TIDMVEIL

RNS Number : 1914Y

Vietnam Enterprise Investments Ltd

12 January 2022

12 January 2022

Vietnam Enterprise Investments Limited

("VEIL" or "the Company")

Monthly Update

47.1% NAV Return in 2021 and -1.7% for December

Vietnam Enterprise Investments Limited ("VEIL") is a closed-end

fund investing primarily in listed equity in Vietnam and a FTSE 250

constituent. The Company's NAV performance for December 2021 is set

out in this notice.

Fund Performance

-- In 2021 VEIL's NAV increased 47.1%, compared to the Vietnam Index which increased 39.0%.

-- As of 31 December 2021, VEIL's NAV decreased by 1.7% over the

previous month (compared with an increase of 1.1% for its reference

index, the Vietnam Index) in US$ terms.

-- VEIL's NAV per share was US$12.21 at the end of December, total NAV was US$2,607m.

-- Seven of VEIL's top ten holdings decreased in December, with

Hoa Phat Group and Vingroup the main laggards. The biggest gainer

was midcap real estate developer Dat Xanh Group, all three are

discussed below.

Economic Overview

-- GDP recovered in Q4 following the lockdown throughout most of

Q3, registering at +5.2% for Q4 to end 2021 with +2.6% growth

year-on-year.

-- The main driver was the manufacturing sector, which advanced +4.1% year-on-year.

-- The CPI rose +1.8% in 2021, lower than observed in the US and

Europe, partly because of Vietnam's more basic CPI basket but also

due to more restrained fiscal and monetary policy in 2021.

-- Total trade for 2021 increased 22.6% to US$668.5bn, with

imports rising 26.6% to US$332.3bn, outpacing exports which gained

only +19.1% to US$336.3bn, partly handicapped by pandemic

constraints globally . T he cumulative trade deficit of US$2.4bn in

July was reversed to a surplus of US$4.0bn by December 31(st) .

-- FDI contribution remained integral at nearly 70% of total

trade. Disbursed FDI reached US$20bn in 2021, a decline of just

1.2% year-on-year. One noteworthy FDI commitment in December was

Lego Group announcing a US$1bn carbon-neutral factory to be built

in Vietnam with construction starting in 2H2022 on a 44-hectare

site around 34 miles from Ho Chi Minh City in Binh Duong, a

neighbouring industrial province.

-- At the end of 2021, more than 90% of Vietnam's adult population (over 18 years old) were double-vaccinated and nearly 56% of children aged 12-17 years old were double-vaccinated. As many as two million doses per day are now being administered, with some parts of the country currently receiving booster shots.

Dien Huu Vu, the Portfolio Manager of VEIL commented:

"It is worth reflecting that not only did Vietnam have one of

the best returns in Asia in 2021, at +39.0%, it also experienced

significant progress in market development. There are now 63

companies with a capitalization in excess of US$1bn. Daily turnover

has also reached a new normal of US$1bn - often much higher,

including a daily average of US$1.4bn in December - this is above

many peers classified as emerging markets.

With the majority of the population now vaccinated against

Covid-19 and treatment drugs being licenced for manufacturing and

distribution domestically, the Government's target for the next

four years of their five-year term can turn to economic

development, including a US$15bn stimulus package which was

announced this week. The Regional Comprehensive Economic

Partnership free trade agreement took effect from 1 January 2022

and contains preferential terms and principles that the Manager

believes have the potential to continue supply-chain shifts to

Vietnam and possibly even accelerate this trend."

December Commentary

Real estate developer Dat Xanh Group gained 6.6% despite

surprising the market with news of the cancellation of a private

placement of 200m shares, the announcement of three new large

projects in Ho Chi Minh City and Binh Duong was well-received by

investors.

Sentiment in Hoa Phat Group's share price was weakened by the

sharp drop in Chinese steel prices, which triggered concern that

profit margins may be squeezed for the steel sector. Sales volumes

for December remained healthy, with the company reporting nearly

800,000 tons of steel products sold, up 14% year-on-year.

Vingroup was sold heavily by investors fearing another potential

delay with the proposed US IPO of its VinFast subsidiary, this was

despite preparatory steps being continued with the transfer of

ownership of VinFast Vietnam to VinFast Singapore as part of the

potential IPO process. In early January, VinFast also announced its

exit from the ICE (internal combustion engine) car manufacturing to

fully focus on EV (electric vehicle) manufacturing. The company

also officially announced 3 new EV models in addition to their

current VFe34 model, which started delivery in late December.

Top Ten Holdings (72.5% of NAV)

Company Sector Vietnam Index NAV % Monthly Change

% %

1 Hoa Phat Group Materials/Resources 3.7 12.2 -5.6

================== =================== ============= ===== ==============

Vietnam Prosperity

2 Bank Banks 2.8 10.7 -5.4

================== =================== ============= ===== ==============

Asia Commercial

3 Bank Banks 1.7 9.8 3.2

================== =================== ============= ===== ==============

4 Mobile World Retail 1.7 9.6 -2.6

================== =================== ============= ===== ==============

5 Vinhomes Real Estate 6.3 6.7 -3.5

================== =================== ============= ===== ==============

6 Vietcombank Banks 5.2 6.1 2.5

================== =================== ============= ===== ==============

7 Vingroup Real Estate 6.4 5.5 -9.8

================== =================== ============= ===== ==============

8 FPT Corporation Software/Services 1.5 4.3 -4.6

================== =================== ============= ===== ==============

9 Techcombank Banks 3.1 3.9 -3.9

================== =================== ============= ===== ==============

10 Dat Xanh Real Estate 0.4 3.8 6.6

================== =================== ============= ===== ==============

For further information, please contact:

Vietnam Enterprise Investments Limited

Rachel Hill

Phone: +44 122 561 8150

Mobile: +44 797 121 4852

rachelhill@dragoncapital.com

Jefferies International Limited

Stuart Klein

Phone: +44 207 029 8703

stuart.klein@jefferies.com

Buchanan

Charles Ryland / Henry Wilson / George Beale

Phone: +44 20 7466 5111

veil@buchanan.uk.com

LEI: 213800SYT3T4AGEVW864

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBKBBNABKKCDD

(END) Dow Jones Newswires

January 12, 2022 02:00 ET (07:00 GMT)

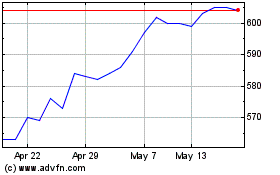

Vietnam Enterprise Inves... (LSE:VEIL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Vietnam Enterprise Inves... (LSE:VEIL)

Historical Stock Chart

From Mar 2024 to Mar 2025