TIDMUOG

RNS Number : 4312A

United Oil & Gas PLC

22 January 2024

United Oil & Gas PLC / Index: AIM / Epic: UOG / Sector: Oil

& Gas

22 January 2024

United Oil & Gas plc

("United" or "the Company")

Receipt of Notice of Default from the Operator of the Abu Sennan

Concession

United Oil & Gas Plc (AIM: "UOG"), the full-cycle oil and

gas company with a portfolio of production, development,

exploration and appraisal assets announces that it has received a

default notice ("Default Notice") from Kuwait Energy Egypt Limited

("Kuwait Energy" or "Operator") for a total of USD $3,822,143 for

outstanding cash calls in relation to the Abu Sennan concession.

Pursuant to the joint operating agreement ("JOA") relating to the

Abu Sennan concession, the Company has 30 days ("Default Period")

to remedy the default from the start of the default period which is

28 January 2024. In the event that the Company does not remedy the

situation during the Default Period, then each non-defaulting party

to the JOA has the option to require the Company to withdraw from

the Abu Sennan Concession pursuant to the terms of the JOA.

The Company had been in advanced discussions regarding the

potential sale of its 22% stake in the Abu Sennan concession to

United Energy Egypt Limited ("UEEL"). UEEL, a sister company of the

operator Kuwait Energy; both share the same parent, United Energy

Group which is listed on the Hong Kong stock exchange. However,

discussions aborted as the Company was unable to agree to execute

the draft sale and purchase agreement ("SPA") presented to it by

UEEL following legal advice notwithstanding the attempts from the

Company to agree a mutually acceptable SPA.

The effective date for the SPA was 1 November 2023, when the

consideration was $2.052 million which would have settled all

outstanding cash calls as at that date, and the Operator would pay

all future cash calls and receive all future revenues. The

increased figure for the default notice is due to the cash calls

received for work undertaken on the concession in the interim

period.

The Company believes that its commercial position remains

unchanged between a default scenario out of the Abu Sennan

concession and the commercial terms of the SPA (if completed), as

the proposed cash consideration from a sale would be used to settle

outstanding cash calls with the Operator and either of scenarios

would involve the divestment of the Abu Sennan concession.

The decision to divest from Abu Sennan was influenced by the

challenging macro-economic conditions in Egypt and the persistent

difficulty the Company faced in repatriating funds from the

country, as previously reported. The Company remained committed to

collaborating with local Egyptian stakeholders, EGPC, and the

Operator to navigate and address these challenges but unfortunately

these efforts have not been rewarded. Also, the 2024 proposed

budget, indicating a net deficit of USD $3 million, reflects

United's belief that the main value has been extracted from the Abu

Sennan concession, prompting a refocus by the Company on other

assets to enhance shareholder value.

Before September 2023, the Company received payments from the

Egyptian National Oil Company ("EGPC") in both USD and EGP, with

the latter primarily used to settle operational liabilities. Since

September 2023, approximately 13% of payments have been in USD,

with the rest in EGP, resulting in considerable foreign exchange

losses when converting EGP to USD. The Company has a receivables

balance of USD $0.80 million outstanding from EGPC and cash in the

bank of approximately USD $1.3 million.

In early November 2023, the JOA partners on the Abu Sennan

concession received a request from the Operator to make a material

USD payment to support the operational needs of the joint venture.

Since this time, United has engaged with EGPC to seek a USD

remittance against our outstanding USD receivable position to

satisfy this demand from the Operator. In parallel, United has

engaged with the Operator to seek alternative solutions to this USD

demand, which included a continuation of the agreed position that

had previously been accepted by the Operator, whereby the JOA

partners settle the Operator cash calls in EGP.

United is currently reviewing the Default Notice in consultation

with its legal advisers. In parallel, we will continue to engage

with the Operator to seek a solution and/or explore other options.

Further information will be provided in due course.

The Company is in discussions with its debt provider (current

balance owing USD $1.089 million) and will update the market in due

course.

United Chief Executive Officer, Brian Larkin commented:

"We are very disappointed that we could not reach agreement with

United Energy Egypt Limited to sell the Abu Sennan concession. We

had worked tirelessly from early December and over the holiday

period to finalise the Sale and Purchase Agreement ("SPA") and

engaged external lawyers to assist through the whole process at a

significant cost. We had agreed the commercial terms, however,

based on external legal advice, we were unable to sign the SPA in

the form that United Energy Egypt Limited presented to us. However,

we believe the differences could have been easily resolved and this

commercial issue avoided."

END

This announcement contains inside information for the purposes

of Article 7 of Regulation 2014/596/EU which is part of domestic UK

law pursuant to the Market Abuse (Amendment) (EU Exit) regulations

(SI 2019/310).

Enquiries

United Oil & Gas Plc (Company)

Brian Larkin, CEO brian.larkin@uogplc.com

Beaumont Cornish Limited (Nominated

Adviser)

Roland Cornish | Felicity Geidt

| Asia Szusciak +44 (0) 20 7628 3396

Tennyson Securities (Joint

Broker)

Peter Krens +44 (0) 020 7186 9030

Optiva Securities Limited (Joint

Broker)

Christian Dennis +44 (0) 20 3137 1902

Camarco (Financial PR)

Andrew Turner | Emily Hall

| Sam Morris +44 (0) 20 3757 4983

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's

Nominated Adviser and is authorised and regulated by the FCA.

Beaumont Cornish's responsibilities as the Company's Nominated

Adviser, including a responsibility to advise and guide the Company

on its responsibilities under the AIM Rules for Companies and AIM

Rules for Nominated Advisers, are owed solely to the London Stock

Exchange. Beaumont Cornish is not acting for and will not be

responsible to any other persons for providing protections afforded

to customers of Beaumont Cornish nor for advising them in relation

to the proposed arrangements described in this announcement or any

matter referred to in it.

Notes to Editors

United Oil & Gas is a high growth oil and gas company with a

portfolio of cash generative production, development, appraisal and

exploration assets across Egypt, UK and a high impact exploration

licence in Jamaica.

The business is led by an experienced management team with a

strong track record of growing full cycle businesses, partnered

with established industry players and is well positioned to deliver

future growth through portfolio optimisation and targeted

acquisitions.

United Oil & Gas is listed on the AIM market of the London

Stock Exchange. For further information on United Oil and Gas

please visit www.uogplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAXFAAFXLEEA

(END) Dow Jones Newswires

January 22, 2024 02:21 ET (07:21 GMT)

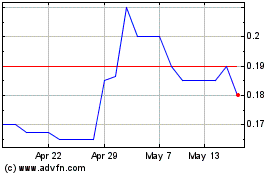

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Oct 2024 to Nov 2024

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Nov 2023 to Nov 2024