RNS Number:1471N

Vp PLC

04 December 2006

Press Release 4 December 2006

Vp plc

("Vp" or "the Group")

Interim Results

Vp plc, the equipment rental specialist, today announces its interim results for

the six months ended 30 September 2006.

Highlights

* Revenues up by 29% to #61.3 million (2005: #47.4 million)

* Operating profits grew 56% to #8.77 million (2005: #5.62 million)

* Profit before tax up 42% to #7.80 million (2005: #5.49million)

* Interim dividend of 2.25 pence per share, an increase of 15% (2005: 1.95 pence)

* Net debt of #34.7 million (31 March 2006: #32.6 million), representing modest gearing of 57%

Jeremy Pilkington, Chairman of Vp plc, commented:

"These excellent interim results endorse our growth plan for the Group and

maintain our record of consistent performance. Organic capital investment has

been strong across all areas of our business, but in particular the results

reflect the successful integration and further development of last year's

acquisitions and the continuing recovery in profitability at Hire Station. Over

30% of the profit increase in the period came from organic growth.

"Overall the markets we serve are in good health with strong growth prospects

over the short to medium term and we enjoy the human and financial resources to

take advantage of expansion opportunities as they arise. Our strategy remains

to lead in our chosen markets."

For further information please contact:

Vp plc

Jeremy Pilkington, Chairman Tel: +44 (0) 1423 533 405

jeremypilkington@vpplc.com

Neil Stothard, Group Managing Director Tel: +44 (0) 1423 533 445

neil.stothard@vpplc.com

Mike Holt, Group Finance Director Tel: +44 (0) 1423 533 445

mike.holt@vpplc.com

Abchurch

Justin Heath / Louise Thornhill Tel: +44 (0) 20 7398 7700

justin.heath@abchurch-group.com www.abchurch-group.com

CHAIRMAN'S STATEMENT

I am very pleased to report an excellent set of results for the Group for the

six month period to 30 September 2006.

Operating profits grew 56% to #8.77 million (2005 : #5.62 million) on revenues

ahead by 29% to #61.3 million (2005 : #47.4 million). These results build on

our achievement of compound annual earnings growth in excess of 14% over the

previous four years. In recognition of this progress, your Board is declaring

an interim dividend of 2.25 pence per share, an increase of 15%. The dividend

is payable on 11 January 2007 to shareholders registered as of 15 December 2006.

Net debt at 30 September 2006 stood at #34.7 million (31 March 2006: #32.6

million), representing modest gearing of 57%.

Business Review

These excellent interim results endorse our growth plan for the Group and

maintain our record of consistent performance. Organic capital investment has

been strong across all areas of our business, but in particular the results

reflect the successful integration and further development of last year's

acquisitions and the continuing recovery in profitability at Hire Station. Over

30% of the profit increase in the period came from organic growth.

Considering individual markets, the first six months has seen very buoyant oil

and gas activity but, not altogether unsurprisingly, continued delays in the

implementation of the AMP4 water industry capital investment programme in the

UK. The construction and housebuilding sectors have remained stable in the

period. The acquisition of TPA last November gives us new exposure to the power

transmission and events sectors. Activity within TPA's key summer events market

produces a significant seasonality in TPA's earnings and to a lesser extent, the

Group results.

Groundforce produced a very satisfactory first half performance. The evolution

of new products and capabilities continues, including the recent introduction of

a new 250 tonne strutting system and the expansion into concrete formwork. The

Dudley Vale business, acquired last year, has integrated well and has performed

in line with expectations.

As anticipated, UK Forks did not repeat last year's strong first half

performance. The reduced activity levels seen in the final quarter of last year

remained both in the housebuilding and general construction sectors. The market

for UK Forks is stable and we continue to see opportunities for the business

going forward.

Airpac Bukom delivered significant growth in the period, benefiting from the

first full six month contribution from the acquisition of Bukom Oilfield

Services in March 2006. Airpac Bukom is now a leading supplier of its

specialist services to the oil and gas exploration and development industry.

Whilst oil prices have fallen back from their recent highs we are confident in

the future strength of this market as it seeks to meet rapidly expanding global

demand, particularly from the developing economies. The merged business has

progressed well and significant capital investment is planned as we embrace the

broadened geographical and product opportunities that our customer base offers

to us.

Hire Station delivered further substantial improvement in profits and margins.

Both the tool hire business and safety equipment business, ESS Safeforce,

performed well. During the period we sold the non-core Pivotal Performance

business, a provider of management development training, contained within the

ESS acquisition made last year, to management. Since the period end, Hire

Station has acquired, for a cash consideration of #3.3 million, MEP Hire

Limited, a Scottish based company specialising in the rental and sale of pipe

fitting equipment. We believe MEP's product range and expertise will fit well

alongside Hire Station's existing activities.

Torrent Trackside had a very satisfactory first half performance having

responded successfully to the challenges presented by the changes within the

rail industry. Further growth opportunities have been developed, including an

increasing demand from London Underground based work.

TPA, acquired in November 2005, had a strong first half. TPA's earnings are, as

expected, significantly skewed by their Summer events programme although

construction related activities, particularly transmission work, will continue

throughout the winter period.

Outlook

This period sees the first results of the Group's significant progress in

strengthening and extending its portfolio of business activities through a

mixture of strong organic investment and selective acquisition activity.

Overall the markets we serve are in good health with strong growth prospects

over the short to medium term and we enjoy the human and financial resources to

take advantage of opportunities as they arise. Our strategy remains to lead in

our chosen markets.

The Group is well positioned to deliver a satisfactory result for the year as a

whole.

Jeremy Pilkington

Chairman

4 December 2006

Consolidated Income Statement

As at 30 September 2006

Note Six months to 30 Six months to 30 Full year to

Sep 2006 Sep 2005 31 Mar 2006

(unaudited) (unaudited)

#000 #000 #000

Revenue 3 61,263 47,387 99,396

Cost of sales (42,159) (34,258) (72,092)

Gross profit 19,104 13,129 27,304

Administrative expenses (10,333) (7,509) (15,842)

Operating profit before financing costs 3 8,771 5,620 11,462

Financial income 58 115 188

Financial expenses (1,034) (249) (978)

Profit before tax 7,795 5,486 10,672

Income tax expense 4 (2,339) (1,589) (3,070)

Profit for the period attributable to equity

holders of the parent 5,456 3,897 7,602

Earnings per 5p ordinary share 6 12.71p 8.96 p 17.49 p

Diluted earnings per 5p ordinary share 6 12.16p 8.66 p 16.83 p

Dividend per share 7 2.25p 1.95 p 6.60p

Dividends paid and proposed (#000) 954 846 2,824

Consolidated Statement of Recognised Income and Expense

As at 30 September 2006

Six months to Six months to Full year to

30 Sep 2006 30 Sep 2005 31 Mar 2006

(unaudited) (unaudited)

#000 #000 #000

Tax on items taken direct to equity - (66) (67)

Actuarial gains on defined benefit pension - - 231

scheme

Effective portion of changes in fair value of

cash flow hedges

130 - (89)

Net income / (expense) recognised directly to 130 (66) 75

equity

Profit for the period 5,456 3,897 7,602

Total recognised income and expense for the 5,586 3,831 7,677

period

Consolidated Balance Sheet

As at 30 September 2006

Note 30 Sep 2006 31 Mar 2006 30 Sep 2005

(unaudited) (unaudited)

#000 #000 #000

Non-current assets

Property, plant and equipment 69,584 66,054 51,285

Intangible assets 33,848 33,637 9,845

Total non-current assets 103,432 99,691 61,130

Current assets

Inventories 3,372 3,119 2,580

Income tax receivable - 34 34

Trade and other receivables 30,034 28,177 26,226

Cash and cash equivalents 4,988 5,587 2,395

Assets classified as held for resale 217 - -

Total current assets 38,611 36,917 31,235

Total assets 142,043 136,608 92,365

Current liabilities

Interest bearing loans and borrowings (3,073) (2,148) (37)

Income tax payable (2,213) (1,235) (1,876)

Trade and other payables (23,702) (21,793) (19,126)

Total current liabilities (28,988) (25,176) (21,039)

Non-current liabilities

Interest bearing loans and borrowings (36,616) (36,062) (8,051)

Employee benefits (2,734) (2,894) (3,744)

Other payables (7,930) (7,930) -

Deferred tax liabilities (4,734) (4,223) (2,854)

Total non-current liabilities (52,014) (51,109) (14,649)

Total liabilities (81,002) (76,285) (35,688)

Net assets 61,041 60,323 56,677

Equity

Issued capital 2,309 2,309 2,309

Share premium 16,192 16,192 16,192

Hedging reserve 41 (89) -

Retained earnings 42,472 41,884 38,149

Total equity attributable to equity 61,014 60,296 56,650

holders of parent

Minority interest 27 27 27

Total equity 5 61,041 60,323 56,677

Consolidated cash flow statement

As at 30 September 2006

Note Six months to Six months to Full year to

30 Sep 2006 30 Sep 2005 31 Mar 2006

(unaudited) (unaudited)

#000 #000 #000

Cash generated from operations 8 14,681 9,741 22,610

Interest paid (522) (226) (710)

Interest element of finance lease rental (91) (5) (111)

payments

Interest received 58 115 188

Income tax paid (894) (1,426) (3,120)

Net cash from operating activities 13,232 8,199 18,857

Cash flows from investing activities

Purchase of property, plant and equipment (15,052) (8,321) (15,506)

Proceeds from sale of plant and equipment 3,267 2,687 6,181

Acquisitions net of cash acquired (91) (4,647) (28,955)

Net cash used in investing activities (11,876) (10,281) (38,280)

Cash flows from financing activities

(Repurchase) / sale of own shares (3,434) (1,123) (1,073)

Repayment of borrowings - - (8,000)

Repayment of loan notes (941) (125) (125)

New loans 3,000 - 33,500

Payment of finance lease liabilities (580) (30) (2,475)

Dividends paid - - (2,572)

Net cash used in financing activities (1,955) (1,278) 19,255

Net decrease in cash and cash equivalents (599) (3,360) (168)

Cash and cash equivalents at beginning of 5,587 5,755 5,755

period

Cash and cash equivalents at end of period 4,988 2,395 5,587

Notes to the Interim Financial Statements

1. Basis of Preparation

Vp plc (the "Company") is a company domiciled in the United Kingdom. The

Consolidated Interim Financial Statements of the Company for the half year ended

30 September 2006 comprise the Company and its subsidiaries (together referred

to as the "Group").

The Consolidated Interim Financial statements do not include all the information

required for full annual Financial Statements.

2. Accounting Policies

Vp's accounting policies have been applied consistently to all periods presented

and are in line with those applied in the annual financial statements for the

year ended 31 March 2006.

The preparation of financial statements in conformity with IFRS requires

management to make judgements, estimates and assumptions that affect the

application of policies and reported amounts of assets and liabilities, income

and expenses. The estimates and associated assumptions are based on historical

experience and various other factors that are believed to be reasonable under

the circumstances, the results of which form the basis of making the judgements

about carrying values of assets and liabilities that are not readily apparent

from other sources. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis.

Revisions to accounting estimates are recognised in the period in which the

estimate is revised if the revision affects only that period, or in the period

of the revision and future periods if the revision affects both current and

future periods.

3. Summarised Segmental Analysis (unaudited)

Revenue Operating Profit

Sept 2006 Sept 2005

Inter- Inter- 2006 2005

External Segment Total External Segment Total

Revenue Revenue Revenue Revenue Revenue Revenue

#000 #000 #000 #000 #000 #000 #000 #000

Groundforce 13,010 - 13,010 11,547 - 11,547 2,752 2,554

UK Forks 6,930 180 7,110 7,498 150 7,648 667 1,295

Airpac Bukom 4,998 - 4,998 2,249 - 2,249 1,248 507

Hire Station 22,121 150 22,271 19,943 130 20,073 1,353 490

Torrent 6,566 - 6,566 6,150 - 6,150 910 774

Trackside

Trax Portable 7,638 - 7,638 - - - 1,841 -

Access

61,263 330 61,593 47,387 280 47,667 8,771 5,620

4. Income Tax

Income tax on profit before tax is based on an effective tax rate of 30% to

reflect the estimated tax charge for the full year.

5. Statement of Changes in Equity

Six months to Six months to Full year to

30 Sep 2006 30 Sep 2005 31 Mar 2006

(unaudited) (unaudited)

#000 #000 #000

Total recognised income and expense for the 5,586 3,831 7,677

period

Tax movements to equity - 50 489

Share option charge in the period 497 162 292

Gains on disposal of shares 47 67 80

Net movement in shares held by Vp Employee (3,434) (1,123) (1,073)

Trust at cost

Dividends to shareholders (1,978) (1,740) (2,572)

Change in equity during the period 718 1,247 4,893

Equity at the start of the period 60,323 55,430 55,430

Equity at the end of the period 61,041 56,677 60,323

6. Earnings Per Share

Earnings per share have been calculated on 42,934,732 shares (2005: 43,502,560)

being the weighted average number of shares in issue during the period. Diluted

earnings per share have been calculated on 44,869,566 shares (2005: 44,995,224).

7. Dividends

The Directors have declared an interim dividend of 2.25 pence (2005: 1.95 pence)

per share payable on 11 January 2007 to shareholders on the register at 15

December 2006. The cost of dividends in the Statement of Changes in Equity is

after adjustments for the interim and final dividends waived by the Vp Employee

Trust in relation to the shares it holds for the Group's share option schemes.

8. Reconciliation of profit before tax to net cash generated from

operations

Six months to Six months to Full year to

30 Sep 2006 30 Sep 2005 31 Mar 2006

(unaudited) (unaudited)

#000 #000 #000

Cash flows from operating activities

Profit before tax 7,795 5,486 10,672

Pension fund contribution in excess of service

cost

(160) (224) (791)

Share based payment charges 497 162 292

Depreciation 6,899 5,655 12,224

Amortisation of intangibles 12 - 4

Profit on sale of tangible fixed assets (1,131) (1,010) (2,275)

Interest expense 976 134 790

Increase in inventories (253) (204) (559)

Increase in trade and other receivables (1,662) (2,183) (579)

Increase in trade and other payables 1,708 1,925 2,832

Cash generated from operations 14,681 9,741 22,610

9. Analysis of Net Debt (unaudited)

As at Cash As at

1 Apr 06 Flow 30 Sep 06

#000 #000 #000

Cash in hand and at bank 5,587 (599) 4,988

Medium term loan (33,500) (3,000) (36,500)

Loan notes (1,011) 941 (70)

Finance leases and hire purchases (3,699) 580 (3,119)

(32,623) (2,078) (34,701)

Comparative Figures

The comparative figures for the financial year ended 31 March 2006 are extracted

from the company's statutory accounts for that financial year. Those accounts

have been reported on by the company's auditors and delivered to the Registrar

of Companies. The report of the auditors was (i) unqualified, (ii) did not

include a reference to any matters to which the auditors drew attention by way

of emphasis without qualifying their report, and (iii) did not contain a

statement under section 237(2) or (3) of the Companies Act 1985.

Independent review report to Vp plc

Introduction

We have been instructed by the Company to review the financial information for

the six months ended 30 September 2006 which comprises the unaudited

Consolidated Income Statement, the unaudited Consolidated Statement of

Recognised Income and Expense, the unaudited Consolidated Balance Sheet, the

unaudited Consolidated Cash Flow Statement and the related notes. We have read

the other information contained in the interim report and considered whether it

contains any apparent misstatements or material inconsistencies with the

financial information.

This report is made solely to the Company in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the Listing

Rules of the Financial Services Authority. Our review has been undertaken so

that we might state to the company those matters we are required to state to it

in this report and for no other purpose. To the fullest extent permitted by law,

we do not accept or assume responsibility to anyone other than the company for

our review work, for this report, or for the conclusions we have reached.

Directors' responsibilities

The interim report, including the financial information contained therein, is

the responsibility of, and has been approved by, the directors. The directors

are responsible for preparing the interim report in accordance with the Listing

Rules of the Financial Services Authority which require that the accounting

policies and presentation applied to the interim figures should be consistent

with those applied in preparing the preceding annual accounts except where any

changes, and the reasons for them, are disclosed.

Review work performed

We conducted our review in accordance with guidance contained in Bulletin 1999/

4: Review of interim financial information issued by the Auditing Practices

Board for use in the UK. A review consists principally of making enquiries of

group management and applying analytical procedures to the financial information

and underlying financial data and, based thereon, assessing whether the

accounting policies and presentation have been consistently applied unless

otherwise disclosed. A review excludes audit procedures such as tests of

controls and verification of assets, liabilities and transactions. It is

substantially less in scope than an audit performed in accordance with

International Standards on Auditing (UK and Ireland) and therefore provides a

lower level of assurance than an audit. Accordingly, we do not express an audit

opinion on the financial information.

Review conclusion

On the basis of our review we are not aware of any material modifications that

should be made to the financial information as presented for the six months

ended 30 September 2006.

KPMG Audit Plc

Chartered Accountants

Leeds

4 December 2006

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR USOVRNWRURRA

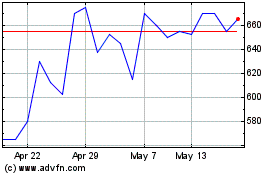

Vp (LSE:VP.)

Historical Stock Chart

From Jun 2024 to Jul 2024

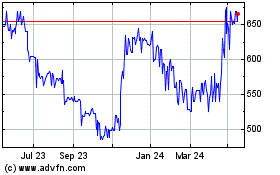

Vp (LSE:VP.)

Historical Stock Chart

From Jul 2023 to Jul 2024