St James House PLC Trading Statement (7688Z)

September 23 2020 - 2:00AM

UK Regulatory

TIDMSJH

RNS Number : 7688Z

St James House PLC

23 September 2020

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

23 September 2020

ST. JAMES HOUSE PLC

("SJH", the "Group" or the "Company")

Trading Update

The Board of Directors of the Company (the "Board") is pleased

to provide the following trading statement and update on recent

developments.

Trading Update

Payments Division

The payments division is pleased to report trading through

August with non-card related GBP and EURO activity holding steady

through the quiet month of August. We have seen a 25% increase in

GBP accounts and 10% increase in Euro accounts. Inbound deposit

receipts were similar to July but with fewer outbound payments for

GBP account holders. Still growing from a relatively low base the

Company will continue to monitor the data closely and develop a

more meaningful data set as patterns in growth emerge over the

coming months.

In card payment services, Prepaid Card Products continue to grow

slowly with a 2% increase in active customers, however daily

spending levels were significantly down at approximately 50% of the

daily spending level in July, largely reflected by a significant

decrease in the use of cards for cash withdrawals.

The merchant services team has agreed to deploy a new gateway

which gives access to 25 acquiring banks, all major ecommerce

checkout/shopping carts, all major alternative payment methods

including PayPal, Amazon Pay, Apple Pay, Android Pay, Google Pay,

etc.. The new system is also integrated into a range of EPOS

systems meaning that we can service any type of merchant in

virtually any market. The impact of COVID-19 continues to disrupt

visits to potential merchants that expect client visits and with

the recent return of certain restrictions in various parts of the

country, this disruption is likely to continue at some level.

October will see the company deploy a full suite of FX and

account options including enhancements to existing GBP and EUR

services and adding USD named accounts as standard. Using the same

technology that powers a number of household names in alternative

banking we will be able to collect, convert, pay and manage our

clients' money from named multicurrency accounts. Clients will be

able to send and receive funds in 37 currencies to 180 countries

with local delivery in 17 currencies.

Lottery Business

Prize Provision Services Ltd ("PPS") has seen stability in the

number of entries into the lotteries it administers during the past

couple of months despite the ongoing COVID-19 restrictions and is

hopeful of an overall increase in entries during the second half of

the year.

The charity sector has begun to return to normal with staff

being brought off furlough and beginning to evaluate fundraising

methods to address the shortfalls in fundraising during the

lockdown period.

The 7 September 2020 draw saw a lucky lottery player scoop the

GBP25,000 jackpot and the win offers PPS a timely opportunity to

extol the virtues of lotteries to both potential players and

societies alike. As the jackpot is insured, the pay-out does not

affect the revenue or profit of PPS nor any group entity.

Claims Management

The Group has established a new claims management business, St.

Francis House Limited. Closely related to payments, claims

management is -regulated activity which involves the acquisition

and management of claims for damages usually associated with road

traffic accidents but applicable across financial services,

housing, criminal injury and employment matters. It is a process

led activity in a highly regulated environment. Led by an

experienced lawyer the Company has recruited a small and

experienced team based in Liverpool.

Technology driven, the business is scalable and gives a

predictable and measurable return on investment, with each case

returning revenue within twelve to sixteen weeks. The Company has a

small caseload in place and has plans to acquire cases over the

coming weeks in order to reach an average work in progress value of

GBP300,000 to GBP500,000 in the first year. As the business becomes

more established the Board will consider the key performance

indicators which will enable shareholders to monitor and track

progress in this new division.

Group

Astro Kings, the joint venture 5-a-side football centre located

in Nottingham, remains fully open with pitch occupancy levels

remaining at the levels which would be expected for the time of

year. While a second wave of restrictions would affect the venue,

it is not expected that this would have a material impact on the

Group .

Graeme Paton, Chief Executive, commented, "We have been

extremely busy delivering a number of significant upgrades to our

payment business' capabilities - now with full FX functionality

expected to come on stream in October we are able to make domestic

and international payments in 37 currencies to over 180 countries

giving our clients the ability to receive, convert and send money

quickly and cheaply virtually anywhere - further the improved

ability for clients to collect payment by all major card types and

almost 150 alternative payment methods means we are well positioned

to help businesses of all sizes. The establishment of our new

claims management business is expected provide the Group with an

attractive third division of business activity."

For further information, contact:

St. James House PLC

Roger Matthews

Website www.sjhplc.com 020 3655 5000

Allenby Capital Limited

(Nomad, Financial Adviser & Broker)

John Depasquale / Nick Harriss 020 3328 5656

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTZLLFLBKLZBBB

(END) Dow Jones Newswires

September 23, 2020 02:00 ET (06:00 GMT)

Tintra (LSE:TNT)

Historical Stock Chart

From Oct 2024 to Nov 2024

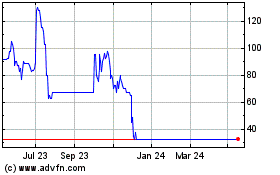

Tintra (LSE:TNT)

Historical Stock Chart

From Nov 2023 to Nov 2024