TIDMVCP

RNS Number : 9166R

Victoria PLC

10 November 2021

For Immediate Release 10 November 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Victoria PLC

('Victoria' or the 'Group')

Acquisition of B3 Ceramics Danismanlik ("Graniser")

A substantial low-cost manufacturing platform

Victoria PLC, (LSE: VCP) the international designers,

manufacturers and distributors of innovative flooring, is pleased

to announce the further expansion of its existing ceramic tile

business and operations, having agreed to acquire Graniser, a

mid-market manufacturer and exporter of ceramic tiles based in

Izmir, Turkey (the "Acquisition") .

Key terms of the Acquisition

-- Graniser prepares and files audited statutory financial

accounts in Turkey, which were audited by Deloitte from 2013 to

2019, with KPMG appointed in 2020. The accounts are prepared in

Turkish Lira, with c. 70% of Graniser's revenue denominated in

Euros.

-- For the 12 months ended 31 December 2020, Graniser generated

audited revenues of EUR59.3 million [1] (c. GBP52.8m 1 ). Current

normalised EBITDA is approximately EUR9 million (c. GBP7.7m 2

).

-- Total consideration to be paid on completion is EUR8.4

million (GBP7.1 m [2] ), which will be funded entirely from the

Group's cash balances. In addition, Graniser has approximately

EUR39.8 million (c. GBP33.7m(2) ) of net debt (including

shareholder loans), which will be repaid on completion.

-- Completion is subject to procedural approval by the Turkish

competition authorities and is expected to take place in December

2021.

On completion, the Acquisition will be immediately earnings

accretive.

Overview of Graniser

Established in 1997, Graniser has been ultimately owned 75% by

the Austrian investment company, Bancroft Group and 25% by the

European Bank of Reconstruction and Development since 2012. It has

robust financial reporting structures in place and its financial

statements have been audited by either Deloitte or KPMG for the

last eight years.

The company manufactures ceramic tiles from a single 75,000

square meter production facility it owns, close to Izmir port, a

major export hub. This factory, which incorporates a cogeneration

power plant to improve efficiency and generate energy savings, has

a current annual production capacity of 20.8 million square meters,

which is not fully utilised, with the opportunity to expand output

considerably with limited capital expenditure. (By comparison,

Victoria's existing ceramic tile operations have an annual

production capacity of 52 million sqm).

Exports, predominantly to the USA, Israel, the UK, and Germany,

accounted for c. 63% of sales in 2020 and c. 75% is expected in

2021, resulting in a significant proportion of Euro and US

Dollar-denominated income and Turkish Lira-denominated costs.

Graniser has an experienced and well-respected management team,

which will be fully integrated with Victoria's well-established

ceramic tiles management team.

Strategic rationale for the Acquisition

(a more detailed presentation is available on Victoria's website

at https://www.victoriaplc.com/reports/)

The acquisition of Graniser continues Victoria's successful

strategy of growing its business with earnings-accretive

acquisitions, and using scale and the Group's industry expertise to

drive further profit increases via cost savings and revenue

growth.

1. Manufacturing diversification

-- Graniser diversifies Victoria's ceramic tiles manufacturing

footprint into a significantly lower energy, labour and raw

material price environment, alongside strict quality

governance.

-- Targeted capex, identified during commercial due diligence,

is expected to deliver a >75% increase in Graniser's earnings

over the next 3 years.

2. Commercial synergies

-- Graniser and Victoria Ceramics will benefit from exposure to

each other's commercial markets. Graniser will provide further

export potential to the Middle East (an 800 million(3) sqm per

annum growing ceramics market) for Victoria. Victoria's ceramic

tiles division, in particular its Italian operations, will open

high-growth European DIY markets for Graniser.

-- The enlarged ceramic tile operations will leverage Victoria's

existing brand and design strengths with product ranges

manufactured in a low-cost environment to drive margins and top

line growth.

-- Graniser will continue to operate an independent brand with

its own management team, reporting within the Group's ceramics

management structure.

The Board believes that Graniser presents an excellent strategic

fit with Victoria's existing business and will have strong

long-term growth prospects as part of the Group.

Philippe Hamers, Group Chief Executive of Victoria,

commented:

"Victoria's ceramic tiles business continues to go from strength

to strength. The low-cost manufacturing environment that Graniser

offers will give Victoria the ability to leverage its manufacturing

expertise and brand strength to further drive operating

margins."

Geoff Wilding, Executive Chairman of Victoria, said:

"Following completion of the Acquisition, Victoria will have

invested c. GBP201 million in the current financial year to add

approximately GBP35 million of EBITDA to the Group. Victoria's

strategy of achieving scale through acquisitions and using that

scale to extract operational synergies continues to deliver value

for the Group and its shareholders.

We continue to have substantial amounts of capital to deploy and

are in active discussions with additional high-quality

opportunities to grow our business. Therefore, shareholders can

expect further earning accretive acquisitions."

(1) Applying a GBP:EUR exchange rate of 1.18

(2) Leverage ratios calculated in-line with the Group's debt

facilities

(3) Freedonia Global Flooring Report

The person responsible for arranging the release of this announcement on behalf of the Company

is Michael Scott, Group Finance Director.

For more information contact:Victoria PLC

Geoff Wilding, Executive Chairman

Philippe Hamers, Group Chief Executive

Michael Scott, Group Finance Director +44 (0) 1562 749 610

Singer Capital Markets (Nominated Adviser

and Joint Broker)

Rick Thompson, Phil Davies, Alex Bond +44 (0) 207 496 3095

Berenberg (Joint Broker)

Ben Wright, Mark Whitmore, Tejas Padalkar

Peel Hunt (Joint Broker)

Adrian Trimmings, Andrew Clark +44 (0) 203 207 7800

Buchanan Communications (Financial PR) +44 (0) 207 418 8900

Charles Ryland, Chris Lane, Vicky Hayns,

Tilly Abraham +44 (0) 20 7466 5000

About Victoria

Established in 1895 and listed since 1963

and on AIM since 2013 (VCP.L), Victoria

PLC, is an international manufacturer and

distributor of innovative flooring products.

The Group, which is headquartered in Kidderminster,

UK, designs, manufactures and distributes

a range of carpet, flooring underlay, ceramic

tiles, LVT (luxury vinyl tile), artificial

grass and flooring accessories.

Victoria has operations in the UK, Spain,

Italy, Belgium, the Netherlands, the USA,

and Australia and employs approximately

4,000 people across more than 26 sites.

Victoria is the UK's largest carpet manufacturer

and the second largest in Australia, as

well as the largest manufacturer of underlay

in both regions.

The Group's strategy is designed to create

value for its shareholders and is focused

on consistently increasing earnings and

cash flow per share via acquisitions and

sustainable organic growth. (Further information

about Victoria can be found on its website,

www.victoriaplc.com .)

About Graniser

G raniser was established in 1997 and is

engaged in the business of manufacturing

and distributing ceramic and porcelain

floor and wall tiles. Since then, the business

has developed as a US-wide online flooring

product designer and distributor with an

absolute commitment to customer service

and environmental sustainability .

Graniser has its headquarters in Izmir/Turkey

and has a capacity of more than 20 million

sqm (across 11 kilns and 20 production

lines). Graniser produces and sells single

and double - fired wall, floor and glazed

tiles in various sizes and over 5,000 varieties

from its factory which is near Izmir, in

the Aegean Region, Turkey and serving customers

around the world.

It is a major exporter of ceramic tiles,

accounting for c.7% of Turkey's total ceramic

exports.

Further information about Graniser can

be found on its website https://www.graniser.com.tr/en

.

[1] 2020 Revenue of 477.1mm Turkish Lira converted to EUR and

GBP at 2020 average rate of 8.04 TL/EUR and 9.03 TL/GBP,

respectively.

[2] Converted to GBP at a rate of 1.18 GBP/EUR.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQBMBFTMTJBMRB

(END) Dow Jones Newswires

November 10, 2021 02:00 ET (07:00 GMT)

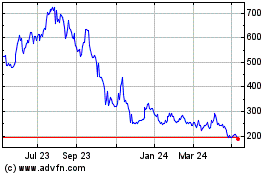

Victoria (LSE:VCP)

Historical Stock Chart

From Jun 2024 to Jul 2024

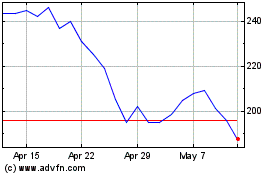

Victoria (LSE:VCP)

Historical Stock Chart

From Jul 2023 to Jul 2024