TIDMVLE

RNS Number : 8262M

Volvere PLC

19 September 2023

19 September 2023

Volvere plc

("Volvere" or the "Group")

Interim Results for the six months ended 30 June 2023

Volvere plc (AIM: VLE), the growth and turnaround investment

company, announces its unaudited Interim Results for the six months

ended 30 June 2023.

Highlights

GBP million except where stated Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

(as restated

(1) )

Group revenue - continuing operations 19.09 15.79 38.03

Group profit before tax - continuing

operations 0.44 0.39 2.33

Loss from discontinued operations - (1.51) (2.39)

Group profit/(loss) after tax 0.44 (1.12) (0.06)

As at As at As at 31

30 June 30 June December

2023 2022 2022

Consolidated net assets per share

(excluding non-controlling interests)(2) GBP14.00 GBP13.33 GBP13.90

Group net assets 35.33 36.05 35.75

Cash and available-for-sale investments 21.41 20.39 20.79

-- Good performance from Shire Foods, the Group's savoury products manufacturer

-- Overall Group performance improved significantly following

closure of Indulgence Patisserie, the Group's frozen desserts

manufacturer in 2022

-- Liquidity and financial position remain strong

-- Michael Tzirki, Managing Director of Shire Foods, joins Group Board

Forward-looking statements:

This report may contain certain statements about the future

outlook for Volvere plc. Although the Directors believe their

expectations are based on reasonable assumptions, any statements

about future outlook may be influenced by factors that could cause

actual outcomes and results to be materially different.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

Note

1 The comparative results for the period to 30 June 2022 have

been restated to exclude the results of Indulgence Patisserie,

which was discontinued during the second half of 2022. The results

of that business have been reported as discontinued operations in

all periods.

2 Based on the net assets attributable to owners of the parent

company and the respective period end shares in issue (excluding

treasury shares), which were 2,343,422 at 30 June 2023, 2,516,422

at 30 June 2022, and 2,364,422 at 31 December 2022.

For further information:

Volvere plc

Nick Lander, Co-founder & Director Tel: +44 (0) 20 7634 9707

www.volvere.co.uk

Cairn Financial Advisers LLP (Nominated

Adviser) Tel: + 44 (0) 20 7213 0880

Sandy Jamieson / James Caithie

Canaccord Genuity Limited (Joint Broker)

Bobbie Hilliam Tel: + 44 (0) 207 523 8000

Hobart Capital Markets LLP (Joint

Broker)

Lee Richardson Tel: +44 (0) 20 7070 5691

Chairman's Statement

The loss of Volvere's long-serving CEO and Co-founder, Jonathan

Lander, on 28 August 2023 at the age of 55, has inevitably deeply

saddened his friends and colleagues both throughout the Group and

wider afield. He was an outstanding individual and we will miss his

contribution enormously.

However, Jonathan's brother, Nick, has been alongside Jonathan

throughout the Volvere journey and led the turnarounds in all the

Group's most significant investments. Nick is well-placed,

therefore, to continue to build on Jonathan's legacy. As part of

our strengthening of it, I am pleased to welcome Michael Tzirki,

the long-standing Managing Director of Shire Foods, to the Group

Board.

Notwithstanding the loss of Jonathan, I am pleased to report the

results for the six months to 30 June 2023. The first half of the

year has continued to show good progress in Shire Foods. Overall,

the performance of the Group was much improved following the

closure of Indulgence Patisserie, the loss-making desserts business

during 2022.

As a result, the Group's financial position remains strong with

total net assets of GBP35.33 million (30 June 2022: GBP36.05

million, 31 December 2022: GBP35.75 million), with continuing high

liquidity.

Net assets per share (1) increased to GBP14.00 in the period (30

June 2022: GBP13.33, 31 December 2022: GBP13.90) following further

treasury share purchases.

We continue to actively seek further investments in both the

food and other sectors and will continue to consider other ways to

deliver value for shareholders.

David Buchler

Chairman

19 September 2023

Note 1: Net assets attributable to owners of the parent company

divided by total number of ordinary shares outstanding at the

reporting date (less those held in treasury) - see note 7.

Executive Management Statement

Overview

The loss of Jonathan, my brother and long-standing business

partner, has hit me, along with his family and friends, very hard

indeed. However, I know that he would wish that we continue to work

actively for the Group's shareholders to deliver the value and

returns for which we have become known over so many years. I have

been part of that journey from the outset and will continue it,

supported by our many loyal colleagues.

In spite of this, I am pleased to report a much-improved overall

performance in 2023 compared to the same period last year. Shire

Foods has performed well in an at-times challenging environment and

continued to grow both its revenues and profits, with further

information set out below. Our careful management of the closure of

Indulgence Patisserie has minimised further losses to the Group and

we have sold one of three properties previously occupied by it.

Indulgence Patisserie's results have been reclassified as

discontinued operations throughout this announcement and

comparative information has been restated where appropriate.

Overall Group revenues (which relate solely to Shire Foods) for

the period increased by GBP3.30 million to GBP19.09 million (30

June 2022 restated: GBP15.79 million, 31 December 2022: GBP38.03

million). The Group's profit before tax from continuing operations

for the period was GBP0.44 million (30 June 2022 restated: GBP0.39

million, 31 December 2022: GBP2.33 million). The increased profit

from the Group's trading activities was partly offset by lower

investment returns from treasury management activities. The Group's

overall profit (including discontinued operations) improved to

GBP0.44 million (30 June 2022 restated: loss GBP1.12 million, year

to 31 December 2022: loss GBP0.06 million) reflecting the cessation

of Indulgence Patisserie's loss-making operations.

Net assets per share increased to GBP14.00 in the period (30

June 2022: GBP13.33, 31 December 2022: GBP13.90). Group net assets

fell marginally to GBP35.33 million from GBP35.75 million at 31

December 2022 (30 June 2022: GBP36.05 million), principally as a

result of treasury share purchases.

Financial performance

Food manufacturing segment - Shire Foods

Revenues increased year-on-year by almost 21%, to a record

GBP19.09 million (30 June 2022: GBP15.79 million, 31 December 2022:

GBP38.03 million). Profit before tax and intra-Group management and

interest charges(2) grew by 29% to GBP0.75 million (30 June 2022:

GBP0.58 million, 31 December 2022: profit GBP2.78 million).

The period was one of raw material cost stabilisation, with some

commodities falling in price. However, staff and overhead costs

remained on a broadly upward trajectory. We have managed to largely

align customer price rises to mitigate the effects of increases in

our own raw materials costs but continue to monitor margins

closely. It is the winter months which tend to have higher sales

volumes for Shire's products and its performance is expected to

increase accordingly.

A summary of Shire's recent financial performance is set out in

Table A below.

Table A Year ended 31 Year ended 31 Year ended 31

6 months to 6 months to December December December

30 June 30 June 2022 2021 2020

2023 2022 GBP'000 GBP'000 GBP'000

GBP'000 GBP'000

Revenue 19,090 15,776 38,027 30,605 27,189

Underlying profit

before tax,

intra-group

management and

interest charges 745 580 2,777 2,139 1,813

Intra-group

management and

interest charges (125) (98) (348) (252) (200)

Profit before tax 620 482 2,429 1,887 1,613

============== ============== ==================== ==================== ====================

Shire continued to supply a number of the UK's fastest growing

supermarkets and this has resulted in pleasing revenue growth from

both volume as well as price increases. The materials margin

increased by 2.8% compared to the first half of 2022 and by 1.8%

compared to the whole of 2022. This reflects the diligence in

effecting price increases with customers to meet our raw materials

and other cost rises. In the latter part of the period, we have

seen some stabilisation of raw material costs and are hopeful that

this will continue.

As shareholders will know from previous reports, the second half

of the year typically sees higher volumes from both retail

customers (due to the colder weather) and foodservice (due to the

academic year). In preparation for that, we increased our

production output by changing factory shift patterns for a period

of time, resulting in increased direct labour costs and inventory

levels. As a result of the increased labour costs, the effect of

the additional revenue and margin was less pronounced. We have,

since the period end, rebalanced headcount to take account of

trading over the summer period and the current level of finished

goods stock.

As ever, we continued to invest in new plant and equipment, with

additions in the period of GBP0.38 million (30 June 2022: GBP0.39

million, 31 December 2022: GBP1.01 million). The majority of

additions in this period were financed by way of lease finance.

There continued to be no Group loans outstanding at 30 June 2023

(30 June 2022: nil, 31 December 2022: nil).

During the period, Shire paid a dividend of GBP2.50 million, of

which GBP2.0 million was to the Group.

Investing and management services segment

This segment represents our central functions covering Group

management, treasury, finance and IT services. The segment result

is the net of the underlying costs of these Group activities,

offset by investment revenues and other gains and losses. The loss

before tax and intra-Group management and interest charges(2) for

the period was GBP0.30 million (30 June 2022: loss GBP0.19 million,

31 December 2022: loss GBP0.45 million).

The increase in the net cost compared to the comparable period

reflects lower investment returns, which totalled GBP0.29 million

in this period (30 June 2022: GBP0.40 million and 31 December 2022:

GBP0.70 million). Further information is shown in note 4.

The Group continued its approach of using leverage within

trading companies whenever appropriate and without recourse to the

remainder of the Group.

Earnings per share

Basic and diluted profit per ordinary share from continuing

operations was 13.45p (30 June 2022: restated 11.48p, 31 December

2022: 74.36p ). Basic and diluted loss per ordinary share from

discontinued operations was (0.17)p (30 June 2022: restated

(59.41)p, 31 December 2022: (95.89)p). Total basic and diluted

profit per ordinary share was 13.28p (30 June 2022: loss (47.93)p,

31 December 2022: loss (21.53)p).

Statement of financial position

Cash and available-for-sale investments

Cash at the period end was GBP19.81 million (30 June 2022:

GBP18.80 million, 31 December 2022: GBP19.14 million). Full details

of cash movements are shown in the consolidated statement of cash

flows. In preparation for the seasonally higher trading months in

Shire Foods, inventory levels were increased during the latter half

of the trading period. Of the GBP2.50 million dividend paid by

Shire Foods, GBP0.50 million was paid to non-controlling

interests.

At the period end there was an investment in available-for-sale

investments with a period end value of GBP1.59 million (30 June

2022: GBP1.59 million, 31 December 2022: GBP1.65 million). The

carrying value of this is below the original cost and the

unrealised loss of GBP0.09 million has been debited to

reserves.

Assets held for sale

The Group owns two properties formerly occupied by Indulgence

Patisserie, with a carrying value of GBP1.45 million (an upwards

revaluation of GBP0.84 million on original cost). The units have

been prepared for sale to allow separate disposal (having been

previously linked) and are being marketed actively. A third

property was sold during the period.

Purchase of own shares

The Company acquired 21,000 ordinary shares for a total

consideration including costs of GBP248,000 during the period (30

June 2022: 52,000 shares for GBP622,000, 31 December 2022: 204,000

shares for GBP2,090,000).

Hedging

It is not the Group's policy to enter into derivative

instruments to hedge interest rate or foreign exchange risk.

Key performance indicators (KPIs)

The Group uses key performance indicators suitable for the

nature and size of the Group's businesses. The key financial

performance indicators are revenue and profit before tax. The

performance of the Group and the individual trading businesses

against these KPIs is outlined above, in the Executive Management

statement and disclosed in note 3.

Internally, management uses a variety of non-financial KPIs in

respect of the food manufacturing segment, including order intake,

manufacturing output and sales, all of which are monitored weekly

and reported monthly.

Principal risk factors

The Company and Group face a number of specific business risks

that could affect the Company's or Group's success. The Company and

Group invests in distressed businesses and securities, which by

their nature often carry a higher degree of risk than those that

are not distressed. The Group's businesses are principally engaged

in the provision of goods and services that are dependent on the

continued employment of the Group's employees and availability of

suitable, profitable workload. In the food manufacturing segment,

there is a dependency on a small number of customers and a

reduction in the volume or range of products supplied to those

customers or the loss of any one of them could impact the Group

materially. Rising inflation, including increases in raw materials

and overhead costs, may not be able to be passed on to customers

through increased prices and this could result in reduced

profitability. Any pandemic or other such similar event which could

affect the consumers, suppliers, customers or staff may limit or

inhibit the Group's operations.

These risks are managed by the Board in conjunction with the

management of the Group's businesses.

Acquisitions and future strategy

We have continued to review an encouraging level of investment

proposals throughout the period. However, there has been a distinct

shortage of potential transactions that we considered to be worthy

of potential investment. Such opportunities have not presented

themselves, which had been somewhat frustrating for both Jonathan

and me. Whilst these things are a matter of judgement, we have

invested only when we believed we had a reasonable prospect of

delivering an improved, sustainable performance and we will

continue to assess opportunities in this context.

I would like to thank shareholders for the support over many

years afforded to Jonathan and me and to reassure them that my

focus will continue to be on growing the value of our investment in

Shire Foods, which I have chaired for more than 12 years. An

increasing, cash-generative performance from Shire will be pivotal

to enhancing shareholder value in Volvere. Whilst we will continue

to seek investment opportunities pursuant to our investing

strategy, maximising shareholder returns remains at the forefront

of the Board's strategy.

Nick Lander

Co-founder & Director

19 September 2023

Note 2: Profit before intra-Group management and interest

charges is considered to be a relevant and useful interpretation of

the trading results of the business such that its performance can

be understood on a basis which is independent of its ownership by

the Group.

Consolidated income statement

As restated

6 months 6 months Year ended

Note to to 31

30 June 30 June December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 3 19,090 15,789 38,027

Cost of sales (16,535) (13,766) (31,921)

--------- -------------- -----------

Gross profit 2,555 2,023 6,106

Distribution costs (1,185) (949) (2,181)

Administrative expenses (1,174) (1,014) (2,174)

Operating profit 196 60 1,751

Finance expense 4 (65) (69) (138)

Finance income 4 287 396 698

Profit on sale of tangible fixed assets 23 - 18

Profit before tax 441 387 2,329

Income tax expense - - -

--------- -------------- -----------

Profit for the period from continuing

operations 441 387 2,329

Loss for the period from discontinued

operations (4) (1,506) (2,391)

Profit/(loss) for the period 437 (1,119) (62)

========= ============== ===========

Attributable to:

- Equity holders of the parent 313 (1,215) (537)

- Non-controlling interests 6 124 96 475

--------- -------------- -----------

437 (1,119) (62)

Earnings/(loss) per share 5

Basic and Diluted

- from continuing operations 13.45p 11.48p 74.36p

- from discontinued operations (0.17)p (59.41)p (95.89)p

--------- -------------- -----------

Total 13.28p (47.93)p (21.53)p

========= ============== ===========

Consolidated statement of comprehensive income

As restated

6 months 6 months Year ended

to to 31

30 June 30 June December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Profit/(loss) for the period 437 (1,119) (62)

Other comprehensive income

Revaluation of freehold

land and buildings - 1,114 1,188

Revaluation of available-for-sale

investments (53) (92) (36)

Transfer to income statement

on disposal of property (55) - -

Deferred tax recognised

directly in equity - (278) (297)

Total comprehensive income

for the period 329 (375) 793

========= ============ ===========

Attributable to:

Equity holders of the parent 205 (471) 318

Non-controlling interests 124 96 475

--------- ------------ -----------

329 (375) 793

========= ============ ===========

Consolidated statement of changes in equity

Share Share Revaluation Retained Non-controlling

Six months to 30 capital premium reserve earnings Total interests Total

June 2023 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Profit for the period - - - 313 313 124 437

Revaluation of available-for-sale

investments - - (53) - (53) - (53)

Disposal of revalued

property - - (55) - (55) - (55)

Deferred tax recognised

directly in equity - - - - - - -

Total comprehensive

income for the period - - (108) 313 205 124 329

Balance at 1 January 50 7,885 1,682 23,258 32,875 2,877 35,752

Transactions with

owners:

Purchase of own

treasury shares - - - (248) (248) - (248)

Dividend paid to

non-controlling interests - - - - - (500) (500)

Total transactions

with owners - - - (248) (248) - (748)

Balance at 30 June 50 7,885 1,574 23,323 32,832 2,501 35,333

Share Share Revaluation Retained Non-controlling

Six months to 30 capital premium reserve earnings Total interests Total

June 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Loss for the period - - - (1,215) (1,215) 96 (1,119)

Revaluation of available-for-sale

investments - - (92) - (92) - (92)

Revaluation of property - - 1,114 - 1,114 - 1,114

Deferred tax recognised

directly in equity - - (278) - (278) - (278)

Total comprehensive

income for the period - - 744 (1,215) (471) 96 (375)

Balance at 1 January 50 7,885 827 25,886 34,648 2,402 37,050

Transactions with

owners:

Purchase of own

treasury shares - - - (622) (622) - (622)

Total transactions

with owners - - - (622) (622) - (622)

Balance at 30 June 50 7,885 1,571 24,049 33,555 2,498 36,053

Share Share Revaluation Retained Non-controlling

Year ended 31 December capital premium reserve earnings Total interests Total

2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Loss for the year - - - (537) (537) 475 (62)

Revaluation of property - - 1,188 - 1,188 - 1,188

Revaluation of available

for sale investments - - (36) - (36) - (36)

Deferred tax recognised

directly in equity - - (297) - (297) - (297)

Total comprehensive

income for the year - - 855 (537) 318 475 793

Balance at 1 January 50 7,885 827 25,886 34,648 2,402 37,050

Transactions with

owners:

Purchase of own

treasury shares - - - (2,091) (2,091) - (2,091)

Total transactions

with owners - - - (2,091) (2,091) - (2,091)

Balance at 31 December 50 7,885 1,682 23,258 32,875 2,877 35,752

Consolidated statement of financial position

30 June 30 June 31 December

2023 2022 2022

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant & equipment 8,011 10,311 8,142

Total non-current assets 8,011 10,311 8,142

Current assets

Inventories 6,899 5,899 3,777

Trade and other receivables 5,606 6,663 9,315

Cash and cash equivalents 19,810 18,802 19,136

Assets held for sale 1,447 - 2,103

Available-for-sale investments 1,595 1,592 1,649

Total current assets 35,357 32,956 35,980

-------- -------- ------------

Total assets 43,368 43,267 44,122

-------- -------- ------------

Liabilities

Current liabilities

Loans and other borrowings (553) (111) (1,258)

Leases (411) (359) (372)

Trade and other payables (5,120) (4,457) (4,807)

Total current liabilities (6,084) (4,927) (6,437)

Non-current liabilities

Loans and other borrowings (759) (878) (818)

Leases (534) (590) (452)

Total non-current liabilities (1,293) (1,468) (1,270)

Total liabilities (7,377) (6,395) (7,707)

Provisions - deferred tax (658) (819) (663)

NET ASSETS 35,333 36,053 35,752

======== ======== ============

Equity

Share capital 50 50 50

Share premium account 7,885 7,885 7,885

Revaluation reserves 1,574 1,571 1,682

Retained earnings 23,323 24,049 23,258

-------- -------- ------------

Capital and reserves attributable

to equity holders of the Company 32,832 33,555 32,875

Non-controlling interests 6 2,501 2,498 2,877

-------- -------- ------------

TOTAL EQUITY 35,333 36,053 35,752

======== ======== ============

Consolidated statement of cash flows

As restated As restated Year Year

6 months 6 months 6 months 6 months ended ended

to 30 to 30 to 30 to 30 31 December 31 December

June June June June 2022 2022

2023 2023 2022 2022

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Profit/(loss) for the

period 437 (1,119) (62)

Adjustments for:

Finance expense 4 65 69 138

Finance income 4 (287) (396) (698)

Depreciation 497 455 933

Operating lease

rentals (7) - (14)

Income tax expense - - -

(Gain)/loss on

disposal

of fixed assets (23) - (18)

Loss from

discontinued

operations 4 1,506 2,391

249 1,634 2,732

Operating cash flows

before movements in working

capital 686 515 2,670

Decrease/(increase) in

trade and other receivables 2,758 1,694 (1,116)

Increase in trade and

other payables 855 1,010 1,126

(Increase)/decrease in

inventories (3,534) (1,092) 291

Operating cash generated

from continuing operations 765 2,127 2,971

Operating cash generated

from/(used by) discontinued

operations 695 (1,293) (1,051)

Net cash generated from

operations 1,460 834 1,920

Investing activities

Interest received 235 - 8

Income from investments 52 86 109

Purchase of property,

plant and equipment (62) (388) (889)

Sale of property, plant

and equipment 34 - 42

Purchase of available-for-sale

investments - (4,548) (6,886)

Disposal of available-for-sale

investments - 3,174 5,782

Cash generated from/(used

by) continuing investing

activities 259 (1,676) (1,834)

Cash generated from

discontinued investing

activities 720 (68) 29

Net cash generated from/(used

by) investing activities 979 (1,744) (1,805)

Financing activities

Interest paid (64) (67) (132)

Purchase of own shares

(treasury shares) 7 (248) (622) (2,090)

Dividend paid to

non-controlling

interests (500) - -

Net repayment of borrowings (948) (1,432) (577)

Cash used by continuing

financing activities (1,760) (2,121) (2,799)

Cash used by discontinued

financing activities (5) (38) (51)

Net cash used by financing

activities (1,765) (2,159) (2,850)

Net (decrease)/ increase

in cash 674 (3,069) (2,735)

Cash at beginning of

period 19,136 21,871 21,871

Cash at end of period 19,810 18,802 19,136

========= ============ =============

Notes forming part of the unaudited interim results for the

period ended 30 June 2023

1 Financial information and basis of accounting

These interim financial statements have been prepared using

accounting policies consistent with IFRSs as adopted by the

European Union.

These interim financial statements should be read in accordance

with the Group's last annual consolidated financial statements as

at and for the year ended 31 December 2022. They do not include all

the information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

performance since the last annual financial statements. AIM-listed

companies are not required to comply with IAS 34 Interim Financial

Reporting and accordingly the Group has taken advantage of this

exemption.

The comparative figures for the year ended 31 December 2022 have

been prepared under IFRS. They do not constitute statutory accounts

as defined by the Companies Act 2006. The accounts for the 12

months ended 31 December 2022 received an unmodified auditor's

report and have been filed with the Registrar of Companies.

Copies of this statement will be available to members of the

public at the Company's registered office: Shire House, Tachbrook

Road, Leamington Spa CV31 3SF and on its website www.volvere.co.uk

.

2 Significant accounting policies

The accounting policies applied in these interim financial

statements are the same as those applied in the Group's

consolidated financial statements as at and for the year ended 31

December 2022.

3 Operating segments

An analysis of key financial data by business segment is

provided below. The Group's food manufacturing segment is engaged

in the production and sale of food products to third party

customers, and the investing and management services segment incurs

central costs, provides management services and financing to other

Group segments and undertakes treasury management on behalf of the

Group.

Analysis by business segment:

Period ended 30 June 2023 Investing and

Food Management

manufacturing services Total

GBP'000 GBP'000 GBP'000

Revenue 19,090 - 19,090

---------------- --------------------- ------------

Profit/(loss) before tax(1) 745 (304) 441

================ ===================== ============

Period ended 30 June 2022 Investing and

Food Management

manufacturing services Total

GBP'000 GBP'000 GBP'000

(as restated)

Revenue 15,789 - 15,789

---------------- --------------------- ------------

Profit/(loss) before tax (1) 577 (190) 387

================ ===================== ============

Year ended 31 December 2022 Investing and

Food management services

manufacturing GBP'000 Total

GBP'000 GBP'000

Revenue 38,027 - 38,027

---------------- --------------------- ----------

Profit/(loss) before tax(1) 2,777 (448) 2,329

================ ===================== ==========

As at 30 June 2023

Investing and

Food manufacturing management Discontinued

GBP'000 services operations Total

GBP'000 GBP'000 GBP'000

Assets 20,483 21,321 1,564 43,368

Liabilities/provisions (8,290) 559 (304) (8,035)

-------------------- --------------------- -------------------- --------------

Net assets(2) 12,193 21,880 1,260 35,333

==================== ===================== ==================== ==============

As at 30 June 2022 (as Investing and

restated) Food manufacturing management Discontinued

GBP'000 services operations Total

GBP'000 GBP'000 GBP'000

Assets 19,021 19,361 4,885 43,267

Liabilities/provisions (6,899) 483 (798) (7,214)

-------------------- --------------------- -------------------- --------------

Net assets(2) 12,122 19,844 4,087 36,053

As at 31 December 2022 Investing and

(restated for Food manufacturing management Discontinued

additional comparative GBP'000 services operations Total

information only) GBP'000 GBP'000 GBP'000

Assets 22,072 18,430 3,620 44,122

Liabilities/provisions (8,015) 504 (859) (8,370)

-------------------- --------------------- -------------------- --------------

Net assets(2) 14,057 18,934 2,761 35,752

==================== ===================== ==================== ==============

Continuing operations Investing and

Food manufacturing management services

Six months to 30 June GBP'000 GBP'000 Total

2023 GBP'000

Capital spend 62 - 62

Depreciation 497 - 497

Interest income

(non-Group) - 235 235

Interest expense

(non-Group) (64) - (64)

Tax (credit)/expense - - -

===================== ==================== ==============

Six months to 30 June Investing and

2022 (as restated) Food manufacturing management services

GBP'000 GBP'000 Total

GBP'000

(as restated) (as restated)

Capital spend 388 - 388

Depreciation 454 1 455

Interest income - - -

(non-Group)

Interest expense

(non-Group) (60) (9) (69)

Tax (credit)/expense - - -

===================== ==================== ==============

Year ended 31 December Investing and

2022 Food manufacturing management services

GBP'000 GBP'000 Total

GBP'000

Capital spend 1,014 - 1,014

Depreciation 932 1 933

Interest income

(non-Group) (8) - (8)

Interest expense

(non-Group) 138 - 138

Tax (credit)/expense (50) 50 -

===================== ==================== ==============

Geographical

analysis: External revenue by location of customers Non-current assets by location of

assets

6 months to 6 months to Year ended

30 June 30 June 31 30 June 30 June 31 December 2022

2023 2022 December 2023 2022

2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(as restated)

UK 19,090 15,320 36,830 8,011 10,311 8,142

Rest of

Europe - 469 1,197 - - -

USA - - - - - -

------------ ---------------- ----------- ------------ ------------ --------------------

19,090 15,789 38,027 8,011 10,311 8,142

============ ================ =========== ============ ============ ====================

Notes:

(1) stated before intra-group management and interest charges

(2) assets and liabilities stated excluding intra-group balances

4 Investment revenues, other gains and losses and finance income and expense

Finance income 30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Bank interest receivable 235 - 8

Investment revenues 52 86 109

Other gains and losses - 310 581

287 396 698

========= ========= ============

During 2022 the Group realised gains on the disposal of

available for sale investments, which are reported above as other

gains and losses. No such disposals took place in 2023.

Finance expense 30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Bank interest payable (64) (67) (41)

Lease interest (1) (2) (44)

Other interest and finance charges - - (53)

(65) (69) (138)

========= ========= ============

5 Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

6 months Year ended

to 6 months 31 December

30 June to 2022

2023 30 June GBP'000

GBP'000 2022

GBP'000

As restated

Earnings for the purposes of earnings

per share:

Profit/(loss) attributable to equity

holders of the parent company:

From continuing operations 317 291 1,854

From discontinued operations (4) (1,506) (2,391)

============ ============== =============

No. No. No.

Weighted average number of ordinary

shares for the purposes of earnings

per share:

Weighted average number of ordinary

shares in issue 2,357,317 2,534,856 2,493,592

Dilutive effect of potential ordinary - - -

shares

------------ -------------- -------------

Weighted average number of ordinary

shares for diluted EPS 2,357,317 2,534,856 2,493,592

============ ============== =============

There were no share options (or other dilutive instruments) in

issue during the period in respect of the parent company's shares

(30 June 2022: nil; 31 December 2022: nil).

6 Non-controlling interests

The non-controlling interests of GBP2.50 million relate to the

net assets attributable to the shares not held by the Group at 30

June 2023 in the following subsidiaries:

30 June 30 June 31 December

2022 2022 2022

GBP'000 GBP'000 GBP'000

NMT Group Limited 67 67 67

Shire Foods Limited 2,434 2,431 2,810

2,501 2,498 2,877

========= ========= ============

The Group owns approximately 80% of Shire Foods and 98.6% of

NMT.

7 Purchase of own shares

The Company acquired 21,000 Ordinary shares for a total

consideration including costs of GBP248,000 during the period (30

June 2022: 52,000 shares for GBP622,000, 31 December 2022: 204,000

shares for GBP2,090,000). This brought the total number of Ordinary

shares held in treasury at the period end to 3,863,652 shares (30

June 2022: 3,690,652, 31 December 2022: 3,842,652) with an

aggregate nominal value of less than GBP1.

At the period end, the total number of Ordinary shares

outstanding (excluding treasury shares), was 2,343,422 (30 June

2022: 2,516,422, 31 December 2022: 2,364,422).

8 Dividend

The Board is not recommending the payment of an interim dividend

for the period ended 30 June 2023.

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZGMLVRRGFZM

(END) Dow Jones Newswires

September 19, 2023 02:00 ET (06:00 GMT)

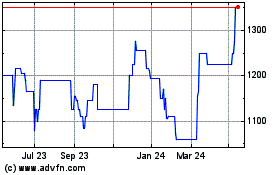

Volvere (LSE:VLE)

Historical Stock Chart

From Oct 2024 to Nov 2024

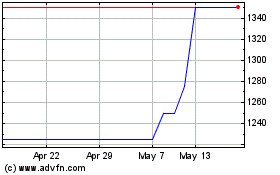

Volvere (LSE:VLE)

Historical Stock Chart

From Nov 2023 to Nov 2024