@vpplc.com www.vpplc.com

Media enquiries:

Abchurch Communications

Sarah Hollins / Jamie Hooper / Stephanie Watson Tel: +44 (0) 20 7398 7719

jamie.hooper@abchurch-group.com www.abchurch-group.com

CHAIRMAN'S STATEMENT

I am very pleased to be able to report to shareholders on another

excellent set of results and a year of further progress for the Group.

Profits before tax and amortisation improved 16% to GBP20.1 million

(2013: GBP17.4 million) on revenues up 10% at GBP183.1 million (2013:

GBP167.0 million) with margins increased to 11.0% (2013: 10.4%). Basic

earnings per share pre-amortisation increased by 18% to 42.0 pence per

share.

Return on average capital employed moved ahead to 13.5% (2013: 13.3%).

Return on capital employed has long been a cornerstone key performance

indicator for the Group, guiding our investment and acquisition

decisions and informing longer term strategy. We have an outstanding

track record in this regard, having maintained ROACE above our target

threshold of 12% in each of the last 10 years, even throughout the worst

periods of the recent recession.

The Group continued to generate strong cash flows with EBITDA increasing

to GBP44.3 million (2013: GBP41.0 million). We spent GBP38.2 million on

rental fleet upgrades and renewals, a 70% increase over the prior year,

demonstrating our confidence in the quality of investment opportunities,

plus GBP4.6 million on the acquisition of Mr Cropper in September 2013,

which is now trading very successfully within Groundforce. Net

borrowings rose to GBP53.0 million (2013: GBP45.3 million) representing

a gearing of 49%. All businesses within the Group are identifying

significant opportunities for growth and investment.

Reflecting this excellent set of results, the Board is recommending a

final dividend of 10.4 pence per share, making a total for the year of

14.0 pence per share, an increase of 14%. Subject to shareholders

approval at our Annual General Meeting on 22 July 2014, it is proposed

to pay the final dividend on 8 August 2014 to members registered as of

11 July 2014.

Economic indicators in the UK and mainland Europe now appear more stable

and positive than they have been for several years and it does not now

seem unreasonable to assume that we will be operating within a more

benign economic environment for the foreseeable future.

During the year, the Board conducted a review of Board effectiveness.

The review confirmed that high standards of governance were generally

being met but we have implemented certain specific recommendations and

remain alert to opportunities for further improvement.

Our employees and their dedication to the business is our one truly

unique distinguishing feature and their longevity of service is one of

our greatest strengths. Fully 50% of our employees have more than 5

years' service and 25% have more than 10 years which is a remarkable

record. There is no substitute for this deep, institutional experience

and memory in terms of delivering outstanding service excellence to our

customers.

On behalf of our shareholders and the Board, it is my pleasure to

recognise the contribution of all employees, in the UK, Europe and

further afield, to these excellent results.

Jeremy Pilkington

Chairman

5 June 2014

BUSINESS REVIEW

Overview

Vp plc is a specialist rental business with six market leading divisions

operating in the UK and overseas. Our objective is to deliver

sustainable, quality returns by providing products and services to a

diverse range of end markets. These include rail, transmission, water,

construction, civil engineering, housebuilding and oil and gas.

Year ended Year ended

31 March 2014 31 March 2013

Revenue GBP 183.1 million GBP 167.0 million

Operating profit before amortisation GBP 21.8 million GBP 19.8 million

Operating margin 11.9% 11.9%

Investment in rental fleet GBP 38.2 million GBP 22.5 million

ROACE 13.5% 13.3%

The Group has again made excellent progressthis year, generating

revenues of GBP183.1 million, 10% ahead of prior year. Whilst there was

a small contribution from the mid-year Mr Cropper acquisition, the bulk

of the increase was organic, with all operating divisions progressing

during the year.

Operating profits before amortisation also grew by 10% to GBP21.8

million, and therefore margins were maintained at a healthy 11.9% (2013:

11.9%). Return on average capital employed (ROACE), a key indicator for

the Group, improved to 13.5% (2013: 13.3%), further demonstrating that

the Group is succeeding in both delivering growth whilst maintaining and

improving the quality of returns.

The Group continued to generate strong cash flows with EBITDA increasing

to GBP44.3 million (2013: GBP41.0 million).

The year to 31 March 2014 saw an uplift in investment with rental fleet

capital expenditure increased to GBP38.2 million (2013: GBP22.5

million). Investment in rental fleet is a combination of growth,

replacement and substitution. In addition, as previously reported, the

Group acquired the entire issued share capital of Mr Cropper Ltd in

September 2013 for GBP4.6 million.

As always, disposal of equipment is an important factor with sale

proceeds of GBP8.6 million (2013: GBP9.6 million) generating profit on

disposal of GBP2.9 million (2013: GBP2.6 million).

The market environment for the Group has been largely supportive.

Housebuilding, infrastructure, water (AMP5) and transmission markets

have continued to generate good demand throughout the year. Oil and gas

markets have become more positive with improved prospects in liquefied

natural gas (LNG) markets in particular. Overseas growth continues to

be targeted both in the oil and gas sector globally and in transmission,

civil engineering and wind power in mainland Europe. The UK general

construction market remains a future opportunity as recovery improves.

Whilst we are expectant of a modest rate of improvement in construction,

the trend is positive and the Group is well positioned to benefit from

this recovery as it happens.

The Group's strategy to support diverse markets both in the UK and

overseas continues to deliver results. The strong growth in earnings

during the year, yet again underlines the benefit and relevance of our

business model, which is delivering genuine shareholder value over the

longer term.

GROUNDFORCE

Excavation support systems, specialist piling solutions and trenchless

technology for the water, gas, civil engineering and construction

industries in the UK and mainland Europe.

Year ended Year ended

31 March 2014 31 March 2013

Revenue GBP42.3 million GBP37.2 million

Operating profit before amortisation GBP7.9 million GBP7.8 million

Investment in rental fleet GBP8.0 million GBP7.3 million

Groundforce delivered another excellent performance with profits of

GBP7.9 million (2013: GBP7.8 million) from revenues up 14% to GBP42.3

million. Whilst margins were reduced, largely due to a change in

business mix, the net result remains of the highest quality.

Demand came from infrastructure projects, large and small, together with

a strong contribution from AMP5. Design led, temporary works solutions,

primarily London centric, also provided strong workflows through the

year. The largest contract was for Crossrail in forming the entrance to

Paddington station. Regional demand was varied, with increased activity

in the South and the North of England compensating for a slower market

in Scotland following completion of a significant contract in the

transmission sector. Overall market share, however, was at least

maintained.

Piletec performed very well, further enhanced by the acquisition of Mr

Cropper in September 2013. Major piling projects were limited in number

but Piletec maintained its share. Mr Cropper was quickly integrated

into the business and subsequent investment in rental fleet and vehicles,

plus the transfer to two new locations, has helped prepare the ground

for further growth.

Progress in Ireland was limited, but positive, against a subdued market

backdrop. Other Group products have been introduced during the year

together with the opening of a satellite depot in Lisburn, Northern

Ireland.

The start-up Groundforce business in Germany continues to develop and

whilst still incurring losses, we remain positive about prospects. The

business is centred around hubs in Germany which provide a platform for

supply of traditional products on a regional basis, together with an

infrastructure to undertake major project work across the wider mainland

European market. The major project work is technically challenging but

the business has been successful in achieving success on a number of

high profile contracts.

Capital investment on rental fleet was GBP8.0 million (2013: GBP7.3

million) in support of opportunities largely in the UK but also Europe.

The new financial year holds the prospect of some further progress for

Groundforce as a declining demand from AMP5, now in its 5th year, is

mitigated by ongoing project work in Europe.

UK FORKS

Rough terrain material handling equipment for industry, residential and

general construction.

Year ended Year ended

31 March 2014 31 March 2013

Revenue GBP 16.3 million GBP14.1 million

Operating profit before amortisation GBP 2.5 million GBP2.1 million

Investment in rental fleet GBP 7.0 million GBP0.4 million

The UK Forks division delivered excellent results with profits up 19% to

GBP2.5 million (2013: GBP2.1 million). After a relatively modest

investment in fleet in the prior year, increasing demand from customers

and new contract wins saw fleet capital expenditure grow to GBP7.0

million (2013: GBP0.4 million) in the year. Whilst the level of

investment in fleet has increased, the returns in the business have also

continued to improve. Demand picked up in both core sectors;

housebuilding and construction. The growing appetite for new homes

across the UK acts as a driver to buoyant housebuild activity.

UK Forks remains the market leader in supplying telehandlers to the UK

housing market and customers continue to recognise the value added

benefit of our commitment to high quality customer service and back up.

The division has had a very strong run over the last three years as the

recovery from recessionary conditions has been used as a platform for

profitable growth. The business continues to explore new markets whilst

maintaining strong management of the cost base and the quality of

revenue. The new year has started well and prospects will be helped by

further recovery in the general construction sector.

AIRPAC BUKOM OILFIELD SERVICES

Equipment and service providers to the international oil and gas

exploration and development markets.

Year ended Year ended

31 March 2014 31 March 2013

Revenue GBP 20.2 million GBP17.4 million

Operating profit before amortisation GBP 2.0 million GBP2.0 million

Investment in rental fleet GBP 5.8 million GBP2.1 million

Airpac Bukom revenues grew to GBP20.2 million, 16% ahead of the prior

year. Profits year on year were flat at GBP2.0 million but this

represents a good recovery from the deficit against prior year reported

at the interim stage. Trading has improved in most geographical areas,

with South East Asia, Australia and the Middle East performing

particularly well. In Asia, a number of contract awards were secured in

well testing, with good demand in Indonesia, India and Thailand. In

addition, LNG contracts were secured in support of the construction of

new plants in Australia. This activity involved support in both

Indonesia and Thailand for the fabrication testing and also projects in

Australia on Curtis Island, Queensland. Prospects for further LNG

activity remain positive with more projects expected to come on stream

in the new financial year. The Middle East North Africa (MENA) region

performed well with good ongoing demand in Kurdistan together with new

opportunities in North Africa. The UK North Sea sector remained quiet

with low well test activity and restrictions on rig fabric maintenance

arising from a combination of adverse weather and helicopter issues.

Activity in the Africa region was subdued compared with prior year.

Investment in rental fleet increased to GBP5.8 million as the division

continued to broaden the product offering. The majority of this

expenditure was at the end of the financial year and will only

contribute in the new financial year.

We anticipate further increased capital investment as the business

reacts to opportunities in the well test, rig maintenance and LNG

markets and this should provide a good platform for the business into

the new year.

TORRENT TRACKSIDE

Suppliers of rail infrastructure portable plant and specialist services

to Network Rail, London Underground and their respective contractor

base.

Year ended Year ended

31 March 2014 31 March 2013

Revenue GBP22.3 million GBP21.4 million

Operating profit before amortisation GBP2.8 million GBP2.2 million

Investment in rental fleet GBP2.9 million GBP0.9 million

Torrent Trackside had an excellent year reporting revenues of GBP22.3

million up 4% on prior year and generating profits of GBP2.8 million

(2013: GBP2.2 million).

Investment in the rail sector continued to be significant and as a major

rental provider to that market, Torrent experienced another year of

strong demand. Business levels were high as the control spend period 4

(CP4) completed with the division busy on renewal, project and

maintenance activities. Torrent continued to provide a full range of

services directly to Network Rail on maintenance across the UK rail

network and also to the Network Rail appointed contractors.

The new 5 year control spend period (CP5) relating to track maintenance

and renewal across the UK, will commence in 2014. Network Rail have

recently confirmed the successful bidders for both plain line renewals

and switches and crossings for CP5, and Torrent are well positioned to

deliver both plant and associated services to the successful bidders.

Investment in the fleet increased significantly to GBP2.9 million (2013:

GBP0.9 million) both to refresh the fleet and also in support of new

growth opportunities.

The rail market is well funded, buoyant and challenging. Year on year,

the market rightly demands increased productivity, efficiency gains and

unit price reductions. Torrent's market leadership places it well to

meet those demands whilst continuing to deliver excellence to both the

existing and new customer base.

TPA

Portable roadway systems, primarily to the UK market, but also in

mainland Europe.

Year ended Year ended

31 March 2014 31 March 2013

Revenue GBP15.8 million GBP14.9 million

Operating profit before amortisation GBP1.8 million GBP1.3 million

Investment in rental fleet GBP1.0 million GBP2.4 million

The TPA business had a good year increasing revenues by 6% to GBP15.8

million, but more importantly further improving margins. Operating

profits increased from GBP1.3 million to GBP1.8 million, a 36%

improvement.

Investment in rental fleet was modest at GBP1.0 million (2013: GBP2.4

million) with revenue growth delivered from improved utilisation and

rates.

In the UK, revenue quality improved as the business mix was changed,

moving away from lower margin and seasonal outdoor event activity,

towards the less seasonal transmission and day to day construction and

rail markets. Trading during the winter was also better at what has,

historically, been a quieter time for TPA. The increasing challenge of

complying with HSE (health and safety) and VOSA (vehicle usage)

regulations has also been met and operational efficiencies have been

gained as a result.

The business in Germany had a much improved year with a more consistent

revenue stream from a wider customer base and a busy transmission

sector. The business enjoyed a strong final quarter and enters the new

financial year with good momentum both in the UK and mainland Europe.

HIRE STATION

Small tools and specialist equipment for industry and construction.

Year ended Year ended

31 March 2014 31 March 2013

Revenue GBP66.2 million GBP62.0 million

Operating profit before amortisation GBP4.8 million GBP4.3 million

Investment in rental fleet GBP13.4 million GBP9.4 million

The Hire Station division enjoyed improving markets during the year,

particularly in the second half, and reported revenues of GBP66.2

million, a 7% uplift on prior year. This growth translated into a

profit improvement of 11% to GBP4.8 million for the year. Progress was

made in all three elements: Hire Station tools, ESS Safeforce and MEP.

The tools business, with its strengthened management, made excellent

progress. Whilst enjoying growth, the emphasis has been on operational

improvement and achieving high availability on the most popular

products. The net result has been enhanced levels of service and market

share gains. The business improved its infrastructure with relocations

of certain key branches and selective openings of new locations in the

new financial year. The tool hire business operates in a highly

competitive market, and includes general construction as one of its key

segments.

ESS Safeforce had another year of excellent growth. New locations were

opened in Port Talbot and Exeter and additional capacity added in other

existing locations. Shutdown activity was quieter, but prospects are

improved and a number of contracts have been secured for the new

financial year. The specialist focus on rental and sales of safety,

survey and communications equipment continues to deliver strong results.

MEP, which supplies press fitting and electrofusion equipment, as well

as operating the largest low level access fleet in the UK, delivered

another year of growth. Supporting the M&E (mechanical and electrical)

sector, activities in the year have included the new Southern General

Hospital in Glasgow and Terminal 2 at Heathrow. The maintained drive by

the HSE on site safety will drive best practice and act as a catalyst

for further potential growth for MEP.

Capital investment in the year was healthy at GBP13.4 million (2013:

GBP9.4 million) as the business invested into growth opportunities and

improved product availability.

Within the tool hire market the dynamics continue to change and as

customers become busier and seek to work more safely, availability,

product quality and customer service become ever more important. The

business survived the downturn better than most and is well positioned

to participate in the market recovery, and we foresee another year of

progress.

Prospects

Building on another good year for the Group, we expect further positive

development both in the UK market place but also in our smaller but

growing overseas activities.

The overall scenario for the markets we support remains positive, with

further improvement anticipated in general construction and oil and gas,

tempered by potential temporary, but modest slowdown in sectors which

have been buoyant in recent times such as water and transmission.

Consistency of quality in products, services and people is increasingly

valued by customers who rightly expect a top level service delivery. As

markets recover, we believe that these factors will further enhance the

attractiveness of our specialist service offering.

We enter the new financial year with excellent business momentum from a

strong final quarter and this gives us confidence that Vp remains in a

good position to deliver further progress for shareholders in the coming

year.

Neil Stothard

Group Managing Director

5 June 2014

Consolidated Income Statement

for the year ended 31 March 2014

2014 2013

Note GBP000 GBP000

Revenue 1 183,064 167,034

Cost of sales (133,470) (124,791)

Gross profit 49,594 42,243

Administrative expenses (28,883) (23,377)

Operating profit before amortisation 1 21,831 19,815

Amortisation (1,120) (949)

Operating profit 20,711 18,866

Net financial expense (1,778) (2,464)

Profit before amortisation and taxation 20,053 17,351

Amortisation (1,120) (949)

Profit before taxation 4 18,933 16,402

Taxation 4 (3,238) (3,353)

Net profit for the year 15,695 13,049

Pence Pence

Basic earnings per share 2 39.78 33.62

Diluted earnings per share 2 36.31 30.84

Dividend per share paid and proposed 5 14.00 12.25

Consolidated Statement of Comprehensive Income

for the year ended 31 March 2014

2014 2013

GBP000 GBP000

Profit for the year 15,695 13,049

Other comprehensive income:

Items that will not be reclassified to profit or loss

Remeasurements of defined benefit pension scheme 233 697

Tax on items taken to other comprehensive income (53) (166)

Impact of tax rate change (118) (42)

Foreign exchange translation difference (181) 45

Items that may be subsequently reclassified to profit

or loss

Effective portion of changes in fair value of cash

flow hedges 704 196

Total other comprehensive income 585 730

Total comprehensive income for the year 16,280 13,779

Consolidated Statement of Changes in Equity

for the year ended 31 March 2014

2014 2013

GBP000 GBP000

Total comprehensive income for the year 16,280 13,779

Dividends paid (4,962) (4,437)

Net movement relating to Treasury Shares and shares

held by Vp Employee Trust (8,593) (1,922)

Share option charge in the year 1,735 1,225

Tax movements to equity 2,876 1,258

Impact of tax rate change (274) (42)

Change in Equity 7,062 9,861

Equity at start of year 100,922 91,061

Equity at end of year 107,984 100,922

Consolidated Balance Sheet

as at 31 March 2014

Note 2014 2013

GBP000 GBP000

Non-current assets

Property, plant and equipment 124,834 110,577

Intangible assets 41,351 39,279

Employee benefits 689 80

Total non-current assets 166,874 149,936

Current assets

Inventories 5,352 5,679

Trade and other receivables 38,356 33,256

Cash and cash equivalents 3 8,978 8,712

Total current assets 52,686 47,647

Total assets 219,560 197,583

Current liabilities

Interest bearing loans and borrowings 3 (17) (24,000)

Income tax payable (632) (1,539)

Trade and other payables (44,396) (34,838)

Total current liabilities (45,045) (60,377)

Non-current liabilities

Interest bearing loans and borrowings 3 (62,000) (30,000)

Deferred tax liabilities (4,531) (6,284)

Total non-current liabilities (66,531) (36,284)

Total liabilities (111,576) (96,661)

Net assets 107,984 100,922

Equity

Issued share capital 2,008 2,008

Capital redemption reserve 301 301

Share premium account 16,192 16,192

Hedging reserve (90) (794)

Retained earnings 89,546 83,188

Total equity attributable to equity holders of the

parent 107,957 100,895

Non-controlling interests 27 27

Total equity 107,984 100,922

Consolidated Statement of Cash Flows

for the year ended 31 March 2014

Note 2014 2013

GBP000 GBP000

Cash flow from operating activities

Profit before taxation 18,933 16,402

Pension fund contributions in excess of service cost (376) (429)

Share based payment charge 1,735 1,225

Depreciation 1 22,507 21,173

Amortisation 1 1,120 949

Financial expense 1,790 2,484

Financial income (12) (20)

Profit on sale of property, plant and equipment (2,862) (2,569)

Operating cash flow before changes in working

capital 42,835 39,215

Decrease/(increase) in inventories 364 (796)

(Increase)/decrease in trade and other receivables (3,525) 1,741

Increase/(decrease) in trade and other payables 7,581 (401)

Cash generated from operations 47,255 39,759

Interest paid (1,848) (2,504)

Interest element of finance lease rental payments (5) -

Interest received 12 20

Income tax paid (3,949) (3,809)

Net cash flow from operating activities 41,465 33,466

Cash flow from investing activities

Disposal of property, plant and equipment 8,554 9,609

Purchase of property, plant and equipment (39,535) (29,635)

Acquisition of businesses and subsidiaries (net of

cash and overdrafts) (4,498) (4,117)

Net cash flow from investing activities (35,479) (24,143)

Cash flow from financing activities

Purchase of own shares by Employee Trust and Company (8,593) (9,767)

Repayment of borrowings (54,000) (5,000)

Proceeds from new loans 62,000 13,000

Capital element of hire purchase/finance lease

agreements (36) (1)

Dividends paid (4,962) (4,437)

Net cash flow used in financing activities (5,591) (6,205)

Increase in cash and cash equivalents 395 3,118

Effect of exchange rate fluctuations on cash held (129) 12

Cash and cash equivalents at the beginning of the

year 8,712 5,582

Cash and cash equivalents at the end of the year 8,978 8,712

NOTES

The final results have been prepared on the basis of the accounting

policies which are set out in Vp plc's annual report and accounts for

the year ended 31 March 2014. The accounting policies applied are in

line with those applied in the annual financial statements for the year

ended 31 March 2013 with the exception of the adoption of new standards

applicable in the year, being IAS1 (as amended), IFRS 13 and IAS19 (as

amended). None of these has had a material effect on the accounts.

EU Law (IAS Regulation EC1606/2002) requires that the consolidated

accounts of the Group for the year ended 31 March 2014 be prepared in

accordance with International Financial Reporting Standards ("IFRSs") as

adopted for use in the EU ('adopted IFRSs').

Whilst the financial information included in this preliminary

announcement has been computed in accordance with adopted IFRSs, this

announcement does not itself contain sufficient information to comply

with IFRSs. The Company expects to publish full financial statements in

June 2014.

The financial information set out above does not constitute the

Company's statutory accounts for the year ended 31 March 2014 or 2013.

Statutory accounts for 31 March 2013 have been delivered to the

registrar of companies, and those for 31 March 2014 will be delivered in

due course. The auditor has reported on those accounts; the reports

were (i) unqualified, (ii) did not include a reference to any matters to

which the auditor drew attention by way of emphasis without qualifying

the report and (iii) did not contain a statement under section 498 (2)

or (3) of the Companies Act 2006 in respect of the accounts for 31 March

2014 or 31 March 2013.

The financial statements were approved by the board of directors on 5

June 2014.

1. Business Segments

Depreciation and Operating profit

Revenue amortisation before amortisation

2014 2013 2014 2013 2014 2013

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

UK Forks 16,301 14,061 2,841 2,629 2,482 2,099

Groundforce 42,298 37,165 4,600 4,015 7,917 7,833

Airpac Bukom 20,201 17,450 3,466 3,458 2,035 2,015

Hire Station 66,174 62,017 9,192 8,454 4,798 4,323

TPA 15,786 14,897 1,582 1,540 1,779 1,310

Torrent

Trackside 22,304 21,444 1,534 1,655 2,820 2,235

Group - - 412 371 - -

Total 183,064 167,034 23,627 22,122 21,831 19,815

2. Earnings Per Share

The calculation of basic earnings per share of 39.78 pence (2013: 33.62

pence) is based on the profit attributable to equity holders of the

parent of GBP15,695,000 (2013: GBP13,049,000) and a weighted average

number of ordinary shares outstanding during the year ended 31 March

2014 of 39,451,000 (2013: 38,818,000), calculated as follows:

2014 2013

Shares Shares

000's 000's

Issued ordinary shares 40,154 40,154

Effect of own shares held (703) (1,336)

Weighted average number of ordinary shares 39,451 38,818

Basic earnings per share before the amortisation of intangibles was

41.97 pence (2013: 35.47 pence) and is based on an after tax add back of

GBP862,000 (2013: GBP721,000) in respect of the amortisation of

intangibles.

The calculation of diluted earnings per share of 36.31 pence (2013:

30.84 pence) is based on profit attributable to equity holders of the

parent of GBP15,695,000 (2013: GBP13,049,000) and a weighted average

number of ordinary shares outstanding during the year ended 31 March

2014 of 43,222,000 (2013: 42,308,000), calculated as follows:

2014 2013

Shares Shares

000's 000's

Weighted average number of ordinary shares 39,451 38,818

Effect of share options in issue 3,771 3,490

Weighted average number of ordinary shares (diluted) 43,222 42,308

Diluted earnings per share before the amortisation of intangibles was

38.31 pence (2013: 32.55 pence).

3. Analysis of Net Debt

At At

31 March 1 April

2014 2013

GBP000 GBP000

Cash and cash equivalents (8,978) (8,712)

Current debt 17 24,000

Non current debt 62,000 30,000

Net debt 53,039 45,288

Year end gearing (calculated as net debt expressed as a percentage of

shareholders' funds) stands at 49% (2013: 45%).

On 15 May 2013 the existing bank facilities, including the facility

which was due to expire on 31 May 2013, were replaced by a GBP35 million

revolving credit facility which expires in May 2016 and a GBP30 million

four and a half year revolving credit facility which expires in October

2017. The agreed facilities also included a GBP25 million step up

facility. The Group will make use of this facility and in June 2014

will establish a GBP20 million committed revolving credit facility also

expiring in October 2017.

4. Taxation

The charge for taxation for the year represents an effective tax rate of

17.1% (2013: 20.4%). The tax charge was reduced by GBP1.1 million

(5.7%) to reflect the adjustment to the deferred tax balance as a result

of the future standard tax rate of 20% in the UK. The effective tax

rate excluding adjustments in respect of prior years is 17.7% (2013:

21.6%).

5. Dividend

The Board has proposed a final dividend of 10.40 pence per share to be

paid on 8 August 2014 to shareholders on the register at 11 July 2014.

This, together with the interim dividend of 3.60 pence per share paid on

3 January 2014 makes a total dividend for the year of 14.00 pence per

share (2013: 12.25 pence per share).

6. Principal risks and uncertainties

The Board is responsible for determining the level and nature of risks

it is appropriate to take in delivering the Group's objectives, and for

creating the Group's risk management framework. The Board recognises

that good risk management aids effective decision making and helps

ensure that risks taken on by the Group are adequately assessed and

challenged.

Our approach identifies risks arising in all parts of the Group, using

both a top down and bottom up approach. Once identified, the impact and

probability of risks are determined and scored at both a gross (before

mitigation) and net (after mitigation basis). These risk scores are

documented in risk registers which are maintained at a divisional and

Group level. Risk registers are subject to ongoing review based upon

business activity.

The risk profile for each division is used to determine the programme of

work carried out by Internal Audit. The risk assessments are captured in

consistent reporting formats, enabling Internal Audit to consolidate the

risk information and summarise the key risks in the form of a Group risk

profile. Mitigation action plans against each risk continue to be

monitored on a regular basis. Further information is provided below on

our principal risks and mitigating actions to address them.

Market risk

Risk description

A downturn in economic recovery could result in worse than expected

performance of the business, due to lower activity levels or prices.

Mitigation

Vp provides products and services to a diverse range of markets with

increasing geographic spread. The Group regularly monitors economic

conditions and our investment in fleet can be flexed with market demand.

Competition

Risk description

The equipment rental market is already competitive, and could become

more so, potentially impacting market share, revenues and margins.

Mitigation

Vp aims to provide a first class service to its customers and maintains

significant market presence in a range of specialist niche sectors. The

Group monitors market share, market conditions and competitor

performance and has the financial strength to maximise opportunities.

Investment/product management

Risk description

In order to grow, it is essential the Group obtains first class products

at attractive prices and keeps them well maintained.

Mitigation

Vp has well established processes to manage its fleet from investment

decision to disposal. The Group's return on average capital employed

was a healthy 13.5% in 2013/14. The quality of the Group's fleet

disposal margins also demonstrate robust asset management and

appropriate depreciation policies.

People

Risk description

Retaining and attracting the best people is key to our aim of exceeding

customer expectations and enhancing shareholder value.

Mitigation

Vp offers well structured reward and benefit packages, and nurtures a

positive working environment. We also try to ensure our people fulfil

their potential to the benefit of both the individual and the Group, by

providing appropriate career advancement and training.

Safety

Risk description

The Group operates in industries where safety is a key consideration for

the well being of both our employees and the customers that hire our

equipment. Failure in this area would impact our results and

reputation.

Mitigation

The Group has robust health and safety policies, and management systems

and our induction and training programmes reinforce these policies.

We provide support to our customers exercising their responsibility to

their own workforces when using our equipment.

Financial risks

Risk description

To develop the business Vp must have access to funding at a reasonable

cost. The Group is also exposed to interest rate and foreign exchange

fluctuations which may impact profitability and has exposure to credit

risk relating to customers who hire our equipment.

Mitigation

The Group has a revolving credit facility of GBP65.0 million and

maintains strong relationships with all banking contacts. Our treasury

policy defines the level of risk that the Board deems acceptable. Vp

continues to benefit from a strong balance sheet, with growing EBITDA,

which allows us to invest into opportunities.

Our treasury policy requires a tangible proportion of debt to be at

fixed interest rates, and we facilitate this through interest rate

swaps. We have agreements in place to buy or sell currencies to hedge

against foreign exchange movements. We have strong credit control

practices and use credit insurance where it is cost effective. Debtor

days were unchanged during the year and bad debts, as a percentage of

revenue, remained low at 0.6% (2013: 0.7%).

7. Forward Looking Statements

The Chairman's Statement and Business Review include statements that are

forward looking in nature. Forward looking statements involve known and

unknown risks, assumptions, uncertainties and other factors which may

cause the actual results, performance or achievements of the Group to be

materially different from any future results, performance or

achievements expressed or implied by such forward looking statements.

Except as required by the Listing Rules and applicable law, the Company

undertakes no obligation to update, review or change any forward looking

statements to reflect events or developments occurring after the date of

this report.

8. Annual Report and Accounts

The Annual Report and Accounts for the year ended 31 March 2014 will be

posted to shareholders on or around 20 June 2014.

Directors' Responsibility Statement in Respect of the Annual Financial

Report (extracted from the Annual Financial Report)

We confirm that to the best of our knowledge:

-- The financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Company and the undertakings included in the consolidation taken as a

whole; and

-- The Business Review and Financial Review, which form part of

the Directors' Report, includes a fair review of the development and

performance of the business and the position of the Company and the

undertakings included in the consolidation taken as a whole, together

with the description of the principal risks and uncertainties that they

face.

For and on behalf of the Board of Directors

J F G Pilkington A M Bainbridge

Director Director

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Vp PLC via Globenewswire

HUG#1790824

http://www.vpplc.com

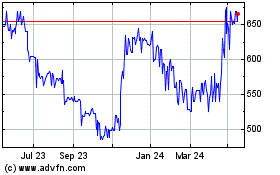

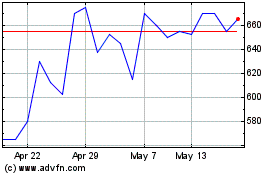

Vp (LSE:VP.)

Historical Stock Chart

From Sep 2024 to Oct 2024

Vp (LSE:VP.)

Historical Stock Chart

From Oct 2023 to Oct 2024