TIDMBLV TIDMTPFG

RNS Number : 7680Z

Belvoir Group PLC

16 January 2024

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

For immediate release

16 January 2024

RECOMMED ALL-SHARE MERGER

OF

THE PROPERTY FRANCHISE GROUP PLC

AND

BELVOIR GROUP PLC

to be implemented by means of a scheme of arrangement

pursuant to Part 26 of the Companies Act 2006

Investor Presentation via Investor Meet Company

On 18 January 2024 at 4.30 p.m. (GMT), Gareth Samples (CEO of

TPFG) and Dorian Gonsalves (CEO of Belvoir) will provide a

presentation (the "Presentation") relating to proposed recommended

all-share merger of TPFG and Belvoir (the "Merger") via Investor

Meet Company.

Defined terms used in this announcement have the meanings given

to them in the announcement of the Merger, by TPFG and Belvoir on

10 January 2024 (the "Merger Announcement").

At this Presentation the benefits of the Merger envisaged by

both CEOs will be summarised, including the reasons why the Merger

should be attractive to TPFG and Belvoir Shareholders alike.

The Presentation will be open to, amongst others, all

shareholders of TPFG and/or Belvoir. To access the Presentation,

investors can sign up to Investor Meet Company for free using the

following link:

https://www.investormeetcompany.com/belvoir-group-plc/register

Those who already follow TPFG or Belvoir on the Investor Meet

Company platform will automatically be notified and invited.

If TPFG and Belvoir Shareholders wish to raise questions in

advance of the Presentation, they can do so via their Investor Meet

Company "dashboard" accessible through the links above. All

questions must be submitted prior to the Presentation and must be

received by no later than 9.00 a.m. (GMT) on 17 January 2024. To

the extent that the TPFG and Belvoir CEOs are able, and in line

with restrictions and obligations applying under the Takeover Code

and under applicable law, they will endeavour to answers as many of

those questions as possible, during the Presentation or after it. A

recorded version of the Presentation and associated materials, will

also subsequently be available (subject to certain restrictions

relating to persons in Restricted Jurisdictions) via the respective

websites of TPFG and Belvoir, until the end of the Offer Period, at

www.propertyfranchise.co.uk and

www.belvoirgroup.com/offer-for-Belvoir/.

Enquiries: support@investormeetcompany.com

Important notices

This announcement and the Presentation are for information

purposes only. They do not constitute an offer or form part of any

offer or an invitation to purchase, subscribe for, sell or issue,

any securities or a solicitation of any offer to purchase,

subscribe for, sell or issue any securities pursuant to this

announcement, the Presentation or otherwise in any jurisdiction.

This announcement and the Presentation do not comprise a prospectus

or a prospectus exempted document.

The Merger will be made solely by means of the Scheme Document

(or, if the Merger is, with the consent of the Panel (and subject

to the terms of the Co-operation Agreement), implemented by way of

an Offer, the Offer Document) which will contain the full terms and

conditions of the Merger, including details of how to vote in

favour of the Scheme at the Court Meeting and the Special

Resolution to be proposed at the Belvoir General Meeting. Any

decision in respect of, or other response to, the Merger should be

made only on the basis of the information in the Scheme Document

(or, if the Merger is implemented by way of an Offer, the Offer

Document) and the TPFG Circular.

The Scheme Document will be published and sent to Belvoir

Shareholders (other than Belvoir Shareholders in Restricted

Jurisdictions) and, for information only, to participants in the

Belvoir Share Schemes as soon as practicable and, in any event,

within 28 days of the Merger Announcement (or such later date as

TPFG, Belvoir and the Panel may agree).

The Belvoir Board and the TPFG Board urge Belvoir Shareholders

to read the Scheme Document carefully when it becomes available

because it will contain important information in relation to the

Merger, the New TPFG Shares and the Combined Group.

TPFG will prepare the TPFG Circular to be distributed to TPFG

Shareholders. The TPFG Board urges TPFG Shareholders to read the

TPFG Circular carefully when it becomes available.

THE PRESENTATION IS (SUBJECT TO THE RESTRICTIONS IN THIS

ANNOUNCEMENT REGARDING ACCESS BY PERSONS IN CERTAIN RESTRICTED

JURISDICTIONS), DIRECTED ONLY AT THE SHAREHOLDERS OF BELVOIR AND

TPFG, IN CONNECTION WITH THE MERGER, AND AT NO OTHER PERSONS

WHATSOEVER, AND SHOULD NOT BE RELIED UPON FOR ANY OTHER PURPOSE OR

BY ANY OTHER PERSON.

In accordance with Rule 30.3 of the Takeover Code, a person so

entitled may request a hard copy of the Presentation (and any

document incorporated into it by reference to another source), when

they become available, free of charge, by contacting Belvoir's

registrars, Computershare Investor Services PLC ("Computershare"),

by: (i) submitting a request in writing to Computershare, The

Pavilions, Bridgwater Road, Bristol, BS13 8AE, United Kingdom; or

(ii) calling +44 (0) 370 707 1762. Calls are charged at the

standard geographical rate and will vary by provider. Calls outside

the United Kingdom will be charged at the applicable international

rate. Phone lines are open between 8.30 a.m. and 5.30 p.m. (London

time), Monday to Friday (excluding public holidays in England and

Wales). Please note that Computershare cannot provide any

financial, legal or tax advice and calls may be recorded and

monitored for security and training purposes. A hard copy of the

Presentation (and any document incorporated into it by reference to

another source) will not be sent unless so requested. A person so

entitled may also request that all future documents, announcements

and information to be sent to them in relation to the Merger should

be in hard copy form.

Overseas Shareholders

The release, publication or distribution of, or access to, the

Presentation in, into or from jurisdictions other than the United

Kingdom (including by persons who are citizens of, or are resident

or located in, jurisdictions outside the United Kingdom) may be

restricted by law and therefore any persons who are subject to the

law of any jurisdiction other than the UK should inform themselves

about, and observe, any applicable legal or regulatory

requirements. In particular, the ability of persons who are not

resident in the United Kingdom to vote their Belvoir Shares at the

Belvoir Meetings, or to appoint another person as proxy to vote at

the Belvoir Meetings on their behalf, may be affected by the laws

of the relevant jurisdictions in which they are located.

COPIES OF THE PRESENTATION, AND ANY OTHER DOCUMENTATION RELATING

TO THE MERGER, WILL NOT BE AND MUST NOT BE, DIRECTLY OR INDIRECTLY,

MAILED OR OTHERWISE FORWARDED, DISTRIBUTED, SENT OR ACCESSED IN,

INTO OR FROM ANY RESTRICTED JURISDICTION OR ANY JURISDICTION WHERE

TO DO SO WOULD VIOLATE THE LAWS OF THAT JURISDICTION. PERSONS

RECEIVING OR ACCESSING SUCH MATERIALS (INCLUDING CUSTODIANS,

NOMINEES AND TRUSTEES) MUST NOT MAIL OR OTHERWISE FORWARD,

DISTRIBUTE OR S THEM IN, INTO OR FROM ANY RESTRICTED JURISDICTION.

ANY FAILURE TO COMPLY WITH SUCH APPLICABLE RESTRICTIONS MAY

CONSTITUTE A VIOLATION OF THE SECURITIES LAWS OF ANY SUCH

JURISDICTION AND/OR MAY RER INVALID ANY RELATED PURPORTED VOTE IN

RESPECT OF THE MERGER, WHETHER AT THE BELVOIR MEETINGS OR AT THE

TPFG GENERAL MEETING.

It is the responsibility of each Overseas Shareholder to satisfy

themself as to the full observance of the laws and regulatory

requirements of the relevant jurisdiction in connection with the

Merger, including obtaining any governmental, exchange control or

other consents which may be required, or the compliance with other

necessary formalities which are required to be observed and the

payment of any issue, transfer or other taxes due in such

jurisdiction.

To the fullest extent permitted by applicable law, TPFG, Belvoir

and any other persons involved in the Merger disclaim any

responsibility or liability for the violation of such restrictions

by any person. Unless otherwise determined by TPFG or required by

the Takeover Code, and permitted by applicable law and regulation,

the Merger will not be made available directly or indirectly in,

into or from a Restricted Jurisdiction where to do so would violate

the laws in that jurisdiction and no person may vote in favour of

the Merger, whether at the Belvoir Meetings or at the TPFG General

Meeting, by use of mail or any other means or instrumentality

(including, without limitation, facsimile, email or other

electronic transmission, telex or telephone) of interstate or

foreign commerce of, or any facility of a national, state or other

securities exchange of, any Restricted Jurisdiction.

The availability of New TPFG Shares, as part of the

consideration payable under the Merger, to Belvoir Shareholders who

are not resident in the United Kingdom may be affected by the laws

of the relevant jurisdictions in which they are resident. Further

details will be set out in the Scheme Document. The New TPFG Shares

have not been and will not be registered under the US Securities

Act or under the securities laws of any state or other jurisdiction

of the United States. Accordingly, unless an exemption under

relevant securities laws is available, including the exemption from

the registration requirements of the US Securities Act provided by

section 3(a)(10) of that Act, the New TPFG Shares are not being,

and may not be, offered, sold, resold, delivered or distributed,

directly or indirectly, in, into or from the United States. Neither

the SEC nor any state securities commission has approved or

disapproved the New TPFG Shares or passed upon the accuracy or

adequacy of the Presentation. Any representation to the contrary is

a criminal offence in

the United States. Financial statements, and all financial

information that is included in the Presentation or that may be

included in any other materials relating to the Merger, have been

or will be prepared in accordance with International Financial

Reporting Standards or other reporting standards or accounting

practice which may not be comparable to financial statements of

companies in the United States or other companies whose financial

statements are prepared in accordance with generally accepted

accounting principles in the United States.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OUPFFFFLLFIELIS

(END) Dow Jones Newswires

January 16, 2024 02:00 ET (07:00 GMT)

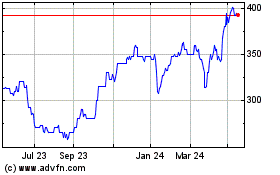

Property Franchise (LSE:TPFG)

Historical Stock Chart

From Oct 2024 to Nov 2024

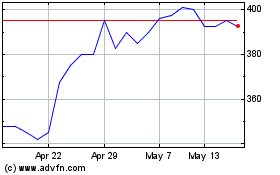

Property Franchise (LSE:TPFG)

Historical Stock Chart

From Nov 2023 to Nov 2024