Trading Statement

September 25 2008 - 2:01AM

UK Regulatory

United Utilities Group PLC

25 September 2008

UNITED UTILITIES TRADING UPDATE

Introduction

United Utilities Group PLC today issues an update on trading for the six months

ending 30 September 2008. The company will announce its half year results on 26

November 2008.

Commenting on the group's trading position, Philip Green, Chief Executive,

said:

"The group is on track to deliver results in line with our expectations for the

six months ending 30 September 2008.

"In August, United Utilities Water submitted its draft business plan to Ofwat

which covers the 2010-15 period. This plan forms part of the 2009 water price

review process and builds on the company's strategic direction statement

published in December 2007. The proposed �4 billion capital investment

programme contained within the plan aims to meet existing standards of service,

address new, higher quality standards and make provision for the challenge of

climate change.

"As planned, we returned approximately �1.5 billion to shareholders last month

following the sale of United Utilities Electricity. This return has helped

create a more efficient capital structure and the Board is aiming to maintain a

credit rating of A3 for United Utilities Water PLC."

Regulated activities

The regulated business is expected to deliver good underlying operating profit

growth, for the six months ending 30 September 2008, despite experiencing cost

pressures during the first half of the year, in areas such as power and bad

debts.

The business continues to focus on improving operational performance and is on

course to meet its 2008/09 economic level of leakage rolling target of 465

megalitres per day, having met its regulatory leakage target for the last two

years. In addition, no water restrictions are anticipated in the year.

The total capital investment programme contained within the draft business plan

submitted to Ofwat, including infrastructure renewals expenditure, is

approximately �4 billion (2007/08 prices), comprising �1.6 billion for the

water service and �2.4 billion for the wastewater service. Of this, investment

to meet new regulatory quality standards, enhance service to customers and

maintain the supply/demand balance is forecast at around �2 billion, almost

half the total programme. The remainder of the capital investment programme

relates to maintenance of the water and wastewater infrastructure.

United Utilities Water expects to improve its efficiency across the 2010-15

period. The company is aiming for a 1.5% annual improvement in its underlying

operating efficiency, although operating expenditure is likely to increase

overall due to cost pressures in areas such as power and rates. United

Utilities Water is also targeting an average improvement in efficiency of 3% in

respect of its capital investment programme.

United Utilities Water believes that to finance this plan an average real,

fully post-tax return of 4.7% is required. This return is consistent with the

cost of capital range published by NERA Economic Consulting in its June 2008

publication: "Cost of Capital for PR09 - Final Report for Water UK". This

compares with a cost of capital of 5.1% assumed by Ofwat at the last price

review in 2004 and reflects the sustained reduction in the cost of debt finance

available to the water sector. The company will, however, wish to reassess its

financing costs at the time of its final business plan submission to Ofwat in

spring 2009, in light of the prevailing financial market conditions.

To deliver this plan, United Utilities Water proposes an average annual real

price increase of 2.7% across the 2010-15 period, although average household

bills are expected to increase by just over 2% in real terms on average each

year.

The company's draft business plan, entitled "planning for the future", is

available on United Utilities' website at: http://www.unitedutilities.com.

Non-regulated activities

Good underlying operating profit growth is expected in the first half of the

year, compared with the corresponding period last year. This partly reflects

the planned increase in activity in relation to the outsourcing contract with

Scottish Water, which is now in the second year of the 2006-10 programme.

Performance across the contract portfolio is in line with management's

expectations and the business continues to benefit from a strong order book and

secured revenue streams, supported by the recent contract extensions with

Southern Water and British Gas Trading.

Other activities

United Utilities Property Solutions (UUPS) is expected to broadly break even in

the first half of this financial year, reflecting the slowdown in the UK

property market. As indicated previously, given the nature of this business,

profits are unlikely to follow a smooth profile. As a result, other activities,

which include central costs, are expected to make a small operating loss for

the six months ending 30 September 2008. However, UUPS has a secured pipeline

of work and is expected to deliver a positive contribution over the medium

term.

Other financial

The group is pre-funded for its capital investment programme through to 2010.

United Utilities Water has in place around �1.5 billion of index-linked

funding, with an average real interest rate of approximately 1.8%. Around two

fifths of this funding was issued with 50-year maturities.

United Utilities has a long-standing relationship with the European Investment

Bank (EIB) and recently enhanced its liquidity position further via a new �400

million term loan facility, which was approved by the EIB in July, to support

the remainder of the company's current capital investment programme.

The vast majority of the planned �1.5 billion return to shareholders took place

in August 2008. The residual balance of approximately �17 million is scheduled

to be returned in April 2009 to shareholders who elected to receive the return

in the next financial year. The Board is aiming to maintain a credit rating of

A3 for United Utilities Water PLC and, following this return, is anticipating a

group net debt to regulatory capital value gearing level towards the upper end

of Ofwat's range (55% to 65% for the 2005-10 price control period) by 2010.

Borrowings, net of cash and short term deposits, at the half year are expected

to show a significant increase compared with the position at 31 March 2008,

excluding the impact of IAS 39. This principally reflects the planned return to

shareholders of approximately �1.5 billion, along with expenditure on the

regulatory capital investment programmes, payment of the 2007/08 final dividend

and payments of interest and tax, partly offset by operational cash flows.

Before adjusting for the impact of the abolition of industrial buildings

allowances, with effect from April 2008, the tax rate at the half year is

expected to be around 28%. This reflects the full provision for deferred tax.

As outlined in United Utilities' 2008 annual report, the company is forecasting

a one-off deferred tax charge in 2008/09 relating to the abolition of

industrial buildings allowances. This one-off adjustment is anticipated to be

over �200 million and is likely to result in a significant increase in the

effective tax rate for the year ending 31 March 2009. However, the cash impact

will be spread over a period of approximately 20 years.

One-off costs in the order of �7 million are expected in the first half of 2008

/09. These costs principally relate to the capital restructuring associated

with the �1.5 billion return to shareholders.

United Utilities' contacts:

Philip Green, Chief Executive +44 (0)1925 237000

Tim Weller, Chief Financial Officer +44 (0)1925 237000

Gaynor Kenyon, Communications Director +44 (0)7753 622282

Darren Jameson, Head of Investor Relations +44 (0)7733 127707

Dominic Fry and Tom Murray, Tulchan Communications +44 (0) 20 7353 4200

END

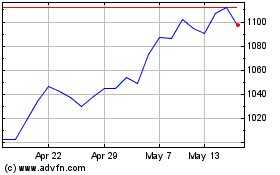

United Utilities (LSE:UU.)

Historical Stock Chart

From Jun 2024 to Jul 2024

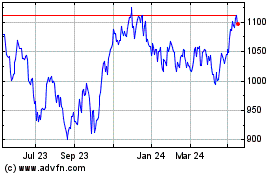

United Utilities (LSE:UU.)

Historical Stock Chart

From Jul 2023 to Jul 2024