TIDMTNT

RNS Number : 2288O

Tintra PLC

30 January 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMENDMENT) (EU EXIT)

REGULATIONS 2019/310.

30 January 2023

TINTRA PLC

("Tintra", the "Group" or the "Company")

Issue of Ordinary Shares Under Funding Round

Further to the announcement of 16 December 2022, the Board is

pleased to confirm that the US$10,000,000 in settlement of the

subscription for 684,594 new ordinary shares of 1 pence each in the

capital of the Company ("Ordinary Shares"), priced at a

subscription price of 1178 pence per Ordinary Share, at an exchange

rate of GBP1.00:$1.24, has been received (the "Subscription").

The Subscription has been made by Ares FZE LLC, a company

incorporated by the International Freezone Authority in the United

Arab Emirates (the "Subscriber").

An application for the 684,594 new Ordinary Shares to be issued

under the Subscription to be admitted to trading on AIM

("Admission") will be made shortly. The Subscriber is currently in

the process of opening an account to enable delivery of the new

Ordinary Shares into CREST and a further announcement will be made

once an application is made for Admission.

On Admission, the Subscriber will hold the equivalent of 4.24%

of the Ordinary Shares in issue.

For each two new Ordinary Shares issued under the Subscription,

the Subscriber will receive one warrant to subscribe for new

Ordinary Shares at an exercise price of 504 pence per Ordinary

Share for a period of five years from Admission, conditional on

either the market capitalisation of the Company exceeding

US$500,000,000 for a period of three consecutive trading days or a

future funding round being concluded with a post-money valuation of

US$500m or greater (the "Warrants"). A total of 342,297 Warrants

will be issued on Admission.

Richard Shearer, the Chief Executive of the Company says "I'm of

course delighted to be in receipt of these funds and the commitment

made to Tintra Plc; with the funds received last month, and the

further commitment under that contract, we now have a mixed funding

stack to see us through most of this year under any

circumstances.

The current fund-raising climate is challenging, to say the

least, but being able to fall back on the wider Tintra Group's

broad relationship base is very helpful. While this is no guarantee

of success, raising these funds in a market such as this is

something that we're proud of, especially considering the Company's

market capitalisation.

We continue to make headway with further closings in this fund

raise and I fully expect that we will announce further progress

soon. We continue to have ongoing funding discussions with a large

number of funders globally, with new prospective partners being

added constantly. Our focus is primarily on getting funds through

the door, but where possible its finding partners that add

strategic value.

We are funded for the rest of the year even at a high capital

deployment rate, but as we continue to raise funds we have really

great conversations ongoing through which we feel very

comfortable.

Further to my comments on the funding round I felt that it might

be worthwhile to reiterate some broader points that I thought may

be helpful to the market's view of us as a company.

I have made several comments both in RNS and in the press where

I have mentioned that my focus is on what the share price does in

3, 5 or 10 years, rather than short-term fluctuations, and this is

also the view of all senior members of the team and indeed all of

the plain equity subscribers who have invested into the Company

over the last year or so. I do not really follow the markets or

what our share price is doing on any given day and I encourage

those buying our shares publicly to do the same. We are driven by

mission and following the 'true north' plan that we have set

out.

I would ask and encourage all of our existing and potential

shareholders to take the time to understand our mission, to decide

if they think we are the right team to deliver on it and whether or

not it will be profitable when we do. If the answer to that is no,

then of course we're likely not a place for that individual or

business to invest. If the answer is yes, then I'd implore them, to

share this long-term view.

All decisions are made through one lens: does this get us closer

to achieving our end goal. Some of those things will be immediately

obvious, some will be less so. In retrospect we may decide that we

didn't always get everything right, and there will be other

decisions that we become very proud of. This is the nature of

building something revolutionary. But every decision takes into

account what we want to achieve and whether it will ultimately

deliver on our mission to drive real change and create substantial

profit for each and every one of our shareholders.

It's not inconsequential that, by a long distance the largest

shareholder in the company is an entity related to the wider Tintra

group, so whilst I speak a lot about mission and societal causes,

there is an established corporate drive for building a successful

high value business. As CEO, I'm certainly not seconded to Tintra

plc because of the GBP1 per year Tintra Holdings receives for my

services - I am expected to deliver value and opportunity for that

largest shareholder, and consequently all other shareholders.

Tintra Plc are engaging some of the best minds in the world in

our sector to work with us on this project, not because of our

current share price but because of our mission. We are laser

focused on success and changing the life of millions of people

around the world. This is not however at the expense of company

valuations, but it is what will allow us to achieve our ambition of

building a $10BN company if we succeed; there are of course

challenges and execution risk between here and there.

As above, every decision we make is based on whether it gets us

closer to success in our mission. It is never, what are the optics

or what will it do to the share price. Usually a business running a

strategy such as ours is still private, so its steps along the way,

including time slippages, mistakes and missteps are just that,

private.

I would like the market to understand that when we make

statements that look to the future, they are just that, forward

looking statements subject to change and adaption based on

real-world, real-time realities. We run an agile business strategy

that allows for these eventualities, no single piece of news,

however good it may sound, is 'the one' and conversely no missed

deadline or single decision is terminal. Frankly, I'd love to not

have to give fixed times for every forward-looking announcement we

make, but it's something I have to live with, and of course do

happily.

We are driving a transformative business, one that has buy-in

externally from governments, regulators and high-profile investors

across the world. Please take a view on our mission and then take a

long view on the business.

To that end and to assist in conveying this as well as we can

I'm planning to do a Q&A for the market during February at some

point, which I hope will be a welcome addition to our

communications strategy.

Today, I hope that our share price reacts rationally given the

above context. Today's news is one piece in what is a long road to

success; we have many more steps to take whilst we are on this

journey with everything we do based on very zoomed-out thinking; it

is just another piece of a very complex multi-year business plan

that we are progressing day by day."

Total Voting Rights

On Admission, the Company will have 16,138,263 Ordinary Shares

in issue, each with one voting right. There are no shares held in

treasury. Therefore, the Company's total number of Ordinary Shares

and voting rights will be 16,138,263 and this figure may be used by

shareholders from Admission as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the FCA's Disclosure Guidance and Transparency Rules.

For further information, contact:

Tintra PLC

(Communications Head)

Hannah Haffield

h.haffield@tintra.com

Website www.tintra.com 020 3795 0421

Allenby Capital Limited

(Nomad, Financial Adviser & Broker)

John Depasquale / Nick Harriss / Vivek

Bhardwaj 020 3328 5656

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFIFVDLTIIVIV

(END) Dow Jones Newswires

January 30, 2023 02:45 ET (07:45 GMT)

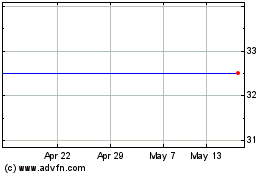

Tintra (LSE:TNT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Tintra (LSE:TNT)

Historical Stock Chart

From Nov 2023 to Nov 2024