Chenavari Toro Income Fund Limited Enhanced dividend policy - rebalancing of strategy (1781P)

June 08 2020 - 2:00AM

UK Regulatory

TIDMTORO

RNS Number : 1781P

Chenavari Toro Income Fund Limited

08 June 2020

Chenavari Toro Income Fund Limited (the Company)

08 JUNE 2020

Enhanced dividend policy and rebalancing of investment

strategy

In the past few years, the Board of the Company has implemented

several measures to seek to enhance the share price of the Company,

in particular by reducing the discount between the Company's share

price and the net asset value per share ("NAV per Share"). These

measures have included undertaking share buy-backs, the

implementation of a semi-annual tender offer mechanism, and a

simplification of the Company's investment strategy.

While the Board acknowledges that the Company's net asset value

("NAV") has held up more robustly than most of the Company's listed

peers in the recent major market dislocation arising from the

global COVID-19 pandemic, it also acknowledges the disappointment

caused to shareholders by the persistent share price discount to

NAV.

The Board is therefore pleased to announce the implementation of

a series of new initiatives with the intention of narrowing the

share price discount to NAV. These initiatives are as follows:

1. An enhanced dividend policy: The Company is targeting a

quarterly dividend yield of 2.5 per cent. (by reference to NAV)

equating to a targeted annualised dividend yield of 10 per cent.

(by reference to NAV). The Company's net target return remains 9-11

per cent. per annum

The dividend and net target return targets stated above are

targets only and are not a profit forecast. There can be no

assurance that these targets will be met and they should not be

taken as an indication of the Company's expected future

results.

2. The continued rebalancing of the investment strategy towards

tradable securities, as well as the realisation of illiquid assets:

Operating within the parameters of the Company's existing

investment policy, the Company's investment strategy will be

rebalanced with a focus on investment in liquid and tradable

European ABS/CLO, through the Company's existing "opportunistic

credit strategy" (provided that a significant market opportunity

arises). Consequently, the Company will cease to make new

investments in illiquid assets through its current "originated

transactions" and "private asset backed" strategies, but will

continue to support existing illiquid assets, where required, with

a view to maximising shareholder value. The Company will seek to

realise its illiquid assets and redeploy the proceeds into liquid

and tradable European ABS/CLO if the opportunity arises. In

addition to this rebalancing of the investment strategy, the

Company will continue to consider share buy-backs, where

appropriate, to assist in narrowing the discount to NAV, and will

continue to invest in hedging instruments.

3. The implementation of quarterly special distributions of

available excess cash: at the end of each calendar quarter until 31

December 2020, the Company will maintain a maximum cash balance in

its portfolio of 10 per cent. of NAV and will distribute all excess

cash above this balance arising in the portfolio as special

dividends on a quarterly basis. These special dividends will be in

addition to any quarterly dividends paid pursuant to the Company's

dividend policy outlined above. With effect from 1 January 2021,

the maximum cash balance cap will be reduced to a level of not more

than 5 per cent. of NAV, unless the investment manager, at its

discretion, decides to maintain such cap at a maximum of 10 per

cent., should market opportunities in liquid and tradable European

ABS / CLO arise.

The payment of any quarterly special dividends is a target only

and will be subject to the Company having excess cash available to

do. Shareholders should have no expectation of any such quarterly

special dividends being paid in any quarter or at all.

Fred Hervouet, Chairman of the Board, commented:

"The persistence of the discount to NAV has somewhat

overshadowed the underlying quality of the Company. We hope that

the announcement of these new initiatives will provide assurance to

shareholders that the Company will do whatever it takes to seek to

narrow and eventually eliminate the discount. Through these new

steps, we are demonstrating the Board's commitments to seek to; (i)

generate a high investment return profile for shareholders, and

(ii) maximize shareholder value".

Further information in relation to the Company is available

at:

http://www.chenavaritoroincomefund.com

Enquiries :

Kirstie Sumarno or Guy Goyard

Chenavari Investment Managers

Email: tlir@chenavari.com

Telephone: +44 20 7259 3600

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFAMPTMTBMBIM

(END) Dow Jones Newswires

June 08, 2020 02:00 ET (06:00 GMT)

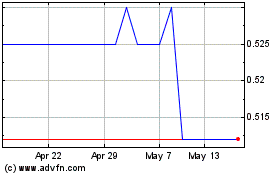

Chenavari Toro Income (LSE:TORO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Chenavari Toro Income (LSE:TORO)

Historical Stock Chart

From Jul 2023 to Jul 2024