Spice Swings To 1st Half Loss On Social Housing Gas Unit Charge

December 14 2009 - 4:57AM

Dow Jones News

Utility support services group Spice PLC (SPI.LN) Monday swung

to a first-half pretax loss because of a charge related to its

social-housing focused gas business, but it raised its dividend as

its supply and utilities distribution business performed

strongly.

For the six months to Oct. 31 Spice, which offers services such

as energy consultancy and bill collection, posted a pretax loss of

GBP31.5 million compared with a pretax profit of GBP9.4 million in

the same period a year earlier, reflecting a GBP42.9 million

non-cash charge at its social-housing focused gas business.

Spice said market conditions have been tough in its social

housing-focused gas business, which has been loss making in the

first half.

Not including the non-cash charge, the company posted a pretax

profit of GBP16 million compared with GBP14 million.

Revenue totaled GBP193.4 million compared with GBP192.6

million.

The company increased its interim dividend to 0.4 pence a share

from 0.36 pence, saying its other businesses were supported by

regulatory and environmental drivers.

However the company said its supply division and its utilities

distribution business have both performed strongly, with earnings

before interest, taxes and amortization rising 25%.

The divisions have recently received contracts with

ScottishPower PLC (SPI) and United Utilities Group PLC (UU.LN),

which Spice said would likely increase start up costs in the second

half.

Company Web site: www.spiceplc.com

-By Rachael Gormley, Dow Jones Newswires; 44-20-7842-9308;

rachael.gormley@dowjones.com

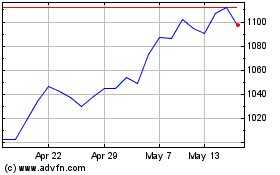

United Utilities (LSE:UU.)

Historical Stock Chart

From Jun 2024 to Jul 2024

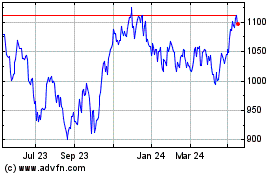

United Utilities (LSE:UU.)

Historical Stock Chart

From Jul 2023 to Jul 2024